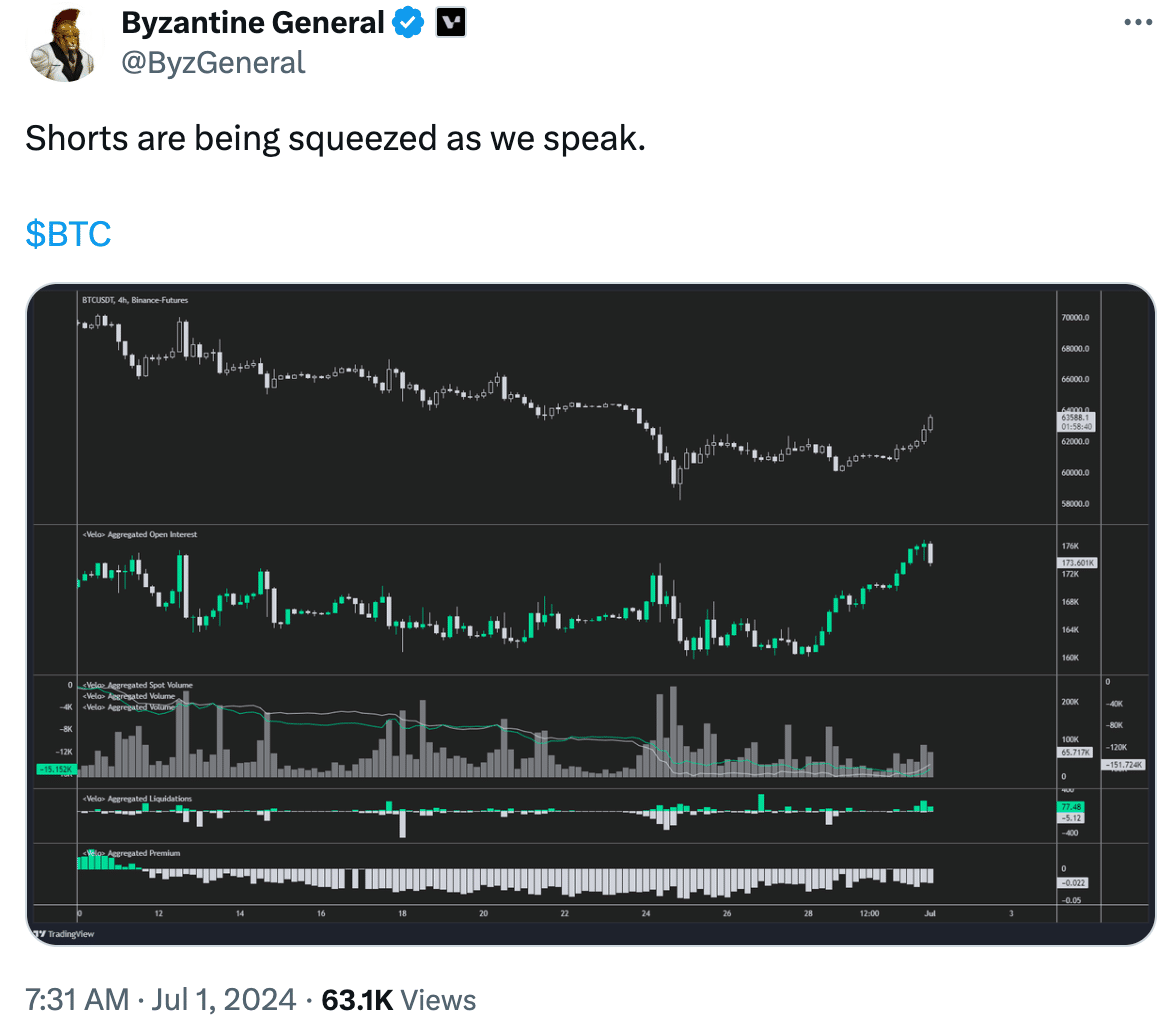

- Bitcoin witnessed a significant uptick in price, causing bears to get liquidated.

- Overall long positions grew, and interest in ETFs surged.

As a seasoned crypto investor with several years of experience in the market, I’ve seen my fair share of bull and bear markets. The recent price surge in Bitcoin has been an exciting development for me, especially after witnessing the bears getting liquidated due to a massive short squeeze.

As a researcher studying the cryptocurrency market, I have observed Bitcoin’s [BTC] price hovering around the $60,000 level for an extended period. Recently, however, there has been a noticeable upward trend in its value, providing renewed optimism for those who believe in its bullish potential.

Short sighted

Despite the bulls’ celebration, the bears suffered significant losses. In the previous day, an enormous amount of short positions were forced to be closed. This situation could lead to a “short squeeze.”

When the cost increases, short sellers receive margin call notices from exchanges to cover their open positions or are compelled to purchase Bitcoin to conclude their shorts. This buying frenzy from anxious short sellers further boosts the price and incites fresh interest among buyers seeking to capitalize on the market rise.

This cycle can lead to dramatic price increases for BTC, exceeding initial expectations.

Although short selling comes with the risk of substantial losses, market instability may ensue as certain investors cash in their gains, leading to possible corrections.

As a crypto investor, I’ve experienced the thrill of riding a short squeeze wave when holding a long position. However, I can’t ignore the inherent risks that come with it. The sudden price volatility during a short squeeze can lead to market reversals, leaving me vulnerable to being liquidated if I’m not careful enough. It’s essential to monitor the situation closely and be prepared for potential losses.

However, these factors haven’t slowed down the bulls one bit.

Bulls march ahead

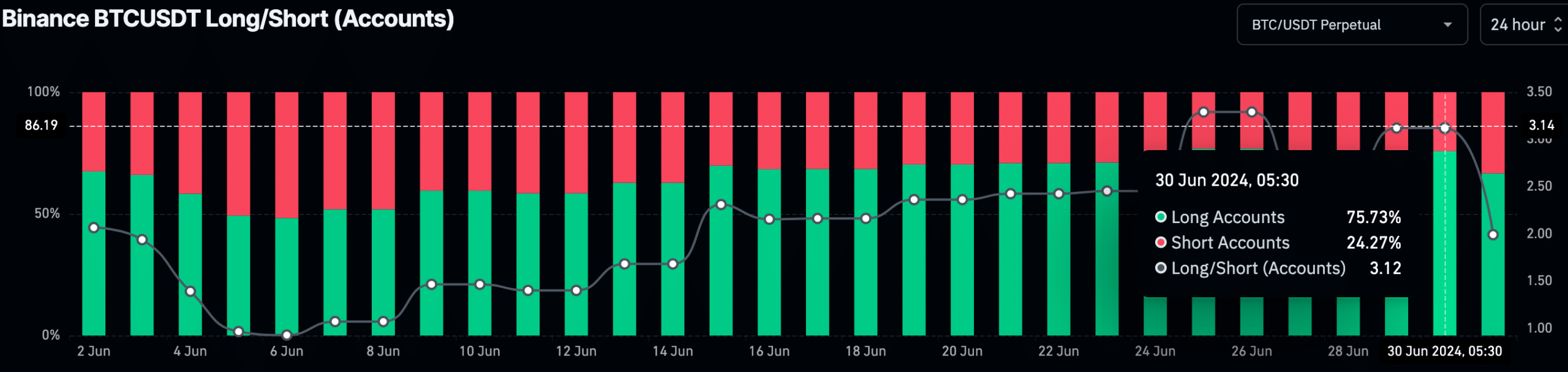

Among Bitcoin traders on Binance, there’s a palpable air of positivity. An in-depth examination of Coinglass’ statistics conducted by AMBcrypto revealed that an impressive 75% of active positions within the past 24 hours were long bets. This significant figure underscores a bullish sentiment among traders.

As a market analyst, I’ve noticed that the sentiment towards Bitcoin (BTC) perpetual contracts paired with Tether (USDT) on Binance is quite pronounced. This is due to the significant trading volume and liquidity of this specific crypto pair.

As an analyst, I’ve noticed a significant pattern emerging among retail traders on Binance. Despite the present market instability, their collective belief in Bitcoin’s potential for growth remains robust.

They are likely looking past the short-term volatility, and are expecting a further surge in price.

Institutional interest rises

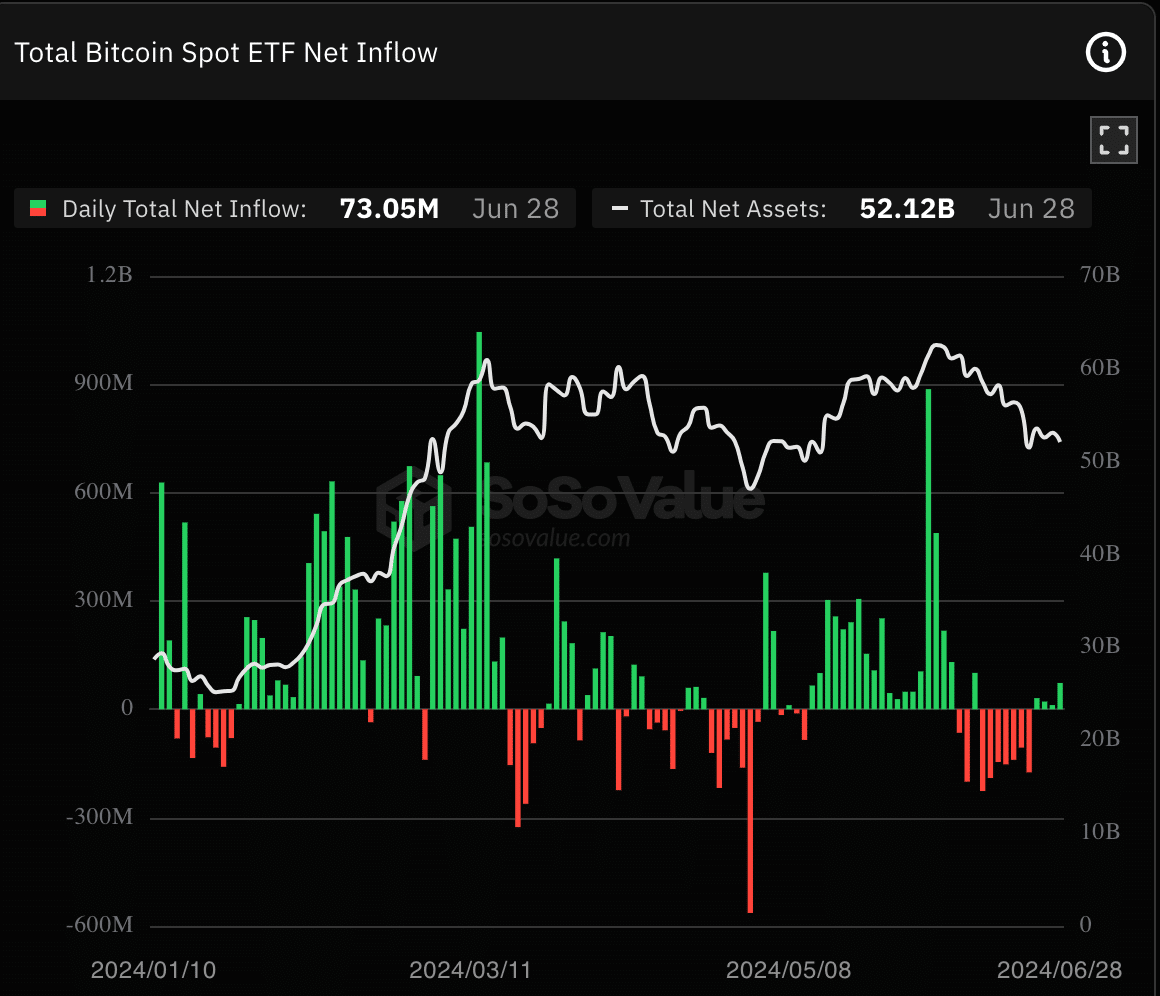

Adding to this positive sentiment, Wall Street is also showing renewed optimism around BTC.

As a researcher observing the Bitcoin Exchange-Traded Fund (ETF) market, I’ve noticed that after several consecutive days of negative net inflows, the tide has shifted once more. The current trend now indicates a positive overall inflow into these funds.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a researcher studying the cryptocurrency market, I’ve observed an increasing number of retail investors showing interest in Bitcoin (BTC), and institutional investors expressing confidence in its potential. This positive momentum could potentially fuel further growth in the price of BTC.

As I pen down these words, Bitcoin (BTC) is currently exchanging hands at an astounding $62,784.09 on the market. Over the past 24-hour period, its price has experienced a noteworthy growth of approximately 2.17%.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-07-01 21:11