- BTC reclaimed $100k, albeit briefly, after cooler-than-expected inflation data

- XRP reclaimed its 7-year high while ONDO faced $2.4B token unlock pressure.

On Wednesday, after the unexpectedly lower U.S. inflation rate was announced, Bitcoin [BTC] briefly dipped and then rebounded to test the $100k mark, causing a general market uplift. The reported inflation figure, known as CPI (Consumer Price Index), was 3.2% year-over-year, which fell short of the 3.3% anticipated by economists.

💥 EUR/USD Faces Historic Test Amid Trump Tariff Turmoil!

Market chaos looms — top analysts release an urgent forecast you must see!

View Urgent Forecast

This alleviated concerns about rising prices and the possibility of a Federal Reserve interest rate reduction, which had previously caused market downturns and pushed Bitcoin down to around $90,000.

It’s noteworthy that the current market projections indicate an approximately 97% likelihood of no change in the Federal Reserve’s interest rate during their meeting at the end of January.

AI agents lead recovery, XRP hits new high

After Bitcoin’s surge, Solana (SOL) and Ethereum (ETH) experienced gains of 14% and 12% respectively. On the other hand, the AI agent sector experienced a more significant rise; Virtuals Protocol (VIRTUAL) and Aixbt (AIXBT) recorded gains of 25% and 35% each.

Similar digital assets linked to AI narratives, such as Fartcoin and Cookie, also reported significant increases, with some even surpassing 10-fold returns. Remarkably, certain AI-related tokens experienced even more substantial growth, recording over 100-fold gains within a single day.

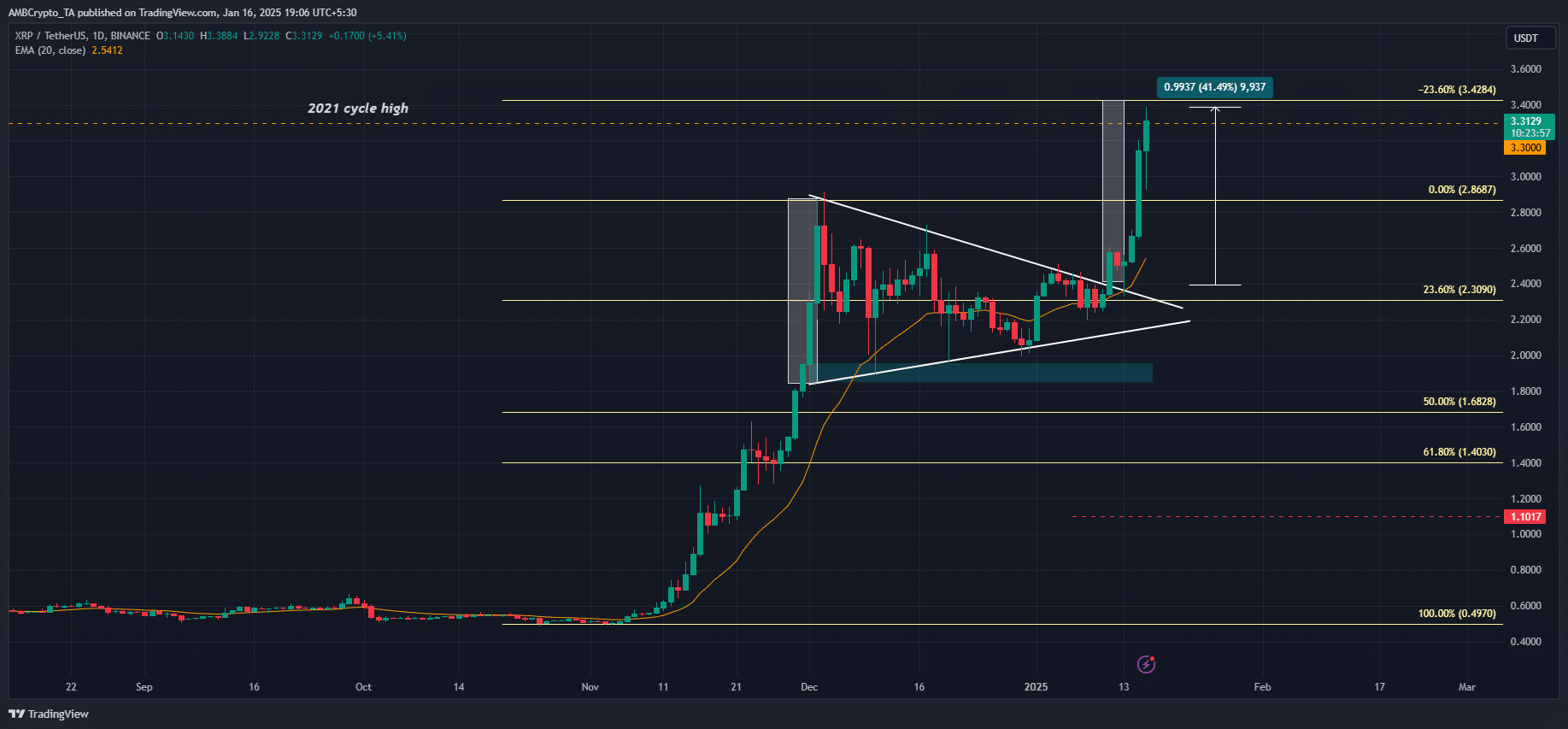

Despite other market events, what really stood out was XRP. At the moment of writing, this digital coin reached a peak of $3.38, surpassing its highest point in 2021. This significant jump increased its gains by about 40%. Remarkably, these positive movements continued even as legal issues arose, with the SEC filing an appeal against Ripple Labs.

The organization expresses disappointment over Judge Analisa Torres’ decision in the U.S. District Court, which categorized XRP as a non-security and lowered Ripple Labs’ initial $2 billion penalty to $125 million.

Although rumors suggested that the agency might not challenge the case, it did, causing frustration among Ripple’s management who labeled it as a frivolous use of taxpayer funds. However, there are whispers within the new Trump administration that they may halt certain crypto-related lawsuits, potentially including Rippe’s.

On January 18th, the leading company in real-asset tokenization, Ondo [ONDO], is set to release approximately 800 million tokens, equivalent to a value of around $2.4 billion.

If this asset increases to 134% of its current market value, it may experience substantial volatility and potential selling pressure. Even though the broader market is recovering as we speak, the cryptocurrency has already decreased by 42%. At a price of $1.2, it hasn’t regained its losses from December’s sell-off yet.

As a researcher, I’m eagerly anticipating the upcoming week, which signifies the inauguration of Donald Trump as president. This event heralds a fresh beginning for the crypto world, promising an exciting new chapter.

As I closely watch the market’s unfolding storyline, I’ve noticed that options traders seem to be particularly intrigued by the potential price points of $100k to $110k, as suggested by insights from trading firm QCP Capital. This hints at a growing anticipation in the crypto community.

Yesterday in the bitcoin options market, there was a noticeable trend of traders favoring BTC JAN calls, particularly those with strikes between $100K and $110K. This suggests a growing bullish sentiment among traders, as they’re buying contracts anticipating higher bitcoin prices. This is an encouraging sign as we approach March, which currently has the most open interest at the $120K strike.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Oblivion Remastered – Ring of Namira Quest Guide

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- E.T.’s Henry Thomas Romances Olivia Hussey’s Daughter!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

2025-01-16 22:15