- BTC broke its previous ATH when it rose to over $94,000.

- It is trading at around $92,500 at press time.

As a seasoned researcher with over a decade of experience in the cryptocurrency market, I’ve witnessed more than my fair share of price swings and market volatility. The recent Bitcoin slump, following its record-breaking ATH of $94,000, is no exception.

In the previous trading day, Bitcoin [BTC] underwent a significant change in direction following its peak at an all-time high of $94,000.

After reaching this high point, there was a sudden drop, initiated when investors holding for the long term sold off assets valued at approximately $3 billion.

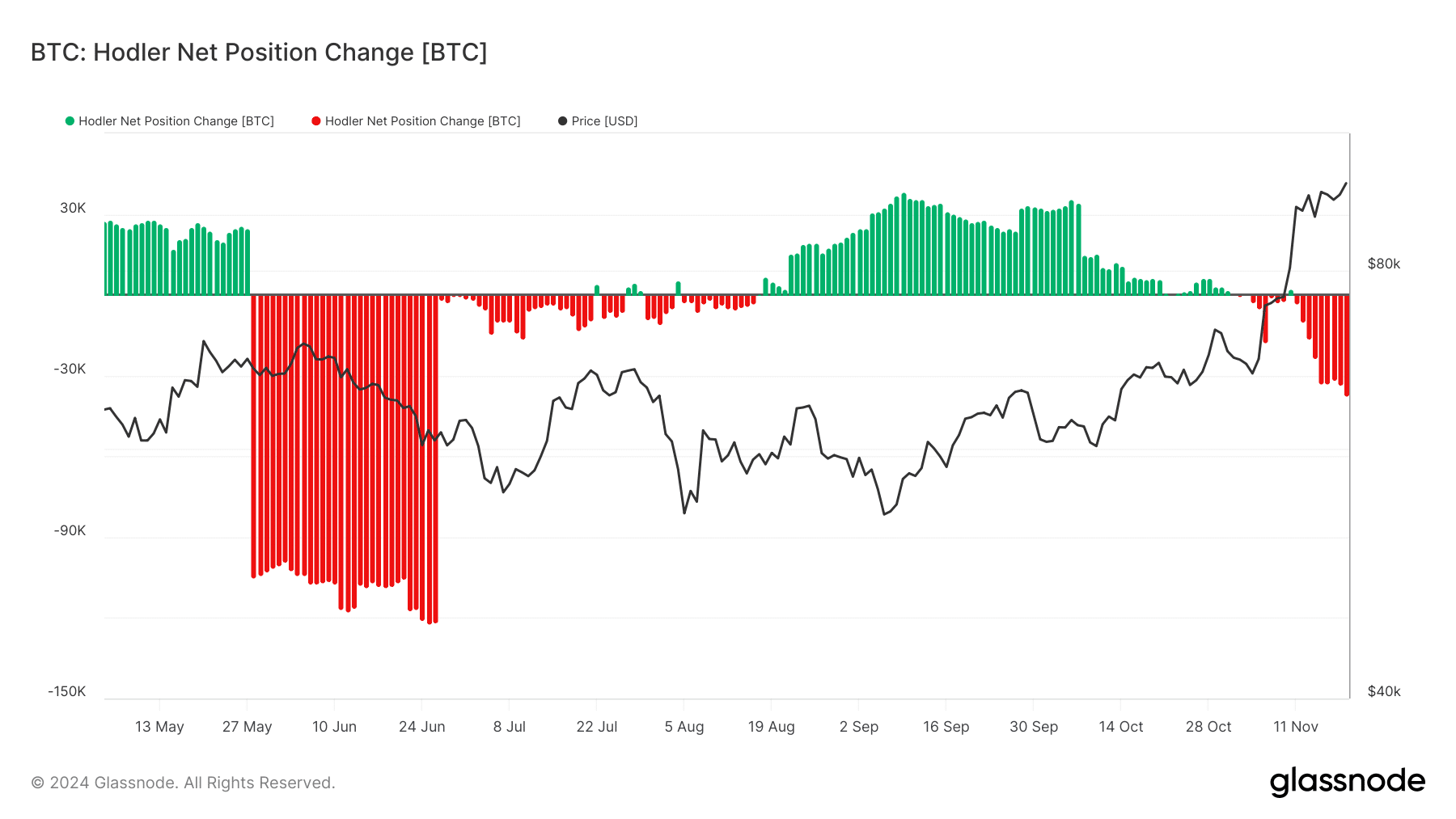

As a researcher delving into on-chain analysis, I’ve noticed a significant downturn in the HODLer Net Position Change metric, reaching its lowest and most negative levels in months. Additionally, exchange netflows seem to suggest an escalation of selling pressure, as more coins are being offloaded than bought.

The blend of these elements has sparked curiosity among investors: Could this be the commencement of a more substantial adjustment, or is it a pause before additional progress?

Bitcoin slumps: Price action and technical analysis

Bitcoin’s price chart highlighted its meteoric rise to $94,000 before retreating to $92,500.

According to AMBCrypto’s analysis, Bitcoin’s value, initially set at approximately $90,000, climbed up to around $94,105 during the most recent trading period.

The amount of trades significantly went up, indicating more intense trading during the period when assets were sold.

In simpler terms, for more than two months, the average price over a 50-day period stayed higher than the average price over a 200-day period, suggesting that the overall upward trend in the market has continued.

Nevertheless, the Relative Strength Index (RSI) stood firm at 76.62, indicating that Bitcoin may be overbought. With the MACD’s decreasing power also noticed, this might hint at an upcoming period of consolidation or even a temporary downturn for Bitcoin.

Keep an eye on support zones near $90,000 and $85,000. If these levels are broken, it could intensify the current decline.

HODLer behavior: Profit-taking at peak levels

In my analysis, I noticed that Glassnode’s chart indicated a substantial change in the long-term holding patterns of cryptocurrency holders, as depicted by the HODLer Net Position Change.

Over the past few months, there’s been an increase indicated by the green bars. However, more recent actions suggest a sudden switch from storing or accumulating (green bars) to distributing (red bars).

Currently, I’ve noticed that my HODLing strategy has faced one of its steepest downward trends since June. Over 37,000 Bitcoins, worth approximately $3.4 billion, have been offloaded from the market.

Thus, long-term investors chose to realize profits as Bitcoin touched its all-time highs.

During prolonged stretches of rallying markets, I often observe that the temptation of substantial returns can sway even the most resilient investors into offloading their assets.

Historically, such sell-offs have often resulted in short-term pauses, after which Bitcoin has continued its upward trend.

Exchange netflows highlight selling pressure

The graph from CryptoQuant shows that the sell-off of Bitcoin is continuing, as indicated by a surge in incoming transactions to exchanges, which could be due to owners wanting to cash out their Bitcoins.

According to AMBCrypto’s examination, there was a significant outflow of Bitcoin during the latest trading period, amounting to approximately 8,600 Bitcoins. At present, this trend shows no signs of reversal.

As a crypto investor, I’ve noticed that during past accumulation phases, negative netflows (outflow of more coins than inflow) have played a significant role in boosting Bitcoin’s price. However, the latest reversal indicates a change in the market mood, suggesting we might be moving towards a new sentiment trend.

If more Bitcoin is coming into exchanges than going out, this persistent trend may lead to a strong demand for selling, potentially making it challenging for Bitcoin to regain its record high value in the immediate future.

However, a decline in inflows could indicate that most profit-taking has already occurred.

What’s next after the Bitcoin slump?

Following a prolonged surge, Bitcoin’s dip from $94,000 can be seen as a typical period of profit-taking, during which long-term investors are taking advantage of their profits.

Based on the technical and blockchain signals, it seems like the overall direction is still positive; however, there might be signs indicating a period of market stabilization or a brief downturn in the near future.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Key areas to keep an eye on are the price ranges around $90,000 and $85,000 acting as potential support levels, while also monitoring on-chain indicators like HODLers’ activity and the flow of coins between exchanges for insights into market trends.

If the trend shifts towards increased buying activity or a decrease in selling activity, Bitcoin might have the opportunity to reach new record prices. However, it’s important to exercise caution because the market is currently working through these substantial changes.

Read More

2024-11-20 21:12