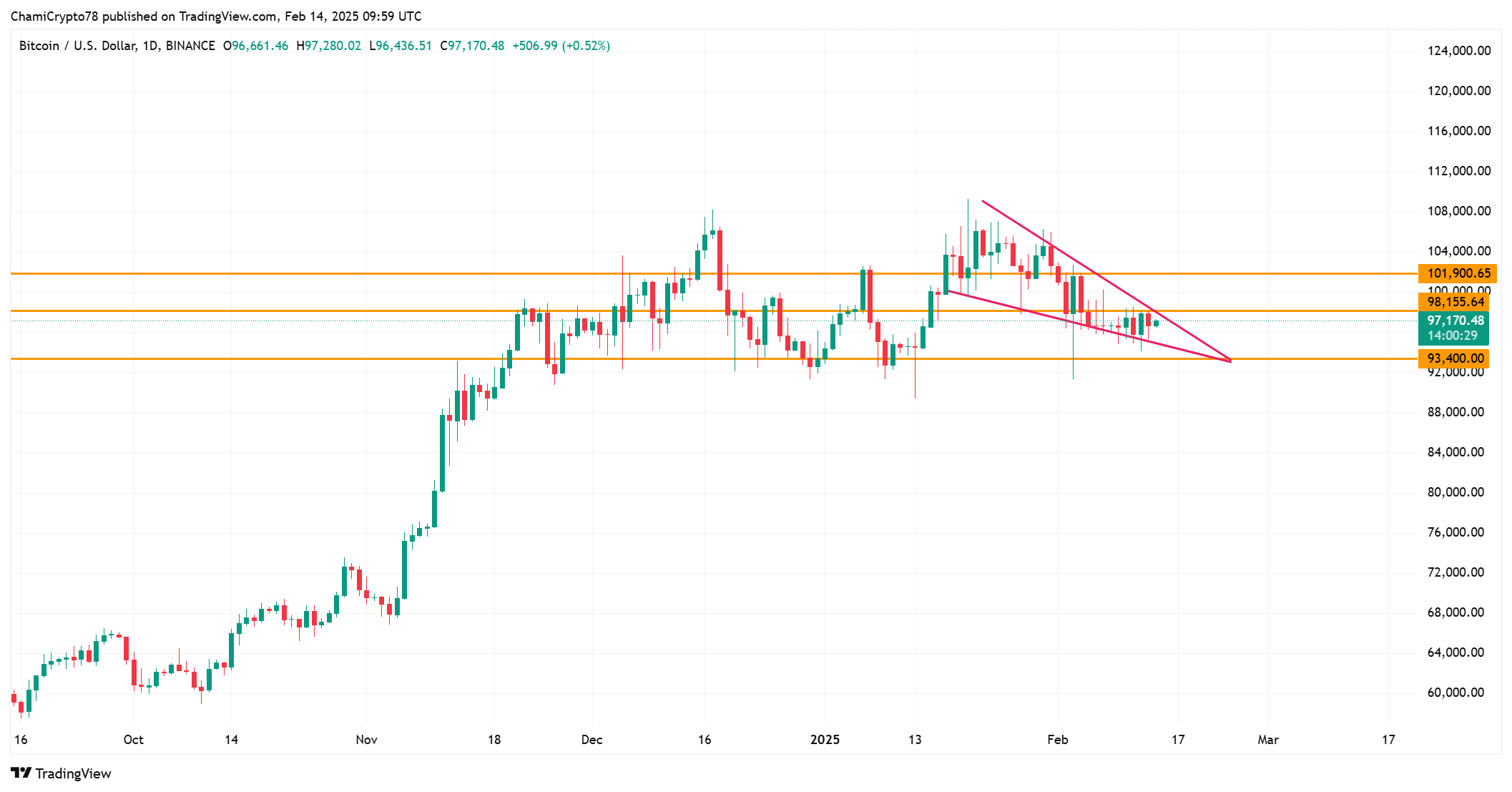

- Bitcoin, that fickle friend, seems to be playing hide and seek below $101,900, forming a symmetrical triangle that could either break out or break down. Talk about commitment issues!

- The NVT Golden Cross and Taker Buy/Sell Ratio are waving red flags, hinting at overbought conditions and a moderate buying pressure that’s about as subtle as a troll in a library.

As of this very moment, Bitcoin [BTC] is testing its crucial support levels, like a cat testing the limits of a cardboard box. Priced at $97,183, the world’s largest cryptocurrency has managed to climb a whopping 1% in the last 24 hours. Not exactly a marathon, but hey, every little bit counts!

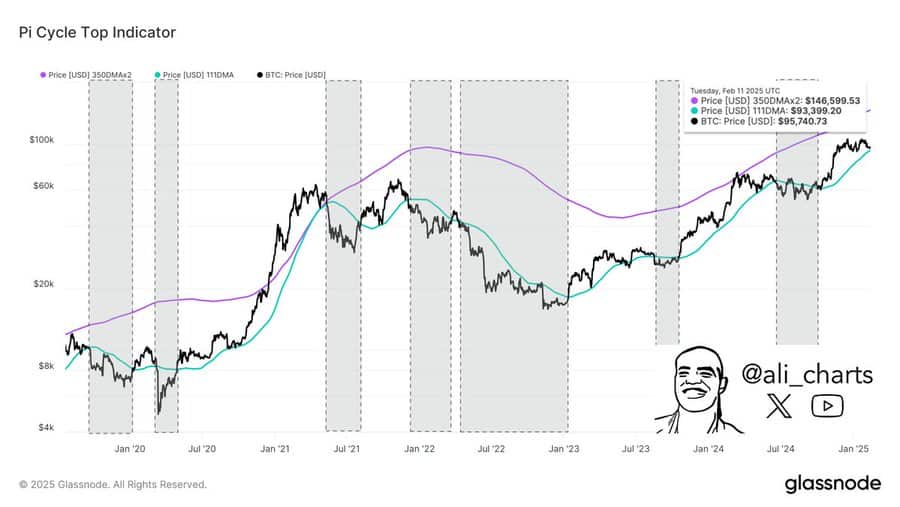

On the charts, the $93,400 level is marked by the 111-day moving average, which has historically been a key support. Will Bitcoin hold steady at this threshold, or is it just waiting for the right moment to pull a dramatic stunt?

What’s next for Bitcoin’s price?

Currently, Bitcoin is consolidating below the $101,900 resistance zone, like a teenager refusing to leave their room. Despite several attempts to break free, it just can’t seem to sustain a price above it. This has led to the formation of a symmetrical triangle – a pattern that often hints at significant price movement, or at least a good old-fashioned squabble.

If Bitcoin manages to break above $101,900, it could surge towards higher resistance levels, potentially starting another rally. But if it fails, we might see a price pullback, testing the $93,400 and $97,170 support zones. Traders, grab your popcorn!

NVT Golden Cross – Should traders be cautious?

Bitcoin’s NVT Golden Cross indicator has climbed by 28.21% over the last 24 hours, according to CryptoQuant analytics. This means Bitcoin might be entering overbought territory, which is like finding out your favorite dessert is actually a calorie bomb.

Historically, such levels have often signaled local tops, which could be followed by price corrections. But fear not! If demand remains strong, Bitcoin could continue its bullish momentum. So, while caution is necessary, it’s not time to panic just yet.

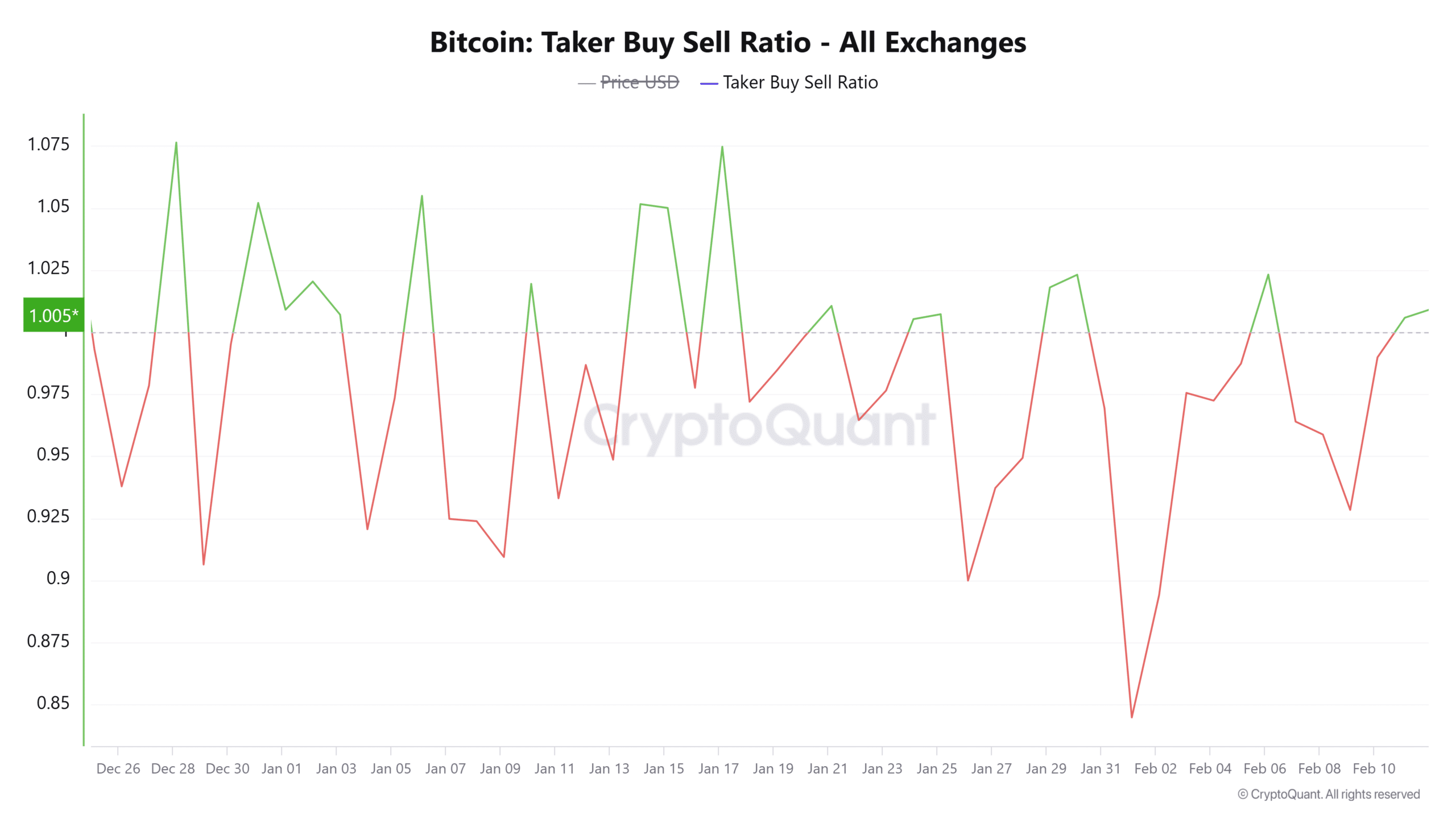

Taker buy/sell ratio – Is buying pressure building?

The Taker Buy/Sell Ratio has risen by 0.95% in the last 24 hours, hinting at a slight uptick in buying pressure. Although the ratio is below 1, it suggests that there’s more buying than selling activity. It’s like a party where everyone’s dancing, but nobody wants to leave the snacks!

If this trend continues, Bitcoin may see upward momentum on the charts. However, if the sell pressure intensifies, it could face a reversal, testing its key support zones once again. Market sentiment will play a crucial role in determining Bitcoin’s next move, so keep your crystal balls handy!

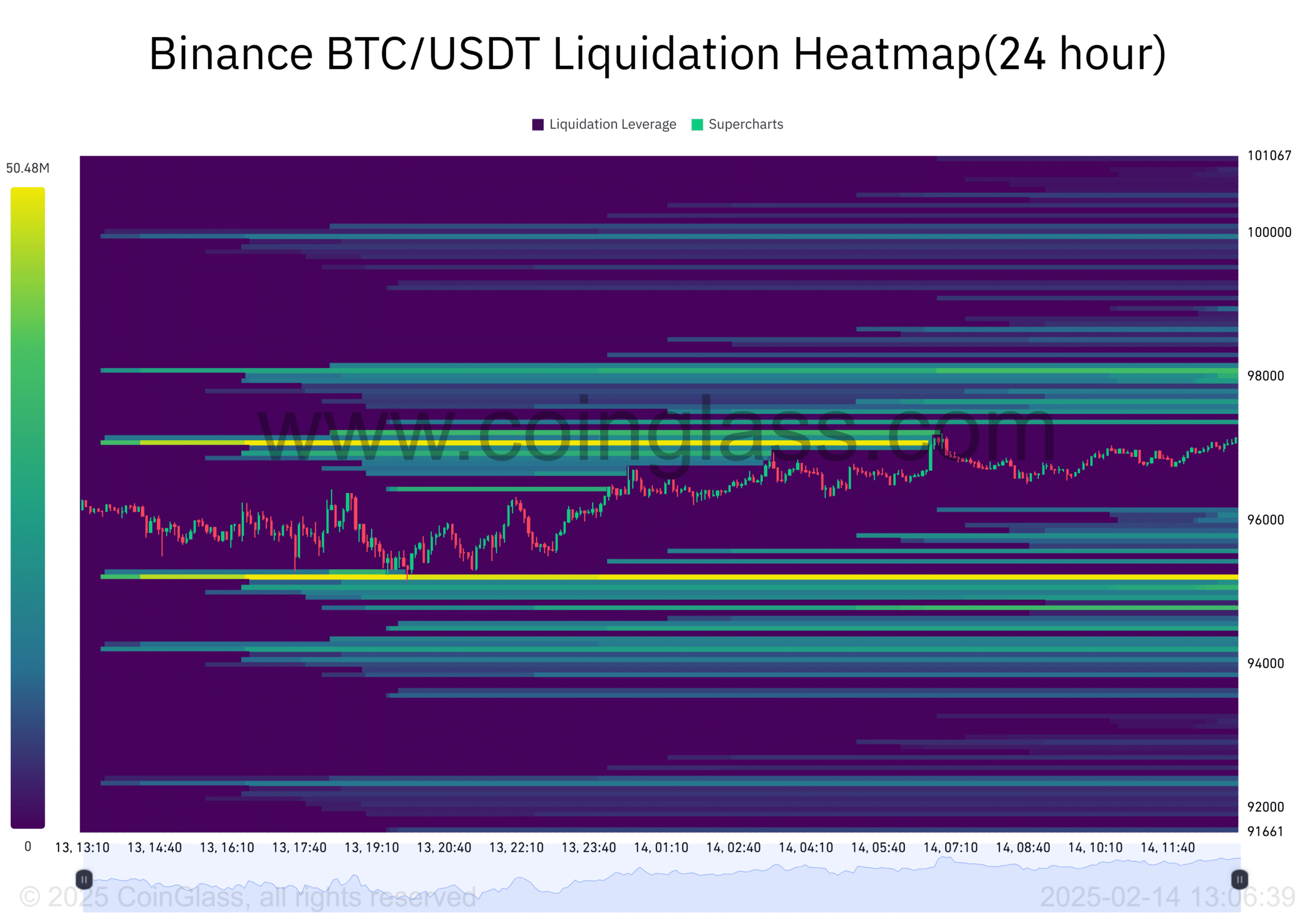

What do liquidations reveal?

Bitcoin’s liquidation heatmap has revealed a significant concentration of liquidations around the $93,400 support level and the $97,170 resistance. If Bitcoin falls further, liquidations could accelerate, sparking a potential rebound. It’s like a game of Jenga, but with more money and fewer wooden blocks.

On the other hand, a push above the $97,170 resistance may trigger long liquidations, increasing upward price pressure. So, it’s a bit of a double-edged sword, or perhaps a double-edged Bitcoin?

At press time, Bitcoin is hanging around the crucial level near $97,170, with multiple indicators hinting at possible volatility.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- PGA Tour 2K25 – Everything You Need to Know

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

2025-02-15 07:07