Ah, Bitcoin, that wily beast! Just when we thought things were looking up thanks to the oh-so-dovish remarks from Jerome Powell (a man who probably smiles when his money printer hums), investor optimism quickly proved to be as fleeting as a Twitter trend. Whales (not the aquatic kind, but the crypto-hungry ones) decided to throw a rather spectacular tantrum, selling their BTC by the boatload. Whale selling, ETF outflows, and cascading liquidations have taken center stage, with Powell’s rate cut hopes promptly shuffled into the background.

On Sunday, a truly dramatic 24,000 BTC sell-off took place, causing a market jolt that could have woken up the most comfortable of investors. “When one wallet dumped 24K BTC, the whole market felt it,” said one analyst-probably after rubbing his temples in despair. And that wasn’t all, oh no. A mere $550 million in long liquidations later, and over 160,000 traders found themselves looking at empty wallets. A true disaster, and all in a single day, according to CoinGlass. Cheers, whales!

Market Overview: Bitcoin Technical Analysis and Key Levels

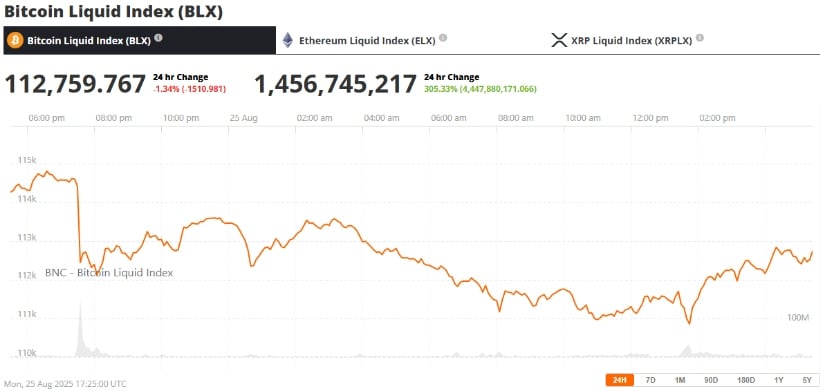

Let’s be clear, Bitcoin’s technical indicators aren’t exactly throwing a party. The cryptocurrency just rejected its broken trendline (as you might reject that second glass of wine you didn’t need), slipping below its 100-day Exponential Moving Average (EMA) at $110,865. Ominous, isn’t it? The risk of further declines is higher than an overly ambitious soufflé, with eyes now on the 200-day EMA, lurking at $103,600.

The Relative Strength Index (RSI) is now at 40, which in layman’s terms means it’s looking more “bearish” than a cuddly teddy bear on a bad day. Meanwhile, the MACD indicator, that trusty harbinger of doom, registered a bearish crossover last week. All signs point to a rocky ride ahead.

If Bitcoin is to pull itself together, it’ll need to climb back over $116,000 and hold above the $110,800-$112,000 support zone like a toddler refusing to nap. Fail at this, and we could be looking at a slow drift towards $108,000 or, dare I say it, $103,000.

Whale Activity and ETF Outflows Add Pressure

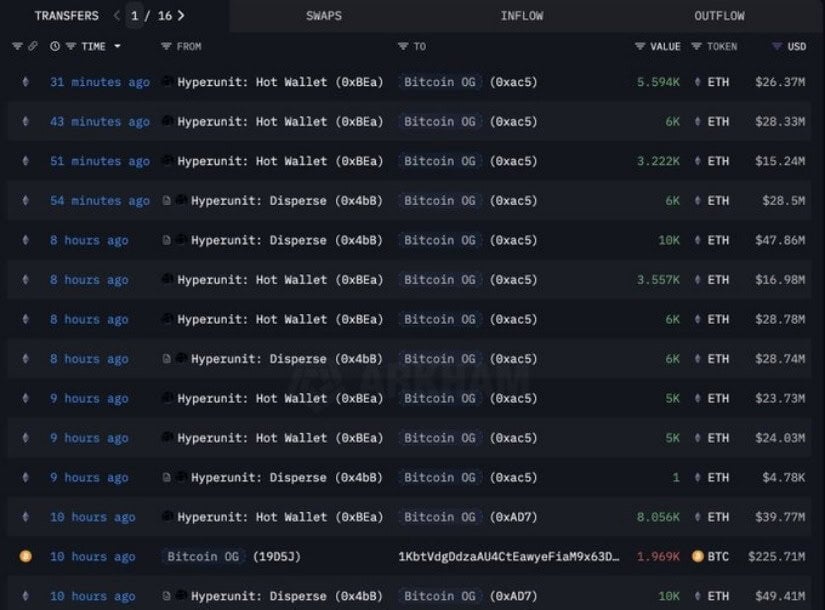

But wait! The flash crash wasn’t a solo act. Blockchain data reveals that one particularly sassy Bitcoin OG wallet moved a staggering 22,700 BTC (worth a cool $2.6B) onto exchanges in record time, adding to the stress. But the drama doesn’t end there. This whale decided to dump some of its Bitcoin and take refuge in Ethereum, which could only mean one thing: a short-term crisis of confidence in Bitcoin. Oh, what a tangled web we weave!

If that wasn’t enough, institutional flows are now negative. The Spot Bitcoin ETFs saw a record $1.17 billion in outflows last week-the worst since March. If this trend continues, Bitcoin might be in for a serious rocky patch as ETF managers offload their BTC like a bad habit. Say goodbye to smooth sailing!

Expert Insights: Fed Optimism Meets Market Reality

Jerome Powell’s Jackson Hole speech initially had the market all abuzz, with risk assets-Bitcoin included-doing a little happy dance. “A balanced approach,” Powell said. “Flexible inflation targeting,” he hinted. It was all very uplifting until reality kicked in and traders quickly shifted their attention back to the crypto-specific headaches plaguing the market.

Yet, not all hope is lost. Some analysts, with all the optimism of a perpetual optimist, point out that Bitcoin’s 30-day MVRV ratio is sitting around -3.37%. This is tantalizingly close to the “reversal zone” near -4%, which historically has been a hot spot for recoveries. “If all coins were sold today, most traders would realize losses,” notes Santiment. In other words, Bitcoin might just be hiding in plain sight as undervalued. Fancy a bargain?

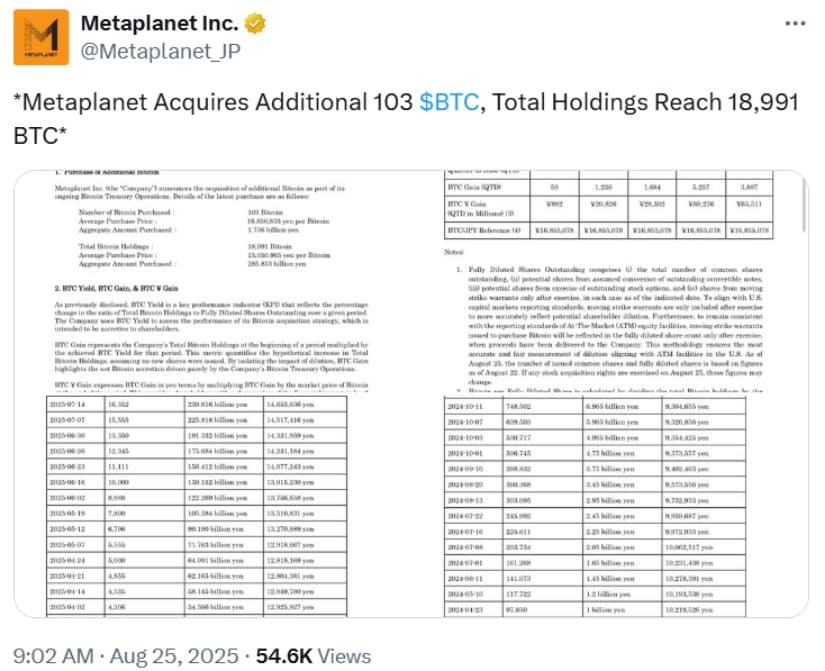

Moreover, corporate buyers seem to be holding strong. Japan’s Metaplanet, often touted as the country’s answer to MicroStrategy, scooped up another 103 BTC, boosting their holdings to nearly 19,000 BTC. One must wonder if they know something the rest of us don’t, or if they’re just that optimistic about Bitcoin being a long-term inflation hedge.

Bitcoin’s Outlook: What’s Next for BTC Price Prediction?

Now, let’s get real. Bitcoin’s future hinges on whether buyers can steady the ship above the $110,800-$112,000 level. If the market takes a breather and some of that selling pressure dissipates, a recovery toward $116,000-$118,000 is still on the table. But, with whales continuing to misbehave and institutional outflows plaguing the scene, $108,000 may soon be the next battleground.

With the Bitcoin halving coming in 2025, long-term investors are keeping their eyes on the prize. Factors like miner revenue, on-chain activity, and Bitcoin ETFs will play a crucial role in whether BTC can regain its momentum. For now, we’re all waiting with bated breath (or perhaps just eye-rolling) to see if the whales will calm down and Powell’s policies can do anything to steady the ship.

So, for the time being, the spotlight remains firmly on Bitcoin whale alerts, ETF drama, and Powell’s policy moves-three things that may either save or doom us all. 🐋💸📉

Read More

- Best Controller Settings for ARC Raiders

- Gold Rate Forecast

- How to Get the Bloodfeather Set in Enshrouded

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Yakuza Kiwami 3 And Dark Ties Guide – How To Farm Training Points

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- Meet the cast of Mighty Nein: Every Critical Role character explained

- Best Werewolf Movies (October 2025)

- How to Build a Waterfall in Enshrouded

- These Are the 10 Best Stephen King Movies of All Time

2025-08-25 23:16