- Bitcoin’s apparent demand, measured by the 30-day sum of daily block subsidies minus one-year inactive supply changes, signaled bearish pressure

- Holders accelerated selling, reinforcing bearish market conditions

Ah, Bitcoin! The darling of the digital age, whose recent price movements have become a veritable soap opera of miscalculations and misplaced optimism. As BTC plummeted from a dizzying $84,600, traders, bless their hearts, seemed to have taken a long position at the wrong time—perhaps while distracted by a particularly riveting episode of their favorite reality show. 📉

Meanwhile, our esteemed large Bitcoin holders, in a fit of panic, decided to reduce their positions, thus adding to the selling pressure like a well-meaning but misguided friend at a dinner party. Demand indicators, it appears, are pointing to one of the weakest periods of 2025, with new supply outpacing the inactive supply—an economic tragedy worthy of Shakespeare! 🎭

Indeed, Bitcoin’s apparent demand, measured by the 30-day sum of daily block subsidies minus one-year inactive supply changes, hinted at bearish pressure at press time. Between 2 December 2024 and 10 March 2025, demand peaked at a staggering 105k BTC on 16 December 2024, when the price was a lofty $97.5k. But alas, by 3 March 2025, demand had plummeted to -100k BTC, as the cryptocurrency nosedived to $80k. The 30-day Simple Moving Average (SMA) of demand also declined from 105k BTC to 77.5k BTC, reinforcing this downtrend—truly a tale of woe! 📉

A shift from positive demand to negative demand occurred after mid-January 2025, with sustained negative demand taking hold by 17 February 2025. This shift suggested that new supply outpaced the retention of inactive BTC, leading to downward pressure on the price. If demand remains negative, Bitcoin could test $75k, potentially declining to $70k. A reversal above 0 might stabilize the crypto at $85k, though sustained buying pressure would be needed to confirm a recovery—if only the market were so obliging! 🤷♂️

Misalignment with market trends

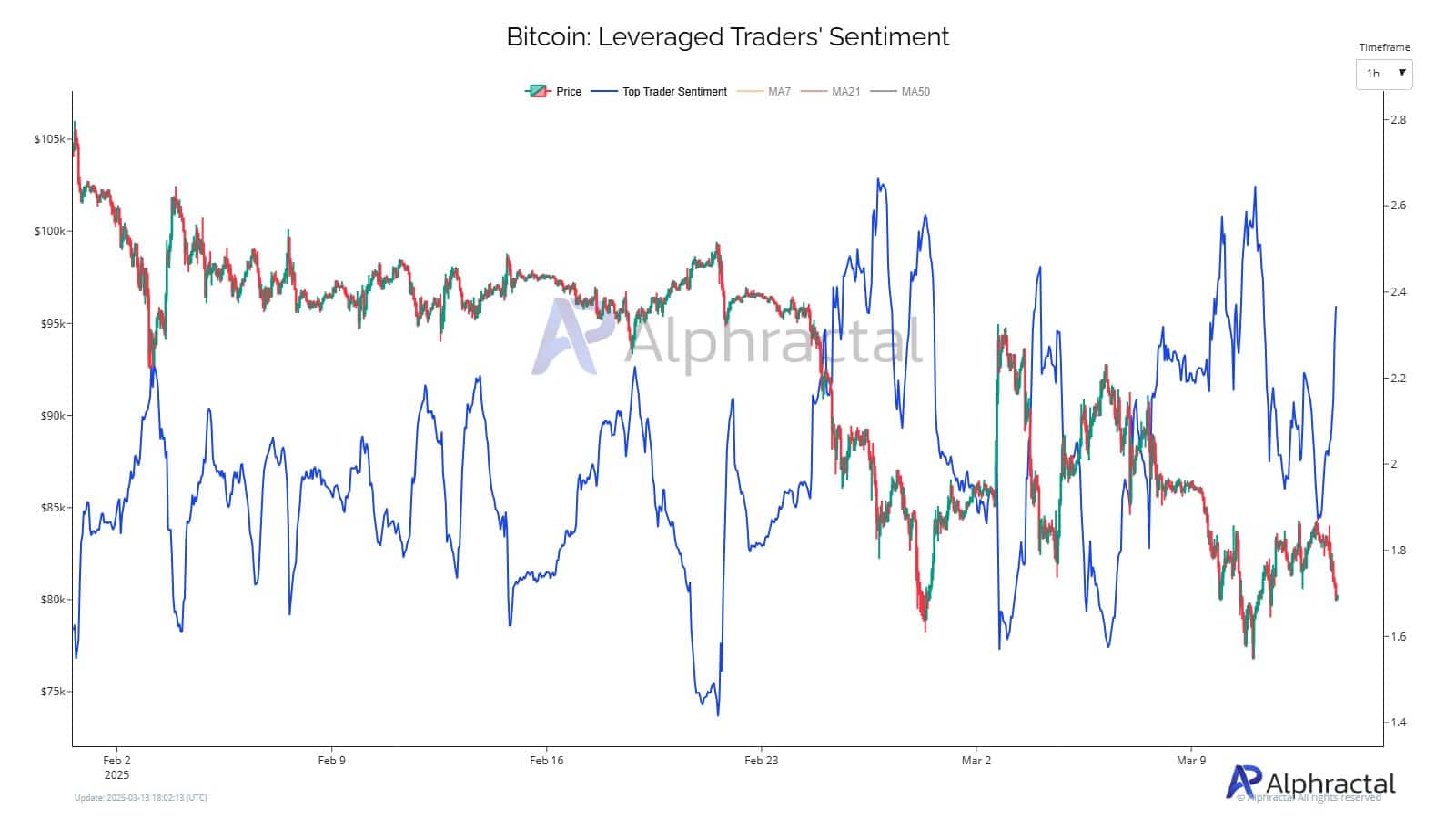

But wait, there’s more! Leveraged traders, in their infinite wisdom, misjudged Bitcoin’s price movement, as sentiment shifts failed to align with the price action. From 2 February to 9 March, Bitcoin traded at $95k while top trader sentiment registered a dismal -2.8—a sign of extreme bearishness, or perhaps just a collective case of the Mondays. 😩

By 16 February, sentiment flipped to 2.8 as the price fell to $85k, indicating that traders were going long despite the downtrend—an act of sheer bravado or perhaps a touch of madness? 🥳

The Moving Averages (MA7, MA21, MA50) of sentiment fluctuated, with the MA50 peaking at 2.2 on 23 February, even as the crypto dropped to $80k. On 9 March, sentiment fell to 1.4 while Bitcoin recovered to $84k, again misaligning with price direction. This persistent misjudgment is a sign of overconfidence in a rally that did not materialize. If traders continue this pattern, further liquidations could push BTC to $78k. However, a realignment of sentiment with price trends could support a recovery, though market behavior remains as unpredictable as a cat on a hot tin roof! 🐱👤

Stakeholders’ selling adds pressure

Finally, our large Bitcoin holders, in a fit of collective anxiety, accelerated selling, reinforcing bearish market conditions. Over the last three months, wallets holding 100–1,000 BTC reduced their holdings by 50,625 BTC, decreasing their market share from 23.48% to 22.94%. It’s as if they were all reading from the same script! 🎭

Similarly, wallets with 10–100 BTC shed 7,062 BTC, bringing their share down from 21.84% to 21.71%.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2025-03-14 16:11