bitcoin-usd/”>BITCOIN: THE FEAR INDEX IS FLASHING RED – WILL YOU BUY THE FEAR? 🚨

- The Fear and Greed Index is a trader’s best friend – or worst enemy, depending on how you play it

- This moment could set the stage for the next major market shift – or a catastrophic crash

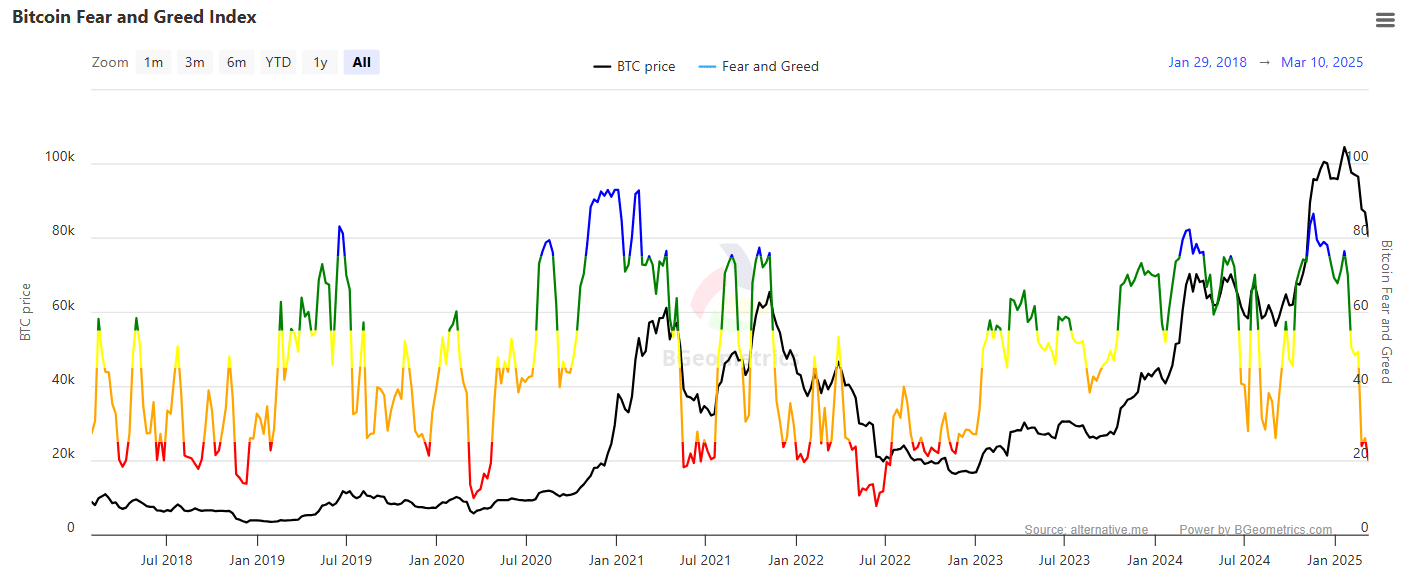

Bitcoin [BTC] has once again entered a volatile phase, with the Fear and Greed Index flashing a crucial signal for traders on the charts. It’s like the market is saying, “Ah, you want to know if I’m going to go up or down? Well, let me just check my emotions first.”

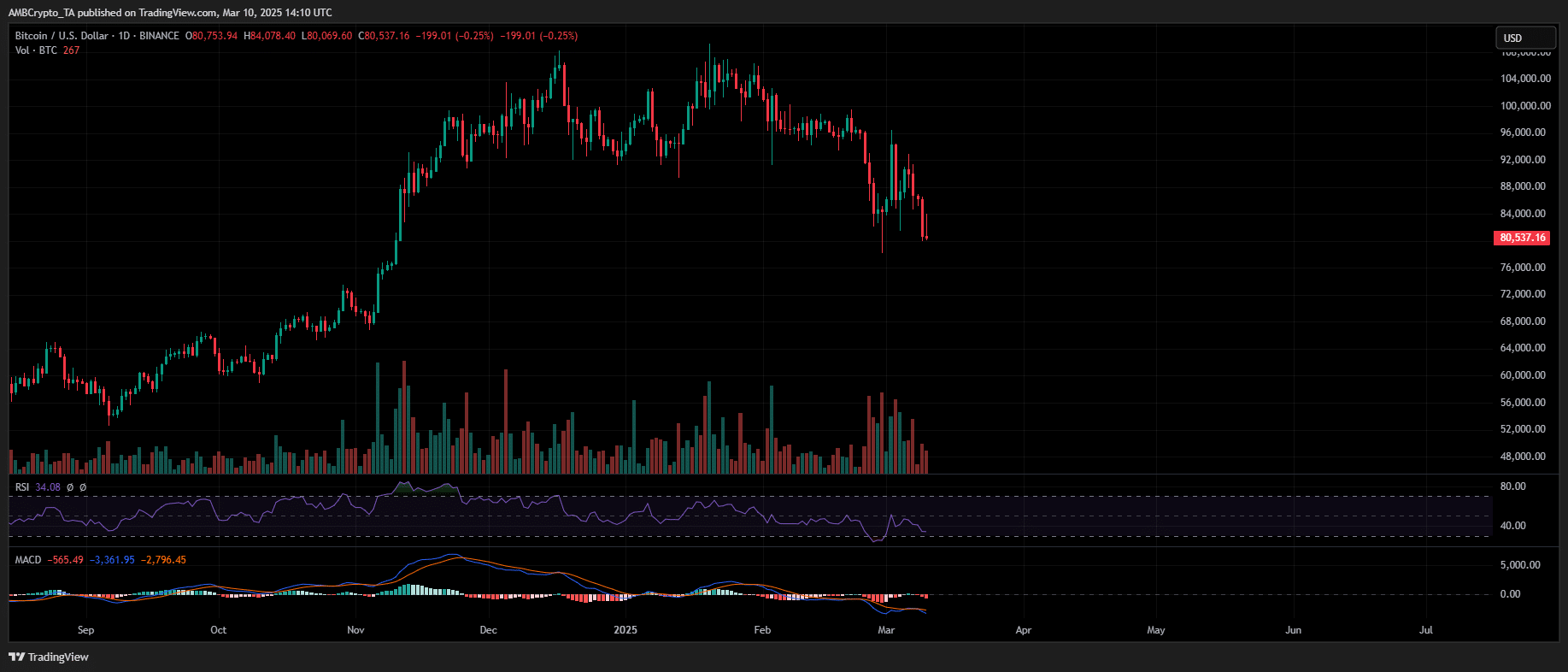

At press time, BTC was well under $80,000, struggling to regain any momentum after a sharp sell-off from its $97,000 peak. The question now is – Does greed signal a deeper dip, or is fear about to take over? It’s like the market is playing a game of musical chairs, and we’re all just waiting to see who gets left holding the bag.

Are traders following the “buy the fear” playbook?

Bitcoin’s sharp 17% drop to below $80k this week pushed the Fear and Greed Index into “extreme fear” – A reading of 20. This marked the first time in two years that the market has entered such a deep red territory. It’s like the market is saying, “Oh no, I’m so scared! Please buy me!”

In previous cycles, Bitcoin has either staged a swift recovery as traders capitalized on the discounted prices or endured prolonged fear-driven sell-offs, pushing the index even lower. But let’s be real, who needs a swift recovery when you can have a prolonged sell-off? It’s like the market is saying, “Hey, let’s just take a nice long nap in the bear market, shall we?”

However, buying BTC at $16k is a world apart from buying it at $80k. It’s like comparing apples and oranges, or in this case, comparing a good investment to a bad haircut.

This can be reflected in the outflows – When BTC was at $16k, total outflows soared past 70k. With BTC at $80k, outflows sat at just 14.2K. It’s like the market is saying, “Oh, I’m so scared, please don’t take me! I’ll be good, I promise!”

That being said, the 13% uptick in outflows from the previous day suggested that traders may be stepping in to buy the dip, potentially establishing the $80k – $82k zone as a key demand area. It’s like the market is saying, “Okay, fine, I’ll take your money. But don’t expect me to go up anytime soon.”

If this trend continues, the Fear and Greed Index could shift back towards the “fear” zone. Historically it has been a precursor to price rallies. It’s like the market is saying, “Oh no, I’m so scared again! Please buy me!”

This would hint at the potential conclusion of the heavy distribution phase. In other words, the market may be nearing a turning point where selling pressure starts to ease. It’s like the market is saying, “Okay, I’m done being scared. Let’s just chill for a bit.”

Bitcoin’s future – What the fear and greed index reveals

Currently, with Bitcoin in the “extreme fear” zone, the market is at a critical inflection point. It’s like the market is saying, “Uh-oh, I’m so scared! What do I do now?”

If selling pressure subsides and buying activity increases, the index could shift towards a more neutral or greed-based stance, potentially triggering a bullish reversal. It’s like the market is saying, “Oh, I’m so happy! Let’s go up!”

In previous cycles, it’s the fear-of-missing-out combined with high-risk greed that has sparked explosive rallies, driving Bitcoin well past key psychological levels like $100k. It’s like the market is saying, “Oh, I’m so excited! Let’s just go wild!”

However, Bitcoin’s 1D chart isn’t signaling this shift just yet. In fact, the MACD flipped bearish and the volume turned negative – A sign that selling momentum remains largely intact. It’s like the market is saying, “Uh-oh, I’m still scared. Don’t touch me!”

With the Fear and Greed Index potentially sliding even lower, the risk of further downside increases. In this environment, a retest of the $78k support level becomes a high probability. It’s like the market is saying, “Oh no, I’m so scared again! Please don’t make me go down!”

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2025-03-11 10:44