-

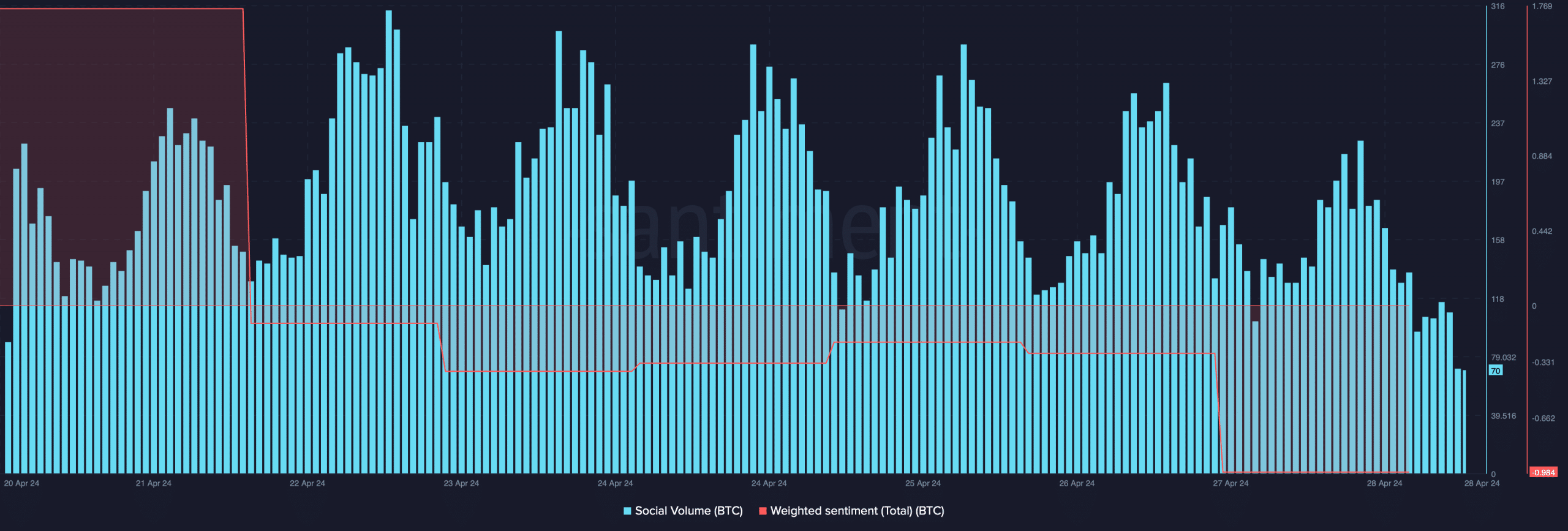

Bearish sentiment around BTC was dominant in the market.

Selling pressure on the coin was high.

Bitcoin’s price action has been underwhelming recently, with the cryptocurrency failing to break above $64k in the past few days. Bearish sentiment and selling pressure have dominated the market, as evidenced by a drop in Weighted Sentiment and Social Volume for Bitcoin. However, there are some conflicting signals that suggest a complex environment.

As an analyst, I’ve observed that Bitcoin‘s price movement has fallen short of expectations, with the coin failing to break through the $64k resistance level in recent days. Simultaneously, a significant Bitcoin metric has transitioned into a neutral zone, signaling indecisiveness in its direction.

Does this mean investors have to wait longer to see BTC rise again?

What’s going on with Bitcoin?

CoinMarketCap’s data revealed that BTC was down by more than 2% in the last seven days.

At the moment of reporting, Bitcoin’s price had dipped below $64,000 to $63,843.66, while its market capitalization exceeded $1.26 trillion.

I’ve analyzed the cryptocurrency market and noticed that the price action for Bitcoin, the leading crypto, took a turn for the worse starting on the 27th of April. This shift in price trend led to a pessimistic sentiment among investors, resulting in a bearish weighted sentiment towards Bitcoin.

Last week, I observed a slight decrease in the social volume associated with Bitcoin (BTC) within the cryptocurrency sphere, indicating a potential wane in its popularity.

At CryptoQuant, Phi Deltalytics, who is both an author and an expert analyzer, recently shared an insightful assessment based on a significant Bitcoin metric.

According to our assessment, the revised Spent Output Profit Ratio (SOPR) for Bitcoin has been trending upward, indicating a bullish market condition. However, the short-term SOPR now lies within an ambiguous range.

This discrepancy highlighted a complex environment where short-term investors faced losses.

The analysis mentioned,

During times when prices are fluctuating significantly, especially as they approach new record highs, it’s important to remain extra cautious.

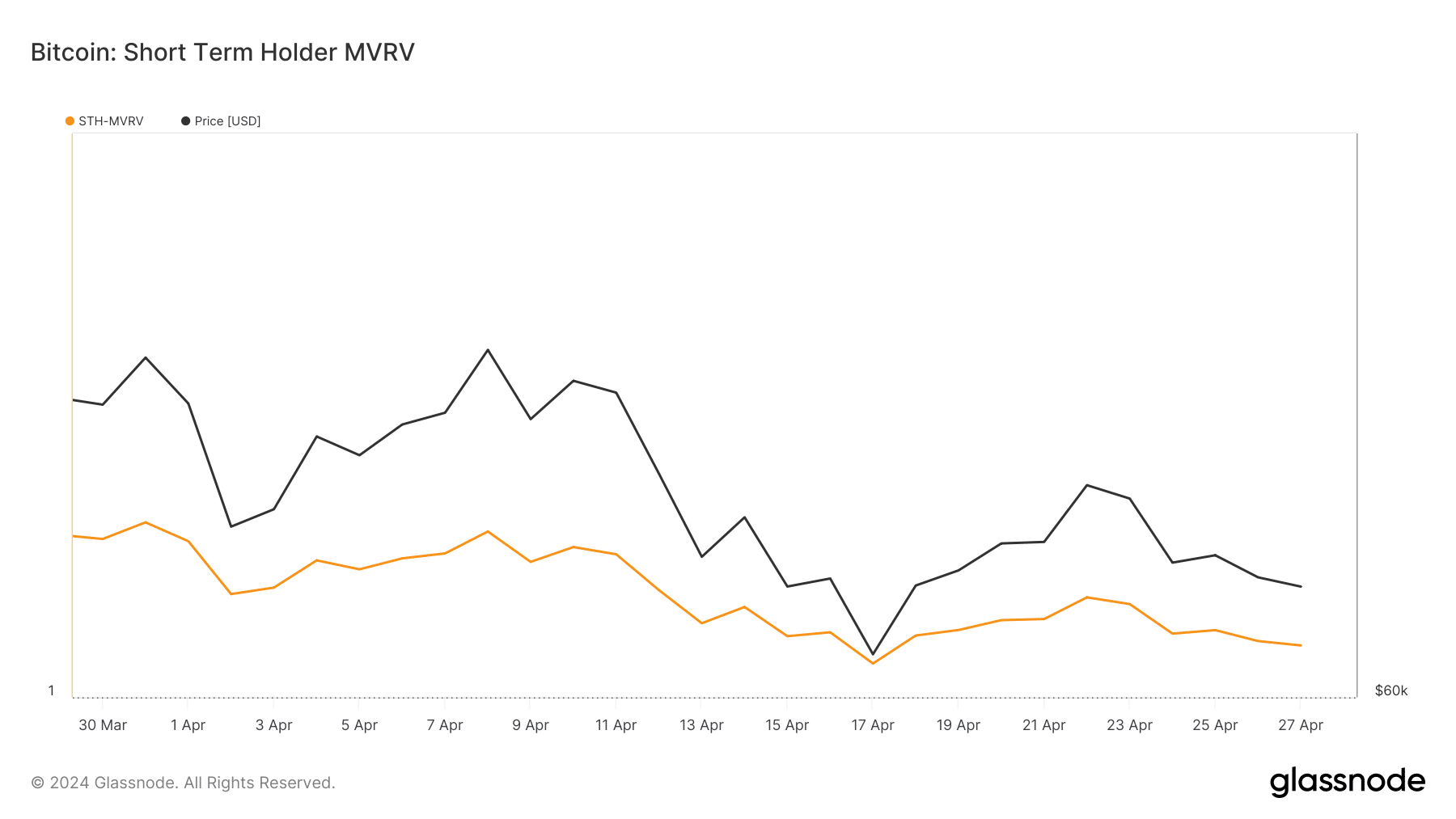

Based on AMBCrypto’s interpretation of Glassnode’s findings, it was noted that the Short-Term Holder Maker-Taker Realized Value (MVRV) for Bitcoin has decreased noticeably in recent weeks.

For those unfamiliar with the term, a low MVRV (Maker’s Cost Basis Divided by Current Value) indicates that the present Bitcoin price is comparatively lower than the prices at which previous transactions were made.

Does this hint at a price uptick?

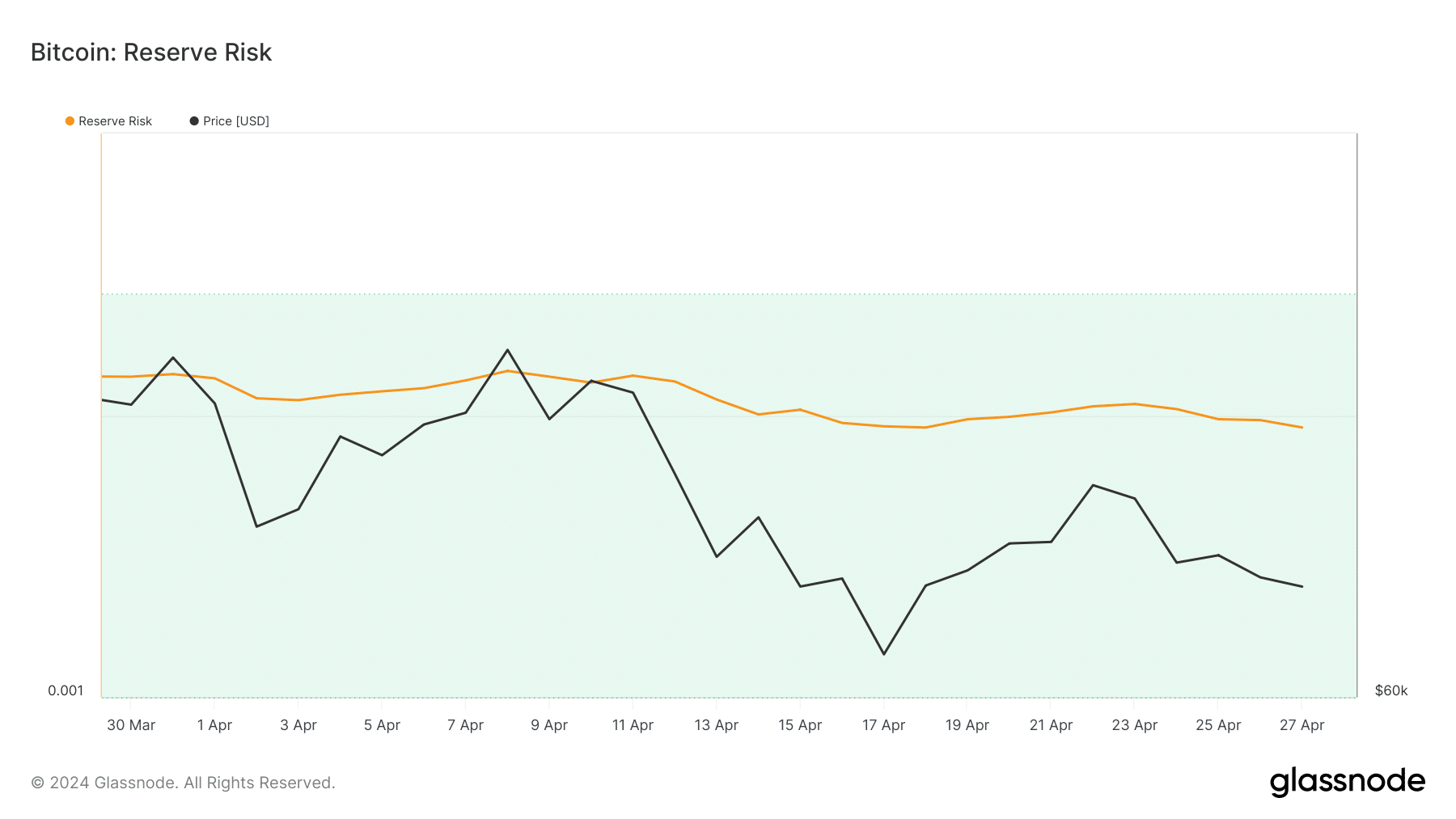

Based on our observation, the value of Bitcoin (BTC) appeared to be underpriced. To gain a clearer perspective, AMBCrypto conducted an in-depth examination of its current condition. According to our assessment, Bitcoin’s reserve risk was relatively low.

As an analyst, I’ve observed that despite a high level of confidence in Bitcoin (BTC) based on this metric, the cryptocurrency’s price remained relatively low at the current moment in time. This discrepancy might actually signal a potential buying opportunity and could be interpreted as a bullish sign.

Based on the analysis by AMBCrypto using CryptoQuant’s data, it appears that there was significant selling pressure for Bitcoin (BTC), as indicated by an upward trend in its exchange reserves.

Its net deposit on exchanges was also high compared to the last seven days’ average.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

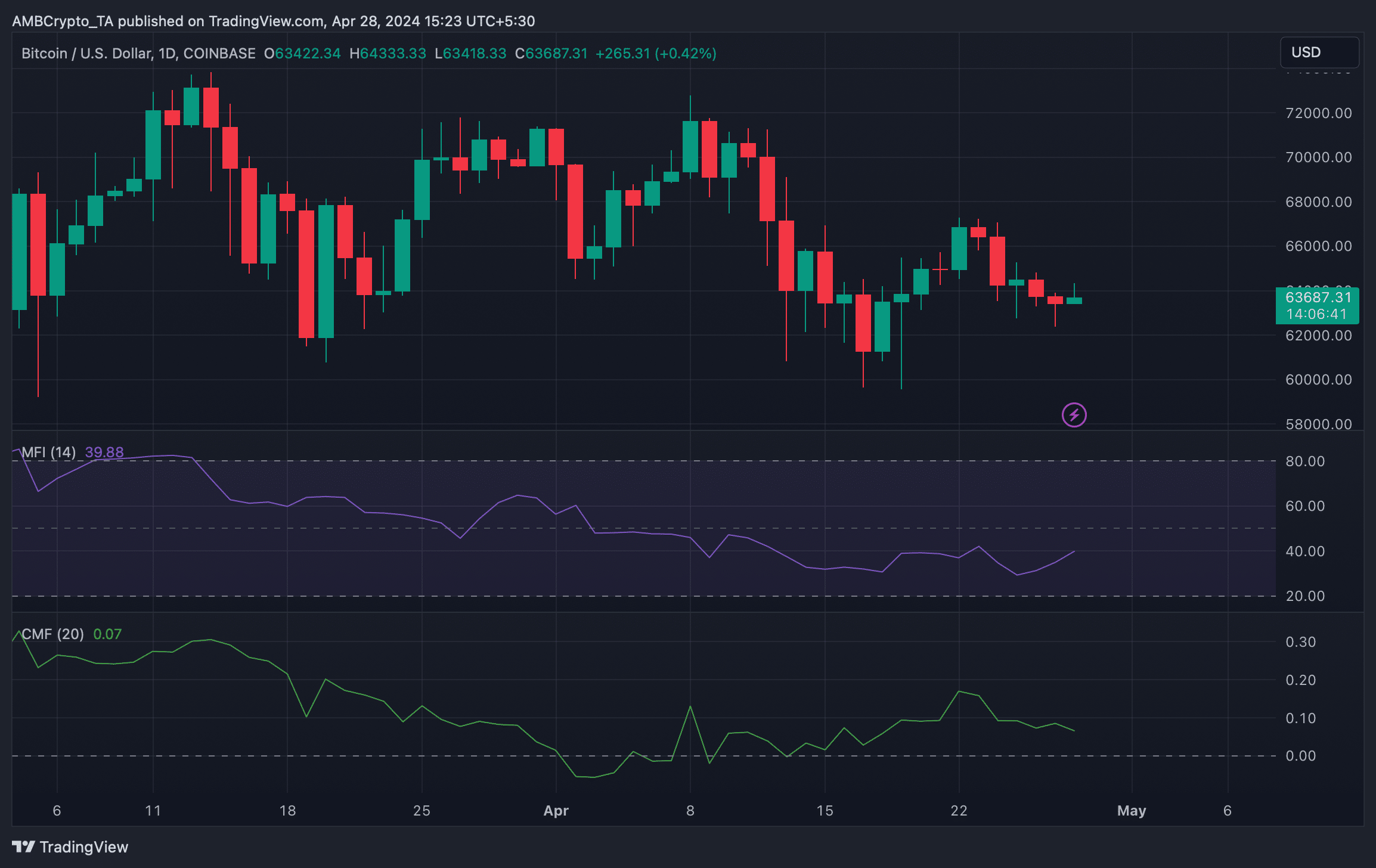

As a crypto investor, I examined Bitcoin’s (BTC) daily chart to identify any market signals that could provide insight into the potential direction of its price trend in the near future.

According to our examination, the Money Flow Index (MFI) indicated a potential price increase based on its upward trend. In contrast, the Chaikin Money Flow (CMF) maintained a bearish outlook.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-04-29 06:15