- Bitcoin’s Implied Volatility saw a surge last weekend.

- Bearish sentiments overrun the market as the halving nears.

Over the weekend, Kaiko pointed out in a recent update on X (previously known as Twitter), that the estimated volatility for Bitcoin [BTC] options, due to expire in April, rose noticeably from 62% to 75%.

Implied Volatility measures the expected future swings in a coin’s price.

A significant increase in an asset’s Implied Volatility within a brief timeframe is indicative of a substantial change in investor feelings about the asset’s potential direction in the near future.

An uptick in Bitcoin’s estimated volatility indicates that traders anticipate more price swings or instability in the near future.

BTC in the spot market

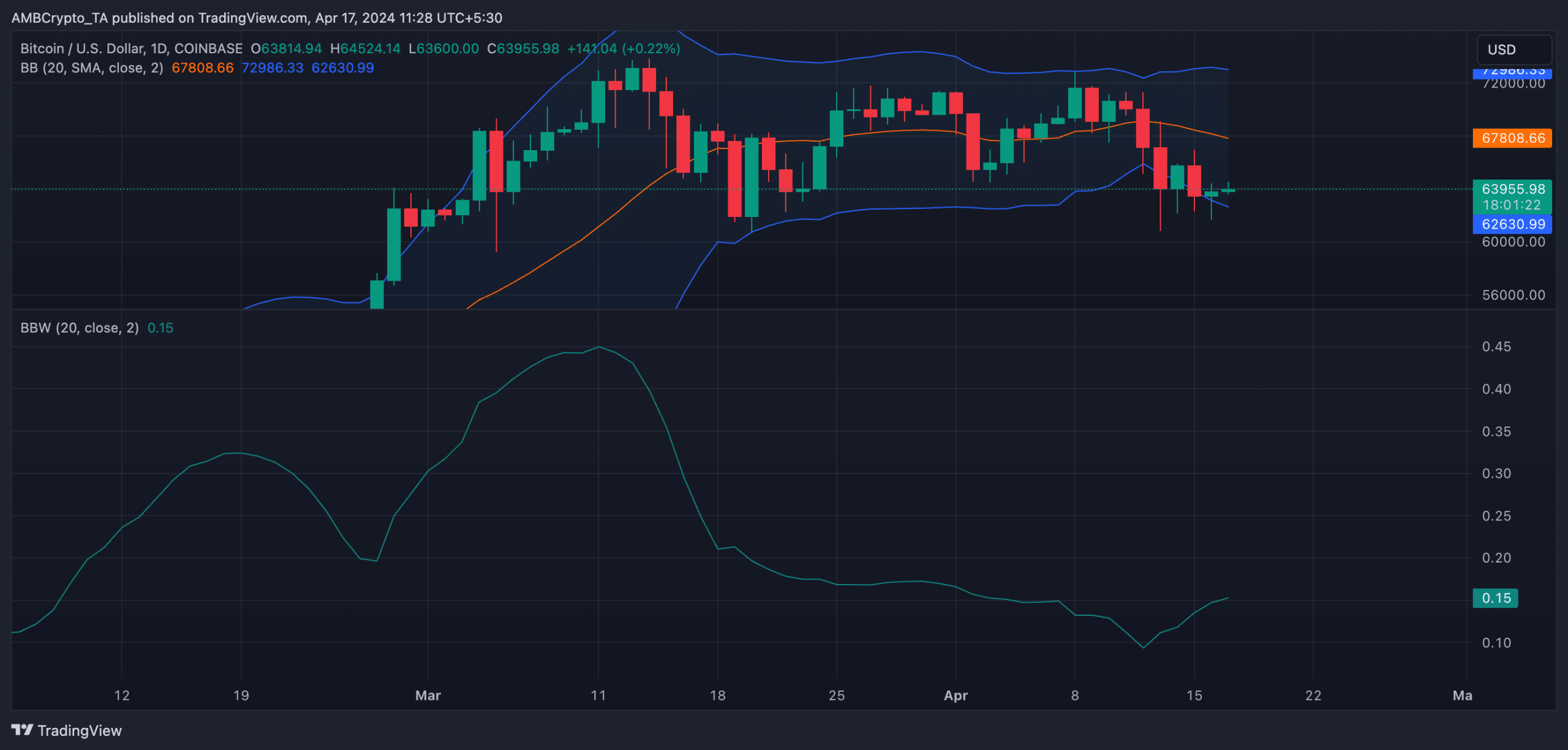

Based on an analysis of important volatility indicators on Bitcoin’s daily graph, it was found that the cryptocurrency continues to face the possibility of large price fluctuations, up or down.

The distance between the coin’s Bollinger Band indicator’s upper and lower bands has increased, signaling higher market volatility and potential for significant price fluctuations in the asset.

As the difference between an asset’s upper and lower price ranges grows larger, the asset’s price becomes more unpredictable and could potentially experience significant increases (uptrend) or decreases (downtrend).

The volatility of Bitcoin (BTC) is increasing, as shown by its expanding Bollinger Bands. Specifically, the Bollinger Bandwidth, which measures this expansion, currently stands at 0.15 – a 67% rise over the past four days.

The size difference between Bollinger Bands in this metric is what this indicator calculates. An increase in this measurement, such as what we see with BTC, signals heightened market volatility.

During increasing price swings leading up to Bitcoin’s scheduled halving on April 20th, pessimistic views continued to dominate the cryptocurrency market.

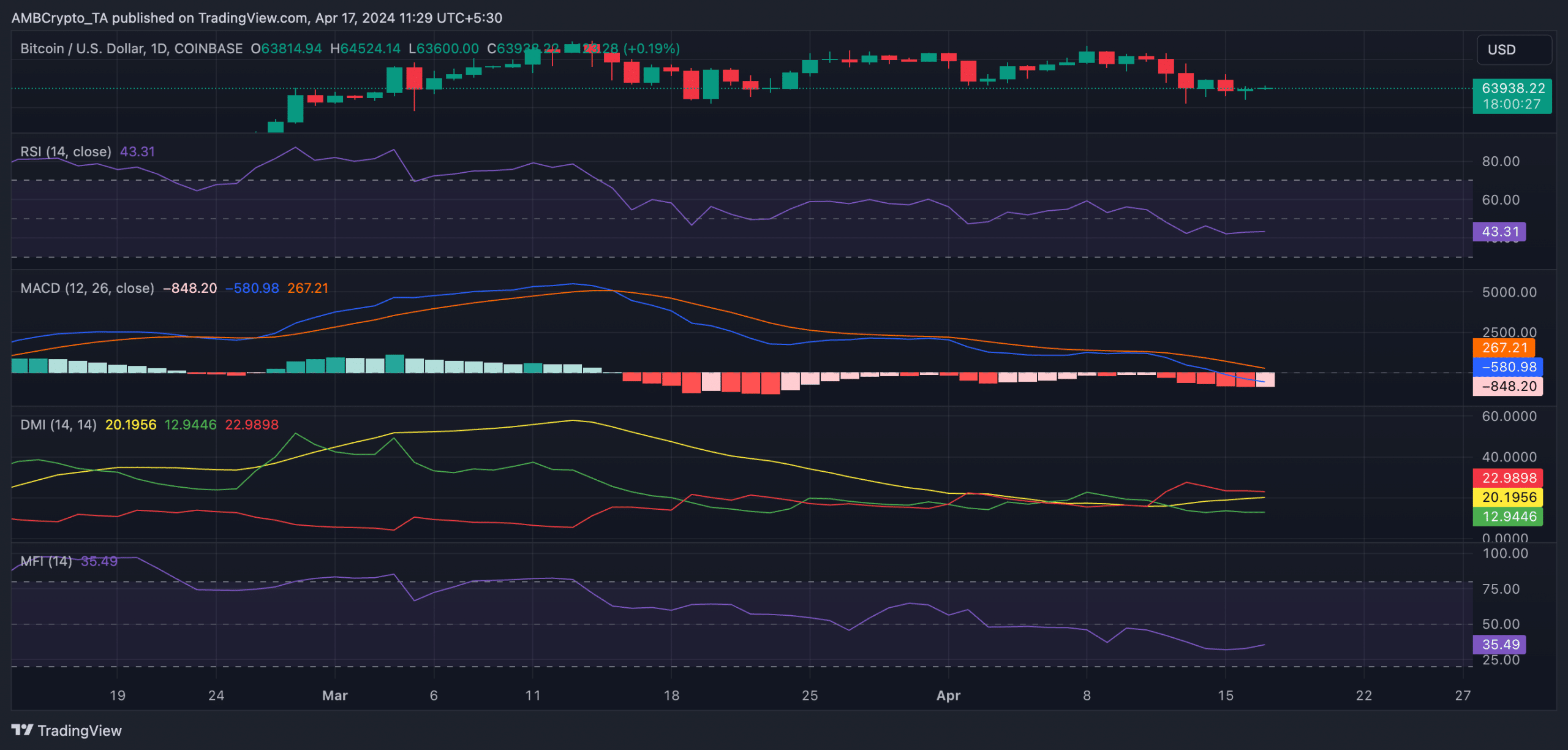

The MACD line of the coin’s moving average convergence divergence indicator was positioned beneath both its signal and zero lines in the readings.

Since the 15th of March is when the coin first dropped from its peak price of $73,750 and settled at its current location.

In simpler terms, when the short-term average of Bitcoin’s price lies below its long-term average, it’s generally seen as a warning sign for possible price decreases.

Additionally, the coin’s green index indicating positive direction was lower than its red index representing negative direction. This signified that the coin experienced more downward movements (bear power) than upward movements (bull power).

Currently, Bitcoin’s Relative Strength Index (RSI) and Money Flow Index (MFI) stand at 43.29 and 35.45 respectively, indicating a weaker demand for the cryptocurrency in the daily market.

Market participants chose to offload their coins instead of acquiring additional ones based on these figures.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Top 10 Stocks and Crypto Robinhood Alternatives & Competitors

- ‘China’s going to have it’ – Donald Trump crypto stance, finally explained

2024-04-17 12:07