In the shadow of fleeting manias, the cryptocurrency realm now dons a mask of weary patience. Bitcoin, that stubborn old soul, clings to its $100,000 perch like a hermit in a gilded cage, while Ethereum and its altcoin kin shuffle in circles, trapped in a waltz of stagnation. The air smells of burnt toast-speculation charred, but not quite ashes. 😐

The crowd’s cheer has dimmed from delirium to a grumpy mutter. Traders, once drunk on leverage, now sip tea and eye their ledgers with the suspicion of a man who’s seen too many Ponzi schemes. On-chain whispers tell of quiet hoarding by the wise, while the speculators’ tents deflate like overpriced balloons. 🎈➡️🪦

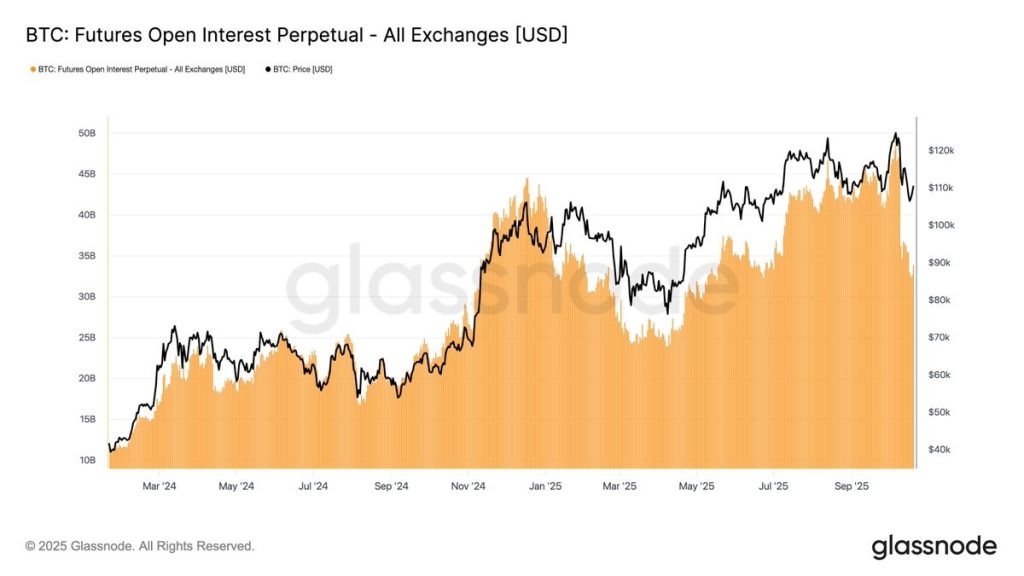

Yet lo! A specter haunts the charts: Bitcoin Futures Open Interest, that fickle mistress, has shed 20% of her girth. One might call it a “leverage flush”-a cleansing, or perhaps a prelude to chaos. Only time, that old scoundrel, will decide. 🕰️

The Great OI Exodus: A 20% Descent into Madness?

2025’s dance of numbers reveals a bitter truth: Open Interest swells with greed, shrinks with fear. January and July’s peaks? Merely gasps before the plunge. When OI breached $45-47 billion, the euphoria died, and the market coughed up its profits like a sputtering engine. Now, it wheezes at $35 billion, a shadow of its former self. 📉

Glassnode’s ledger confirms the exodus: $45 billion to $35 billion in weeks. A cold bath for the speculative fever, yet Bitcoin’s price remains stubbornly upright. One might call it “discipline,” but we know better-it’s the market’s way of saying, “I’ll sip this coffee, but I won’t spill it.” ☕

A Cooling Pot, Not a Boiling Kettle

Beneath the surface, Bitcoin clings to a support zone like a beggar to his last coin. Institutions, those patient vultures, circle quietly, scooping up scraps while the speculators’ feast turns to famine. This is no crash-it’s a sigh of relief, a pause in the ballet of panic. A healthy market, they say, but who are we to argue with survival? 🦴

If Open Interest finds its new home at $30-35 billion, prepare for a base-building farce. The next act? A dash toward $120,000, or a pratfall into oblivion? Only the gods of volatility know. 🤷♂️

The Metrics: A Symphony of Sighs

Listen closely-the market hums a tune of exhaustion:

- Futures Open Interest: Down 20%. Leverage’s torch has dimmed. 🔥➡️🕯️

- Funding Rates: Neutral as a monk’s stare. Longs and shorts play nice-for now. 🙏

- Volatility Index: Flat as a pancake. Boredom, thy name is consolidation. 🥞

- Exchange Balances: Low. The wise have buried their gold. 💰

Together, they paint a portrait of a beast cooling its heels, not charging. A prelude to glory-or a lull before the storm? The future is a riddle wrapped in a cryptic tweet. 🕵️♂️

The Road Ahead: Patience or Peril?

Short-term? Bitcoin dawdles between $95K and $110K, a squirrel debating whether to bury more nuts. Break above $115K? A bull’s trumpet. Drop below $95K? A buying spree for the patient. Long-term? ETFs flow like rivers, institutions dig in, and exchanges empty like a thief’s pockets. Demand grows, but so does the weight of expectation. 🏋️♂️

In this grand theater of greed and fear, Bitcoin endures. Whether it ascends to $125K or stumbles into oblivion, one truth remains: the market is a fickle lover, and we are all just players in her eternal game. 🎲🃏

Read More

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Gold Rate Forecast

- Best Controller Settings for ARC Raiders

- How to Build a Waterfall in Enshrouded

- The 10 Best Episodes Of Star Trek: Enterprise

- Resident Evil Requiem cast: Full list of voice actors

- Best Thanos Comics (September 2025)

- Best Shazam Comics (Updated: September 2025)

- 10 Most Iconic Comic Book Resurrections From Jean Grey to Superman

2025-10-21 14:54