-

Analyst claims that the price impact on BTC from miners has declined.

However, the total miner supply stood at over $100 billion, hence a key price factor.

As an experienced financial analyst, I strongly believe that Bitcoin miners continue to be a significant price factor for BTC despite recent declines in their total supply and selling pressure. The staggering amount of Bitcoin held by miners, worth over $100 billion at current market prices, represents a constant sell pressure that cannot be ignored.

Bitcoin‘s price dipped once more, returning to the $60,000 mark after a prolonged three-month downtrend, fueled by escalating pessimism triggered by multiple reasons.

Experts note several factors contributing to market instability. These include macroeconomic uncertainties, the ongoing crisis among Bitcoin miners, and oversupply issues arising from various sources such as upcoming Mt. Gox reimbursements.

Nevertheless, according to Fred Krueger, an analyst, the influence of Bitcoin miners on Bitcoin’s price fluctuations should be discounted due to the relatively small proportion they hold compared to the total monthly supply.

The influence of these five miners on Bitcoin’s price is insignificant now. They collectively possess approximately 34,000 Bitcoins (BTC). If they were to sell half of their holdings, this would equate to around $1 billion USD, which represents just 0.1% of the asset’s total value. In terms of new supply, these miners produce roughly 2,000 BTC monthly. Their impact is no longer a significant factor.

No, BTC miners still matter

Marathon Digital, CleanSpark, and Riot Blockchain rank among the leading publicly-traded Bitcoin mining companies based on market capitalization. Yet, some analysts have presented opposing views to Krueger’s assessment.

James Van Straten pointed out that a significant portion of the miner sell-off came from privately owned mining operations experiencing losses.

“Approximately 75-80% of Bitcoin’s hash rate is controlled by private entities, while public miners account for only a fifth or so. Furthermore, many of these private companies are experiencing financial difficulties or actively selling their Bitcoin holdings. This situation may contribute significantly to the price instability observed following each Bitcoin halving event.”

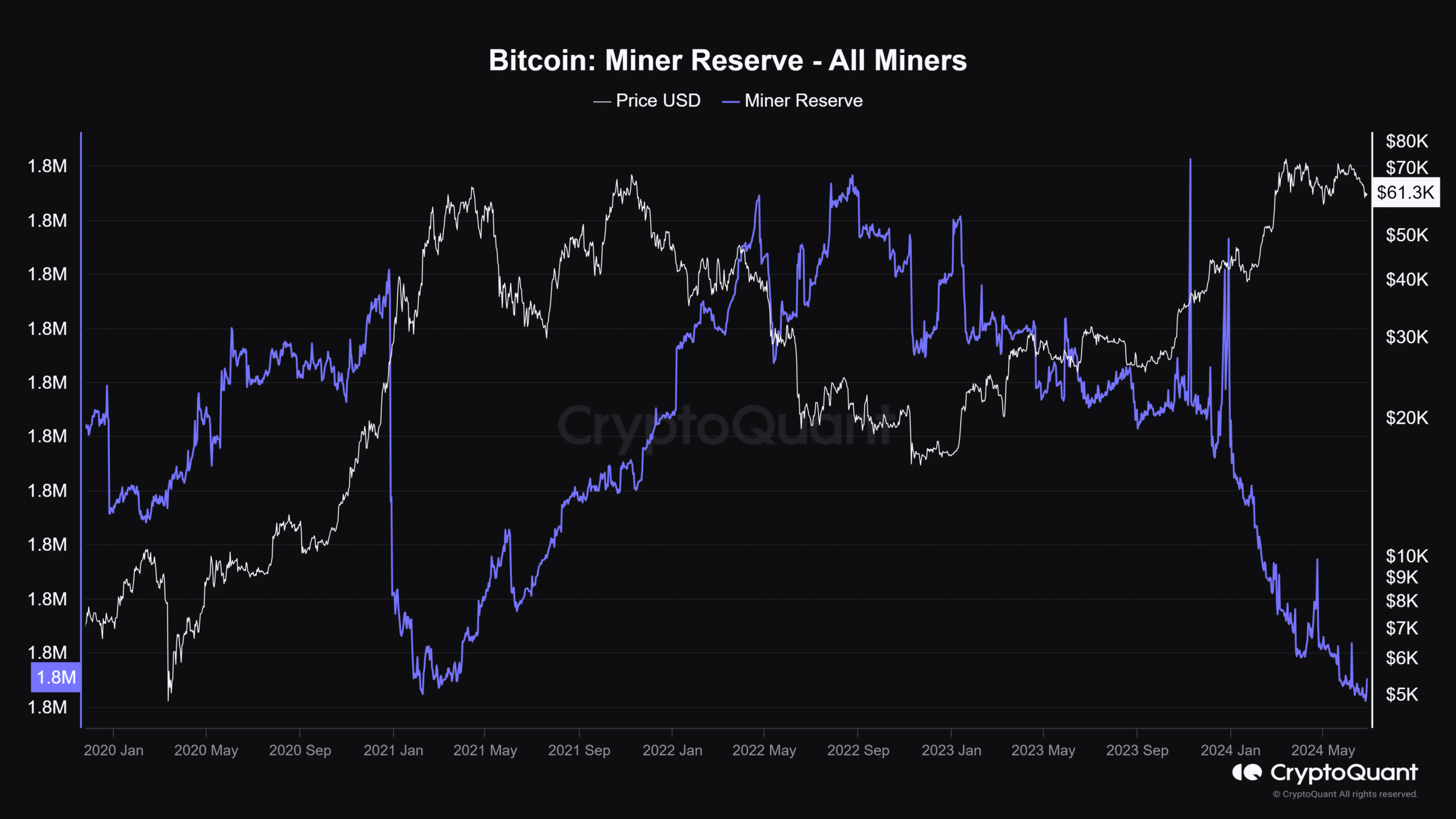

According to Per Straten’s estimation, miners collectively held a breathtaking amount of 1.8 million Bitcoins, which translated to approximately $109.8 billion based on current market values.

Despite a decrease in the overall cryptocurrency stockpiled by miners, they continued to put significant selling pressure on the market with their substantial holdings.

According to AMBCrypto’s examination, Straten’s hypothesis was validated by the data. The total Bitcoin miner reserve metric reached a level of approximately 1.8 million BTC, corresponding to the minimum observed in 2021.

According to a recent analysis by AMBCrypto, the amount of Bitcoin mined and sent to exchanges for selling has decreased, indicating fewer Bitcoins are being offloaded from mines to exchange platforms.

As a market analyst, I would interpret this situation as follows: My analysis indicates that when prices rise in the future, miners are likely to sell their holdings at increased profits.

Another analyst, Willy Woo, also maintained that the miners still matter.

As a researcher delving into market dynamics, I found it essential to peel back the layers of complexities and focus on the fundamental long-term demand and supply trends. The entry of new investors, the actions of original sellers, and the release of freshly mined supplies in bursts have proven to be significant influencers. Their impact remains substantial.

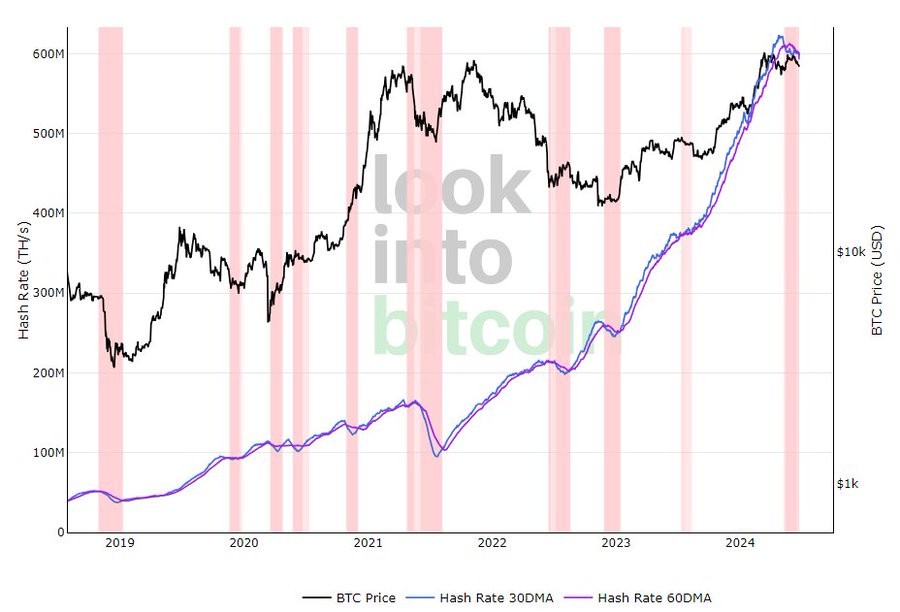

During this period, miner surrender was still prevalent, and hashrates continued to be suppressed. One observer remarked that this was the longest instance of miner surrender since the 2022 cryptocurrency winter.

As a crypto investor, I’ve noticed that the Bitcoin hashrate has been on a downward trend lately. In fact, this current drop in hashrate marks the longest period of miner capitulation we’ve seen since the depths of the 2022 bear market.

As a researcher studying the historical trends of Bitcoin (BTC), I’ve observed an intriguing pattern: Whenever hashrates – the measuring unit of computational power in Bitcoin mining – increase, so do BTC prices. This correlation suggests that miners may exert some influence over Bitcoin pricing. If this trend persists, it strengthens the argument that miner activity plays a significant role in determining the market value of Bitcoin.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-06-27 18:48