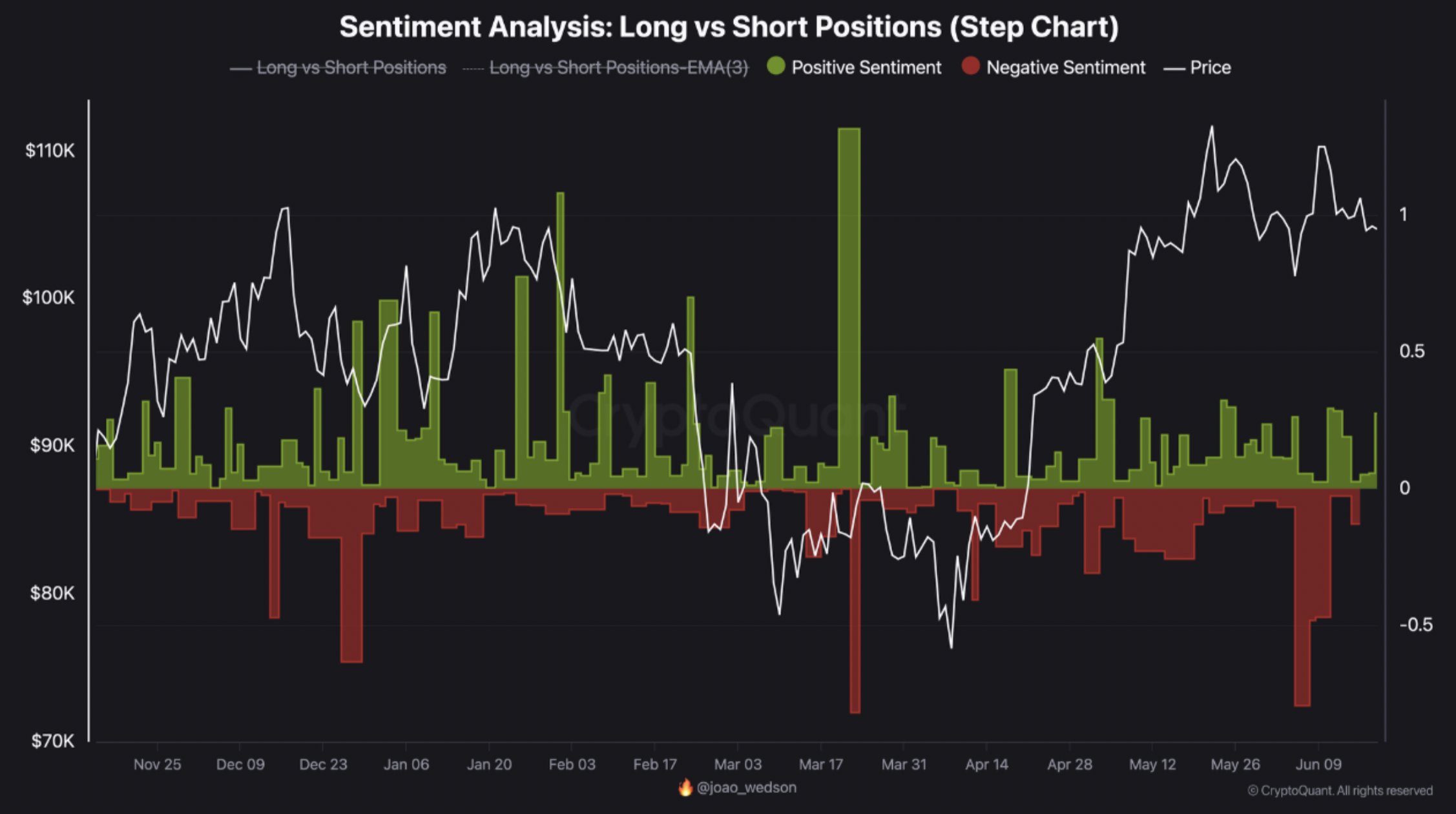

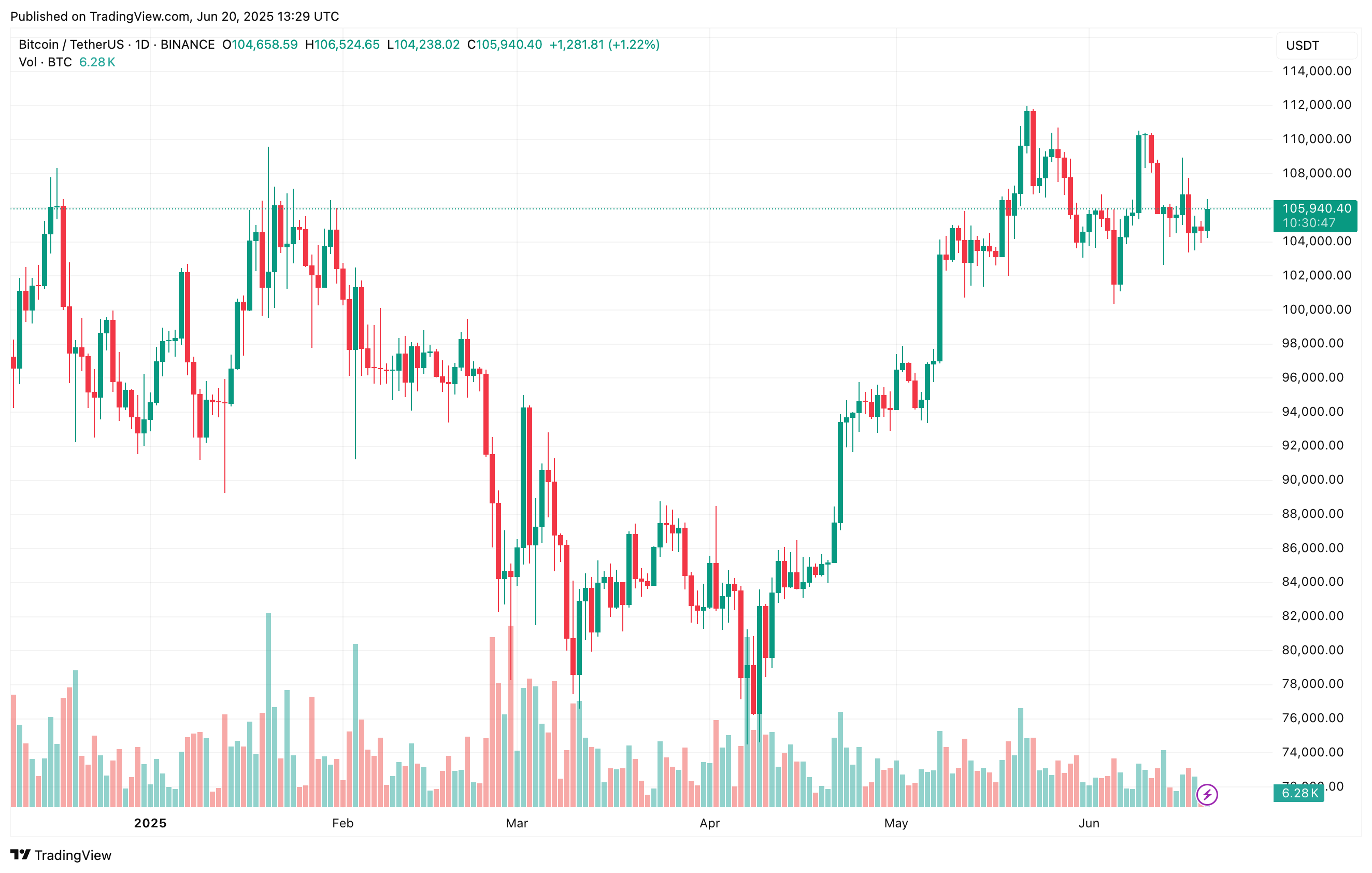

So, Bitcoin’s been loitering between $100,000 and $110,000 for nearly a month. That’s four weeks of digital loitering, the financial equivalent of standing outside the school disco and pretending you’re texting someone important. Both short and long positions are piling on, but the shorts? They’re gathering like they’ve heard about free drinks.

Longs Are in the Lead (But Don’t Get Cocky)

After karate-kicking its way to an all-time high of $111,814 (try saying that number out loud three times without feeling poor), Bitcoin has been positively non-committal. It’s like it’s waiting for a sign from the universe. Or, more likely, somebody’s bored cat.

BorisVest, who sounds like he could either be a rockstar or the guy who helps you reboot your router, says new Binance drama: longs slightly out ahead, just barely beating the shorts. But enough that the long-people are high-fiving in unison… quietly, because who wants to jinx it?

Apparently, when the shorts build up, we get what’s called a “short squeeze.” Not, as I hoped, a dance move. Likewise, too many bullish optimists and we’re looking at a long squeeze—think less hugging, more frantic spreadsheeting. If Bitcoin finally chooses a direction, expect mass panic, jubilation, or possibly both (finance is nothing if not a dramatic teenager).

The ratio of longs vs. shorts is basically balanced—a standoff so tense even Clint Eastwood would look away. The funding rate is neutral, the market is filled with existential angst, and everyone’s pretending they’re chill while secretly checking the charts every seven minutes.

But wait! The shorts are still climbing—fuelled, perhaps, by Middle East headlines and the world’s collective love for a good disaster. BorisVest sums it up with a flourish:

“Everyone thinks the rally’s dead. Shorts pile in faster than free Wi-Fi seekers at a coffee shop. This whole range? An actual emotional minefield.”

But here’s the kicker: when everyone’s betting on doom, sometimes the opposite happens. Like when you prepare all week for a breakup and your partner suggests getting a puppy instead. Giant market players might be quietly buying and waiting to pounce. Or maybe they’re just bored billionaires, who knows. 🤷♀️

Boredom or Boom: Which Will It Be?

Despite Bitcoin’s wild commitment to monotony, there are whisperings it’s about to make a move bigger than your ex’s apology texts. Some analysts say up only, targeting $150,000, because “liquidity” (which is financial lingo for: someone somewhere might have money to spend).

Technically: Apparently, there’s a bullish “inverse head and shoulders” thing happening on the charts. Not, as you’d expect, a new yoga pose, but apparently quite exciting for the crypto faithful.

But! The NVT Golden Cross (scientific name for “your network’s expensive, mate”) has waltzed into the overpriced zone. So, caution. Or mild suspense. As of this hot minute, Bitcoin’s at $105,940, up 1.1%—which is either huge or boring, depending on your level of caffeine.

Moral of the story? Watch your positions and your blood pressure. Or just wait for Bitcoin to get bored enough to move already. 🍿

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2025-06-21 06:47