- Bitcoin surged above $64,000 following the U.S. Fed rate cut but fell to $63,786 at press time.

- Bitcoin’s MVRV ratio signaled undervaluation, with further upward momentum needed for a sustained rally.

As a seasoned researcher who has closely followed Bitcoin’s [BTC] price fluctuations and market trends for over a decade, I find myself intrigued by recent developments. The latest U.S. Fed rate cut seems to have sent ripples through the cryptocurrency market, with BTC surging above $64,000 following the announcement. However, the subsequent retracement to $63,786 at press time leaves us in a state of cautious optimism.

After the U.S. made its recent reduction in interest rates, there’s been a steady increase in Bitcoin’s [BTC] value.

On September 23rd, the value of the cryptocurrency soared past $64,000, marking an 8.5% increase in its worth over the previous seven days.

After experiencing a rise, Bitcoin has seen a minor dip to $63,786 at the current moment—a 0.2% increase over the last day.

As a crypto investor, I’ve found myself drawn to the captivating performance of this particular asset lately. Its notable resistance and support levels have piqued the interest of analysts, hinting at a potential change in momentum on the horizon.

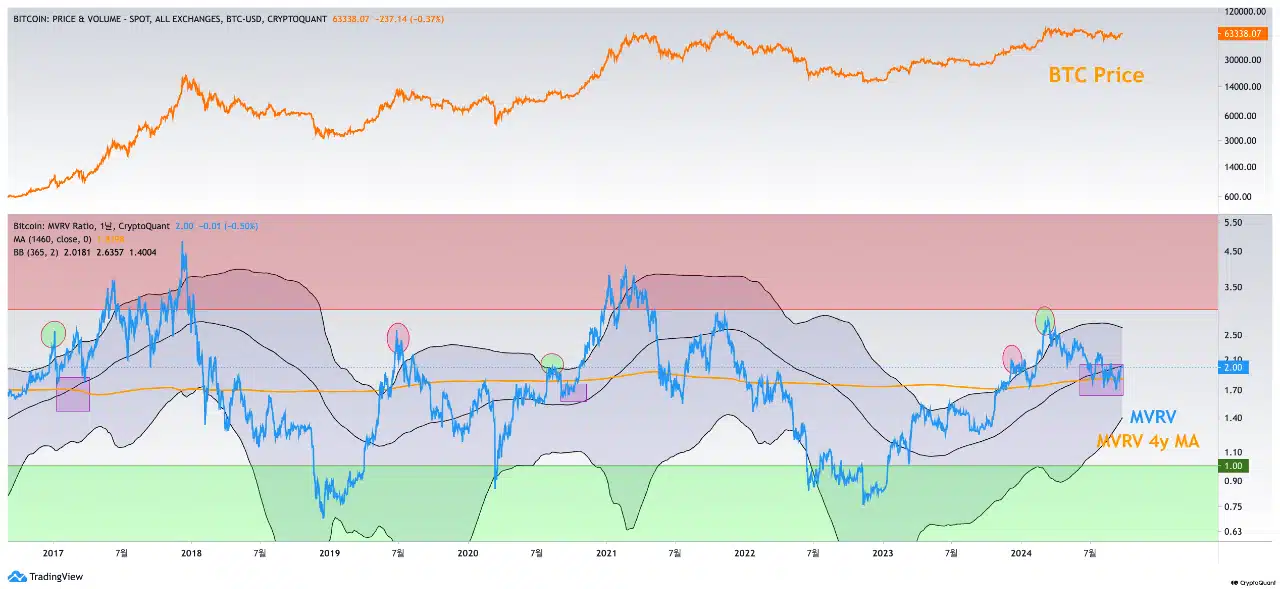

A crypto analyst, going by the name CoinLupin on the CryptoQuant site, highlighted the Market Value to Realized Value (MVRV) ratio of Bitcoin as a crucial signpost for predicting market trends.

In simpler terms, the MVRV (Market Value to Realized Value) ratio assesses if Bitcoin’s current market price is higher or lower than its actual worth based on past transactions. This helps traders determine whether the asset appears overpriced or underpriced at a specific moment.

Key indicator for Bitcoin’s trend

In a recent analysis, CoinLupin explained that Bitcoin’s 1-year and 4-year MVRV averages have historically served as critical resistance or support levels during various market trends.

According to the analyst,

“The overall market flow tends to follow a similar pattern.”

In simpler terms, CoinLupin pointed out that the MVRV ratio, especially during the recovery stages of 2023, offered crucial understanding about the ups and downs in Bitcoin’s price movements.

The current market scenario reveals a deviation from past trends.

Following a short spell of increased value or “overvaluation” during the latest market rebound, the decrease in Bitcoin’s price turned out to be less severe than predicted, and the subsequent period of stability has persisted for a longer time than forecasted.

Over an extended span, the accumulation phase for Bitcoin has pushed its Market Value to Realized Value (MVRV) ratio lower than both its one-year and four-year benchmarks.

Instead of possibly indicating an undervaluation, the analyst proposed that for Bitcoin to rekindle robust bullish trends, it’s essential for the MVRV ratio to surpass its 12-month median.

This could trigger a new bullish phase, leading to potential gains in the coming weeks.

Open Interest and Active Addresses

Additionally, it’s beneficial to scrutinize other essential indicators apart from the MVRV ratio, as they can provide valuable insights into potential future movements in Bitcoin’s pricing.

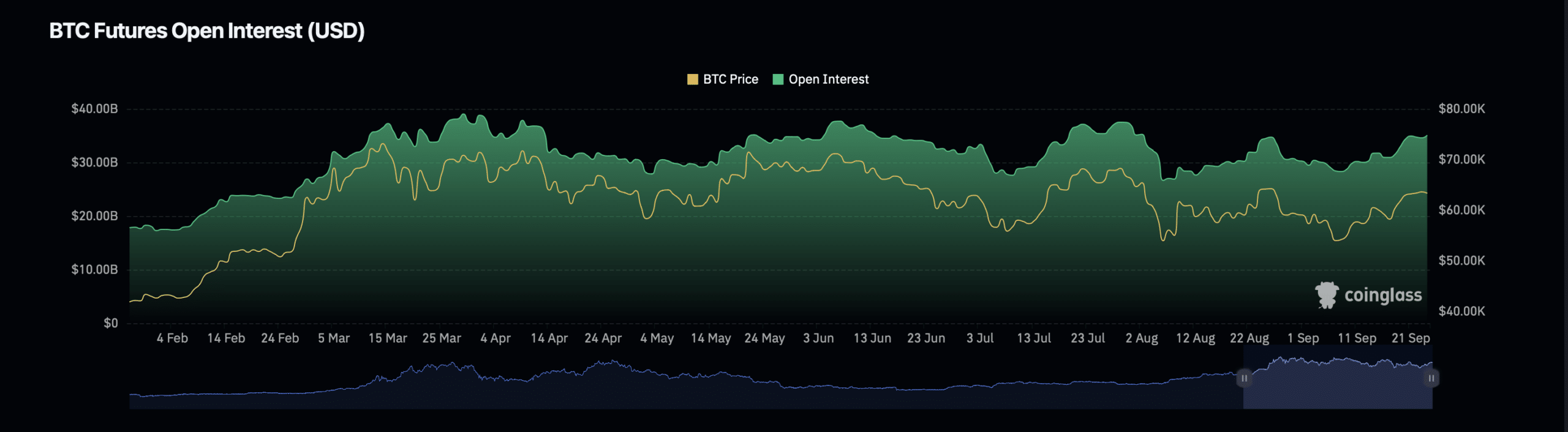

Based on information from Coinglass, the value of open Bitcoin Futures contracts, which serves as an indication of active contracts, has decreased by approximately 0.85%, now standing at around $34.78 billion.

The drop in Open Interest implies that market participants might be wrapping up their positions, possibly indicating a sense of caution or hesitation among them.

Furthermore, the Open Interest volume of Bitcoin, representing the combined worth of ongoing contracts, has dropped by a significant 20.86%, now standing at approximately $45.77 billion.

A significant drop in Open Interest usually signals less involvement in the market, potentially leading to a more subdued price fluctuation.

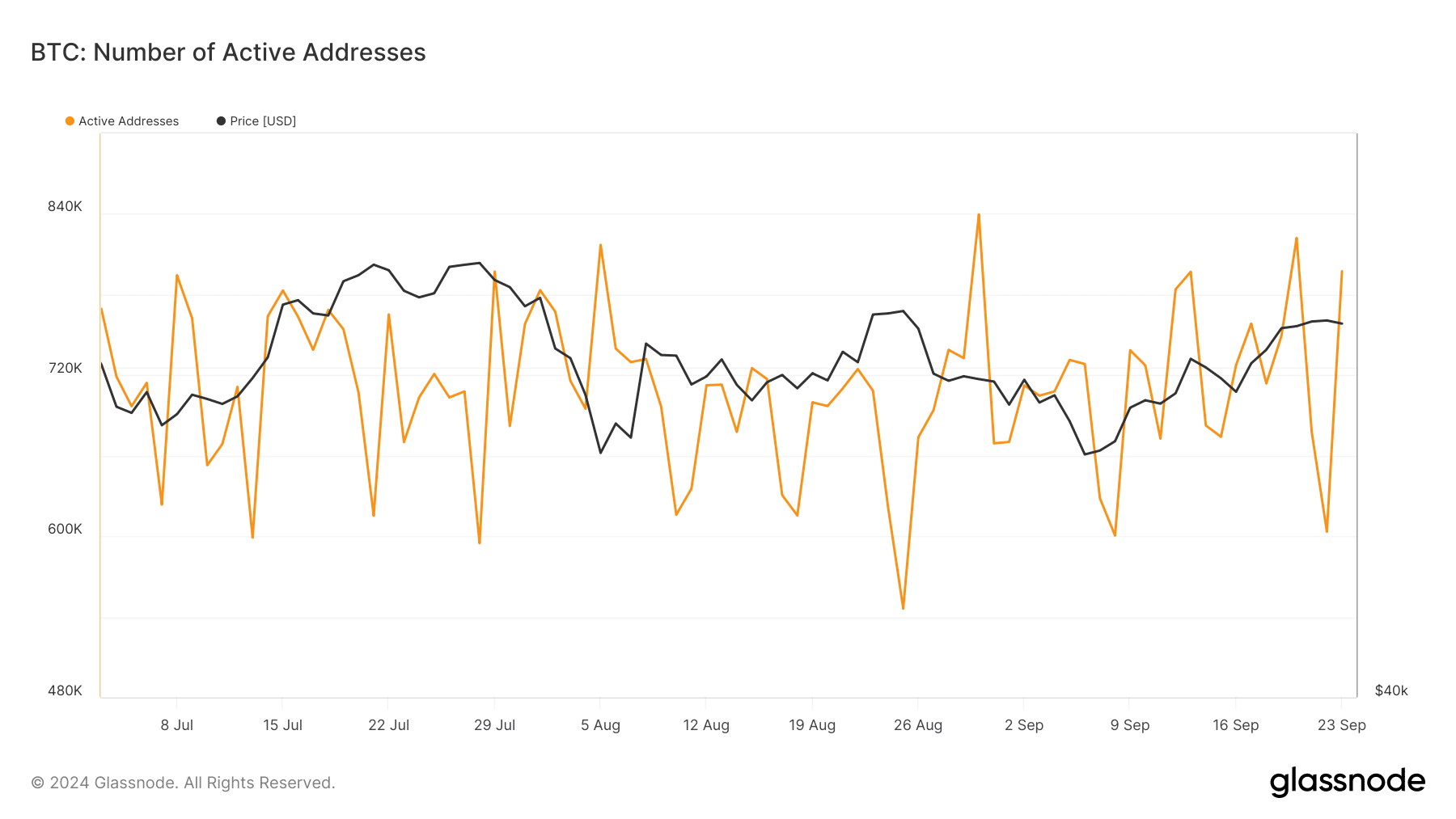

Meanwhile, information provided by Glassnode suggests an encouraging improvement in the number of active Bitcoin addresses. This figure has experienced a substantial increase following a sharp decline earlier in the month.

Bitcoin active addresses

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Today, the count of actively used addresses, a measure of network activity, has bounced back from 600,000 to 797,000.

An increase in active Bitcoin addresses might be a sign that people are becoming more interested in it again, which could possibly predict stronger price fluctuations in the future, particularly as more individuals start interacting with the network.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

2024-09-24 21:12