- After a euphoric rise last week, Bitcoin has fallen, influenced by negative news.

- Bitcoin’s longs started getting liquidated, which could be another troubling sign for the king coin.

As an analyst with over two decades of market experience under my belt, I’ve seen more than a few market swings – from the dot-com bubble to the crypto boom and bust cycles. This week’s Bitcoin (BTC) dip is reminiscent of those rollercoaster rides we all love to hate.

Over the past week, the anticipation for Bitcoin (BTC) has reached nearly frenzied heights. Indeed, much buzz surrounded it, primarily due to the upcoming Bitcoin Conference in 2024.

Contrarily to previous weeks, the market seems to be moving at a more leisurely pace this time around, and Bitcoin’s price fluctuations reflect this slowdown as well.

Just like how good news boosted Bitcoin’s surge, this week’s cryptocurrency fluctuations are largely due to unfavorable news reports.

In simpler terms, this event contributed to Bitcoin’s volatile behavior, as seen in its price fluctuations. At the moment of reporting, its value had dropped nearly 6% to approximately $66,042.

Bitcoin experienced a significant surge of about 30% from its lowest point in July, which means short-term investors who purchased during the dip might now find it profitable to sell their holdings. This selling activity could potentially continue fueling the current price correction.

But how long can this trend last?

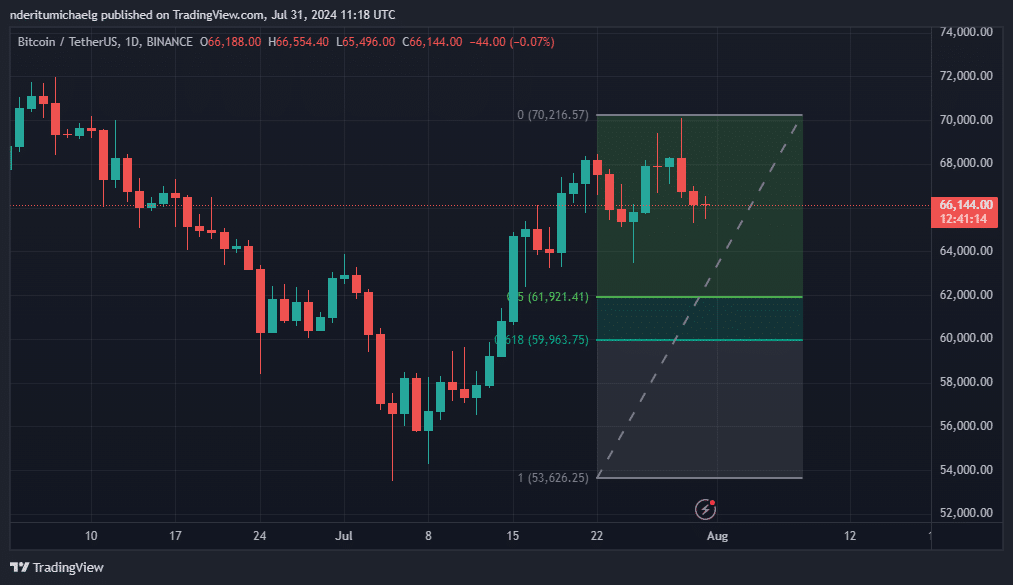

According to AMBcrypto’s analysis based on Fibonacci levels, a potential new pivot point may emerge within the range of $61.921 to $59,693. This could happen if the selling pressure persists.

Bitcoin goes on a hype recess

Last week saw a great deal of politically-driven conjecture, but the excitement has subsided. This week, however, the market appears to be adopting a more reserved approach, likely due to the FOMC report and the upcoming Federal Reserve meeting.

Economic uncertainties often impact investment choices, leading many traders to sell off their holdings and pause their actions until there’s more clarity about the situation. Then, they can make informed decisions about their next steps.

This may explain the profit-taking.

Following a cautious approach might have increased the selling pressure, which could be further intensified due to recent Mt. Gox data. As per Lookonchain’s analysis, an estimated 47,229 Bitcoin were transferred to unidentified wallets within the last 24 hours.

As a seasoned investor with years of experience in the crypto market, I can confidently say that this recent development has raised some red flags for me. The potential move to dump Bitcoin could create approximately $3.8 billion worth of sell pressure in the market, which is a significant amount that could potentially impact the overall health and stability of the market. This kind of event has happened before, and I remember the chaos it caused. It’s always important to stay vigilant and keep a close eye on market movements, especially when large amounts of cryptocurrency are at play.

Longs liquidated?

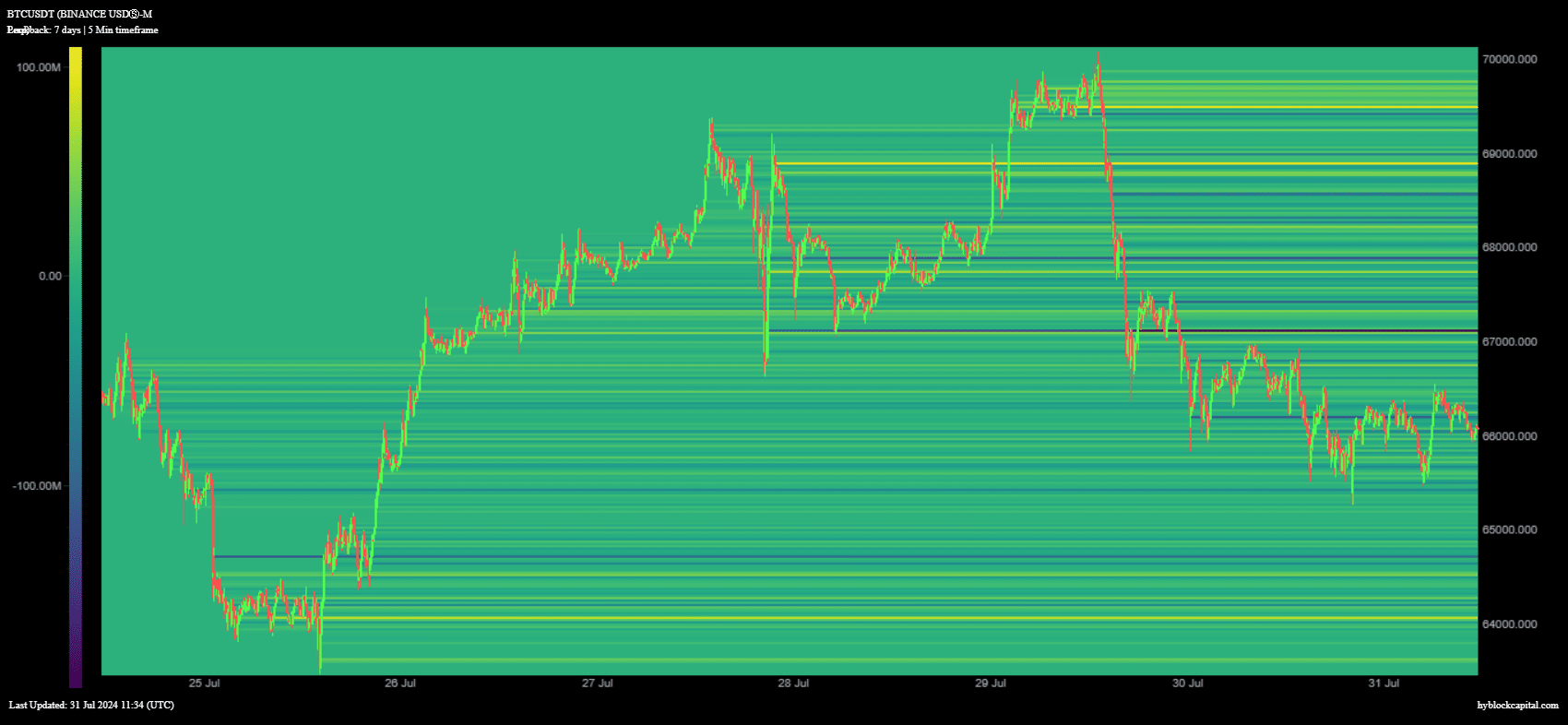

It appears that holding long positions on Bitcoin might have led to the swift drop we saw this week. An analysis by AMBCrypto’s longs heatmap showed that there were two significant areas where long positions were concentrated.

At approximately $68,875 and $68,901, Bitcoin long positions surged to a massive $101.8 million. Another significant area was around $69,472 and $69,500.

When Bitcoin (BTC) suddenly dropped, it likely offered additional opportunities for traders to sell short, as this quick dip went below the two highly-leveraged buy positions.

Read Bitcoin’s [BTC] Price Prediction 2024-25

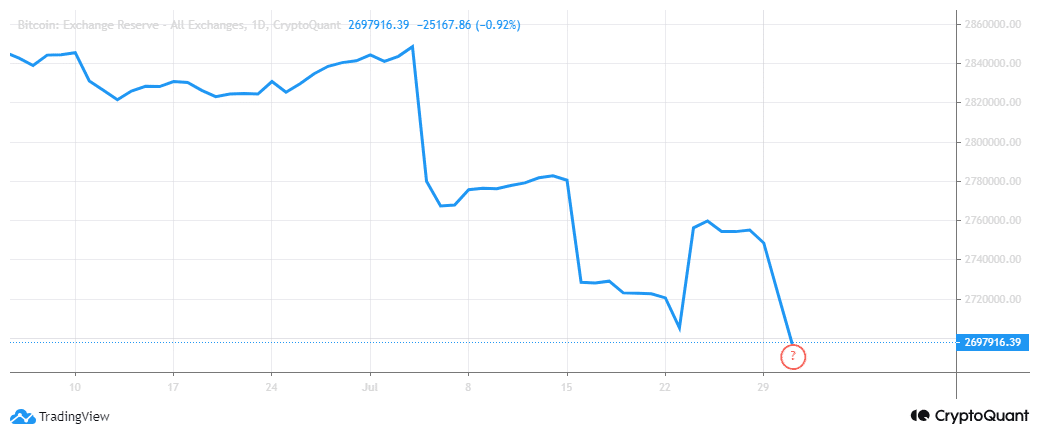

It’s uncertain whether Bitcoin will plunge further, given the unpredictable nature of market fluctuations. However, it’s worth noting that Bitcoin reserves ended July at their lowest point since 2018.

At the current moment, approximately 2.6 million Bitcoins were being held on exchanges as per the exchange reserve indicator.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-08-01 02:15