- Bitcoin reclaimed $100k, albeit briefly, with both internal and external factors signaling a potential Q1 breakout

- History tells us that the crypto market has a knack for defying mainstream predictions

The most recent economic figures have presented the Federal Reserve with a challenging situation. Unsurprisingly, the cryptocurrency market swiftly responded. In just a 4% increase in market value, leading coins have returned to positive territory, and Bitcoin momentarily exceeded $100k – a level it hadn’t reached in more than a week. Whether this rise was coincidental or intentional is up for debate, but it appeared to align with the upcoming inauguration of former President Trump.

Given all the current circumstances, could it be overly daring to anticipate that Bitcoin might reach a fresh record high before the end of this month?

If anticipation outweighs execution…

The unexpected decrease in December’s Core CPI inflation to 3.2% instead of the predicted 3.3% suggests that the positive response in the cryptocurrency market wasn’t just a coincidence. This surprising drop has fueled speculation about potential interest rate cuts, as evidenced by the notable 4% increase.

This situation might mark a significant shift that many investors have been anticipating. As inflation decreases, there’s a possibility that the Federal Reserve will reconsider reducing lending rates. Lower interest rates could mean reduced costs for leveraging, which in turn could lead to an influx of new capital into the cryptocurrency market.

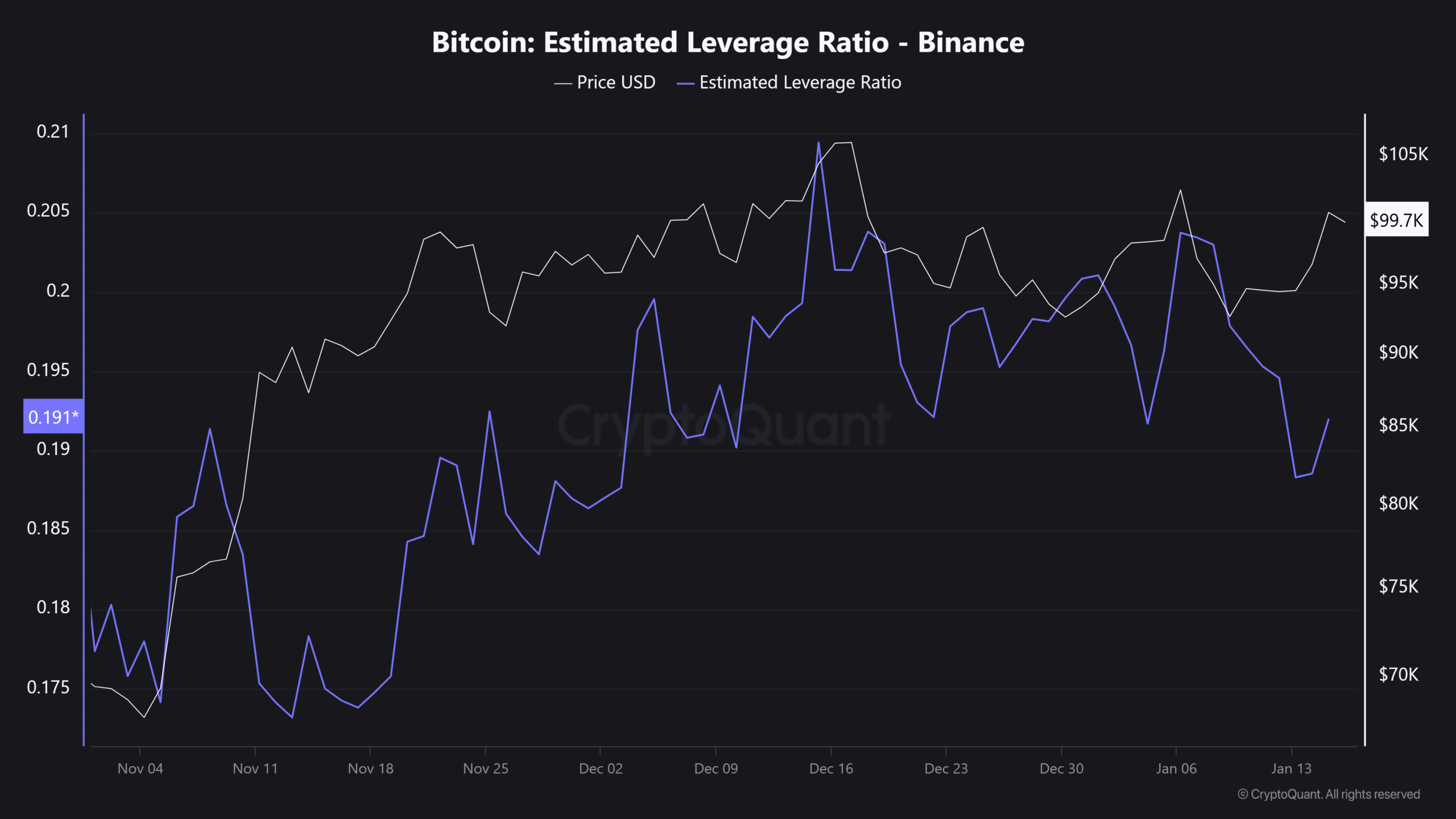

current Open Interest of over $64 billion signals significant activity. Given that Binance‘s leverage ratio is surging, there might be even greater movement if the Federal Reserve decides to act – an event worth closely monitoring in the near future.

The 3.61% surge in Bitcoin price as the report was released wasn’t solely due to the inflation data; instead, it stemmed from a combination of “expectations” for possible interest rate reductions, optimism over Trump’s proposed SEC crypto reforms, and speculation about his potential return to office.

Combined, these elements are paving the way for a possible BTC milestone of $102k. Yet, surpassing a fresh record high isn’t solely about prediction; it requires actual performance. History shows us that the market often challenges popular opinions. Could this situation be another instance of such defiance?

A peek to the other side of Bitcoin

For Bitcoin to reach a new record high, it would require a 10% jump from its current price of $99,800. In comparison to last year’s “Trump pump”, where BTC increased by 9% in just one day, the situation now is significantly more challenging due to the elevated stakes involved.

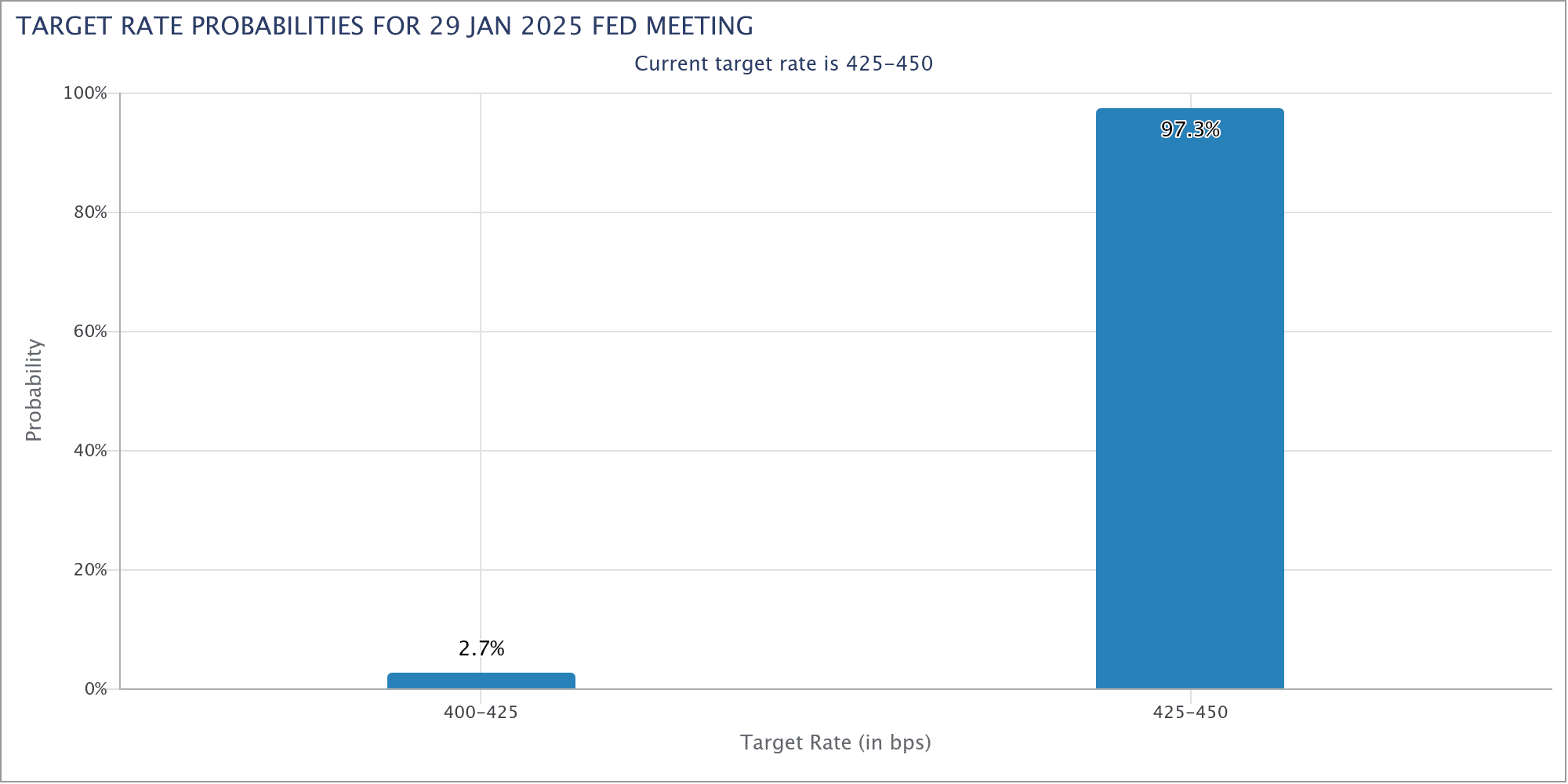

In simple terms, the Federal Open Market Committee (FOMC) meeting is coming up in 13 days’ time, and it could significantly impact the financial terrain for the year 2025. The market is tense as there’s a strong likelihood of a rate reduction, standing at approximately 97.3%. Will the Federal Reserve follow through with this reduction, or will investor expectations be disappointed yet again?

In the near future, expect significant market fluctuations as a 10% increase appears imminent. Short-term investors are more likely to chase quick gains rather than holding long term. Furthermore, with Trump’s recent efforts towards tariffs against nations such as Denmark and Canada, it’s understandable that the Federal Reserve may be reluctant about lowering interest rates.

Read Bitcoin’s [BTC] Price Prediction 2025-26

Given the numerous uncertain elements, the path for Bitcoin might become rough, emphasizing the importance of investors staying vigilant as the coming days could either reinforce market optimism or see it waver.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2025-01-16 17:33