“`html

- Ah, BTC, still prancing in the bull market, as declared by the illustrious CEO of Ark Invest.

- U.S. spot BTC ETFs have enjoyed a delightful three-day inflow spree, but will it be enough to revive our dear BTC? 🤔

In the face of recent Bitcoin [BTC] tribulations and the ominous whispers of a bear market, the ever-optimistic Cathie Wood, CEO of Ark Invest, remains a beacon of hope. In a rather charming Bloomberg interview, she proclaimed that the market is still frolicking in a bull market. 🌟

“Bitcoin is merely halfway through its four-year cycle. We maintain that we are still in a bull market, and the U.S. deregulation is the key to enticing institutions into this new asset class.”

With a flourish, she upheld her audacious $1.5M BTC price target by the year 2030. How delightfully ambitious! 🎩

Contradictory Opinions on Bitcoin

Matt Hougan, the CIO of Bitwise, echoed Wood’s exuberance, suggesting that should the current macroeconomic fog lift, our beloved asset could soar to a staggering $200K by year’s end. Oh, the sweet scent of optimism! 🌈

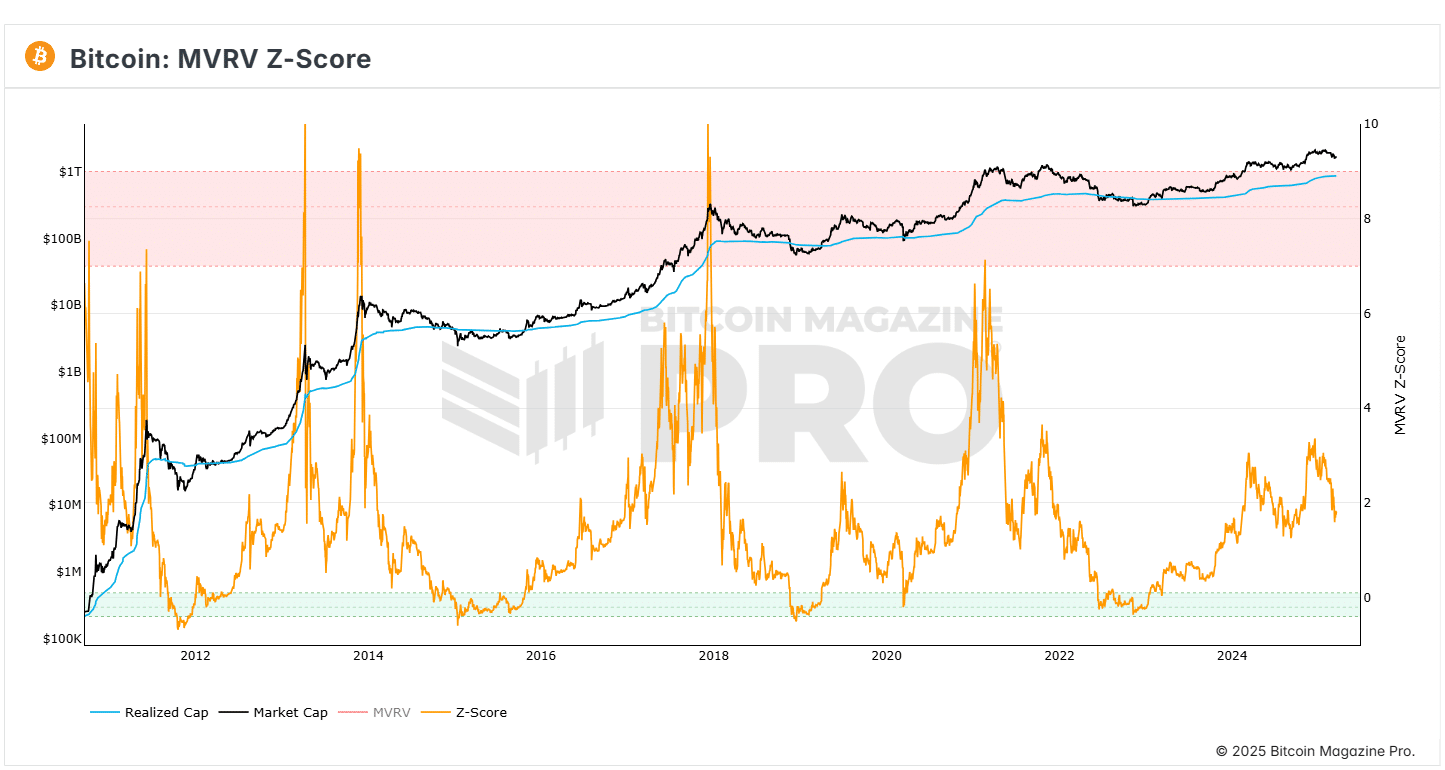

These bullish forecasts align splendidly with the MVRV-Z score, a rather fashionable valuation model and cycle top indicator. Currently at 1.5, it flirts with last year’s local bottom. Intriguingly, this indicator reached its zenith in December, nearly mirroring the heights of Q1 2024. 📈

However, when compared to the past cycle tops that soared above 6 (the upper band), BTC still has ample room for growth, should history decide to repeat itself. 🕰️

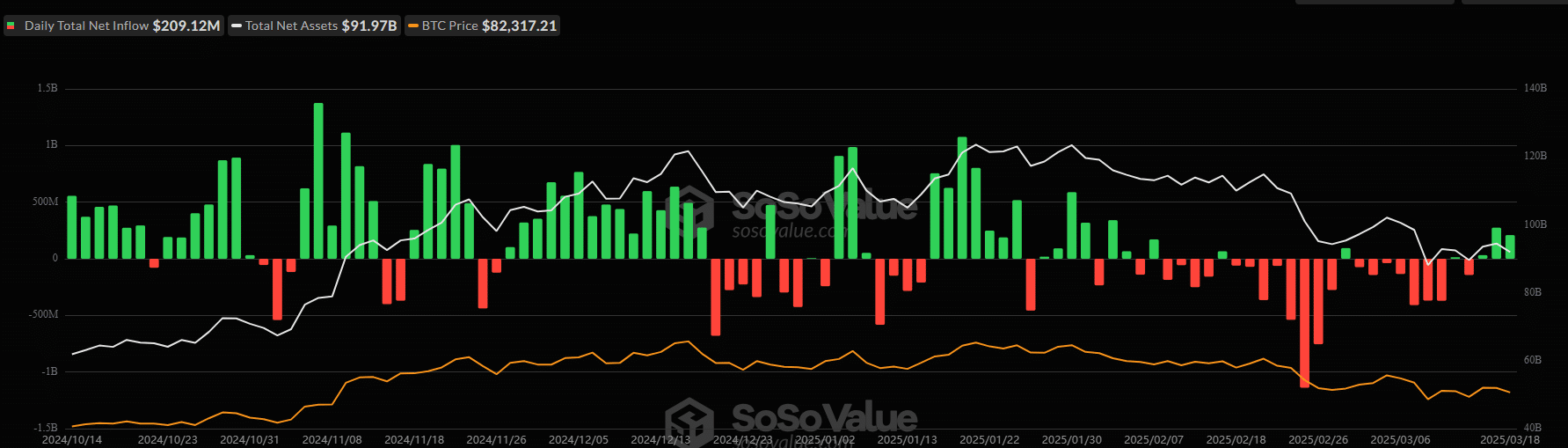

Yet, in a rather gloomy twist, Ki Young Ju, the CEO of CryptoQuant, has donned the bear costume, declaring that the bull market is but a distant memory for the next 6–12 months. He cites weak ETF flows and volume as the culprits preventing BTC from crossing the illustrious $100K threshold. 🐻

It is worth noting, however, that the ETF products have recorded three consecutive days of inflows, a delightful reversal from the disheartening outflow trend of the preceding weeks. 🎉

On the 17th of March, they basked in $274.5M inflows, followed by another $209M on the 18th, according to the ever-reliable Soso Value data. 💸

Whether this renewed demand will flourish and elevate BTC’s recovery in the short term remains a tantalizing mystery. As of this moment, BTC is valued at a respectable $83K, eagerly awaiting the Fed’s rate announcement. 🧐

“`

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2025-03-19 13:15