-

BTC whales now hold 20% of the BTC supply.

BTC has risen to around $55,000 in the last 24 hours.

As a seasoned analyst with years of experience navigating the crypto markets, I find myself increasingly optimistic about Bitcoin [BTC] and its potential for growth. The recent surge in accumulation by large addresses, representing over 20% of the total BTC supply, is a testament to the confidence these whales have in Bitcoin’s long-term potential.

In the past few months, there’s been a substantial rise in the amount of Bitcoin (BTC) being hoarded by specific accounts. Compared to half a year ago, this accumulation is much more significant when considering the amount these addresses currently hold.

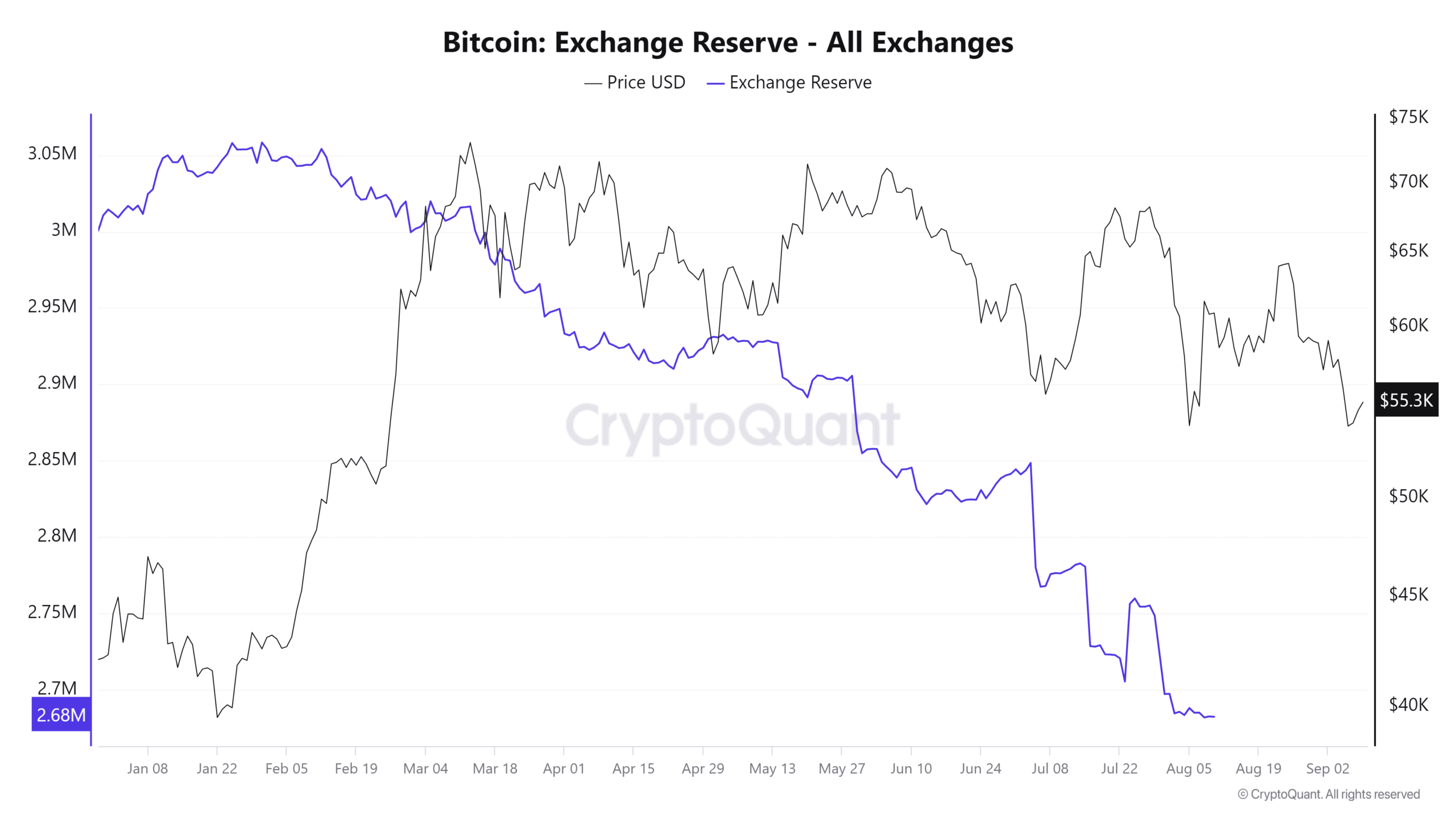

A more optimistic trend arises when we examine the growing assets against the exchange reserves during the same timeframe.

Bitcoin whales accumulate an extra 5%

According to the latest findings from IntoTheBlock, there’s been a substantial rise in the number of Bitcoin wallets storing between 100 and 1,000 Bitcoins, as they’ve been actively adding more coins to their holdings.

These addresses now hold over 4 million BTC, representing over 20% of the total Bitcoin supply.

Over the past six months, there’s been a significant jump of approximately 5%, meaning these ‘whale’ wallets now control about 4.01 million Bitcoin (compared to the 3.82 million they had half a year ago).

This growth in accumulation underscores the growing confidence in Bitcoin’s long-term potential, particularly amid volatile market conditions.

The significant rise in assets controlled by these accounts implies that bigger players, often referred to as ‘whales’, are strategically preparing for potential profits in the future.

Bitcoin’s exchange reserve continues to deplete

It’s clear that a growing number of large Bitcoin wallets are stockpiling Bitcoin, which is a strong indicator of an upcoming price increase. Furthermore, the current decline in Bitcoins held on exchanges adds credence to this optimistic perspective.

Based on a review of cryptocurrency exchange reserve data from CryptoQuant, it appears that Bitcoin held on these platforms has consistently decreased over time.

Currently, the Bitcoin reserve is roughly 2.68 million, which is lower than the 2.93 million recorded six months back.

The persistent drop in Bitcoin reserves being traded, coupled with an increase in the hoarding of BTC by wallets containing between 100 and 1,000 BTC, suggests that these owners are opting to keep their Bitcoins instead of selling or trading them.

By transferring their Bitcoins from exchanges to personal wallets, these investors typically indicate a buy-and-hold approach, which frequently points towards increased trust and optimism about Bitcoin’s potential future value growth.

A decrease in available reserves for exchange, along with an increase in accumulation, indicates a possible reduction in supply. This could result in increased demand and potential price increases.

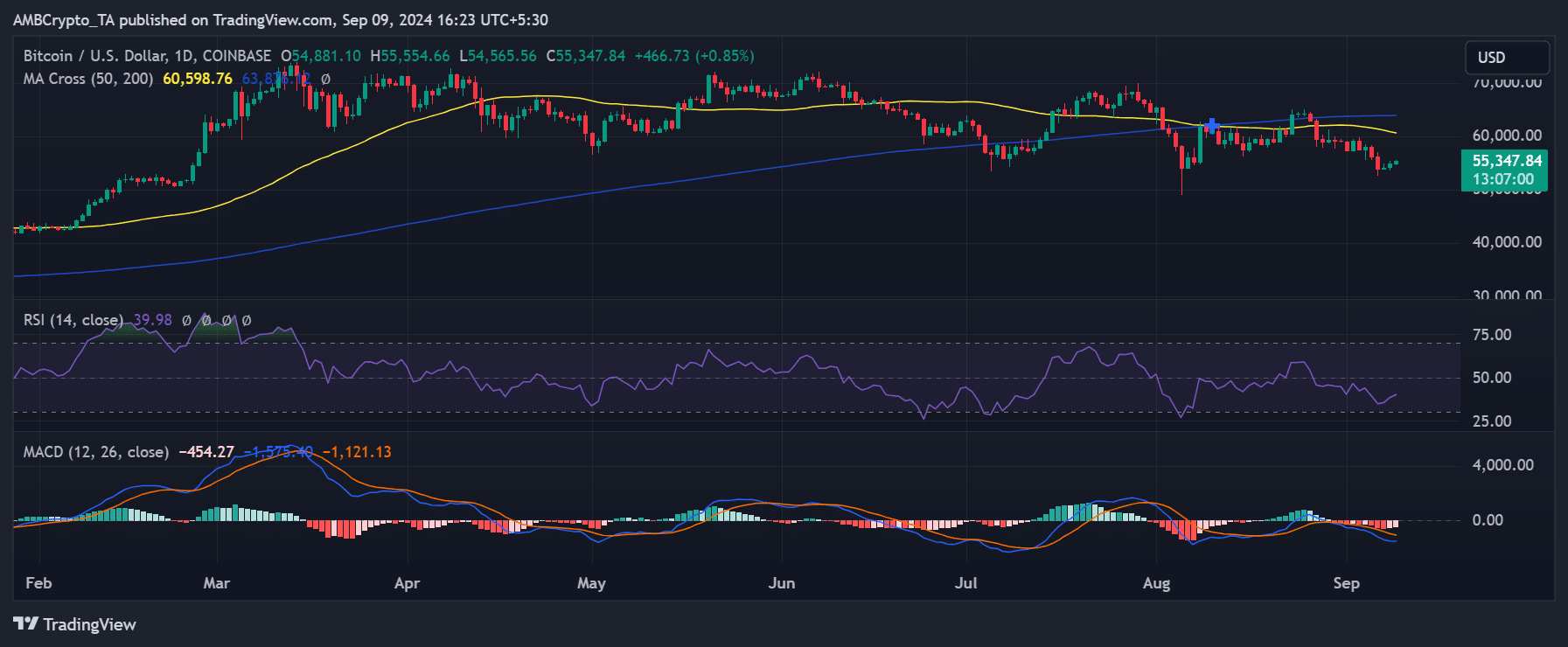

BTC’s price rises

In my recent investment journey, I noticed a significant growth of approximately 1% in the value of Bitcoin, propelling its price to approximately $54,881, as per my review of its daily price chart.

Currently, Bitcoin’s price is approximately $55,300, having experienced a minimal rise of almost 1%.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Reflecting on the price history since the accumulation phase started, Bitcoin (BTC) was being traded above $60,000. As a result, those who bought during this period are now holding their cryptocurrency assets at a lower value than their initial purchase price.

If Bitcoin manages to surpass the $65,000 price barrier, it will put early investors squarely in profitable territory.

Read More

2024-09-09 23:04