- Whale activity surged as Bitcoin formed a double-bottom pattern, testing key resistance levels

- Market sentiment strengthened on the back of rising active addresses, declining exchange reserves, and the bullish buy/sell ratio

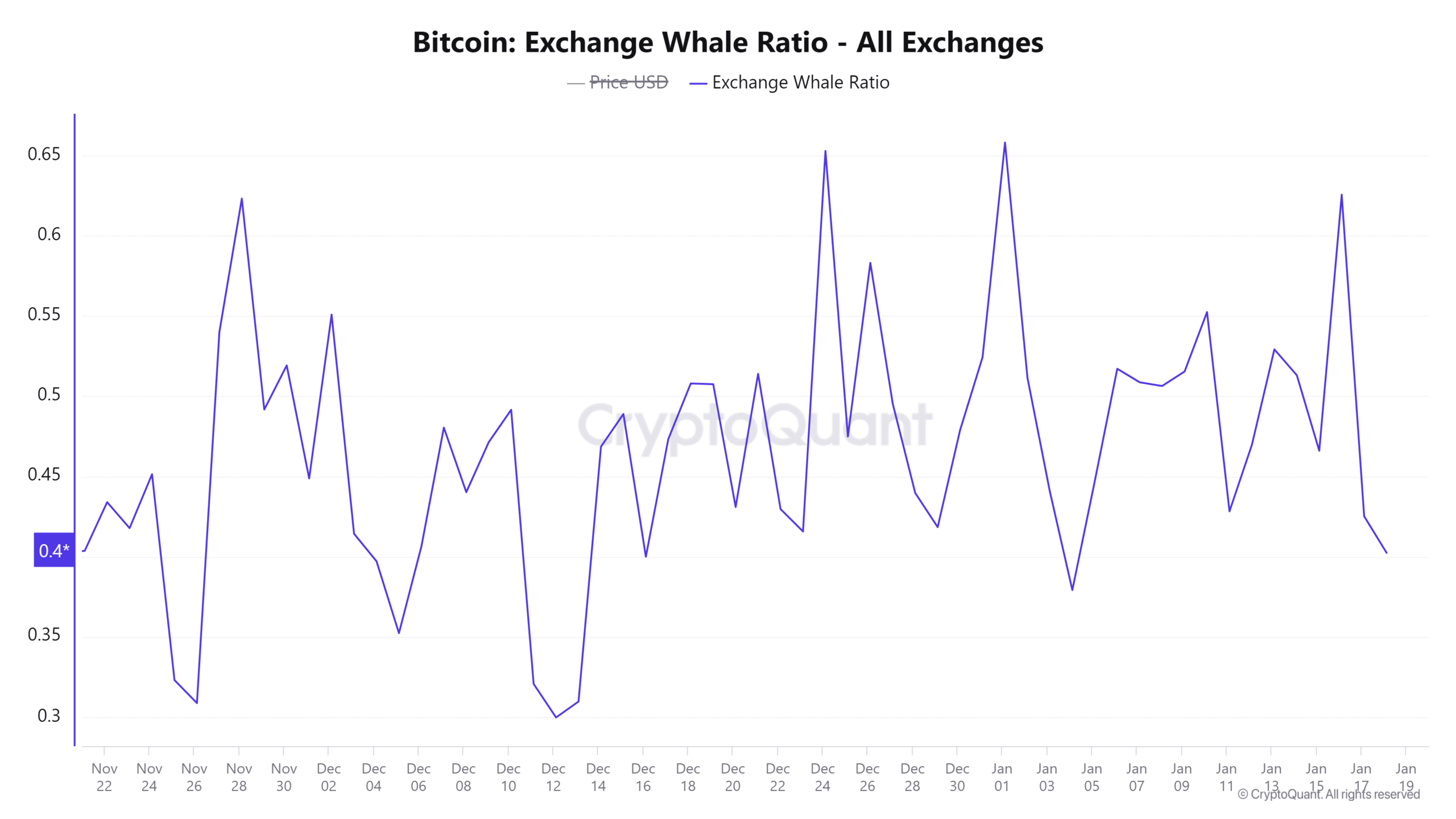

Recently, there’s been a noticeable increase in whale interactions on Binance, as the percentage of transactions made by large Bitcoin holders (whales) has risen by more than 1.02%. This statistic, known as the whale ratio, measures the proportion of inflows from top investors to the total inflows. It’s a useful tool for monitoring substantial Bitcoin movements by these significant players in the market.

Historically, increased whale activity (whales being large investors) tends to signal upcoming significant buying or selling. This is frequently a sign that substantial price fluctuations are about to occur in the charts as well.

It’s clear that Bitcoin’s recent increase has sparked debate over whether it signals a major market change or simply a short-term price spike.

Is Bitcoin ready to test new highs?

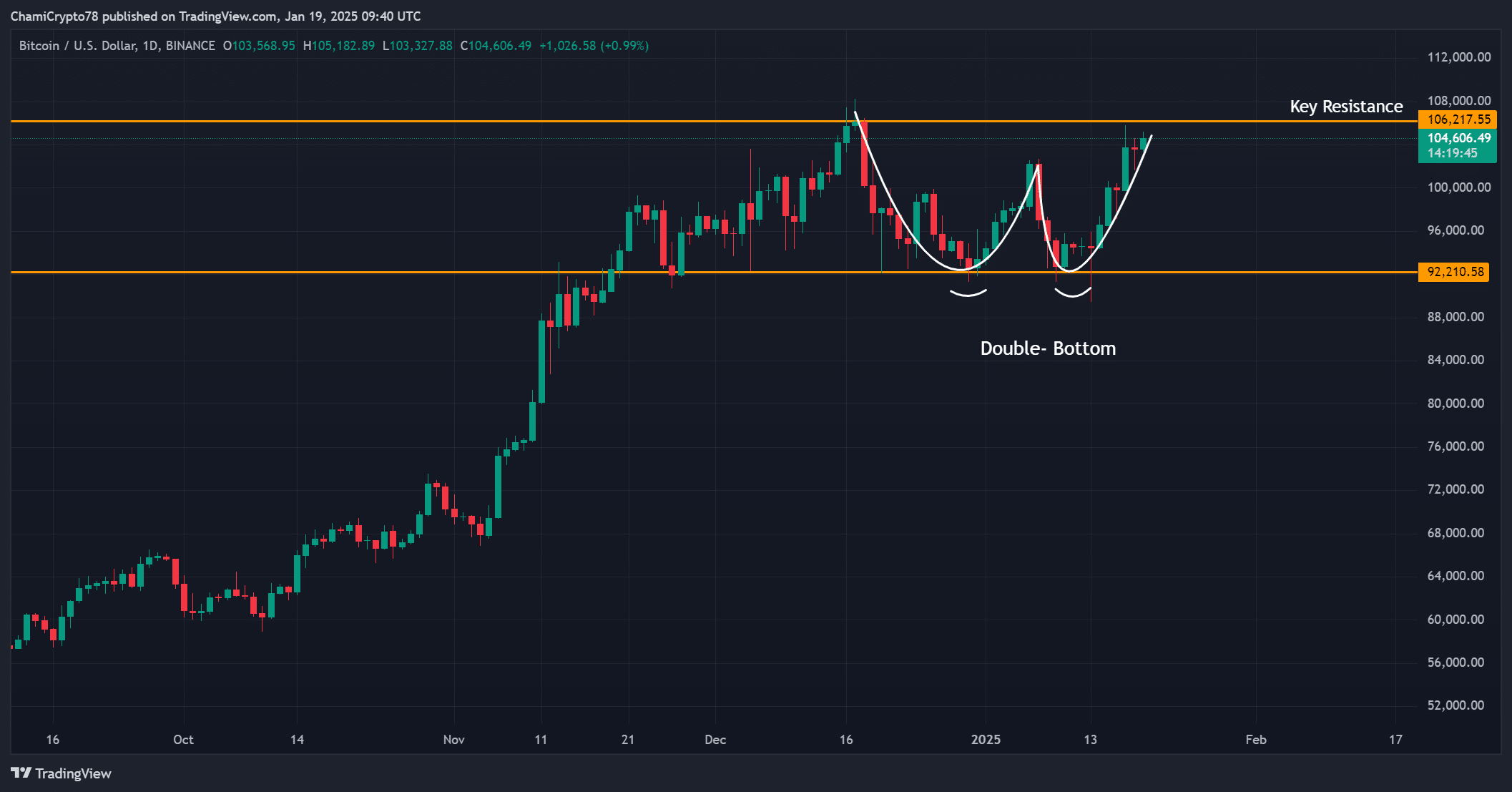

Currently, Bitcoin is being exchanged for approximately $104,473.77, representing a 1.39% increase over the past day. On the price charts, a double-bottom pattern is emerging, with significant support found around $92,000. The $106,200 level continues to present a significant obstacle as resistance.

Should Bitcoin manage to surpass this resistance point, it could lead to a significant surge ahead. Yet, if the growth slows or reverses, there might be a return to lower price ranges, making it an important moment for investors to keep a close eye on.

How can active addresses shape the market?

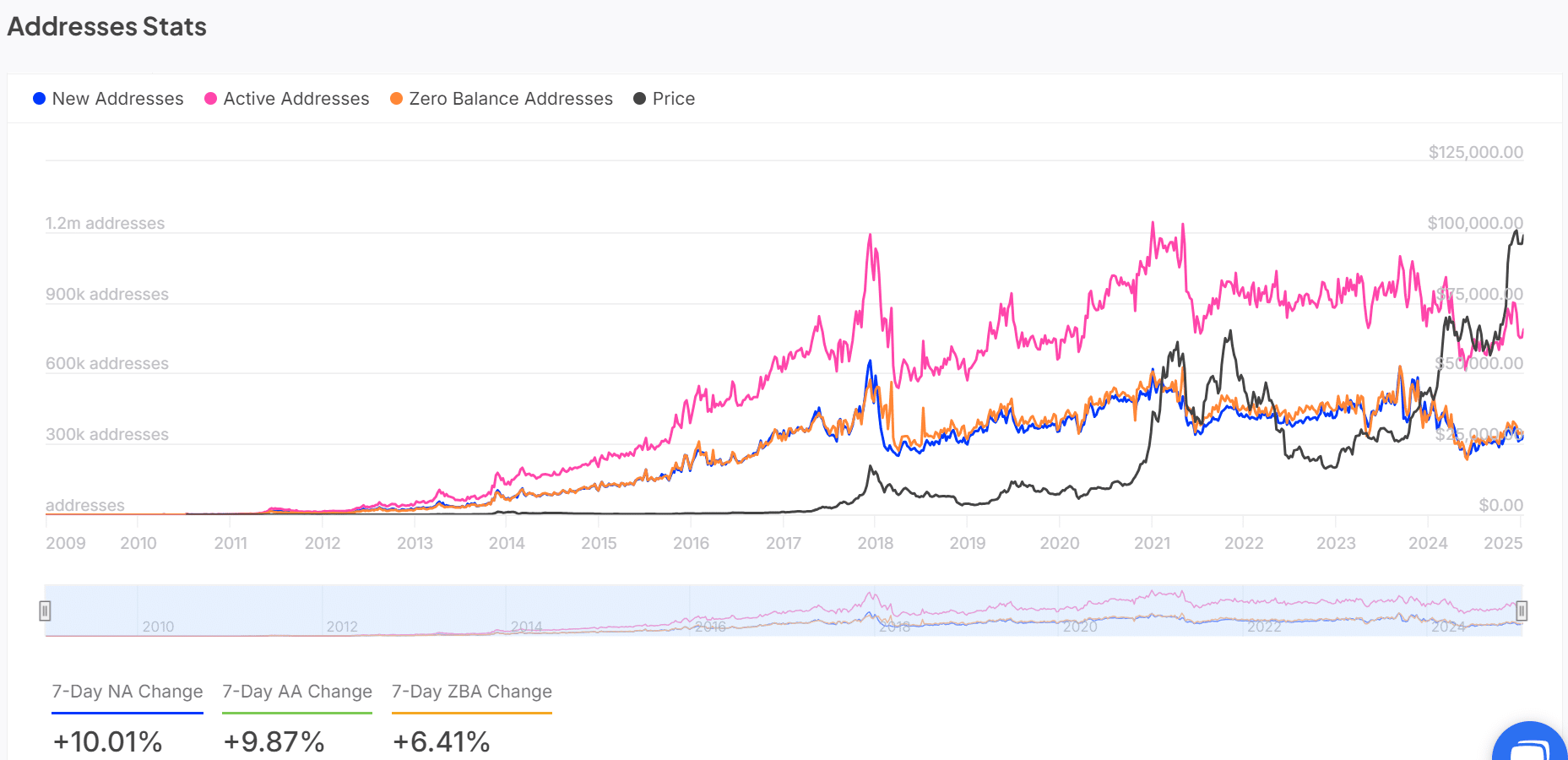

Over the past week, the number of active Bitcoin addresses has increased by approximately 9.87%, suggesting a rising fascination with this digital currency. This significant jump serves as a key sign of market engagement, implying that there’s growing interest from both individual and institutional investors in terms of transactions.

As a crypto investor, I’ve noticed that an increase in the number of active wallets serves as a barometer of market trust. Should this upward trajectory persist, it might offer the necessary transaction volume to propel Bitcoin towards higher valuations.

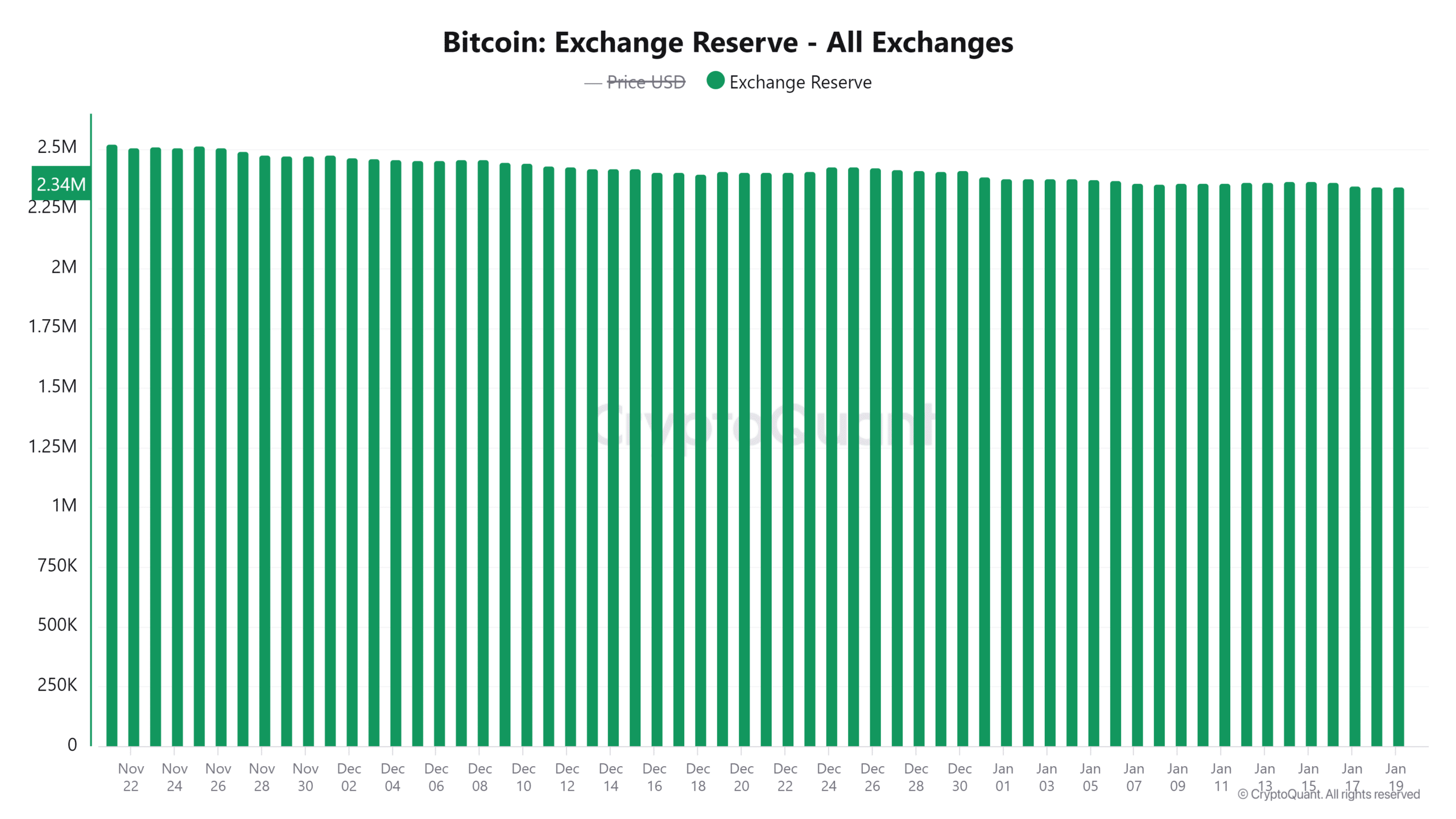

Exchange reserves signal reduced selling pressure

In the past 96 hours, over $2 billion worth of Bitcoin (around 20,000 BTC) has been taken out of trading platforms. As I’m typing this, exchange holdings are at approximately 2.344 million BTC, indicating a consistent decrease in supply.

This pattern shows that investors are shifting their assets into personal wallets, which suggests a positive, long-term outlook on the market.

It’s important to point out that when exchange reserves decrease, this often indicates a drop in selling pressure. This observation could lend credence to the possibility of an upcoming Bitcoin rally.

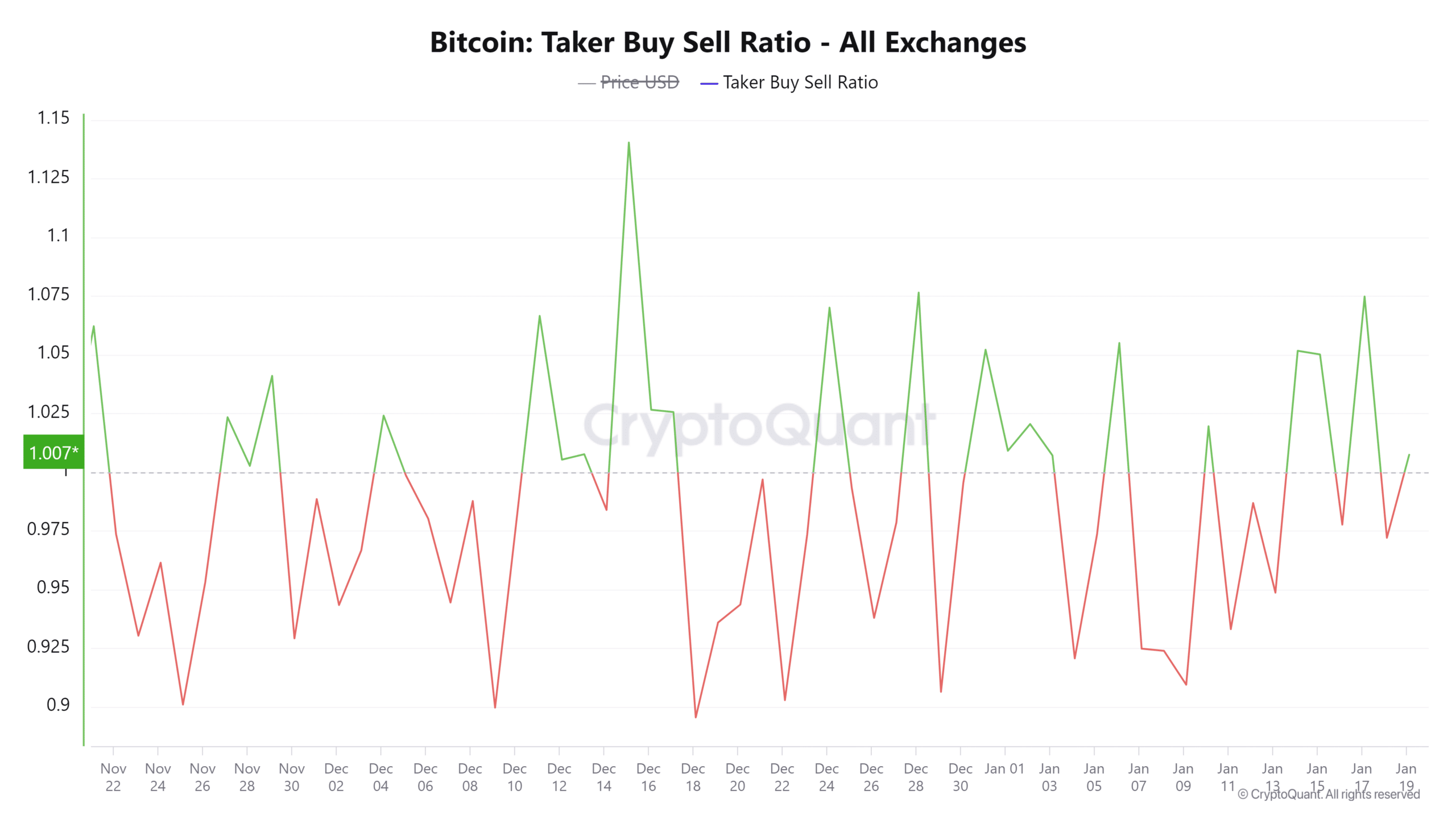

Taker buy/sell ratio indicates bullish momentum

As of now, the balance between buyers and sellers showed a slight edge towards buying, with a 0.99% increase in buyer activity. This indicates that investors are actively purchasing Bitcoin even at elevated prices, suggesting an upward trend in demand.

Moreover, this optimistic attitude reinforced the overall story of growing enthusiasm for Bitcoin, strengthening the likelihood of a rise in the near future.

Due to a significant rise in whale behavior, an uptick in active wallets, a decrease in exchange holdings, and a strong ratio of buyers over sellers, it seems that Bitcoin is ready for a major surge or breakthrough.

While risks of a pullback remain, data strongly supported a bullish case for the cryptocurrency.

Read More

2025-01-19 21:12