- BTC drops below $100K amid Powell’s Fed comments, triggering sell-offs and market-wide uncertainty.

- Whale activity spikes as traders monitor BTC resistance at $105,400 to confirm recovery trends.

As a seasoned analyst with over two decades of experience in the financial markets, I’ve witnessed countless market fluctuations and trends that left even the most hardened investors scratching their heads. The recent drop in Bitcoin below $100K, triggered by Fed Chair Jerome Powell’s comments, is no exception.

On the evening of December 18th, the value of Bitcoin (BTC) dipped below $100,000, a result of remarks made by the Chairman of the U.S. Federal Reserve, Jerome Powell.

At a recent press gathering, Powell clarified that it’s currently against regulation for the Federal Reserve to possess Bitcoin, and they have no plans to push for legal changes to alter this status quo.

Responding to a query about a potential U.S. government Bitcoin reserve, Powell clarified,

“We’re not looking for a law change.”

Currently, a single Bitcoin is being transacted for approximately $101,292. Over the last day, its value has decreased by 2.01%. On the other hand, over the course of the last week, it has only dropped slightly by 0.18%.

Powell’s comments and FOMC projections spur market uncertainty

In simple terms, when Jerome Powell spoke and hinted at potential interest rate increases in 2025 by the Federal Open Market Committee (FOMC), the wider cryptocurrency market showed signs of disapproval.

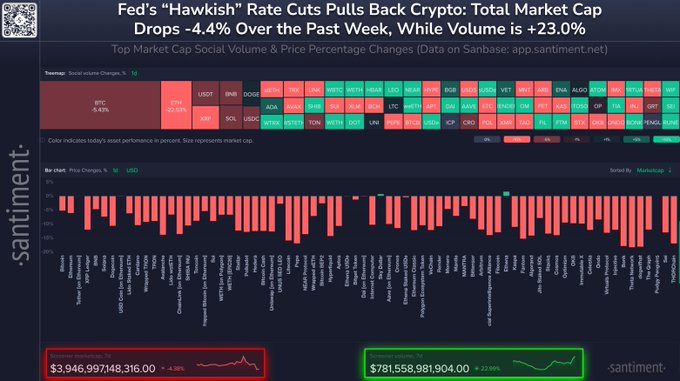

According to Powell’s recent statement, the anticipated reduction in interest rates by 2025 is expected to be only half of what was previously projected. This has caused concern in both the cryptocurrency and stock market sectors. As a result, Santiment reports that the announcement sparked widespread sell-offs across these markets.

Over the last 24 hours, alternative cryptocurrencies such as Avalanche, Chainlink, Litecoin, and Pepe experienced significant declines. Specifically, Avalanche, Chainlink, and Litecoin dropped by approximately 16% each, while Pepe saw a drop of around 17%.

In simpler terms, Ethereum (ETH) decreased by 6%, and XRP experienced a 10% decrease. Bitcoin dipped below the significant $100,000 level, contributing to negative market expectations.

Technical analysis: Bitcoin’s critical resistance levels

crypto expert Ali observes that Bitcoin seems to have moved beyond a head-and-shoulders chart configuration, which potentially indicates a downward price prediction of approximately $99,000. Yet, it’s important to remember that Bitcoin must rise above $105,400 to contradict this bearish forecast.

The recent shifts in price seem to indicate that traders are carefully watching these points, hoping for more confirmation before making additional moves.

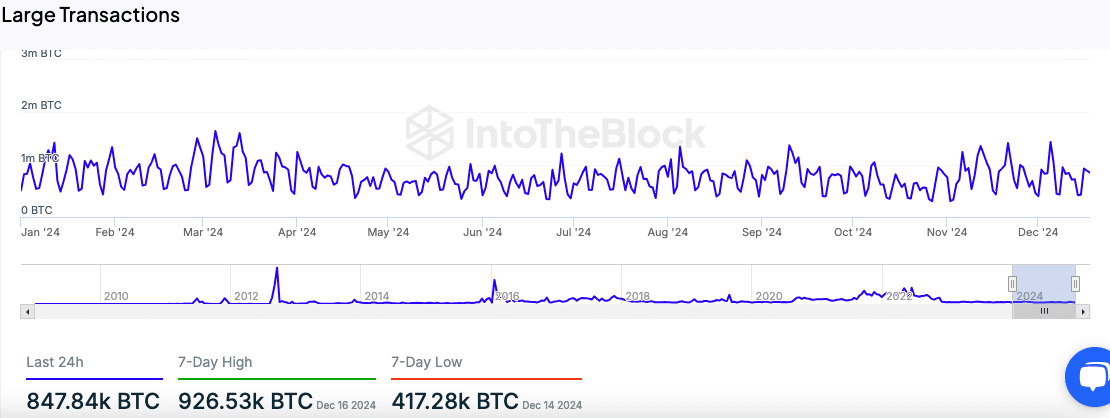

Despite the bearish sentiment, market participants remain active. Data from IntoTheBlock showed that large Bitcoin transactions, exceeding $100K, remain consistent throughout the year.

On the 16th of December, I observed whale activity peaking at an astounding 926.53 thousand Bitcoin (BTC), indicating that institutional participation in this digital currency remains robust and persistent.

Market trends: Trading volume, open interest, and netflows

The trading volume on Coinglass increased by approximately 39.05%, peaking at around $150.01 billion, demonstrating a surge in activity. Yet, the open interest decreased slightly by 1.10% and now stands at roughly $67.77 billion.

In simple terms, the trading volume in options markets surged by about 33%, amounting to approximately $4.28 billion, while the number of outstanding option contracts, or open interest, experienced a minor uptick of 0.84%, reaching close to $41.68 billion.

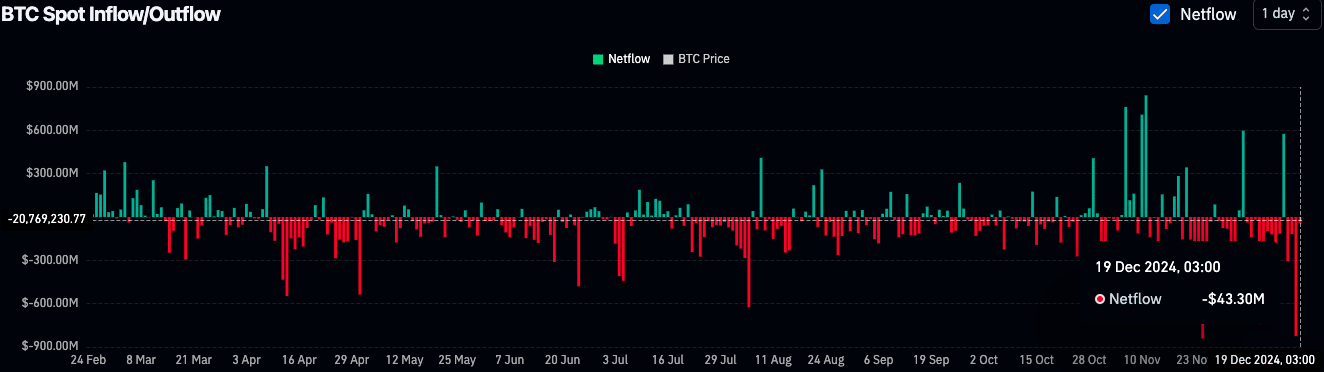

2024 saw a significant dominance of Bitcoin outflows, suggesting intense accumulation patterns. The majority of the bars were red, indicating persistent low sell pressure.

19th December saw a net withdrawal of approximately $43.3 million in Bitcoin, indicating that traders might be transferring their BTC to cold storage. This action could suggest a high level of trust or faith these traders have in the value of the asset.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The total value of the cryptocurrency market decreased by 5%, landing at approximately $3.44 trillion, yet trading activity saw a significant increase of 40% to reach around $251 billion.

The overall data indicates that both Bitcoin and the larger market are experiencing challenges, yet traders continue to be active, strategically adjusting their positions in anticipation of a major shift.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- How to Get to Frostcrag Spire in Oblivion Remastered

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Daredevil’s Wilson Bethel Wants to “Out-Crazy” Colin Farrell as Bullseye in Born Again

- tWitch’s Legacy Sparks Family Feud: Mom vs. Widow in Explosive Claims

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

2024-12-19 16:08