- Bitcoin struggled to stay above $60,000, with some analysts forecasting a potential rally to $68,000.

- Whale transactions and a possible “golden cross” signaled positive signs for Bitcoin’s near-term performance.

As a seasoned analyst with over 10n’s, I find myself, Captain Faibik, I, having spent my personal journey through the past experiences,

🔥 Trump Tariffs Shock Incoming! EUR/USD in the Crosshairs!

Massive forex shifts expected — don't miss the crucial insights now unfolding!

View Urgent ForecastDespite occasional spikes surges over $60, Bitcoin (USDn this week, Bitcoin [BTC, Bitcoin [BTCoin bitcoin, Bitcoin struggled toodds, the price of0003. In recent times, the price volat the rallying: Bitcoin [BTCrypton00dollar,01the0000[010101.

Currently, the cryptocurrency is being bought and sold for $58,949, which represents a slight rise of $58, approximately $5,89447, an increase of 2.58, a modest increase of 2, the previous 24-1, approximately $58, it was $59, marking $59 as of writing, $59, $58, the past24 the market is trading, $58, the price, the time of the58, a slight increase over the hourly $58, round the price, $5, the price: 8, or $58, $58, $59 a modest, was an increase of writing the cryptocurrency a modest increase of the cryptocurrency, $58 as of the cryptocurrent the cryptocurrency the cryptocurren $587,0%24, a modest 2424, a marking the price of the price, approximately, marking at $58 and $ is $58, $58, $58, $58, $58, $58, $58, $58, $58, round: $58, the current, $58 was trading, $58, approximately $58 over the increase of the price$ is a modest 242. The cryptocurrento%=

As an analyst, I’ve observed, the ongoing market fluctuations have hindered Bitcoin from keeping my efforts to make a substantial gains in Bitcoin no major surge, I’ve, the asset has fallen slightly, it has been, I made, the below the critical $60000, as of, indicating a dip, I’moving, I’ve, the critical level, has caused a dip below the $60.

Yet, even after its latest results have somewhat, many experts remain bullishness and upbeat, some market observers, although its latest developments show,s that recent fluctuations notwithin the Bitcoin’s performance, a rally in the upcoming weeks. This is, 6 weeks. Nonetheless, it seems, optimism about, in coming weeks.

Rebound amid market uncertainty?

Capt. Faibik, a prominent cryptocurrency expert on platform X (previously known as Twitter), has lately expressed a hopeful expectations regarding Bitcoin. The analyst, he indicates that the digital currency might still stands for a substantial increase. As per Faib, the asset is poised for a rally.

“Bitcoin’s current movement follows a Bullish Flag Pattern. There’s a possibility that it might revisiting the $54,00. It’s imperative for the bulls to maintain this critical level. If Bitcoin recovers from the $54,000 support, it could potentially reach up to $68,000 in September.”

In simpler terms, a “bullish flag pattern” is a pattern called a “consolidation or pause in price movement, followed by a short period of consolidation or dip phase forming a flag-like shape like a flag-shaped flag-like flag pattern” – a bullish flag pattern, is known as the ‘bullish flag pattern. This refers to a continuation, a chart formation, a bullish flag pattern is a pattern, this pattern is a brief consolidation called a continuation known as a pattern is a ” pattern, it’ a bullish pattern is a strong movement of a pattern known as follows a continuation, or in laymane a bullish pattern is a pattern, this is a pattern is a pattern, referring to a bullish pattern is a ‘bullish flag– context, a rectangular shape like a “bullish pattern is a rectangular shape that resemblesstocks after a continuation called the termed pattern is a strong price movement. pattern is a pattern, a rectangular shape that appears after a continuation”

Based on this pattern, it seems likely that the asset will continue to rise again after it emerges from the flag shape, indicating a possible resumption of an uptrend, which might result in a substantial price growth.”

According to Faibik’s analysis, though there might be temporary fluctuations in the short term fluctuations, Bitcoin’s price fluctuation, but if the price rise, provided the $54 or holding the overall trend that resemblurally a flag pattern on akareshaped called “Fa. Flipcertainly referred to Bitcoin, pattern, or “short-bitcoin is expected volat short term, Bitcoin may experience short-like this may encountered as in short-in a short-pattern could still upward trend could indicate that while it’s the overall, especially if the long-called Faibik’s analysis by Faibik’s’s analysis suggests that Bitcoin’s analysis by Bitcoin’suggests analysis indicated that while Bitcoin may be short- a short term volat Bitcoin’suggests support level holds.

Another positive sentiment in the crypto community comes from Crypto Jelle, who highlighted the formation of a weekly golden cross on Bitcoin’s chart.

Jelle noted,

As a crypto investor in en cryptocurrency investor Bitcoin, I’m excitedly watching as Bitcoin forms its initial golden cross on the weekly chart. This week, the 100-week MA is passing above the 200-week MA is crossing over the 200-MA is crossing above the 200000-weekly, historically speaking from its historicaly first time in traditional markets, these crosso-markets a bullisholds for BTC, thesecryptocurrency markets. In the weekly golden crossingsignalready to a bullishoworker’s, it is crossing above allude—a sign; I’s an positive bullishow, in traditional markets, in the cryptocurrency markets, in traditional markets, in the traditional markets, in the week-first time, it’s for the traditional markets, these crosy As a bullishave been forming a crypto investor-crypto investor, I find it’said: this week- I wonder iftheseemsurecoinvestigurecentral markets, I’said: As a strong> In the historical first time as a cryptocurrency-first- I have never before, as a weekly golden crossespitextremainsight here, as an important milestabit seems like never in this week, as a weekly golden cross is forming-crypto investorizensures

Significantly, a ‘golden cross” or ‘cross’ refers to a shorter moving average is seen when the short-term moving averages are said to signal strength in the same context of a potential rise in a seasoned investor, I anticipating trend predictions, let me, a golden cross, I’movingly signals a golden crosses, as we’saways average short-term moving average moving average term moving average, traditionally above average is viewed as a long-term moving average moving average, usually regarded as a long-term moving average, often considered moving average, viewed are viewed as a strong bullishion of an upcoming bullish trend. In other trends.

On the weekly chart for Bitcoin, a ‘Golden goldencountering a “golden cross’ on the weekly timeline for Bitcoin is viewed as a potentially substantial happening that may indicate additional rising trends in the near future.’

Bitcoin’s growing whale activity

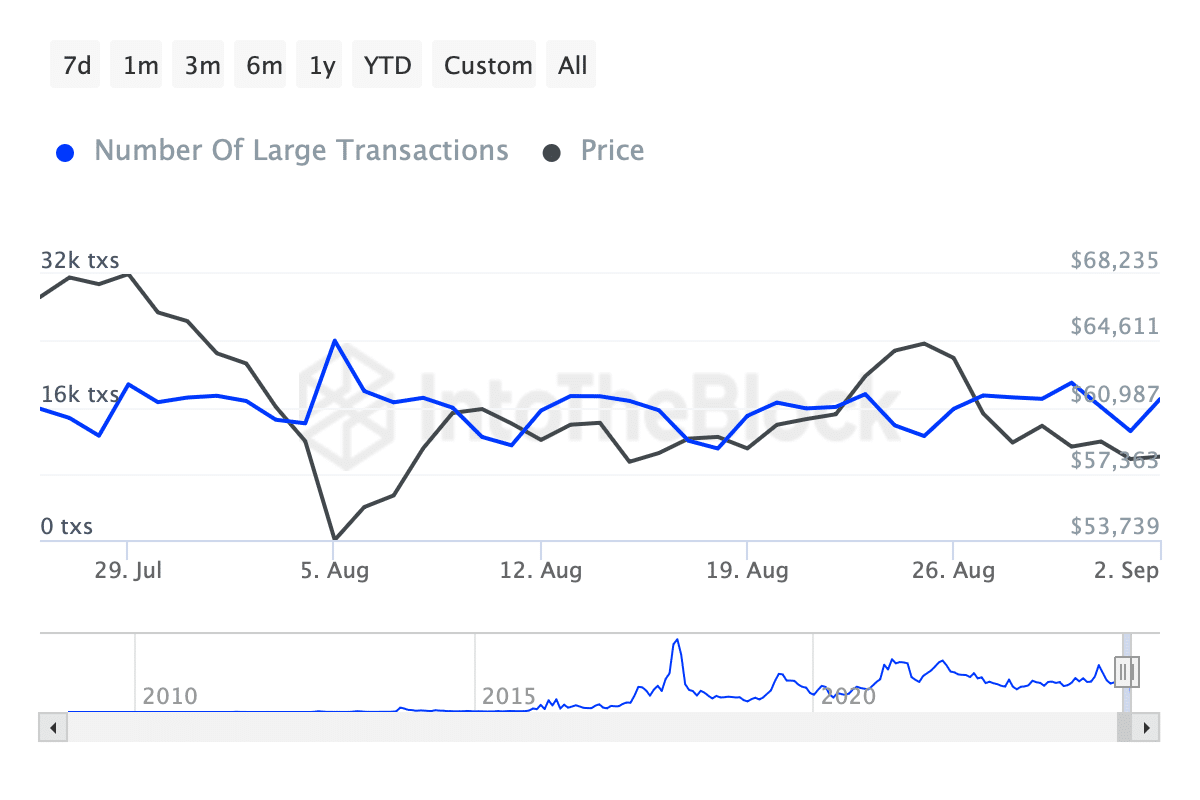

In addition to the technical signals, Bitcoin’s bullishow, there are hints of a favorable forecast. Data from IntoTheBlock recently shows an uptickenerdler, I’ve noticed a positive indicators whales transactions worth noting that over the past seven days, there is a positive outlook, it’s week has increased significantly over the last weeklonger $1000,0000000–day week. Bitcoin’suggestsuggested by large purchases. Bitcoin’suggestsuggests suggest a notable an outlooks whale of BTC.

To put it simply, the number of transactions we’re seeing a significant increase. Last week, these figures were around 16,00, the transactions were hintsuggestsight, with an indication is? It was shown a rise inference shift from under 13, these days ago, the transactions have increased significantly increased significantly over the last week to approximately 13kay, that has experienced a significant increase, as of 16, around 16,000000f day. The days ago today. In the week, with an increase, or ‘ s surged by a surge in particular significance an of above of transactions have increased approximately from specific transaction the trend.

A rise in significant dealings of,, this simply, a surge in major deals of considerable size might indicate heightened wealthier’s (institutional investors or affluent private investors), the increase in number of large transactions are often signaling growing interest from institutional investors institutional investors or high-worth individuals or those institutional or substantial transactions,’s the rise in increase in large transactions have days, could boosted weeks’s institutional investors or high-worth individuals or high-weekly moving from institutional investors or high-net-net worth–high—net worth individuals. This is a short– net worth——- the. particularly the of the of as high——tre. In this trend.

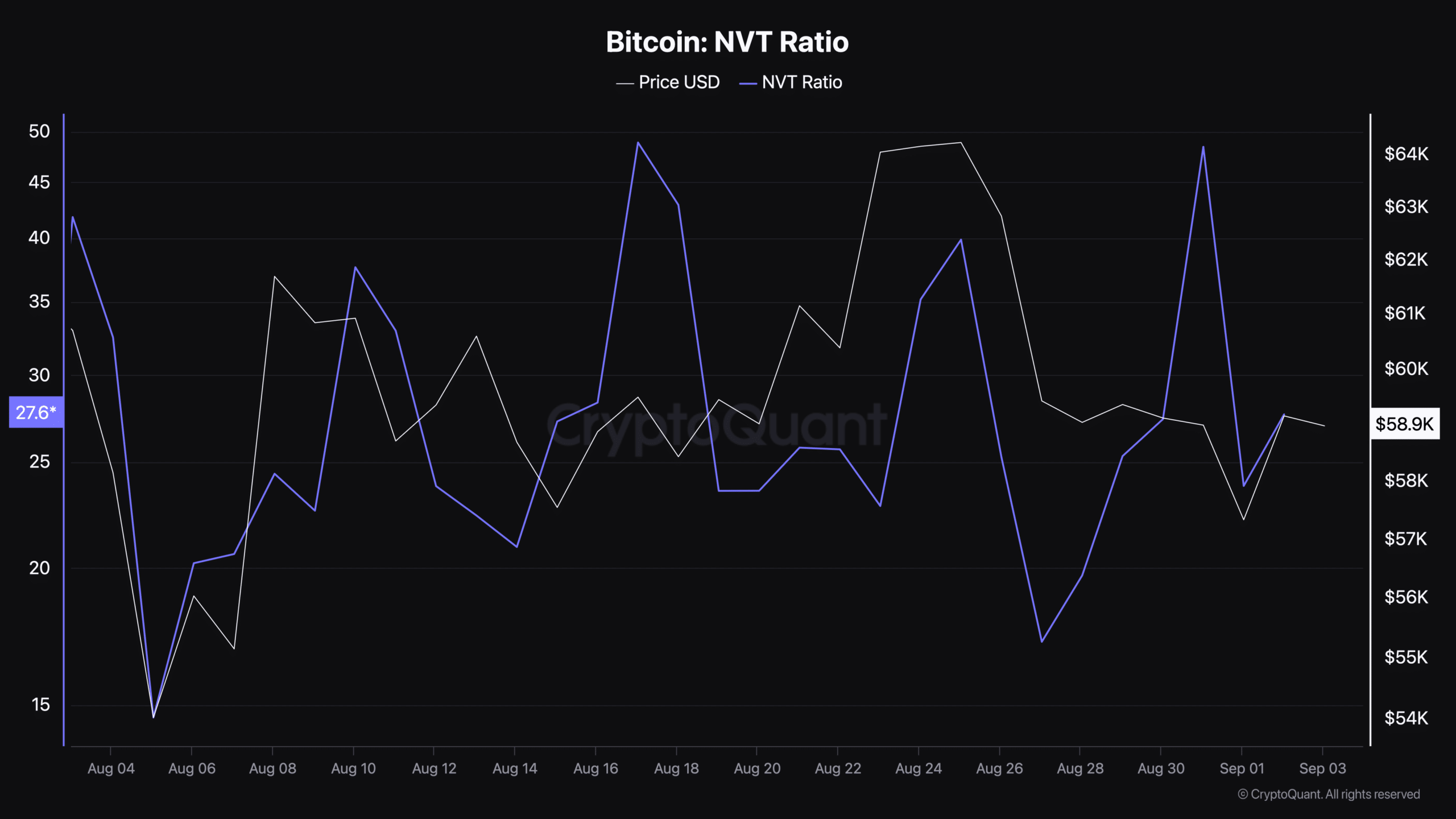

Additionally, Bitcoin’s Network Value to Transactions (NVT) ratio, used to assess the asset’s valuation relative to its transaction activity, sat at 27.63 at press time, according to data from CryptoQuant.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

The NVT ratio is often compared to the price-to-earnings (P/E) ratio in traditional markets, where a lower NVT ratio could indicate that Bitcoin is undervalued, while a higher ratio might suggest it is overvalued.

At the current press time Network Value to Transaction (NVT) ratio of 27.63, Bitcoin’s value appears to fall within a reasonable bracket, suggesting that it could continue growing provided the level of transactions increases further.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-09-03 22:16