- Bitcoin faces resistance at $60K, with prices down 23% from its March peak.

- Analysts suggest mixed signals, debating whether this is a temporary slump or the start of a bear market.

As a seasoned analyst with over two decades of experience in the financial markets, I’ve witnessed numerous bull and bear cycles, and the current state of Bitcoin is reminding me of the 2019 scenario more than any other. The parallels are striking, and I believe that we might be in for a prolonged consolidation period before the next bull run kicks off.

In recent times, the value of Bitcoin (BTC) has been experiencing significant strain, as it’s been having a tough time holding its ground at crucial points. Even though there was initial enthusiasm, Bitcoin has repeatedly met with resistance whenever it nears the $60,000 threshold.

Despite numerous attempts, Bitcoin has yet to surpass its March record of over $73,000 due to persistent resistance. Currently, Bitcoin is being traded at $56,584, marking a 1% decrease in the last 24 hours and a 23.3% drop from its peak this year.

As reported by IntoTheBlock, there’s been a notable change in investor sentiment towards Bitcoin compared to earlier this year. Back then, both individual and institutional investors held optimistic views that the cryptocurrency would further surge and set record highs.

Nevertheless, economic conditions on a large scale and a deceleration in Bitcoin’s acceptance have sparked concerns about its future. Some investors are now pondering if this is merely a brief dip or the start of a longer-lasting downturn.

Market trends and Bitcoin’s struggles

In a recent update posted by IntoTheBlock, they point out potential reasons behind Bitcoin’s ongoing pricing difficulties, suggesting a change in overall market sentiment surrounding the cryptocurrency.

One of the key challenges mentioned was the broader macroeconomic landscape. IntoTheBlock said that with the possibility of a recession looming, markets have been under pressure, and risk assets like Bitcoin have been no exception.

Some believe that future reductions in interest rates might eventually have a positive effect on cryptocurrencies, but it’s important to note that the consequences of such actions might not be immediately apparent.

For now, the broader economic landscape is expected to impact investor confidence and the fluctuations of Bitcoin’s value.

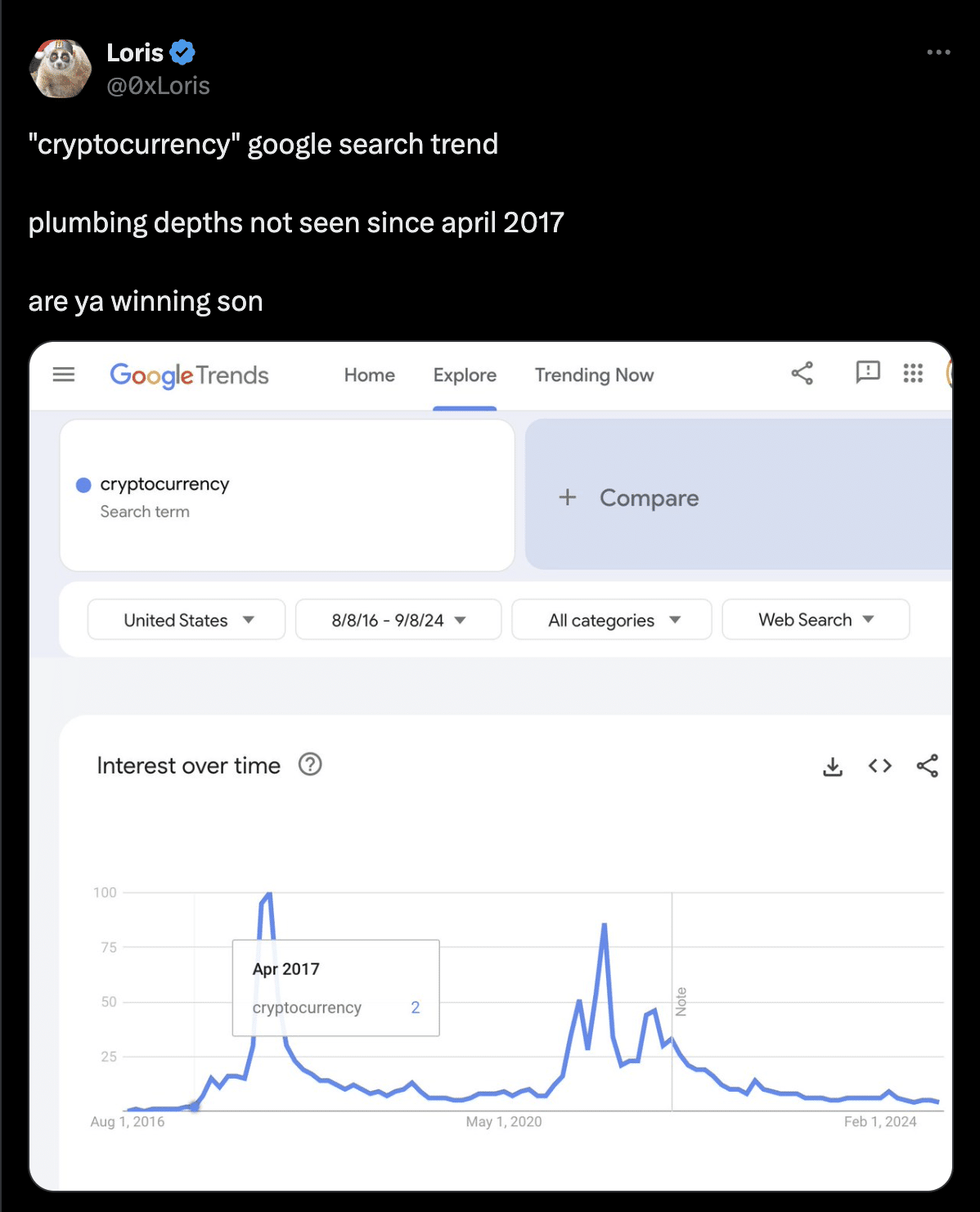

It seems that there’s a decreasing enthusiasm towards cryptocurrencies, as suggested by various indicators. The interest in cryptocurrency-related subjects, as measured by search trends, has noticeably decreased, mirroring a less heated market atmosphere compared to when the markets were booming during bull phases.

The decrease can also be seen more clearly through the drop in popularity of apps like Coinbase, indicating that there may be a reduction in the number of individuals interacting with cryptocurrencies on these platforms.

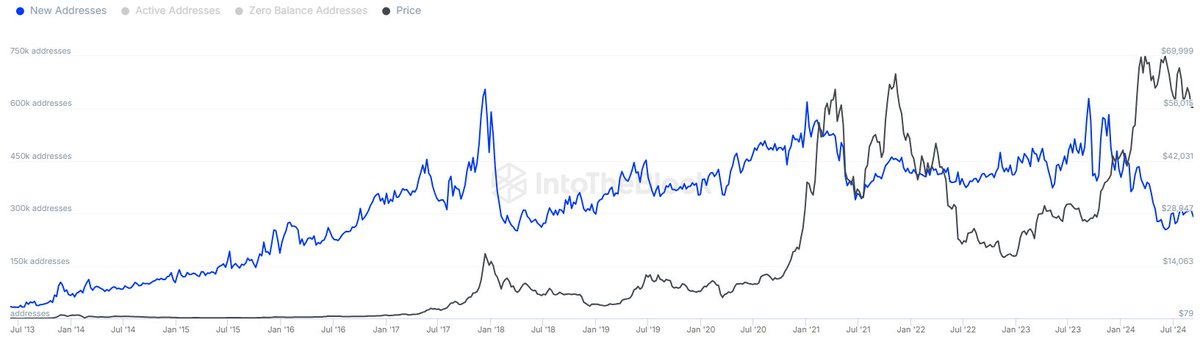

According to IntoTheBlock’s analysis, the data from the blockchain suggests a period of minimal growth in Bitcoin trading activity. The creation of new Bitcoin wallets has decreased, indicating a potential decline in the number of new investors entering the market.

As a researcher, I’ve noticed a decline in the number of new users, which seems to suggest a decrease in initial excitement compared to the start of the year. The significant rise in Bitcoin’s price back then had sparked a deluge of new investors drawn to it.

According to IntoTheBlock’s findings, an absence of fresh market players could potentially prevent Bitcoin from reaching its former peaks in the short term.

Analyst outlook on BTC

Observing Bitcoin’s pattern of price fluctuations, certain experts suggest that the present situation resembles past stages of accumulation.

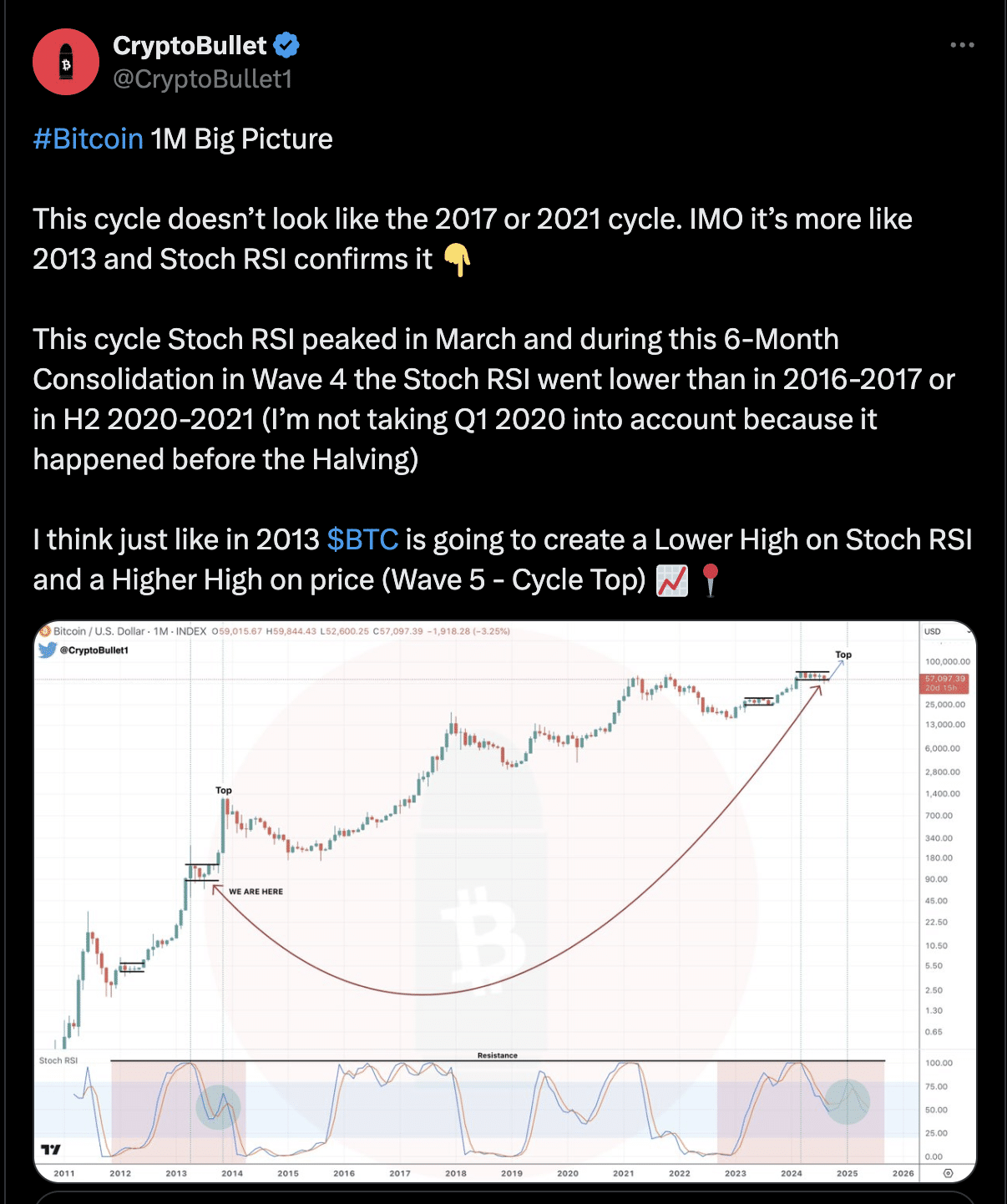

Specifically, the financial analyst, CryptoBullet, has made observations that resemble the situation in 2019, a year during which Bitcoin went through a similar sluggish phase following a peak in its value.

As a researcher delving into the intricacies of the cryptocurrency market, I’ve noticed an interesting pattern that warrants further exploration. The market appears to have entered a phase of prolonged consolidation, which is not unlike the one it experienced in the past. Some analysts, like CryptoBulle, posit that Bitcoin might be following a similar trajectory right now. They suggest that the current dip in prices could be part of a larger cycle, setting the stage for another bullish run in the near future. This hypothesis is certainly intriguing and requires more investigation to confirm its validity.

On X, the analyst offered their findings about the patterns in Bitcoin’s price fluctuations, likening the present market situation to past years for comparison purposes.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Based on his examination, this pattern seems to align more closely with the one observed in 2013 rather than the patterns seen in 2017 or 2021.

He highlighted the behaviour of the Stochastic Relative Strength Index (Stoch RSI), suggesting that Bitcoin is undergoing a consolidation phase before entering a fifth wave that could lead to new highs.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-09-11 17:12