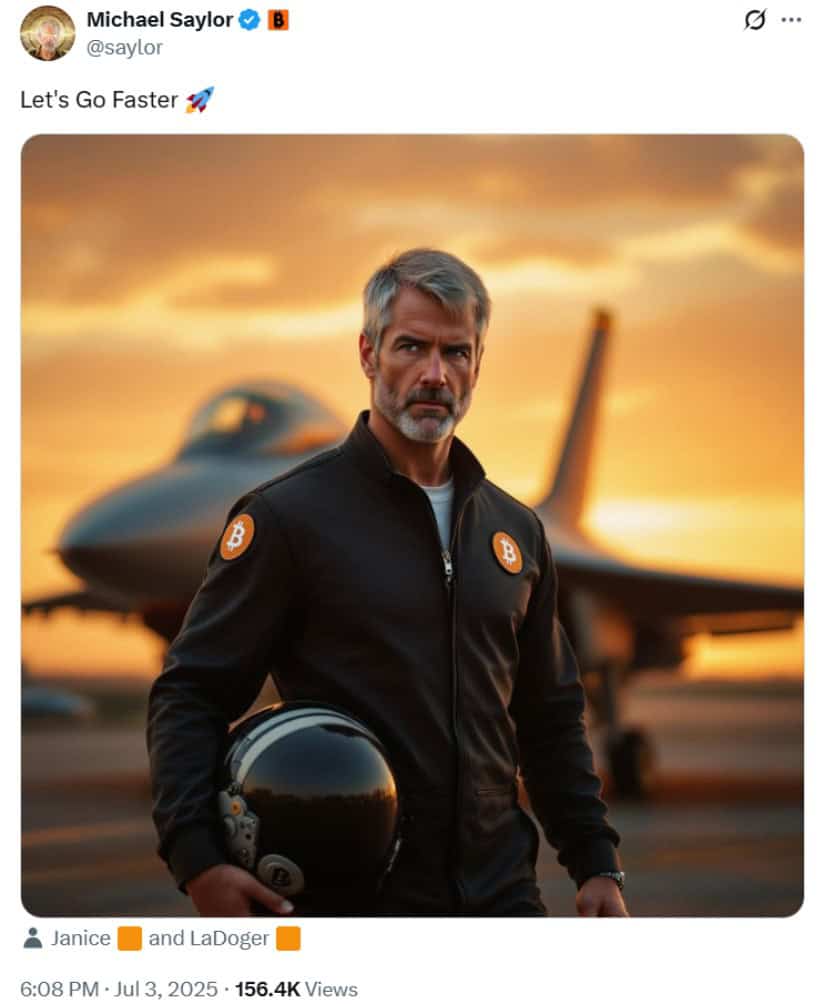

Rumours of Bitcoin’s demise, it appears, were greatly exaggerated. Picture it: plucky Bitcoin, sunglasses on, wind in its virtual hair, zooming past $110,000 while the crowd shrieks “Goose! Maverick!” all thanks to institutional money, ETF FOMO, and Michael Saylor’s newfound career as a Top Gun cosplayer. You couldn’t make it up. Is $150K next or are we all just in for a turbulent landing with free peanuts?

Bitcoin Swans Around $110K, Acting Like It Owns the Place

Currently, Bitcoin’s loitering just above $110,000 like someone who’s just remembered they left their Bentley in a no-parking zone. Only three weeks ago it had a (justifiable) existential crisis at $58K, but now it’s channeling its inner Brigitte Jones post-diary-resolution, bouncing up by nearly 90%. And where are we now? Through $108K resistance and flashing technical signals more bullish than a motivational poster in a WeWork kitchen (yes, “Live, Laugh, Leverage”).

If Bitcoin can manage to swagger past $115K, analysts suggest a clear runway to $120K. That bullish continuation pattern they’re all muttering about? It’s back, and apparently last time it cropped up BTC surged 20%. Even the daily chart’s gotten involved, with a breakout above the Gaussian Channel—absolute scenes. Clearly, this isn’t just another Tuesday in crypto land.

Saylor Doing His Best Tom Cruise. ETFs, Whales—Everyone Wants a Cameo

Michael Saylor—yes, the man, the myth, the tweet machine—dropped a Top Gun meme that had Crypto Twitter keyboard pilots rolling out the afterburners. His company is still stuffing BTC into the corporate purse as if it’s about to get banned from the store, now holding a king-sized chunk of the 848,902 BTC treasuries have amassed (do these companies actually *do* anything anymore, or just hodl?).

The “corporate treasury invests in Bitcoin” trend is hotter than Bridget’s gossip diary: more than 50 companies are now raising cash just to buy Bitcoin. Meanwhile, BlackRock’s spot Bitcoin ETF inflows are rolling in like guests to a garden party after you announced free champagne—June’s net inflows alone were enough to make even the most jaded TradFi exec sit up straighter.

Bitcoin: New Inflation Hedge or Just an Expensive Safety Blanket?

If world central banks keep printing funny money, who’s laughing now? Apparently, it’s Bitcoin buyers: the “digital gold” of the 2020s, now available in flavours like “Taproot Upgrade” and “Lightning Network.” One analyst even called it a uniquely positioned inflation hedge for our dystopian age—next they’ll say it cures hangovers and makes you irresistible at weddings.

Fed rate cuts are in the air (again), optimism is high, and the 2026 halving is coming faster than your favourite reality TV finale. Multiple analysts are eyeballing $150,000 and muttering “Any day now” over their morning coffee. Admittedly, they said that at $20K, $40K, and $69K, but let’s not spoil the fun with details. 🚀

Crystal Ball: Are We at the Start of the Start?

Today’s headlines are obsessed with technical breakouts and Saylor in aviator shades, but the real story? Serious money seems to think this party isn’t over. If Bitcoin can cling to $110K like a diary clutched during a family crisis, who’s to say $120K—or even a record-smashing $150K—are off the table?

Is this a sensible time to FOMO in? Probably not, but since when has crypto Twitter ever cared about ‘sensible’? Bitcoin’s current rally seems built on more than memes and chaos (for once), and even Bridget would admit that’s something worth writing about. 🥂

Read More

- Best Controller Settings for ARC Raiders

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Battlefield 6 Season 2 Update Is Live, Here Are the Full Patch Notes

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- The Best Members of the Flash Family

- Dan Da Dan Chapter 226 Release Date & Where to Read

- Ashes of Creation Mage Guide for Beginners

- Duffer Brothers Discuss ‘Stranger Things’ Season 1 Vecna Theory

- ‘Crime 101’ Ending, Explained

- Gwyneth Paltrow’s Son Moses Martin Makes Red Carpet Debut

2025-07-03 23:53