- Bitcoin breaks past key resistance levels, surpassing the 2015-2018 cycle’s high points.

- Institutional adoption and macroeconomic trends drive Bitcoin’s momentum toward a $100K target.

As a seasoned researcher with over two decades of experience in financial markets, I must admit that the current trajectory of Bitcoin is nothing short of astounding. Having closely observed the ebb and flow of various cycles, from the Dotcom Boom to the Crypto Winter, witnessing Bitcoin break past historical resistance levels and surge towards a $100K target feels like a ride on an unpredictable rollercoaster.

Bitcoin (BTC) has broken through a significant price threshold, outpacing crucial resistance points that historically guided its pattern of growth during the 2015-2018 bullish period.

The recent surge underscores the digital currency’s robustness and increasing sophistication within an industry that has undergone substantial growth and transformation since its initial days of wild speculation.

Compared to the rollercoaster ride of the 2015-2018 period, Bitcoin’s current path seems smoother due to its foundation on solid fundamentals and increased acceptance across a wider audience.

As the price soars past levels once thought to be unreachable barriers, there is speculation if this rise signifies the start of a fresh bull trend—or perhaps an upward trajectory leading towards a valuation of six figures.

Breaking past historical cycles

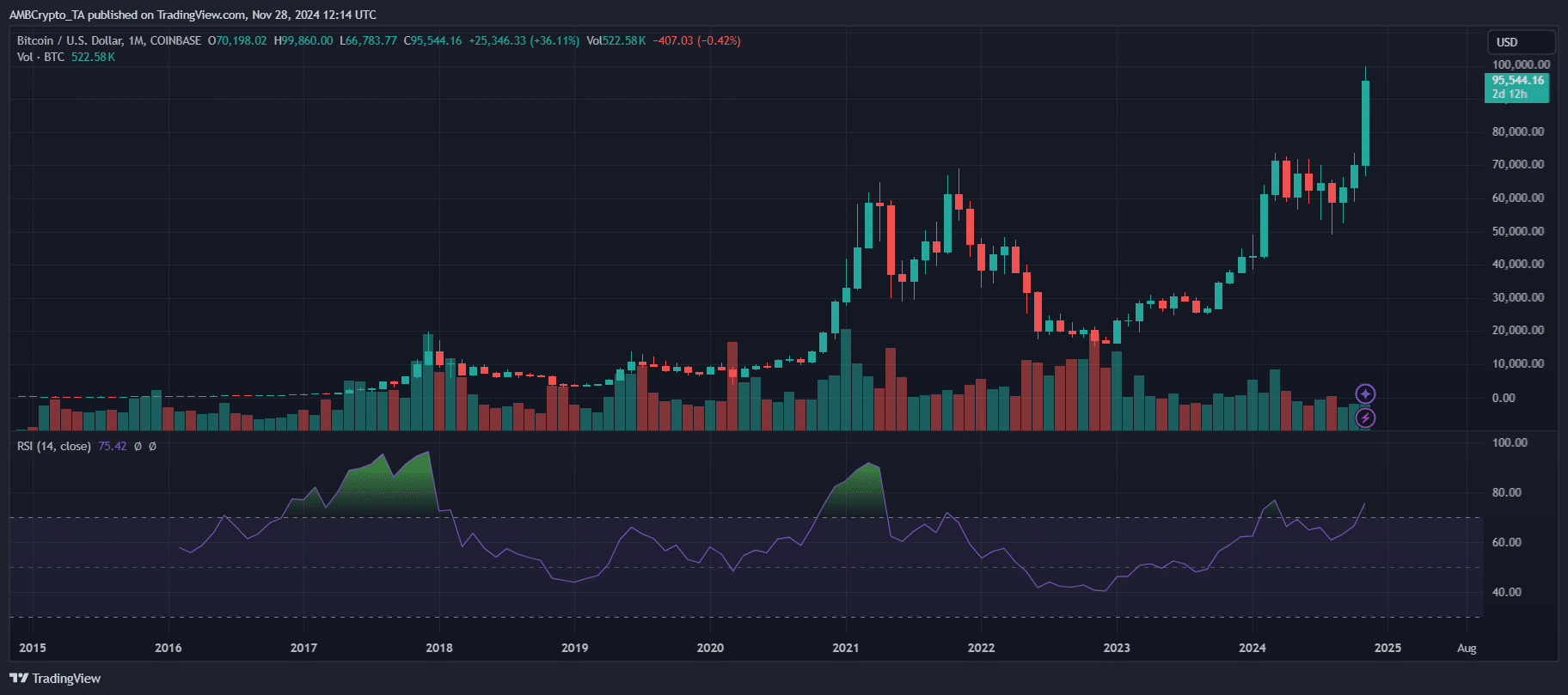

Compared to the 2015-2018 cycle, Bitcoin’s current growth phase is advancing more swiftly. After reaching an all-time high of $20,000 in 2017, Bitcoin took approximately three years to regain its strength, spending time at lower levels before experiencing another surge.

Contrastingly, compared to the sluggish recovery after its bottom in 2022, Bitcoin bounced back more swiftly, reaching over $50,000 just two years later – approximately one year ahead of the pace set by its previous rebound.

The graph demonstrates that Bitcoin is continuing its upward trend, as the Monthly Relative Strength Index (RSI) readings are consistently above 75, indicating a robust bullish market scenario.

The current trading activity levels are greater than during the previous period, indicating a higher level of market involvement.

Reaching this milestone indicates a significant rebound, approximately 80%, from the lowest points of 2022. This uptrend is largely attributed to increased holding by long-term investors and a decrease in cryptocurrency balances on exchanges.

The changes occurring within the blockchain indicate a stronger foundation relative to past periods, implying fewer speculative actions and a greater emphasis on long-term expansion. Furthermore, Bitcoin’s swift rebound deviates from traditional trends.

What sets this cycle apart

Two key factors define this cycle: institutional adoption and macroeconomic tailwinds.

Leading entities such as BlackRock and Fidelity are advocating for Bitcoin Exchange-Traded Funds (ETFs), suggesting growing mainstream approval and potentially increasing financial investment in this digital currency market.

Open Interest in Bitcoin Futures has surged, reflecting heightened institutional activity.

From an economic perspective, ongoing inflation, political unrest, and the tendency for countries to move away from the U.S. dollar, have been boosting Bitcoin’s attractiveness as a safe haven investment option.

Furthermore, innovations such as the Lightning Network have boosted scalability, making Bitcoin more practical and useful.

In newer periods, these unique factors – not present before – are driving increased and long-term interest, making Bitcoin appear more established and valuable to both individual and corporate investors.

Can Bitcoin hit $100K?

The current fluctuations in Bitcoin’s value, combined with its robust underlying network factors, make reaching $100K a plausible scenario.

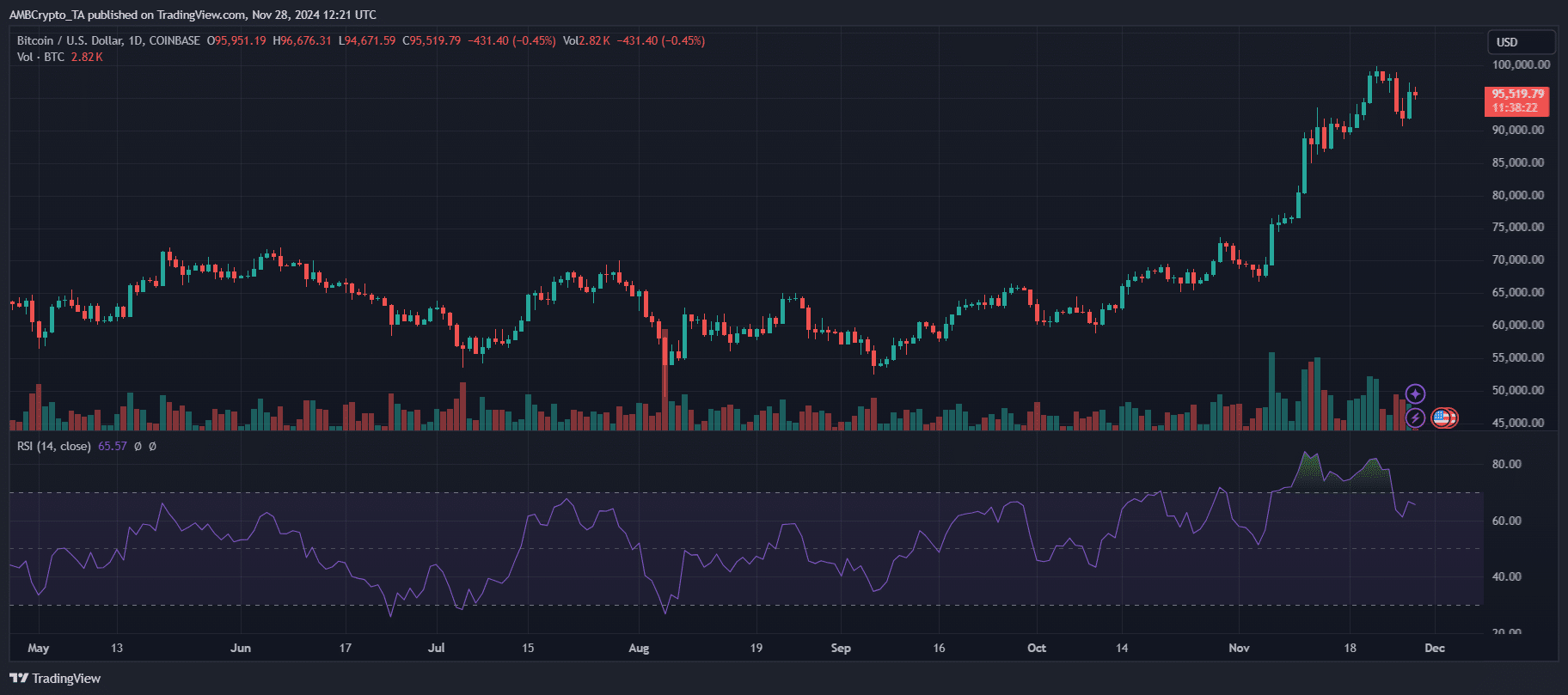

In the month of November, Bitcoin soared beyond the $90K mark, accompanied by an uptick in trading activity and Relative Strength Index (RSI) reaching 75, indicating strong buying pressure or bullish sentiment.

As an analyst, I’ve observed that after the recent adjustments, Bitcoin has managed to stabilize around the $95K mark. This stability is reflected in a Relative Strength Index (RSI) of 65, suggesting the market isn’t showing signs of being overbought yet, indicating there might still be room for further growth.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Continued acceptance within institutions and broader economic aspects like worries about inflation and increased interest in Bitcoin Exchange-Traded Funds (ETFs) strengthen the optimistic perspective on Bitcoin’s future.

After the halving, it’s plausible that Bitcoin can reach $100K, but there might be risks due to overall market instability that could affect this journey.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-11-29 06:16