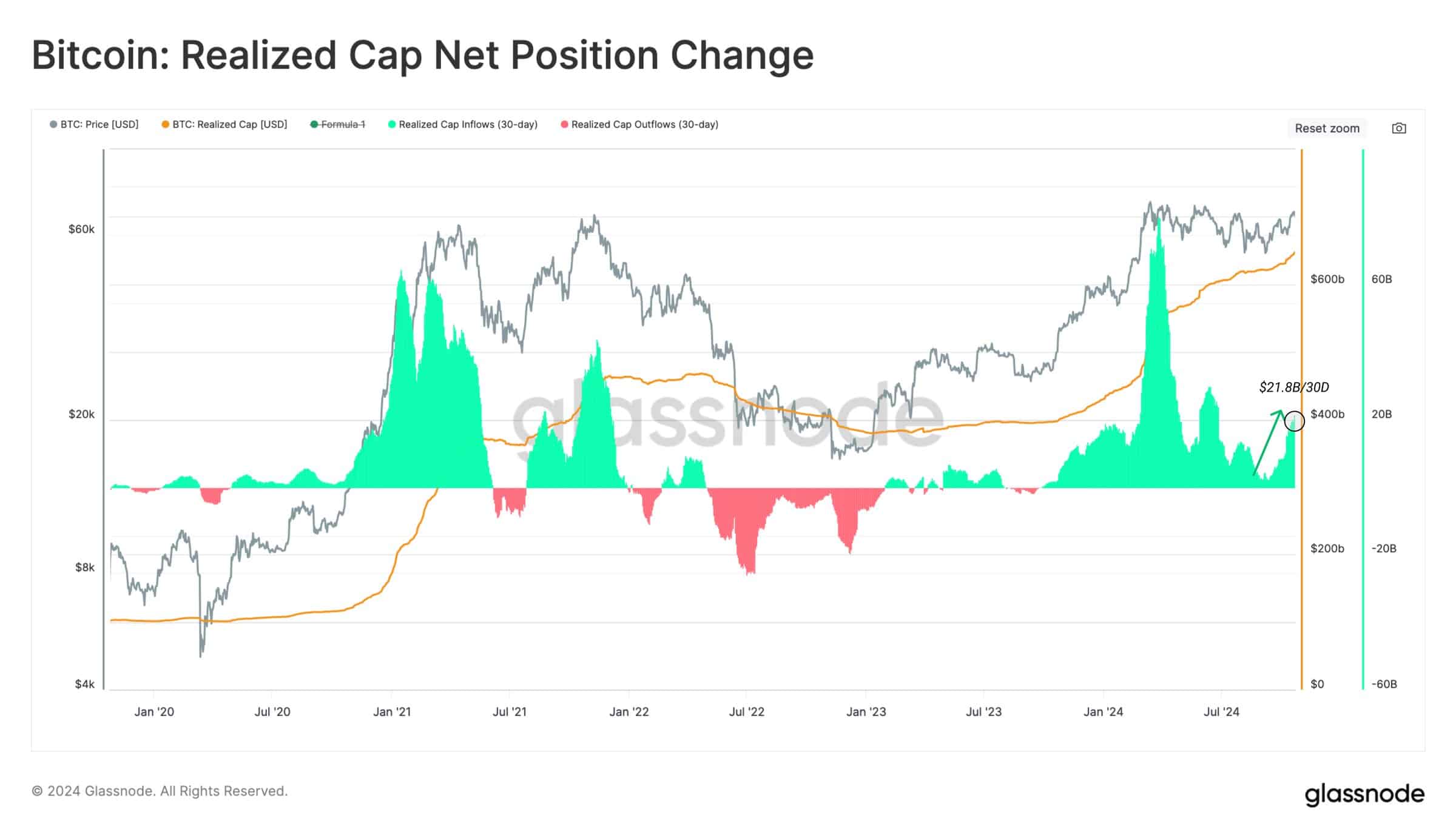

- Capital inflows into Bitcoin surged to new ATH.

- Exit of weaker hands may have strengthened BTC’s market foundation.

As a seasoned researcher with years of experience analyzing cryptocurrency markets, I find myself captivated by the recent surge in capital inflows into Bitcoin, pushing its realized cap to unprecedented highs. The increase in liquidity and the exit of weaker hands suggest that we could be on the precipice of a significant price rally.

The current shifts in the price of Bitcoin (BTC) are being closely monitored due to new data indicating an increase in net investments, suggesting that prices may climb further.

Over the last 30 days, capital inflows into Bitcoin have surged by $21.8 billion, a 3.3% increase, pushing Bitcoin’s realized cap to an all-time high of over $646 billion.

The increase in this growth indicates a rise in Bitcoin’s liquidity, which might imply that there is more capital supporting the asset. As a result, we may anticipate that Bitcoin could experience a substantial price surge.

Weak hands out as BTC retests breakout level

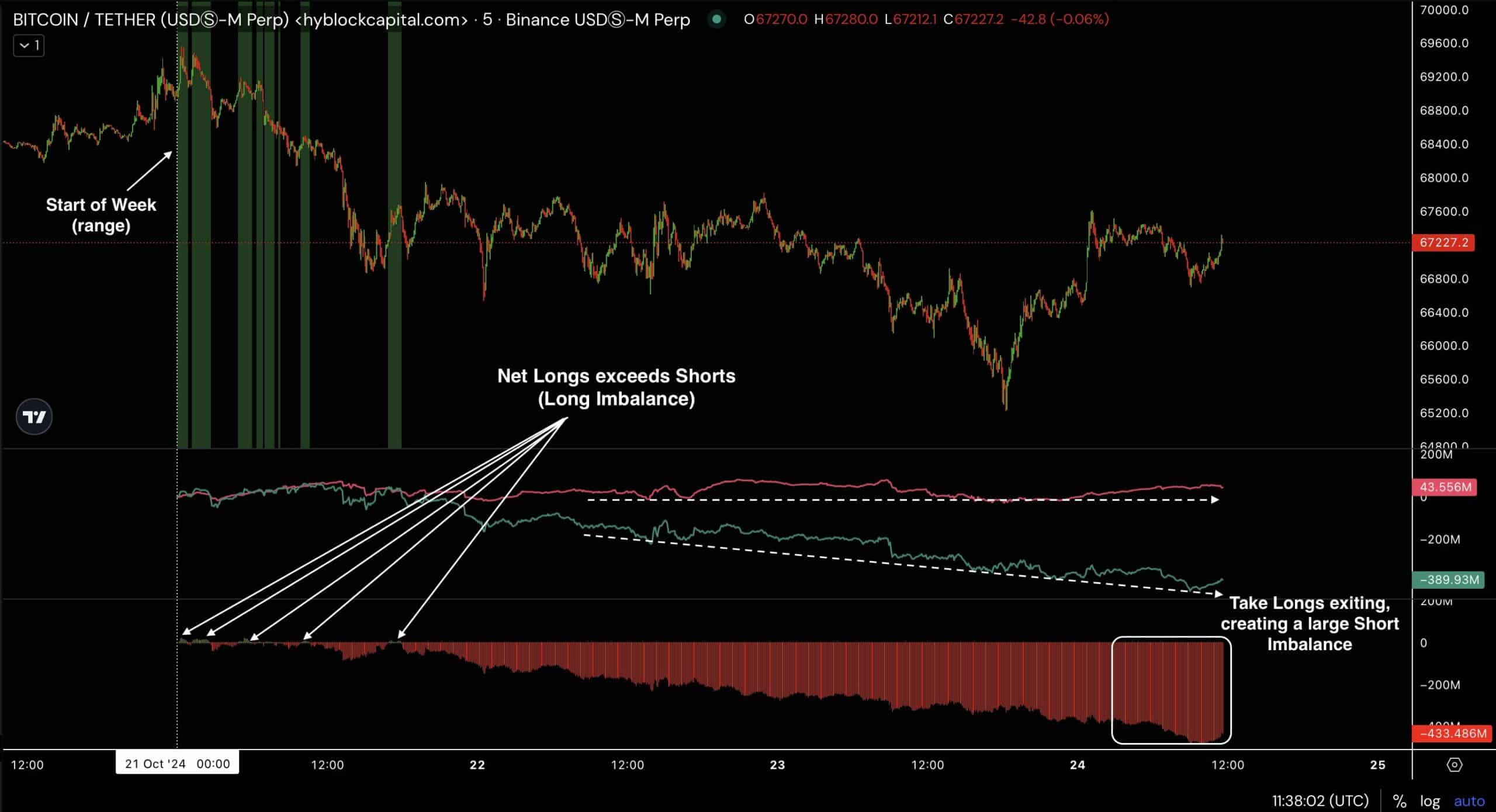

This week’s fluctuations in Bitcoin’s pricing suggest that less experienced investors might have sold off their holdings, opening up opportunities for fresh investments to shape the next significant price shift.

At the beginning of the week, Bitcoin experienced a drop, causing some investors to take on bold long positions, aiming to capitalize on any potential recovery.

This created a scenario where BTC trapped some of these longs, leading to further selling pressure.

After the recent turbulence, it’s worth noting that Bitcoin’s price bounced back swiftly, suggesting that the departure of less resilient investors might have fortified the market’s base.

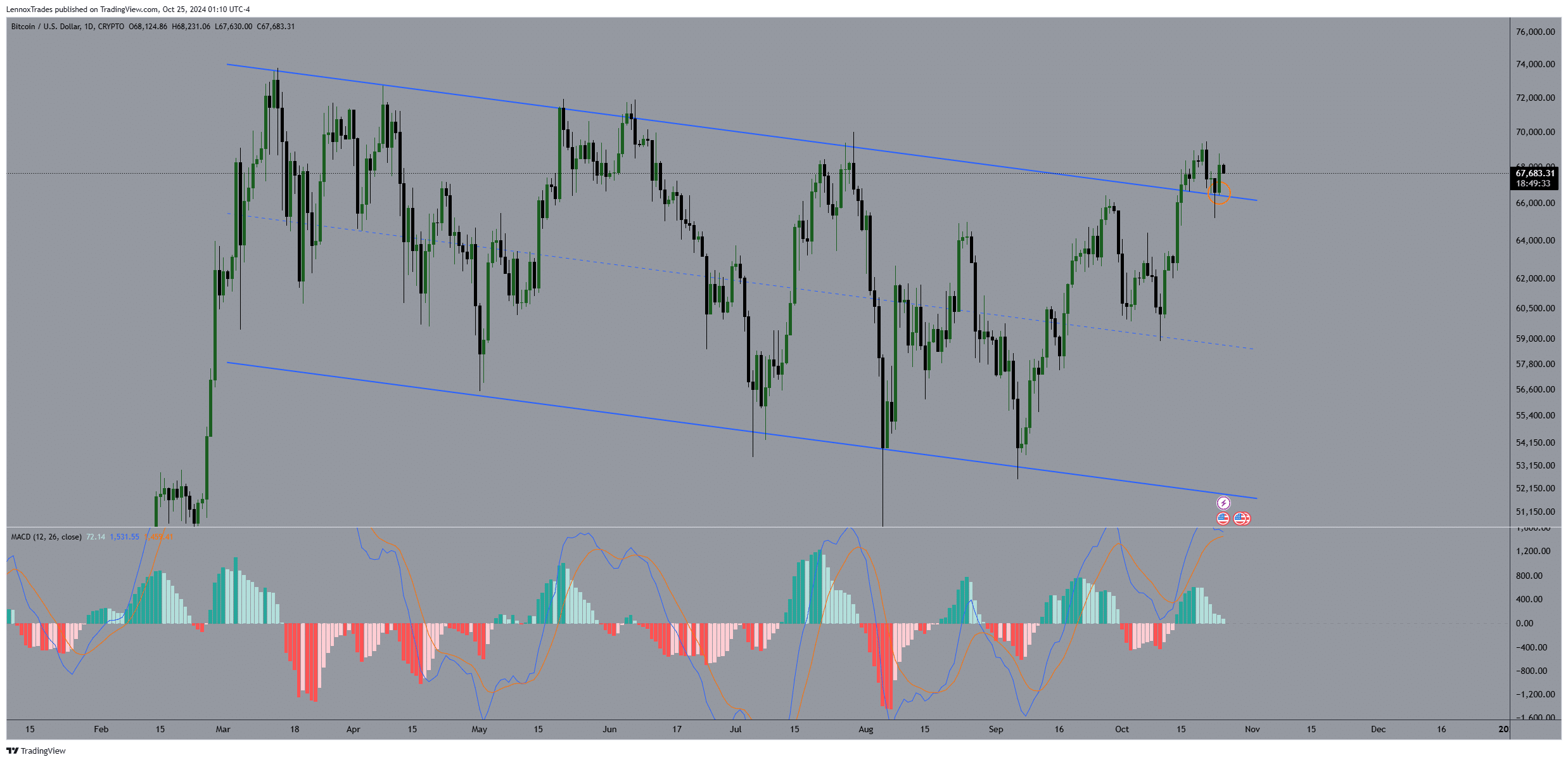

Regarding the technical analysis, Bitcoin (BTC) has lately encountered its falling trend line, a significant barrier that’s held firm for over eight months.

From my perspective as a researcher, a successful retest after an exit from this channel implies that Bitcoin’s bullish trend might persist further.

As an analyst, I observed that the trend channel’s upper limit was tested by Bitcoin, reaching around the $69.5K mark. However, it subsequently retreated after this test.

Regardless of the initial setback, Bitcoin has bounced back robustly from its breakout point, and yesterday’s closing price (at the time of reporting) shows a bullish trend.

Making this move might offer the confirmation traders have been seeking, which could pave the way for an upward trend that may aim to surpass past records.

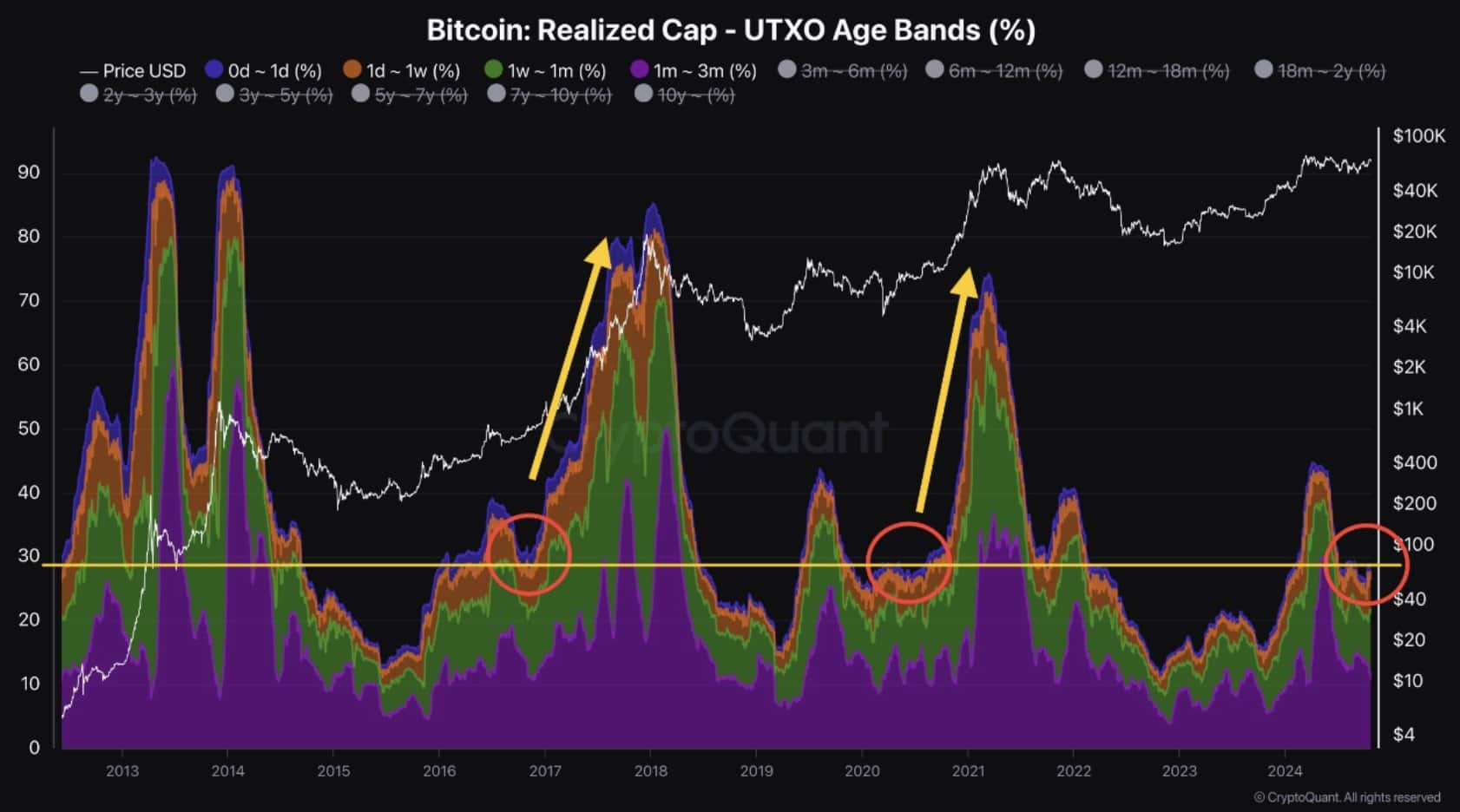

New holders to determine next move

Ultimately, it seems that the moves made by new investors could play a pivotal role in deciding where Bitcoin’s significant price trend will head next.

From analyzing past trends, it appears that an upward spike in the number of Unspent Transaction Outputs (UTXOs)—essentially, bitcoins held for under six months—tends to occur after a period of stagnation. This pattern is often followed by substantial price increases in Bitcoin.

Is your portfolio green? Check the Bitcoin Profit Calculator

New data suggests a distinct pattern that hints at Bitcoin’s potential price increase. With significant funds flowing in and supportive technical signals, a Bitcoin breakthrough appears to be more probable than ever.

With Bitcoin’s liquidity and funds growing significantly, and most inexperienced investors (often referred to as “weak hands”) having largely exited the market, Bitcoin might be gearing up for a continued upward trend. The upcoming weeks should provide important clues about whether Bitcoin is on track to hit new record highs, so traders will be closely monitoring for such indicators.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2024-10-25 20:08