- Bitcoin has registered a strong uptrend lately, with analysts eyeing a parabolic rally to $276,400

- Last 24 hours saw BTC hike by 2.08% on the charts

After several weeks of fluctuation and even a pause in price increase, the last few days witnessed Bitcoin [BTC] soaring. Remarkably, this surge in value propelled the cryptocurrency to reach an all-time high of $105k for the first time in 2025.

Currently, as I’m typing this, Bitcoin has experienced a slight pullback, dropping to approximately $103,000.

Regardless, it’s important to note that the recent surge in Bitcoin’s price enabled it to escape from a cup and handle pattern, signaling a strong upward trend. Given the possibility of another breakout, analysts are now closely monitoring the market for further growth.

Indeed, some crypto experts such as Ali Martinez are speculating that the price could potentially reach around $276,400 by the year 2025.

In simpler terms, despite the market showing signs of pessimism following a long period of stability, this abrupt surge indicates that positive trends can still arise, even when some investors adopt a negative stance.

How bear zones build strong Bitcoin rallies

As a researcher studying cryptocurrency trends, I’ve observed that significant Bitcoin rallies can materialize even in bear markets, provided investors exhibit patience. Indeed, this phenomenon was evident just last week when BTC dipped below the $90k mark on the charts, only to bounce back.

According to this study, an intriguing pattern becomes apparent when examining Bitcoin’s price drops. When the market experiences downturns in what are known as “bear markets,” and investors seem to have lost optimism, the market tends to recover.

In other words, being patient can present a powerful investment opportunity when it comes to Bitcoin. Historically, following extended periods of calmness, Bitcoin has shown a tendency to surge significantly on price charts. Consequently, after significant market corrections, there’s usually a pause, followed by a deep breath, before the market resumes a stronger upward trend.

Investing in areas labeled as ‘red zones’ may seem unappealing at first, but history shows us that the recovery following such periods can be particularly remarkable.

What do BTC’s charts say?

Although the analysis given earlier looks optimistic, it’s crucial to examine other market signs as well to get a more comprehensive view.

Based on AMBCrypto’s examination, Bitcoin is currently experiencing a bullish trend, with bulls holding the upper hand in the market.

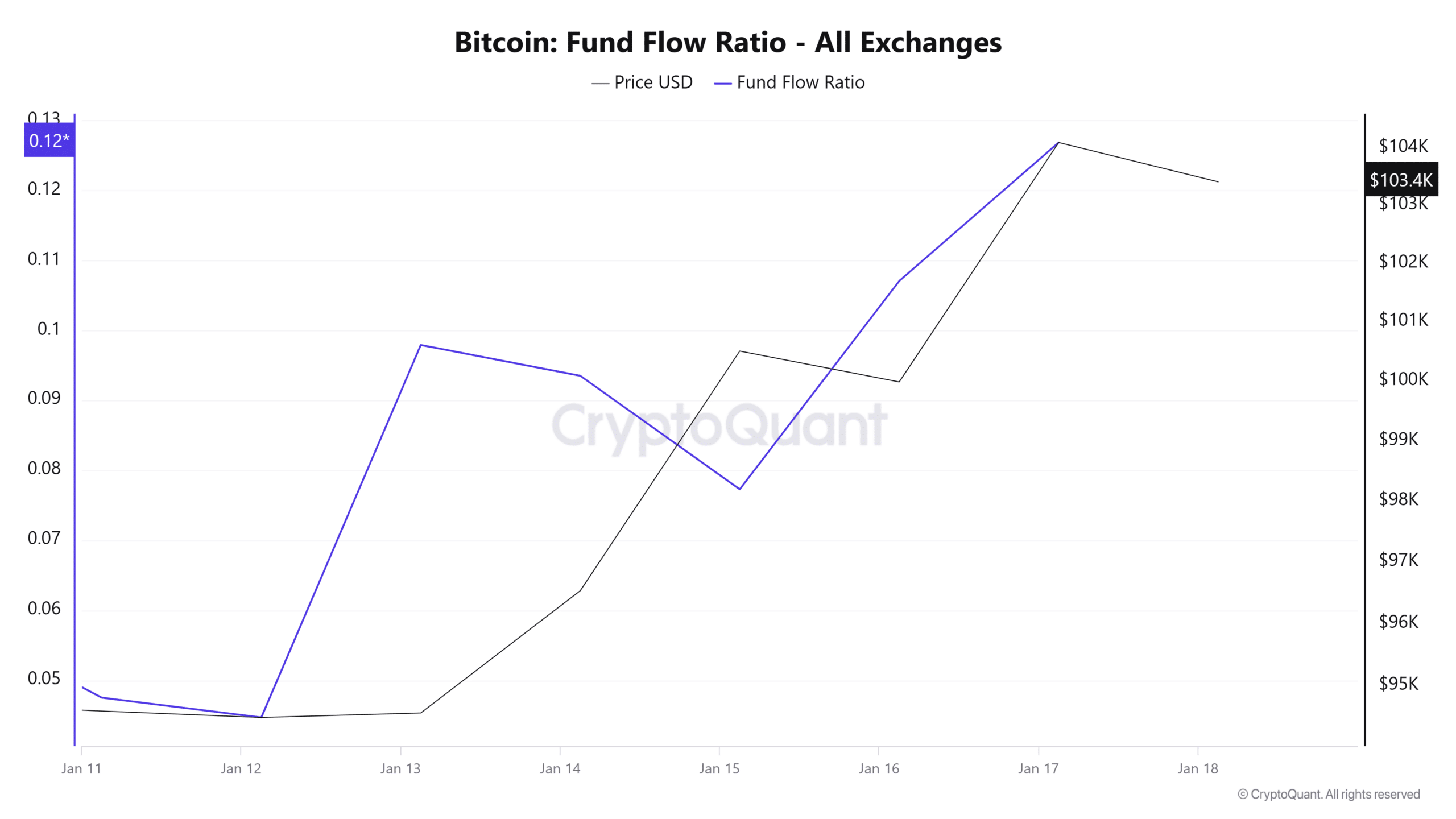

For example, Bitcoin’s fund flow ratio spiked over the past week to 0.12.

When there’s an increase (in the price), it often indicates a rise in investments flowing into Bitcoin, with investors purchasing more tokens. This might be interpreted as evidence of increased buying demand and a tendency towards accumulation.

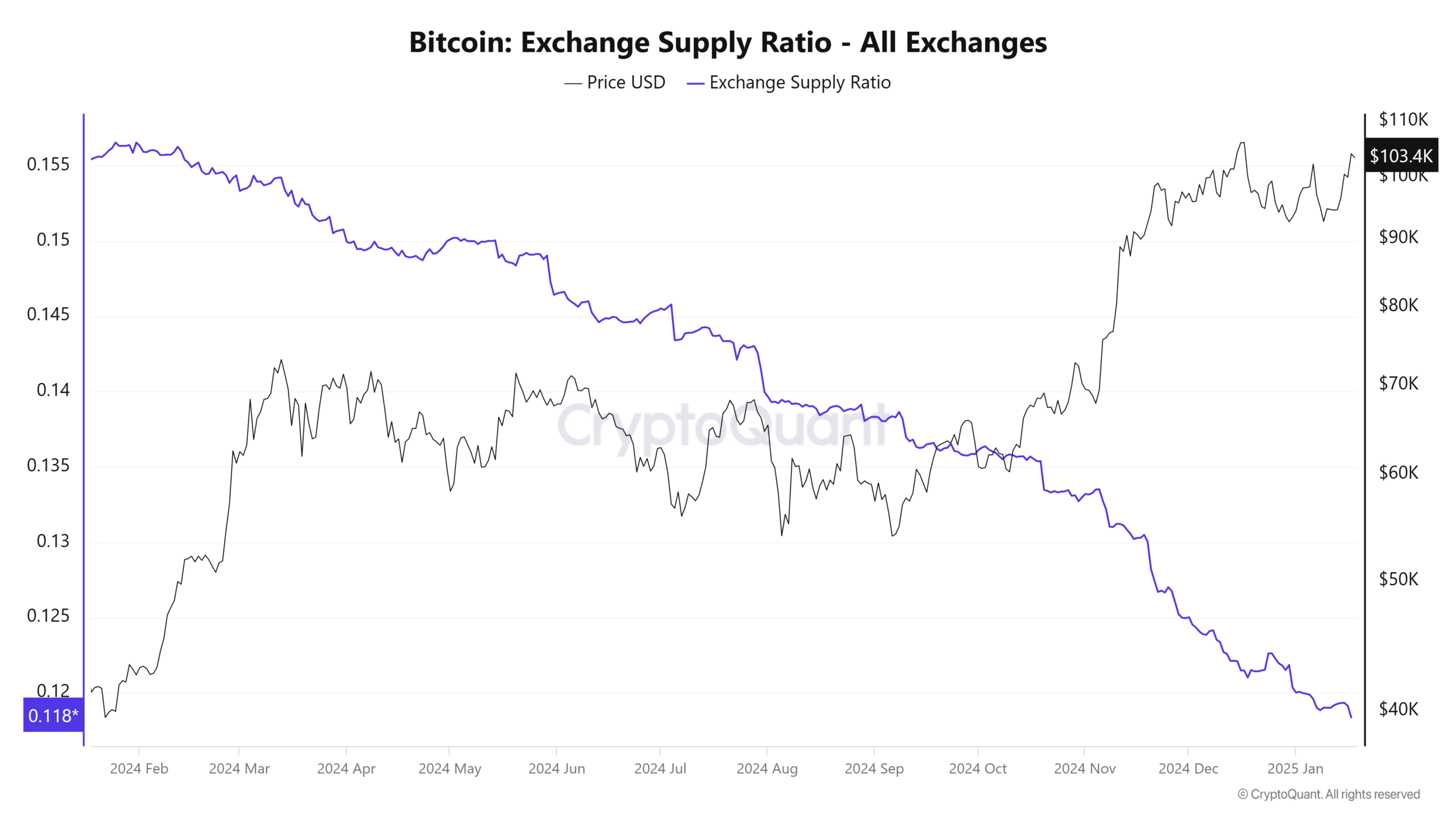

Furthermore, the exchange ratio for Bitcoin’s supply has dropped to reach its lowest point this year, suggesting that investors are choosing to hold onto their Bitcoin rather than keep it on exchanges.

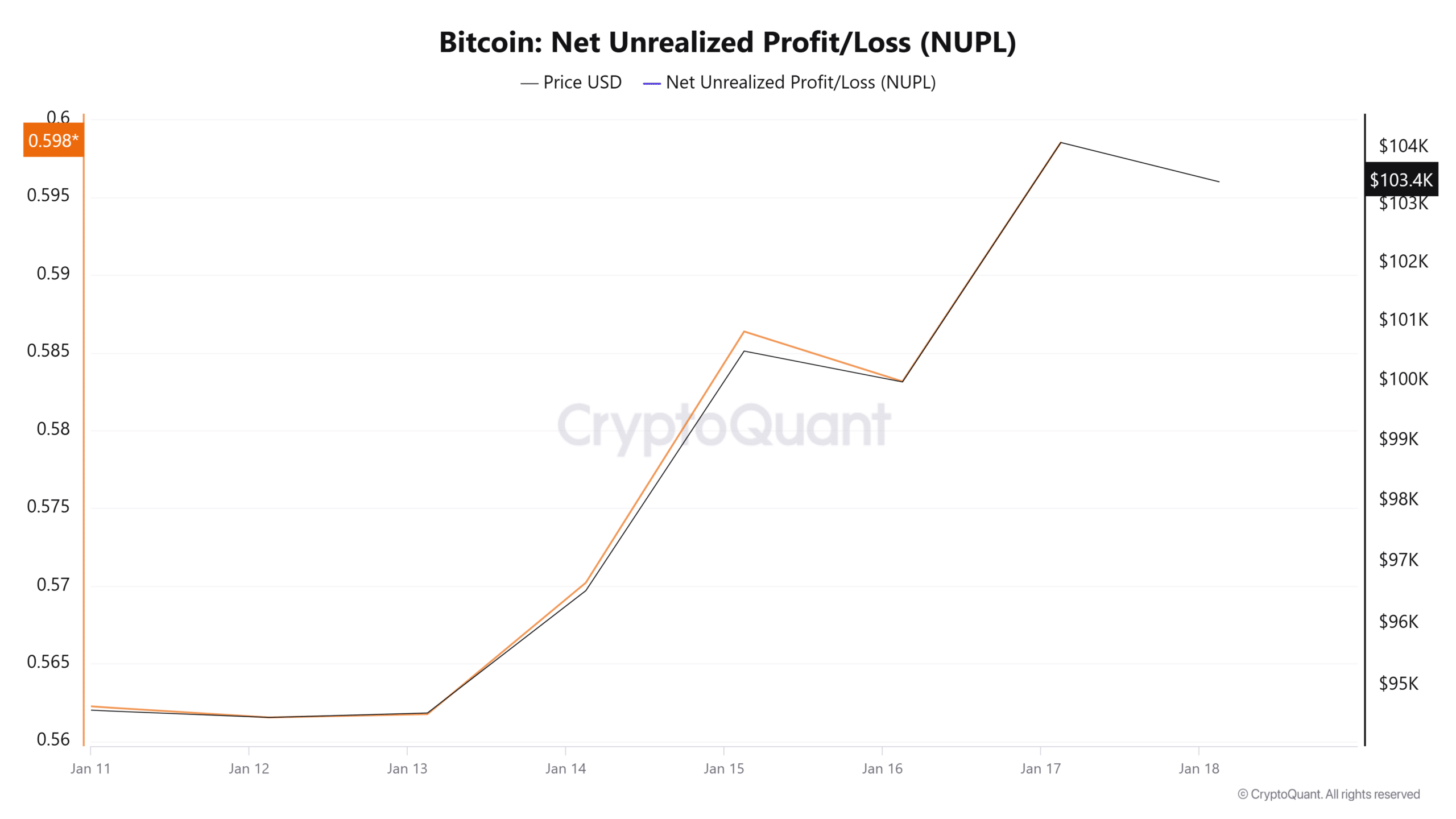

Finally, Bitcoin’s NUPL has spiked over the past week to hit 0.59.

historically, NUPL values ranging from 0.5 to 0.6 typically appear in the mid-phase of bull markets, just prior to a significant surge in prices.

How far can Bitcoin go?

Essentially, the recent drop in Bitcoin’s value served to bolster its potential for a steep upward trend, as investors seized this opportunity to buy at lower prices. With a positive outlook and high spirits, Bitcoin appears primed for further growth at this time.

Given that the current market conditions persist, Bitcoin might regain its all-time high of around $108k and possibly set a new one soon. However, reaching prices beyond $200k, as forecasted by Martinez, could be unrealistic in the immediate future. Yet, it’s plausible that such figures may materialize in the long term.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2025-01-18 16:08