- Bitcoin’s rebound sparks debate among investors like Tapiero and Novogratz on future prospects.

- Uncertainties remain about Fed cuts and regulations.

As a researcher with a background in finance and cryptocurrencies, I have closely monitored the recent price action of Bitcoin (BTC) with great interest. The digital asset’s rebound from its weeks-long slump has ignited a heated debate among industry veterans like Dan Tapiero and Michael Novogratz regarding its future prospects.

As a researcher studying the cryptocurrency market, I’ve noticed that Bitcoin [BTC] has been bleeding red for weeks, but recent price action suggests it might be on the mend. Currently, BTC is trading at $62,150, representing a modest increase of 0.39%.

On May 14th, Bitcoin saw a notable rise, reaching over $63,000 momentarily before experiencing a slight pullback.

The current fluctuation in Bitcoin’s value has ignited significant debate and enthusiasm among users on various social media outlets.

Execs diverging views BTC

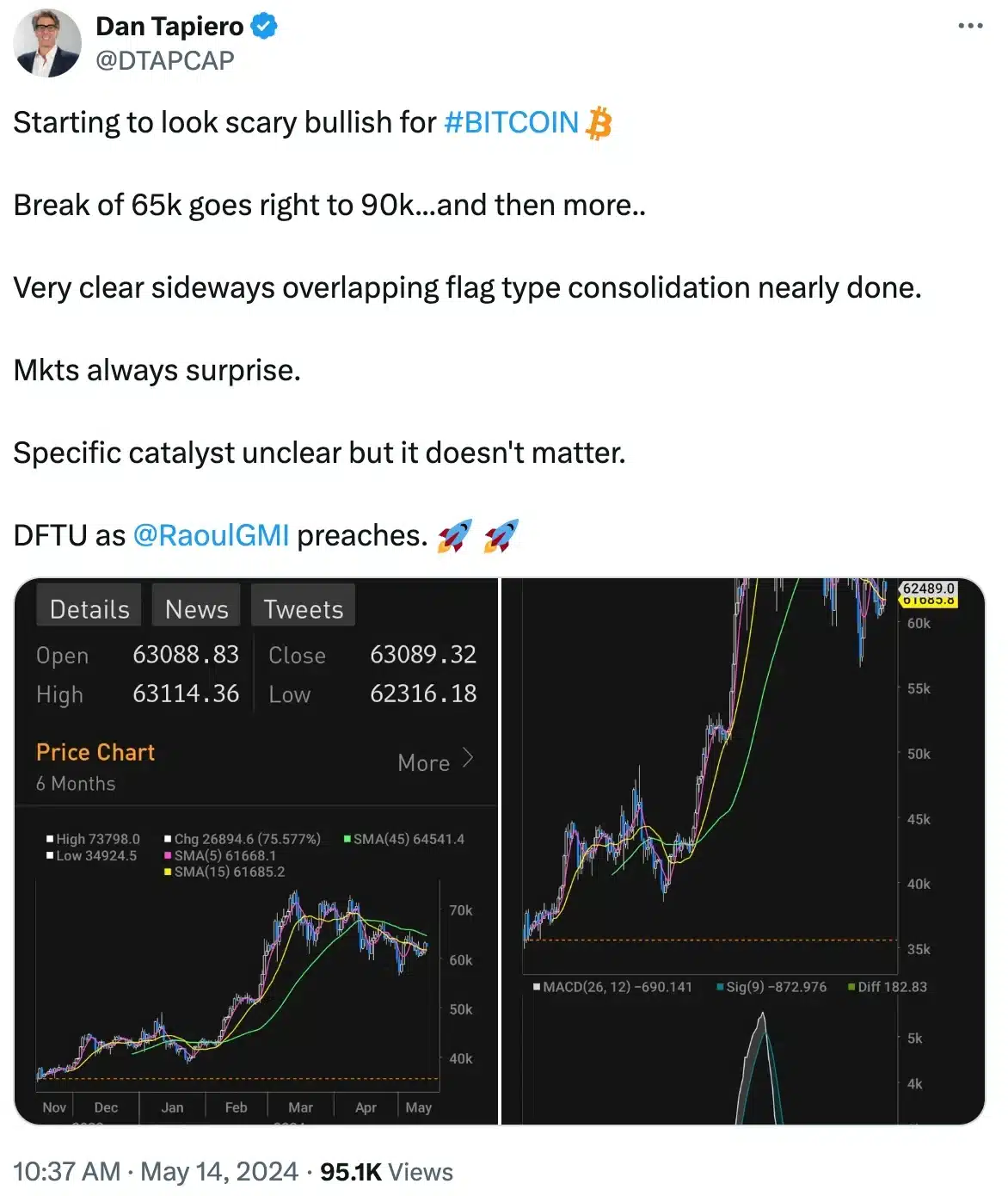

One notable voice driving this conversation is Dan Tapiero, an accomplished macro investor and fund manager, who strongly asserts that Bitcoin is poised to reach new peak prices (ATHs) soon.

Taking to X (formerly Twitter) he noted,

I, as an analyst, believe that Bitcoin’s trading range is expected to remain narrow during the current quarter based on Michael Novogratz’s prediction. Traditional finance’s increasing adoption of cryptocurrencies may contribute to this trend. (Bloomberg reported that) Novogratz made this statement.

In simpler terms, we’re currently experiencing a period of stability in the cryptocurrency market. Bitcoin, Ethereum, Solana, and all other cryptocurrencies are not showing significant price changes but rather holding their current values. This phase is referred to as consolidation.

He added,

“This estimate suggests a range of around $55,000 to $75,000 for the near future, with potential market changes causing an increase beyond that point.”

He also linked the record-breaking price of around $73,000 previously achieved to the debut of US Bitcoin ETFs on the stock market and the Bitcoin halving event.

Based on the present market situation, he is of the opinion that the market’s growth has slowed down as investors have become less hopeful about prospective Federal Reserve interest rate decreases, notwithstanding robust economic signals.

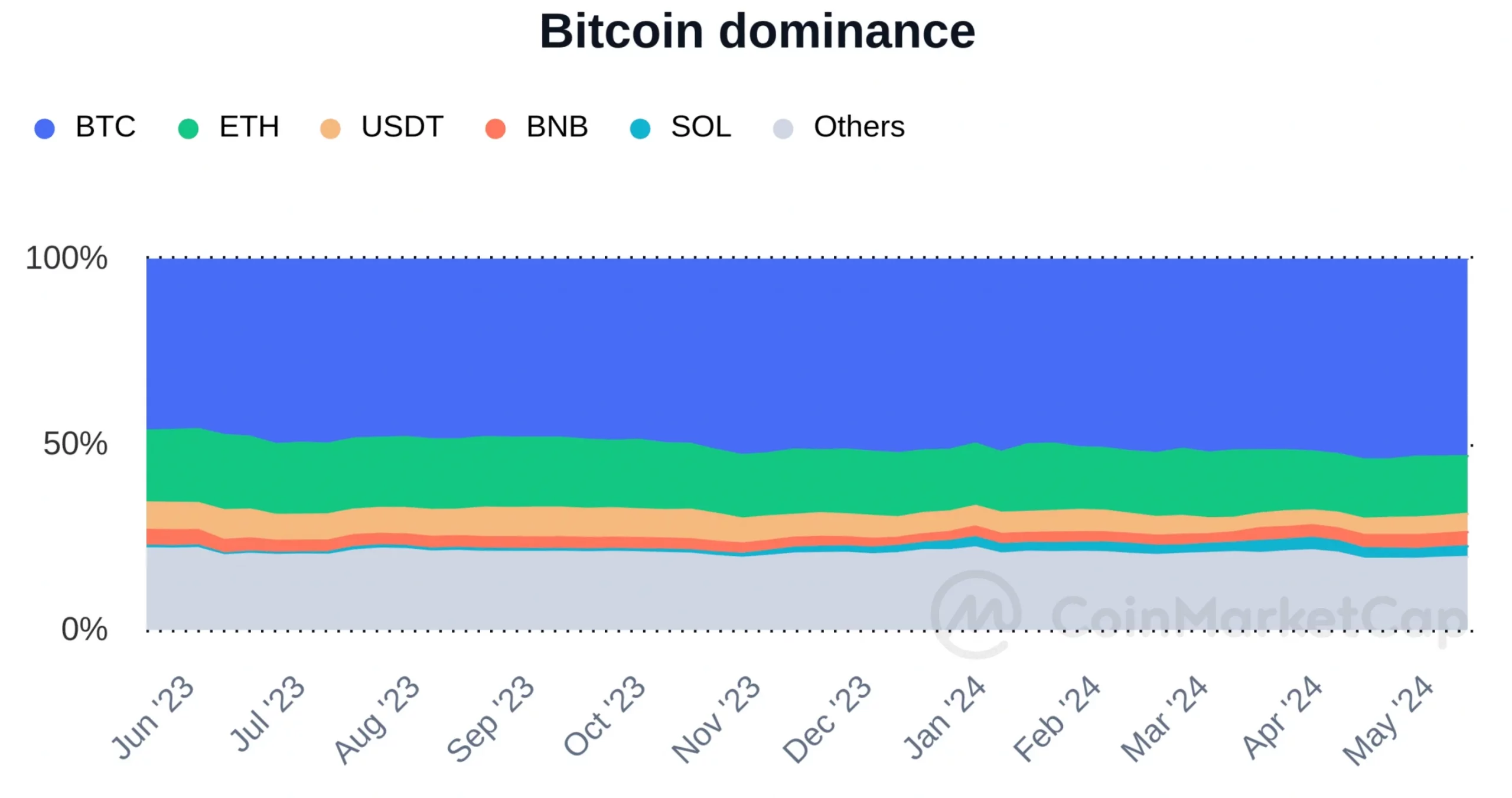

Bitcoin dominance marks a milestone

I’ve noticed an intriguing discrepancy here. Although Bitcoin’s price experiences ups and downs, its market dominance persistently hovers above the 50% threshold.

As a crypto investor, I’d say: Based on the latest figures from CoinMarketCap, Bitcoin holds around 51% of the entire cryptocurrency market value at present.

As an analyst, I would interpret the current situation with Bitcoin’s (BTC) price as follows: The cryptocurrency may shatter the confines of its consolidation period if there are significant developments in two key areas. Firstly, should the Federal Reserve decide to reduce interest rates, this could potentially boost investor confidence and appetite for riskier assets like BTC. Secondly, if the upcoming election brings about a clearer regulatory landscape for cryptocurrencies, it may lead to increased adoption and investment, further driving up the price of Bitcoin.

What lies ahead for Bitcoin?

As a crypto investor, I’ve learned from past trends that they can offer valuable insights. However, it’s essential to remember that these trends don’t guarantee future outcomes. The market is subject to significant volatility and may experience fluctuations or sideways movements in the coming days.

And, if we go by Michaler Saylor’s words,

Approximately 27 trillion dollars’ worth of assets are managed by countless pension funds across the United States. It is proposed that they should consider investing a portion of these funds into Bitcoin.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Bitcoin’s Golden Cross: A Recipe for Disaster or Just Another Day in Crypto Paradise?

2024-05-15 23:04