The top cryptocurrency’s short-term holders-those delightful folks who treat Bitcoin like a hot potato-are once again realizing losses. This, much to everyone’s surprise (not), is eerily similar to that time earlier in the year when the markets threw a tantrum.

Here’s CryptoQuant’s take, which may or may not involve tea leaves and a crystal ball.

The Great Short-Term Loss Spectacle

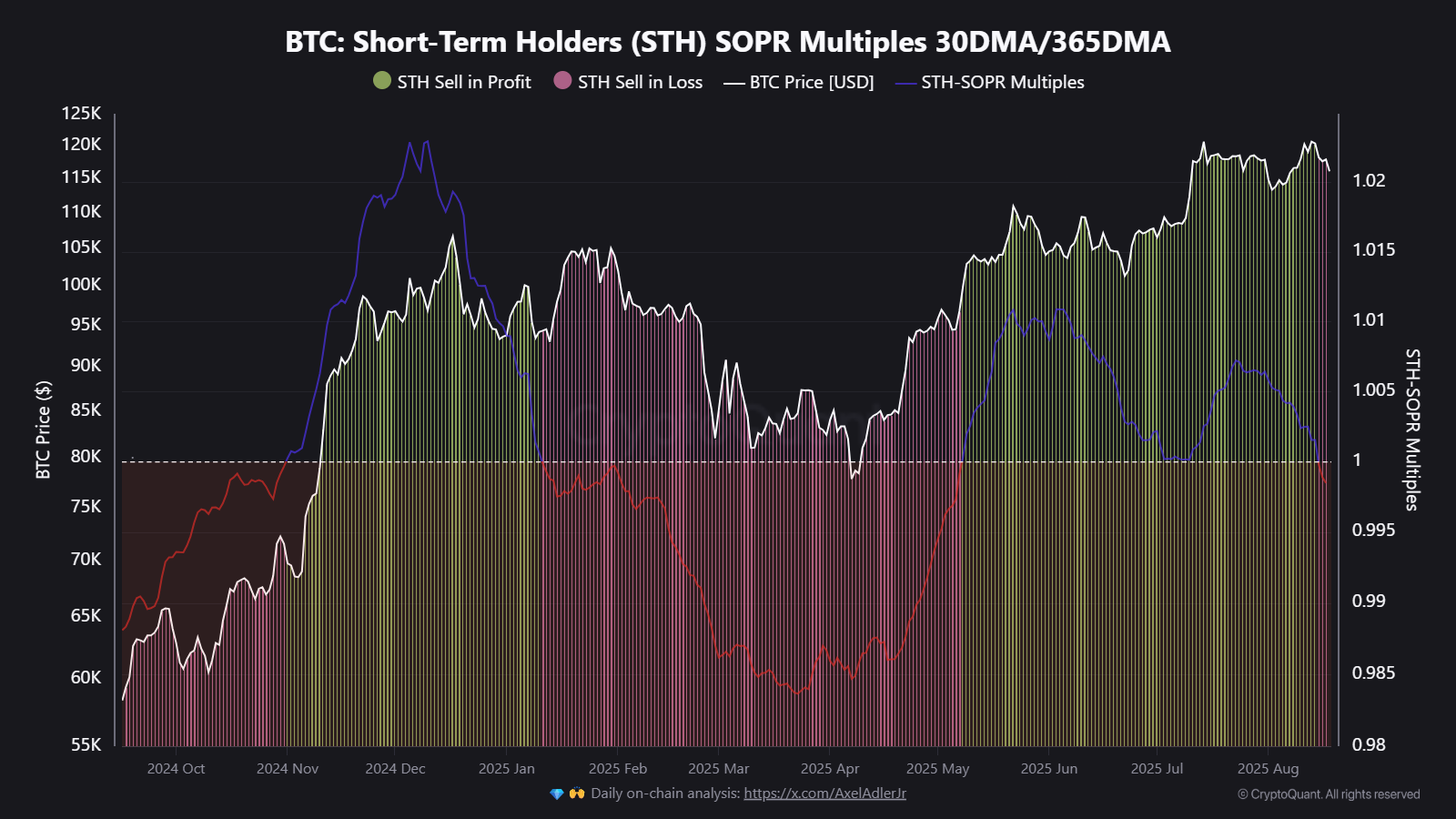

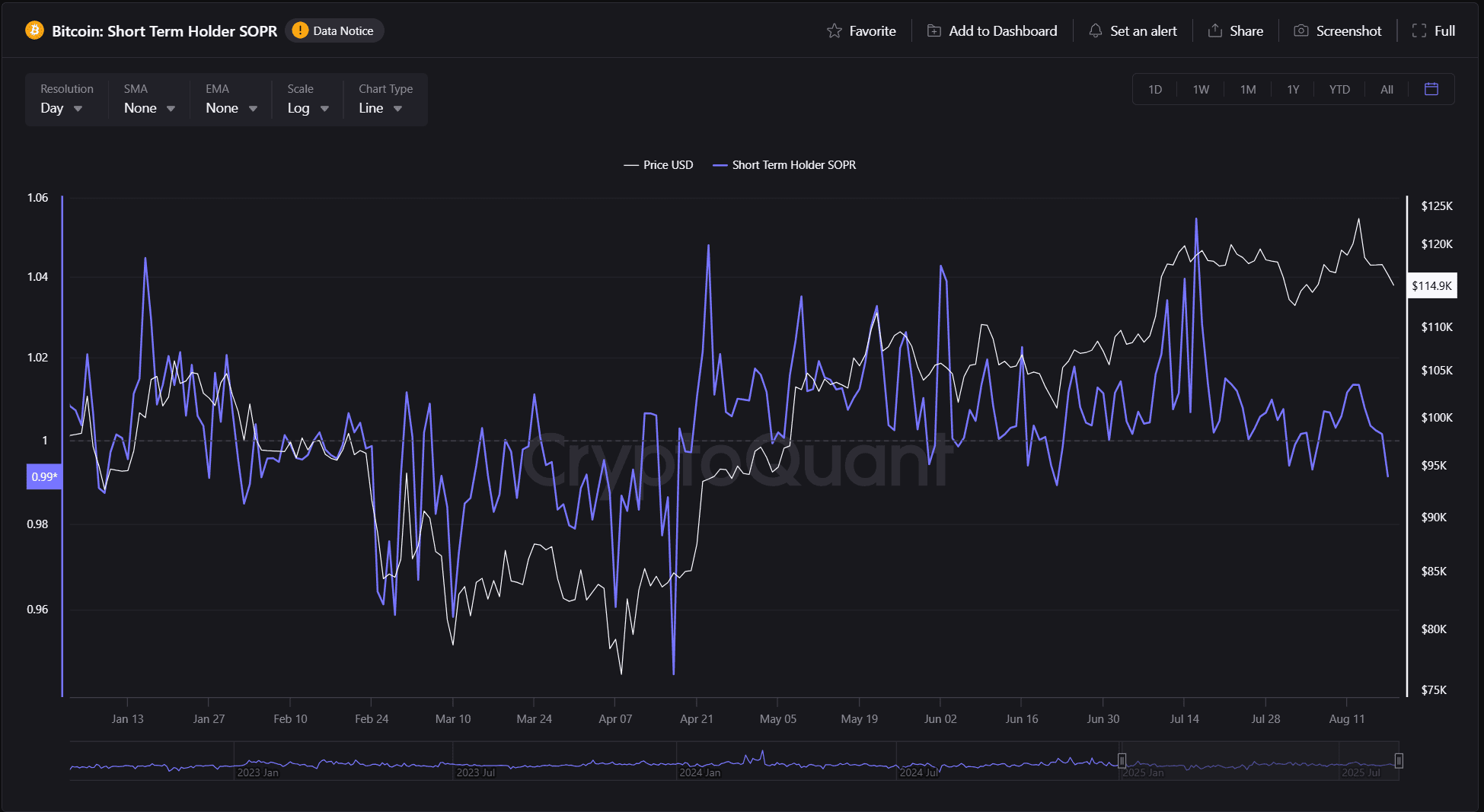

Bitcoin’s short-term holders-those who hold coins for roughly five months or less (or, as some prefer, fewer than 155 days, because specificity is everything)-have been selling at a loss for the first time since January. Back then, the world was a mess: Trump was doing whatever Trump does, interest rates were threatening to rise like bread in a sullen bakery, and AI had everyone in a tizzy thanks to DeepSeek’s grand debut (spoiler: it still couldn’t predict this).

The market’s little dip reached peak drama in early April, but then-plot twist-it started recovering. Not only did losses vanish like socks in a dryer, but some assets (yes, BTC included) even broke their all-time highs. STHs, ever the opportunistic bunch, were happily selling for sweet, sweet profit as Bitcoin danced into six-figure territory.

But wait! The past few days brought another correction-*gasp*-dragging BTC down by a cool $10K. And just like that, STH-SOPR multiples (Spent Output Profit Ratio, or “How Much Pain Are We In?”) dropped below 1 for the first time in six months. History suggests this either means:

- Traders are fleeing like startled pigeons.

- The market is taking a breather before launching into another rally, like a boxer between rounds.

If history repeats itself (which, let’s be honest, it often does when we’re not looking), this could be pivotal for Bitcoin’s future. If bulls manage to absorb the selling frenzy quickly, we might see a rebound faster than you can say “hodl.” If not? Well… buckle up, it might get bumpy.

There’s Always a Silver Lining (Or So They Say)

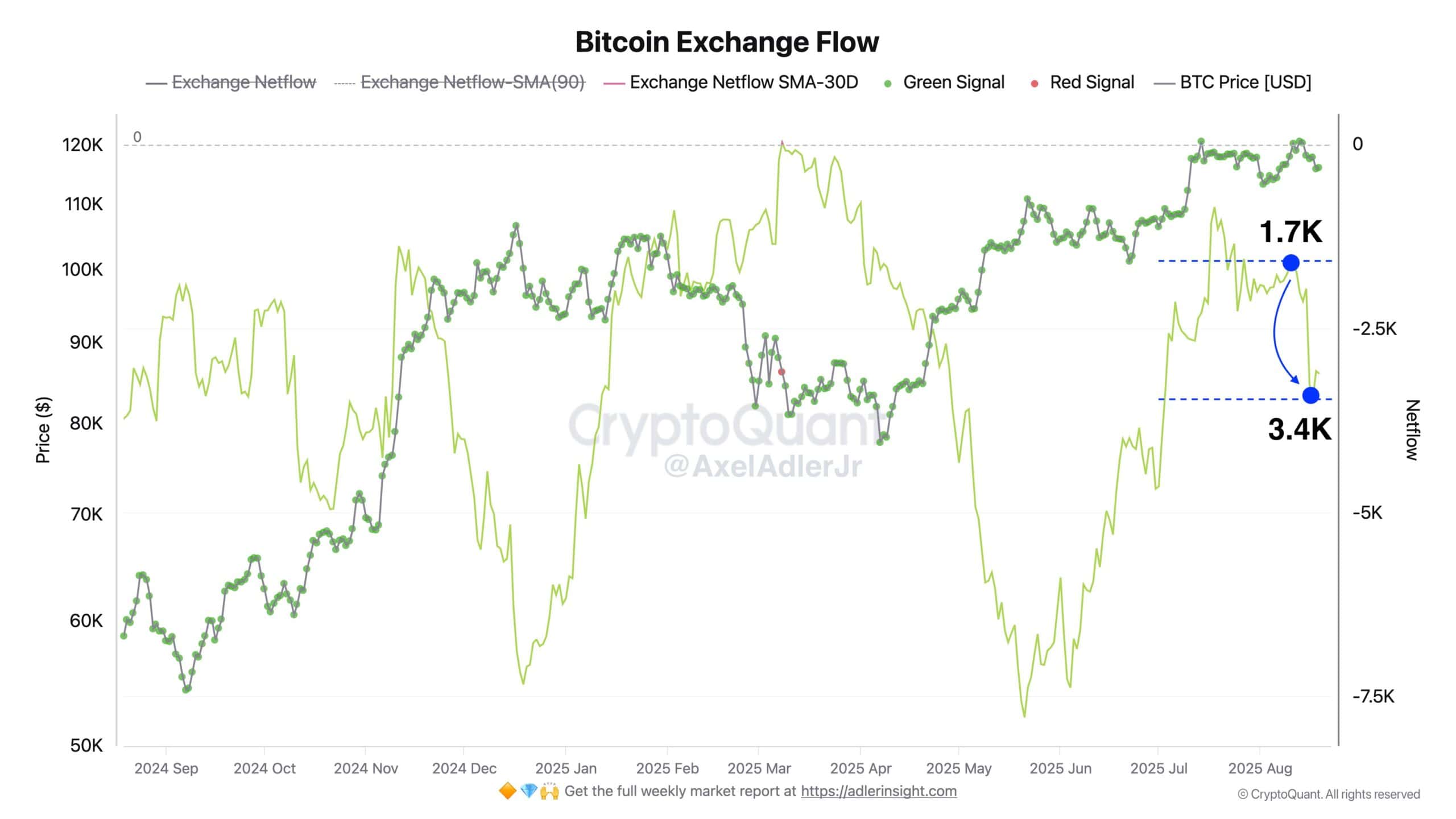

A CryptoQuant analyst-armed with graphs and a mild caffeine addiction-points out that Bitcoin’s exchange netflow has become even more negative, going from -1.7K to -3.4K BTC per day.

This means Bitcoin is being bought faster than it’s being sold on exchanges, hinting that traders are happily gobbling up discounted BTC like it’s the last chocolate croissant at a buffet. Either that, or they’re just very bad at math. Either way, optimism prevails-for now.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Gold Rate Forecast

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Goat 2 Release Date Estimate, News & Updates

- 10 Movies That Were Secretly Sequels

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Best Werewolf Movies (October 2025)

- Best Controller Settings for ARC Raiders

2025-08-19 13:36