-

Short-term Bitcoin holders are sitting at the highest profits since August after BTC broke above $63,000.

The widespread profitability has seen market sentiment shift to positive, which could stir an extended rally.

As a seasoned analyst with over two decades of experience in financial markets, I’ve seen my fair share of market rallies and corrections. This latest surge in Bitcoin (BTC) is certainly grabbing my attention, particularly because it seems to be driven by short-term holders who are now sitting on profits not seen since August.

⚡ URGENT: Trump's Tariff Threats Shake EUR/USD Forecasts!

Will the euro survive the next Trump move? Find out the latest analysis now!

View Urgent ForecastAt the moment of reporting, Bitcoin [BTC] was trading at an unprecedented $63,790 this month. Favorable global trends have allowed BTC to buck the usual September downtrend, and as we approach “Uptober,” optimistic investors seem to be taking action.

In light of the fact that the favorable trends supporting Bitcoin seem to have run their course this month, it’s the traders who’ve owned Bitcoin for fewer than 155 days whose actions will likely determine the direction of its short-term price fluctuations.

Surge in Bitcoin short-term holder gains

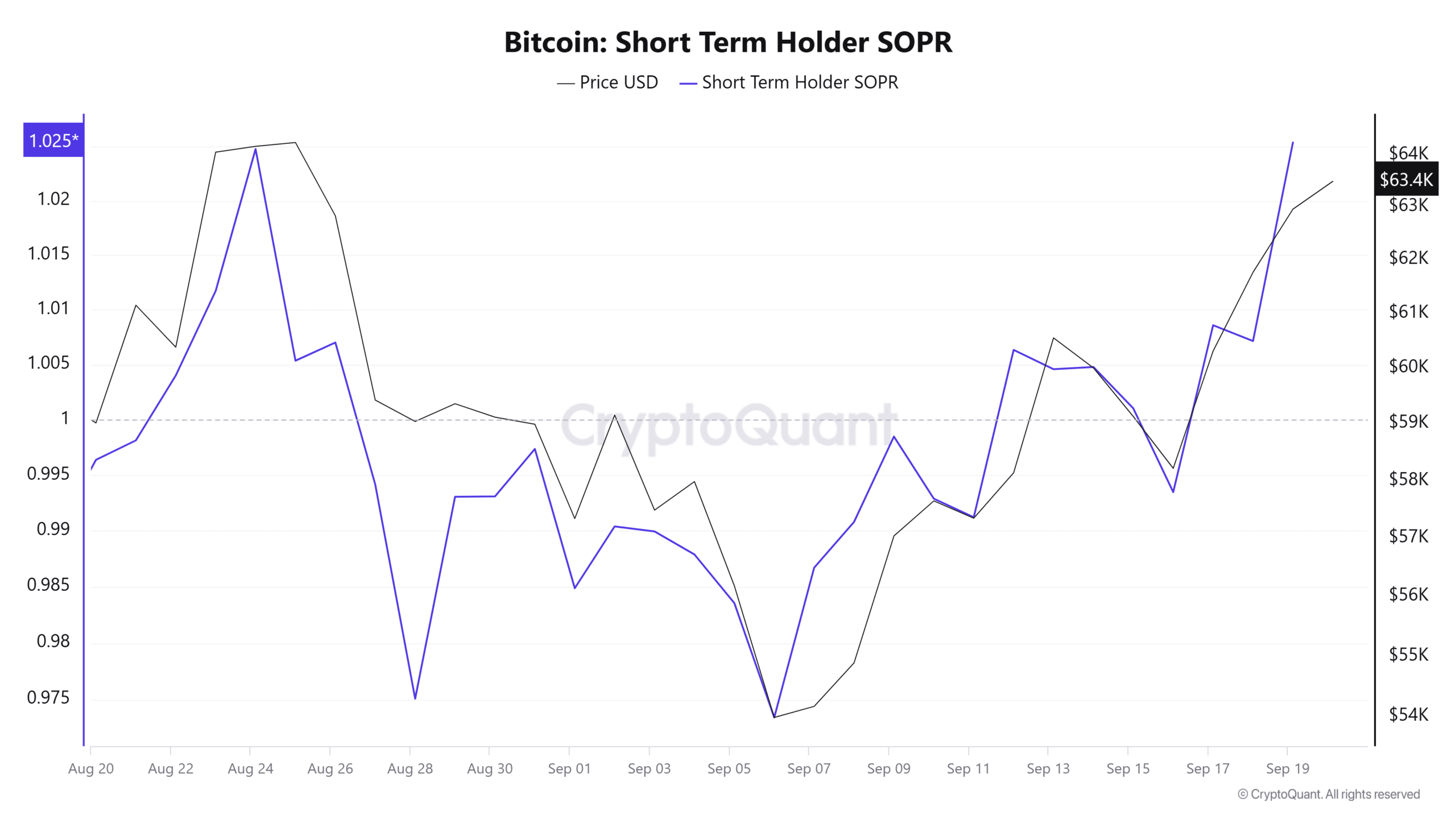

According to data from CryptoQuant, it was revealed that following Bitcoin’s price surge above $60K earlier in the week, short-term holders managed to make a gain on their investments. These investors had previously been experiencing losses.

The short-term Output Profit Ratio (SOPR) has witnessed a significant jump, rising sharply from nearly 1 to its highest point since late August.

It appears that this measure showed a change in investor attitude towards the market, moving from pessimistic to optimistic. Furthermore, the Bitcoin Fear and Greed Index supported this, as it climbed up to 54, which is its highest point in over three weeks.

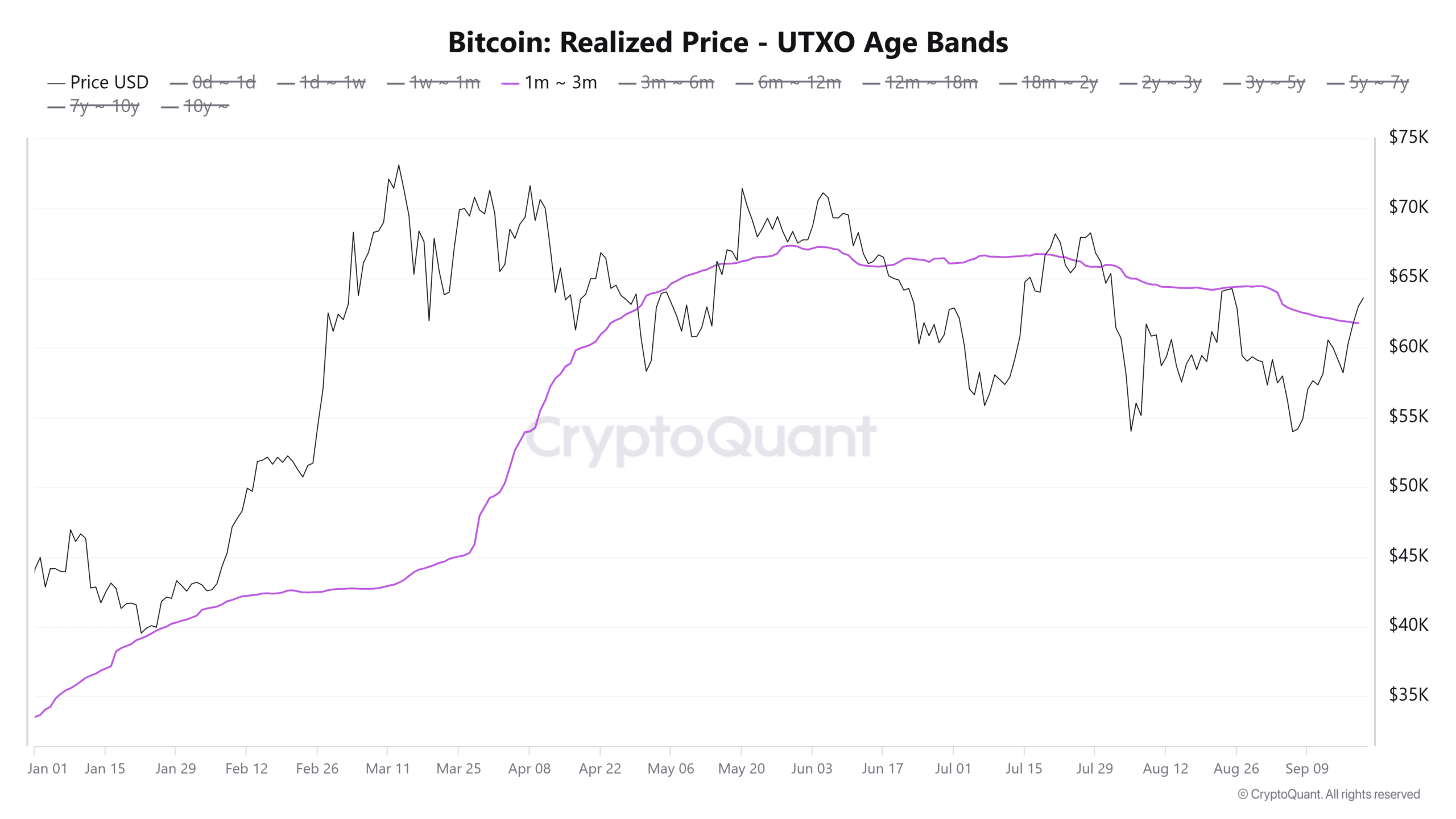

Short-term holder profitability is also seen in the Realized Price — UTXO Age Bands. Traders that have held BTC for one to three months have been below their average buy price since August.

These traders re-entered profitability on the 18th of September, after BTC rallied above $61,800.

According to the analysis by CryptoQuant’s expert, Avocado_onchain, the typical purchase price for short-term investors often serves as a robust barrier for further price increase. When Bitcoin surpasses this level, it indicates a powerful upward trend.

Risk of profit-taking

The widespread profitability among short-term Bitcoin holders shows bullish sentiment, but it also poses a risk to the short-term rally if they decide to sell.

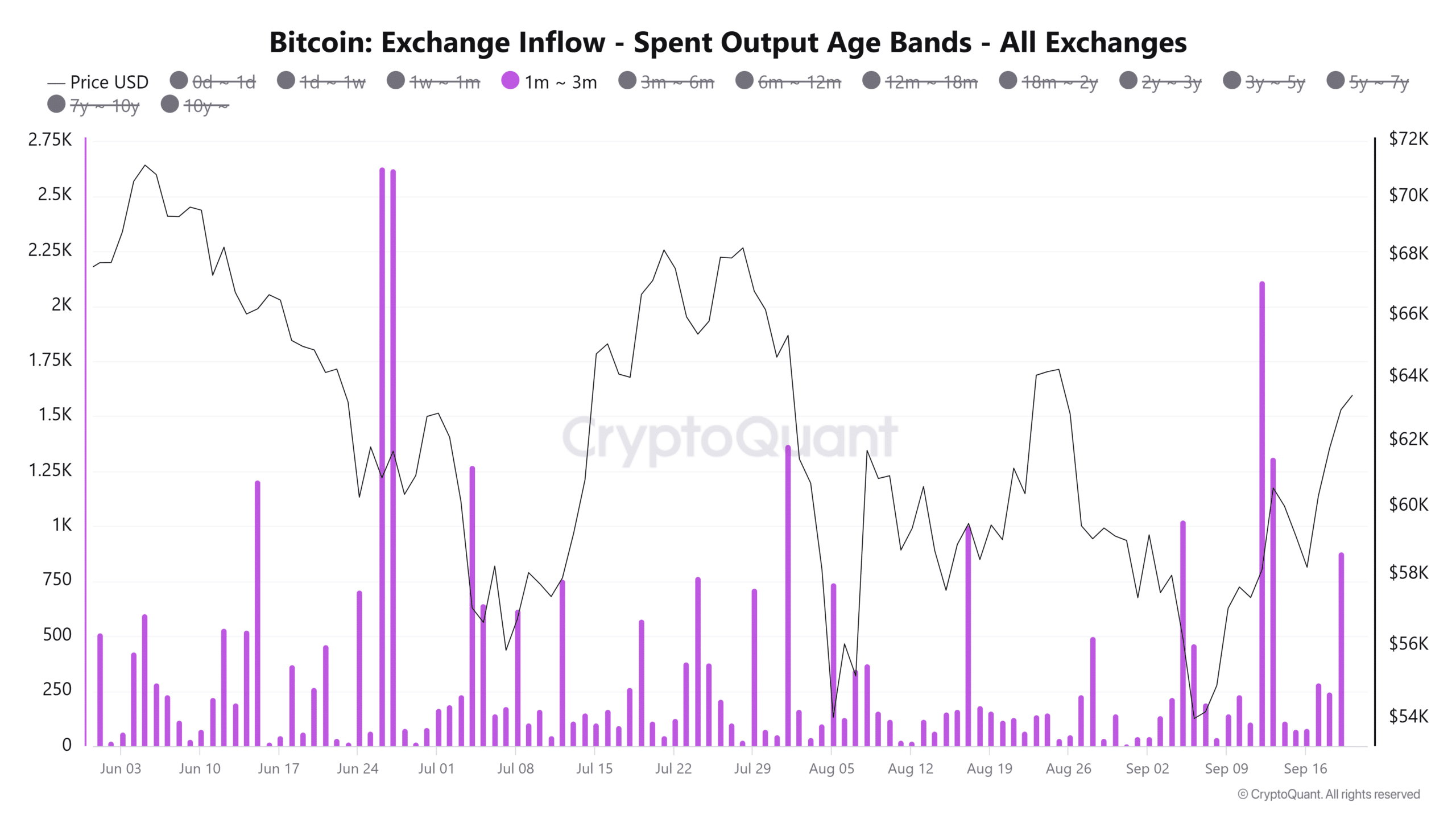

The value of coins dispensed from these containers has recently hit a new weekly peak, matching the increase in price and aligning with the Spent Output Value Bands on the exchange inflow.

This suggests that short-term holders could be taking profits after realizing gains.

Despite the ongoing selling activity not causing a downturn, an abundance of short-term traders cashing out their gains might pique the curiosity of potential new buyers.

Keep an eye on the Bitcoin price ranges between $64,000 and $70,000, as approximately 4.5 million wallets holding Bitcoin purchased at those levels are currently showing a loss, according to information from IntoTheBlock.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As such, Bitcoin will face resistance as it approaches this zone.

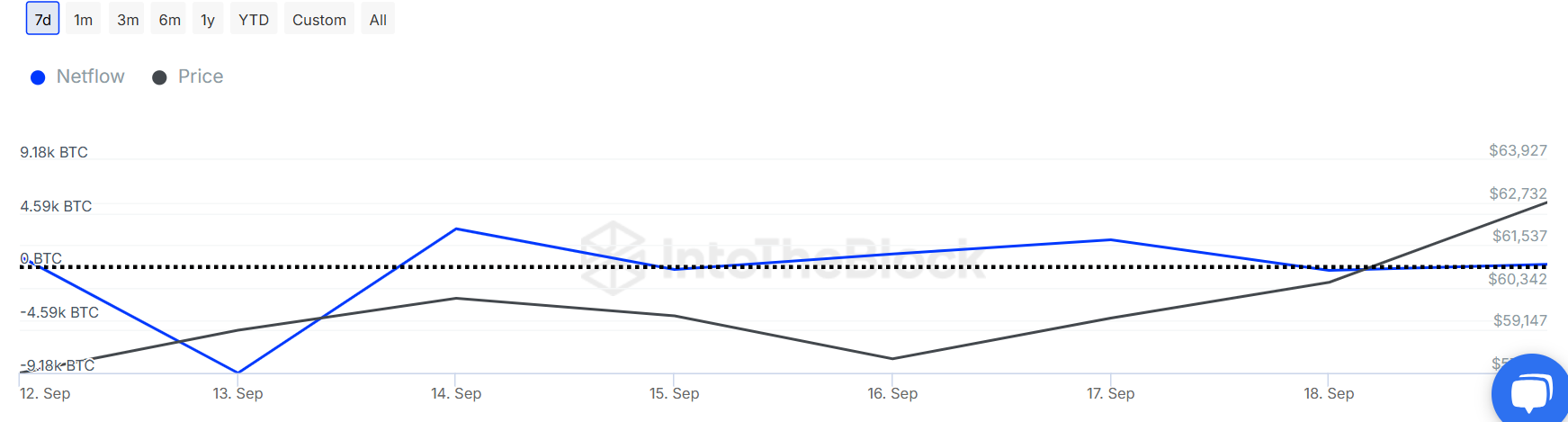

Despite recent Bitcoin price increases, it seems that whales haven’t engaged with BTC just yet. After a phase of stockpiling, the flow of holdings among larger investors has been generally steady for the past two days, which lessens the likelihood of significant sell-offs.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-09-21 07:03