-

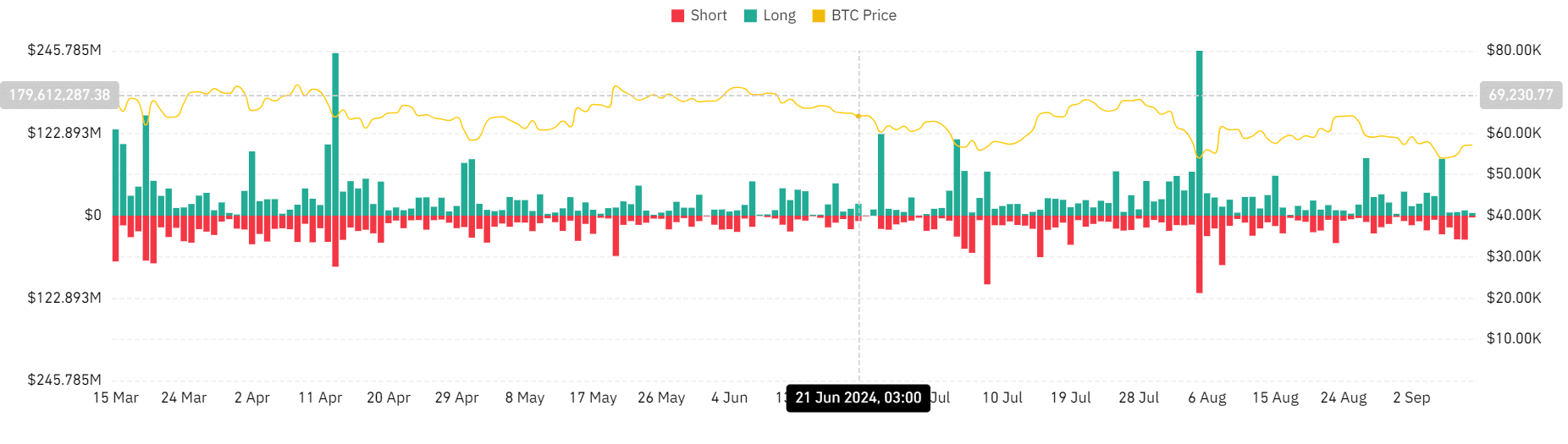

BTC has been heavily shorted for the last three days, but the recent price hike has increased liquidation.

Bitcoin’s investors FUD and doubt in the rally will increase prices, suggesting volatility.

As a seasoned researcher with years of experience studying cryptocurrency markets, I find myself constantly amazed by the rollercoaster ride that is Bitcoin [BTC]. The past few days have been particularly intriguing, with the recent price surge leading to increased liquidation of short positions and market volatility.

Currently, Bitcoin (BTC), the leading cryptocurrency by market value, is showing signs of a modest rebound as indicated by its price graphs. At this moment, one Bitcoin is being traded for approximately $57,110, following a 4.27% increase over the last 24 hours.

Over the last day, trading activity significantly surged by approximately 53.38%, reaching a whopping $33.57 billion. Moreover, Bitcoin’s total market capitalization experienced a growth of 4.24%, now standing at an impressive $1.13 trillion.

Prior to this rise, Bitcoin was on a noticeable decline, falling by 6.54% over the past month. Consequently, while it has recently seen some growth, it continues to stay comparatively low, being $61,457 away from its most recent peak and approximately 22.8% beneath its all-time high (ATH).

Under the present market scenario, Bitcoin appears to be regaining strength, as analysts express a positive outlook. For example, Santiment’s analysis indicates potential price increases based on Bitcoin’s market worth.

What market sentiment says

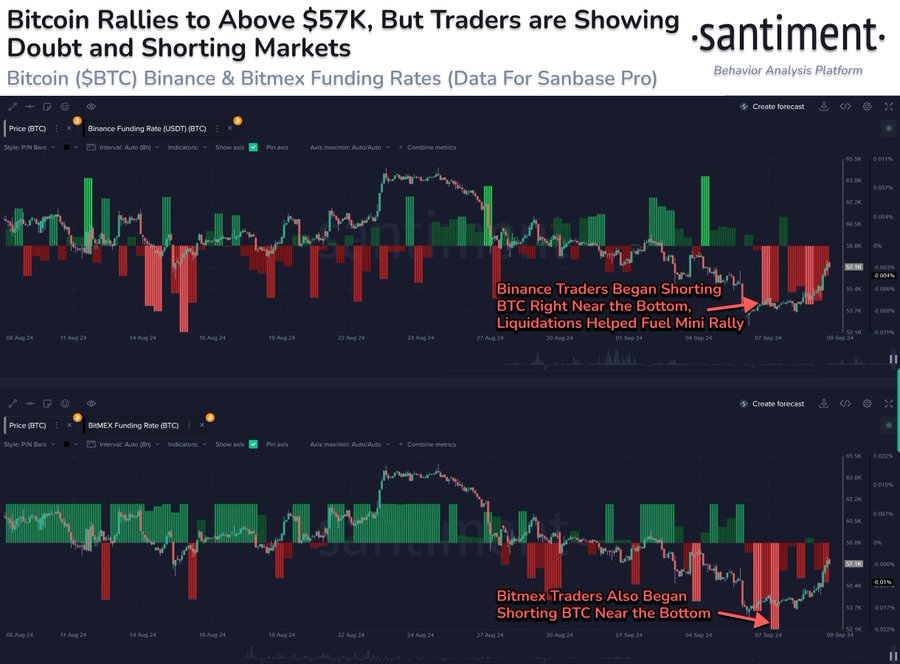

According to Santiment’s analysis, Bitcoin’s worth has risen in the last day, despite being sold short for the previous four days, particularly on prominent trading platforms like Binance and Bitmex.

In this situation, a significant number of traders anticipate that Bitcoin’s value will decrease. Typically, they engage in a practice known as short selling, where they borrow Bitcoin, immediately sell it, hoping to purchase it back later at a lower price.

Therefore, the significant shorting happening since Saturday suggests that traders are anticipating a decrease in prices. This prevailing mindset among traders is often influenced by fear, uncertainty, and doubt (FUD), as they have low faith in the market’s future direction and are hoping for a correction or pullback.

However, if the prices fail to decline as short sellers expect and rise, they come under pressure.

These investors must repurchase the assets they previously obtained on loan to maintain their positions, particularly when there’s a potential for increased losses, as evidenced by the significant price increase observed over the past 24 hours.

Consequently, the price hike has led to an escalated liquidation of short positions, indicating market instability. The compulsion to buy arising from this situation boosts demand, causing prices to surge, ultimately leading to a ‘squeeze’ where traders are forced to buy more shares (to cover their short positions), thereby driving the price even higher.

Bitcoin’s price charts

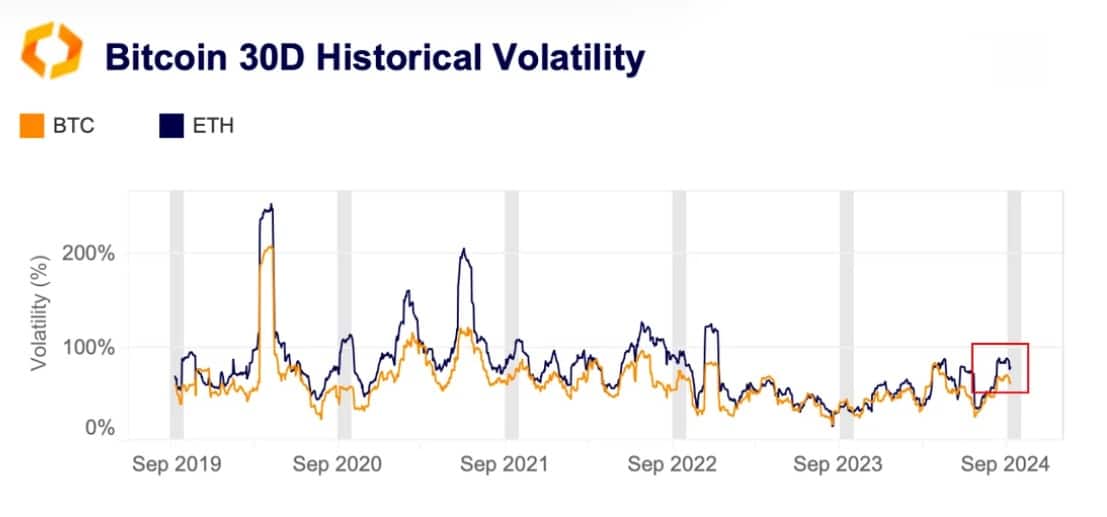

According to Santiment, the Bitcoin market is currently showing greater levels of unpredictability, leading to higher price fluctuations. Typically, September is a month that has traditionally seen increased volatility in the past. This year, the volatility of Bitcoin over the past 30 days has significantly risen by approximately 70%.

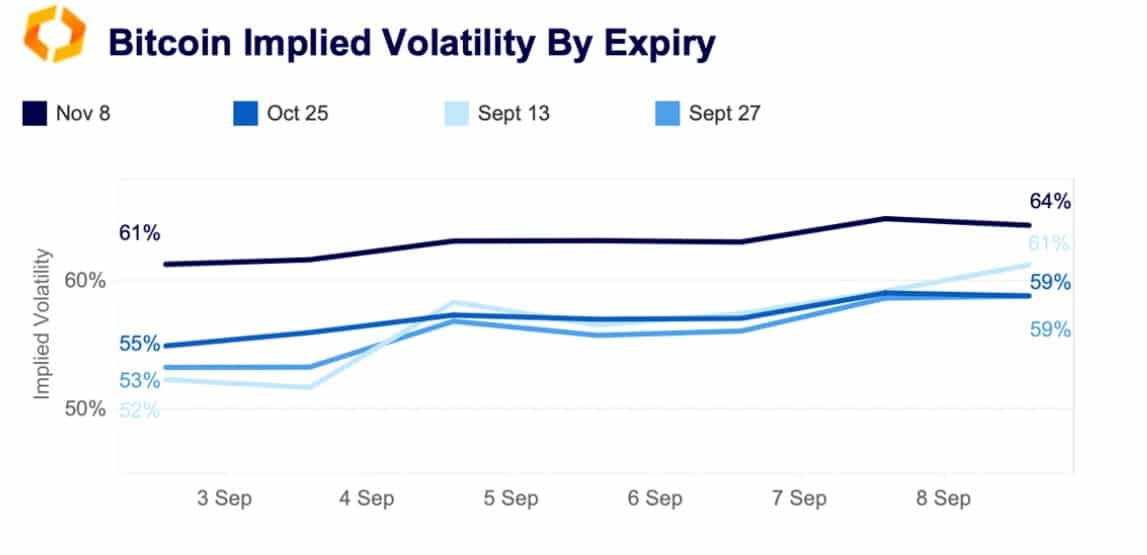

Since the start of September, Indicators like Implied Volatility have risen significantly following a decrease in August. Notably, short-term options have experienced a jump of approximately 60%, rising from 52%.

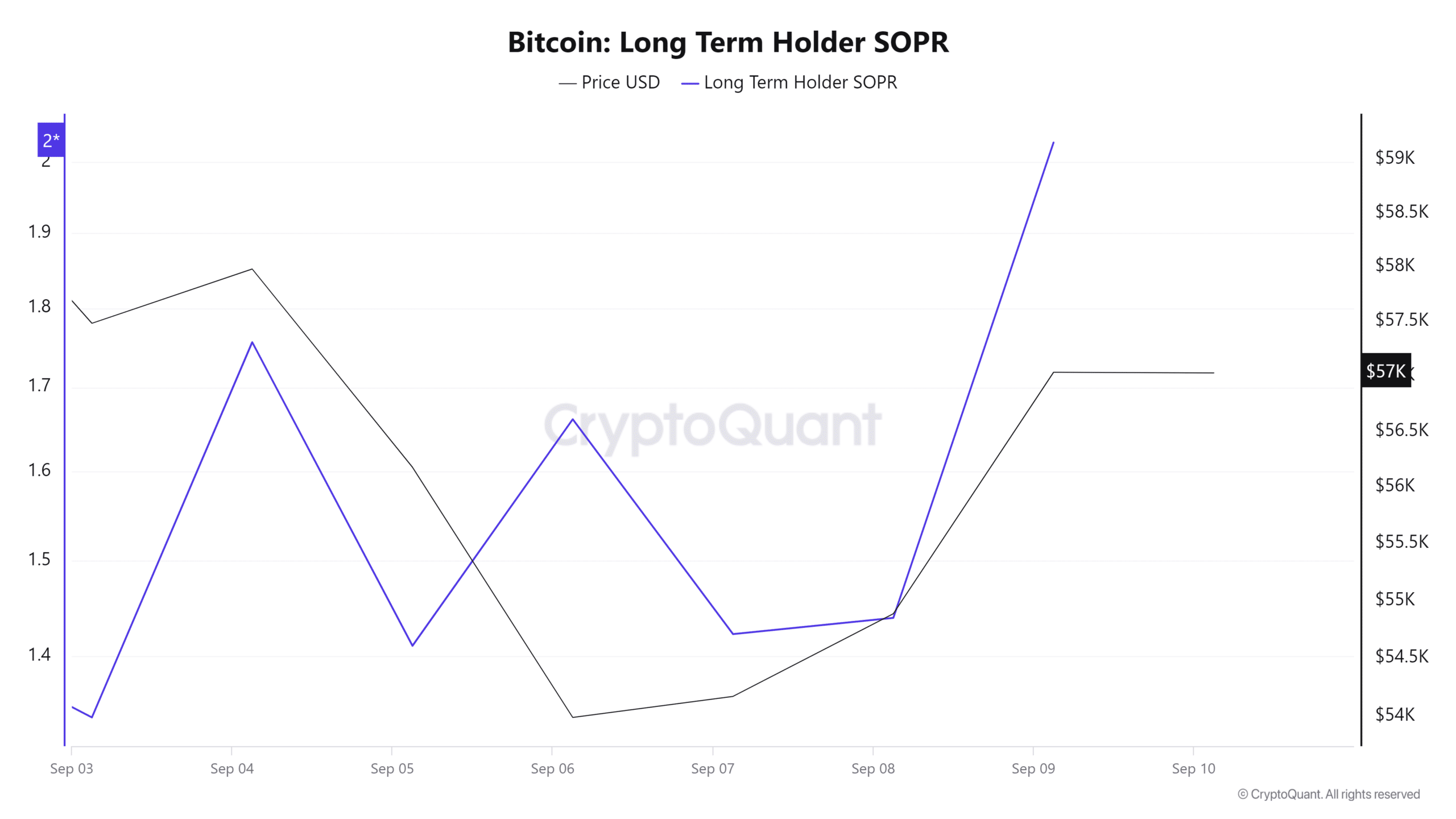

Furthermore, the approaching U.S. presidential elections are adding to the existing market turbulence. This apprehension, or fear, unsurprisingly coincides with a sharp increase in Long Term Holder’s Spent Output Profit Ratio (SOPR), which has risen from 1.4 to 2.0.

Even though prices are currently increasing, there might be a temporary dip or correction (pullback) before the end of the trading period to lock in the realized profits.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Consequently, a high demand for short positions suggests that investors anticipate prices will drop. Yet, this demand for short positions can actually fuel more demand, potentially leading to additional price rises.

If fear, uncertainty, and doubt (FUD) cause Bitcoin’s price to rise, that could enable Bitcoin to break through its current resistance at around $59,363 and reach a new high above the $60,000 threshold.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-09-11 04:08