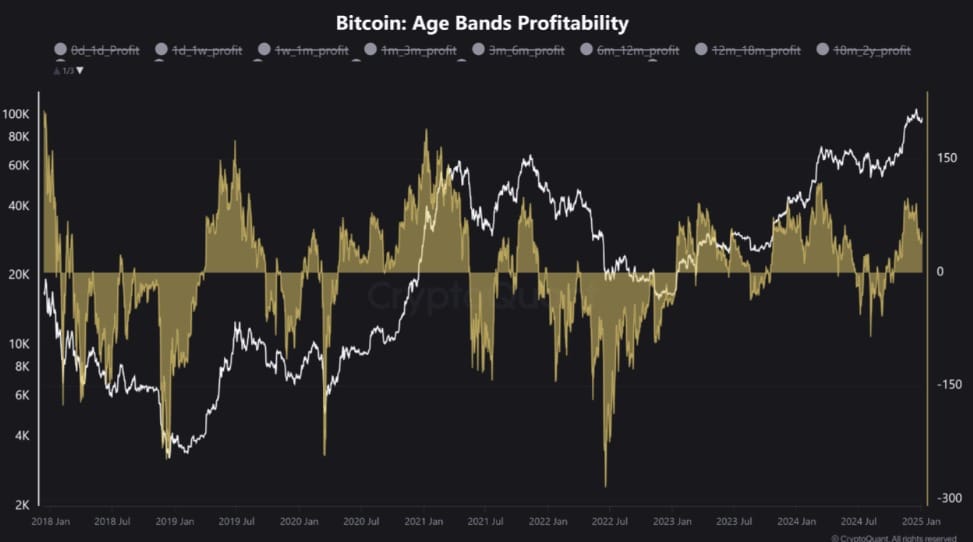

- Declining profitability for Bitcoin’s short-term holders signaled potential price corrections.

- BTC has surged by 6.08% over the past week as buyers regained the market.

Starting from January 2025, Bitcoin (BTC) has displayed remarkable strength, bouncing back to hit the $99k mark. During this timeframe, the value of BTC climbed significantly from approximately $92,768 to around $99,857.

Despite a recent increase in Bitcoin prices, analysts are expressing worries about the present market situation. Notably, CryptoQuant analysts predict a possible correction, based on the falling profits of short-term investors.

Bitcoin’s short-term holders’ profitability decline

According to analyst Crazzy Block, it was noticed that the profitability of short-term Bitcoin holders was decreasing.

As a result of Bitcoin (BTC) failing to return to its all-time high ($108K), the profitability gap for Stakers and Hodlers (STHs) has noticeably narrowed.

If the profitability for STH decreases, it suggests a decline in market demand and an increase in pessimistic feelings (bearish sentiment) over both the immediate future and mid-term.

A significant decrease in interest implies a high chance for price adjustments. Thus, temporary price adjustments seem unavoidable, but Bitcoin holds great promise for substantial growth over the long haul.

Impact on BTC charts?

Although profits for short-term Bitcoin traders have decreased due to prices dropping below $100k, the market appears poised for further growth in the near future.

Consequently, it appears that the bulls are trying to push prices higher, making a significant market crash seem rather improbable, at least for now.

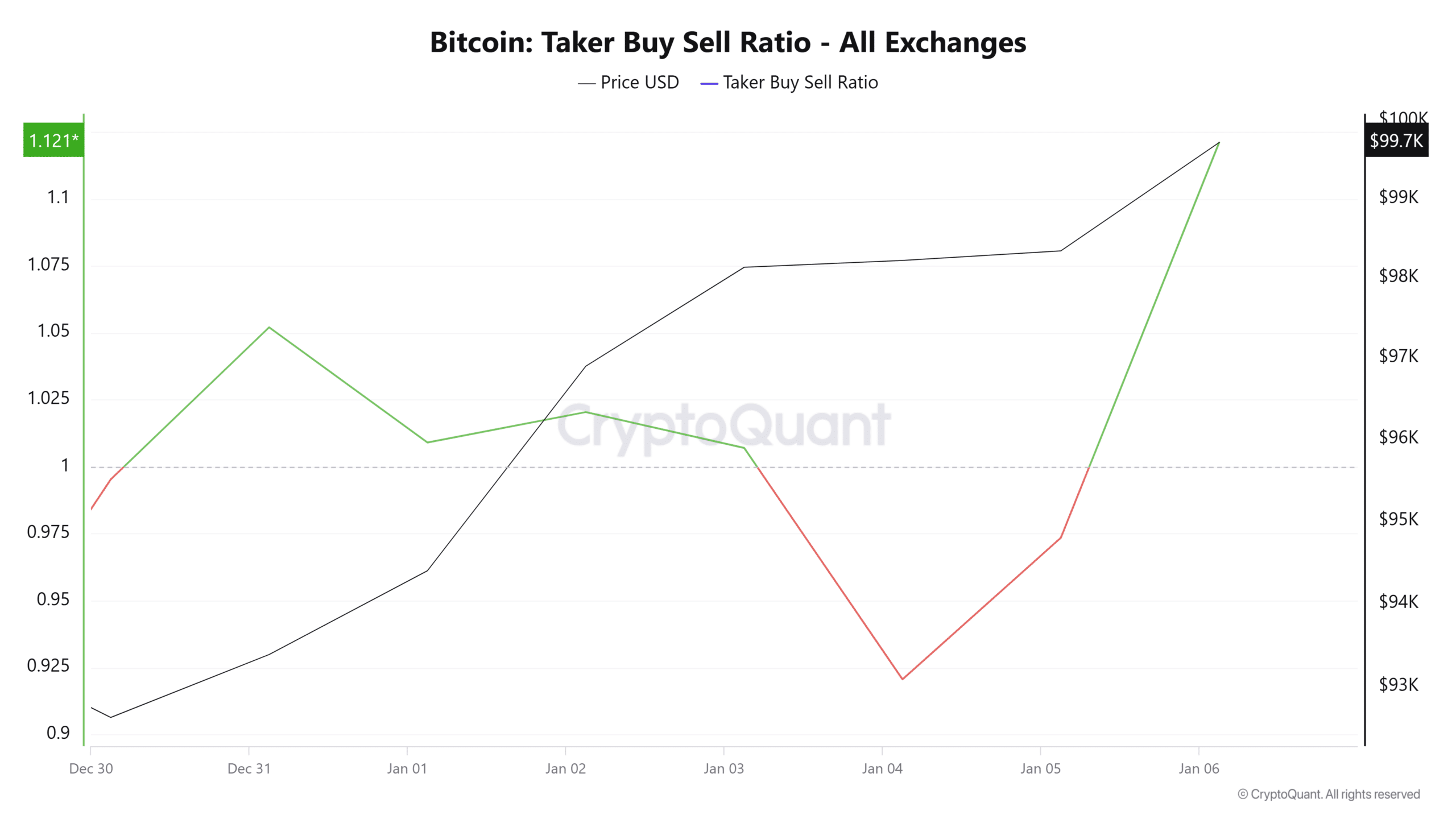

In simpler terms, the rate at which Bitcoin is bought and sold, known as the Taker buy-sell ratio, has significantly increased over the last 48 hours, reaching 1.121. A ratio greater than 1 indicates that there’s more buying activity happening compared to selling, suggesting that Bitcoin is currently experiencing a surge in buyers who are outpacing sellers.

This shows a positive outlook, as there’s a strong push towards higher prices, with traders mainly buying instead of selling.

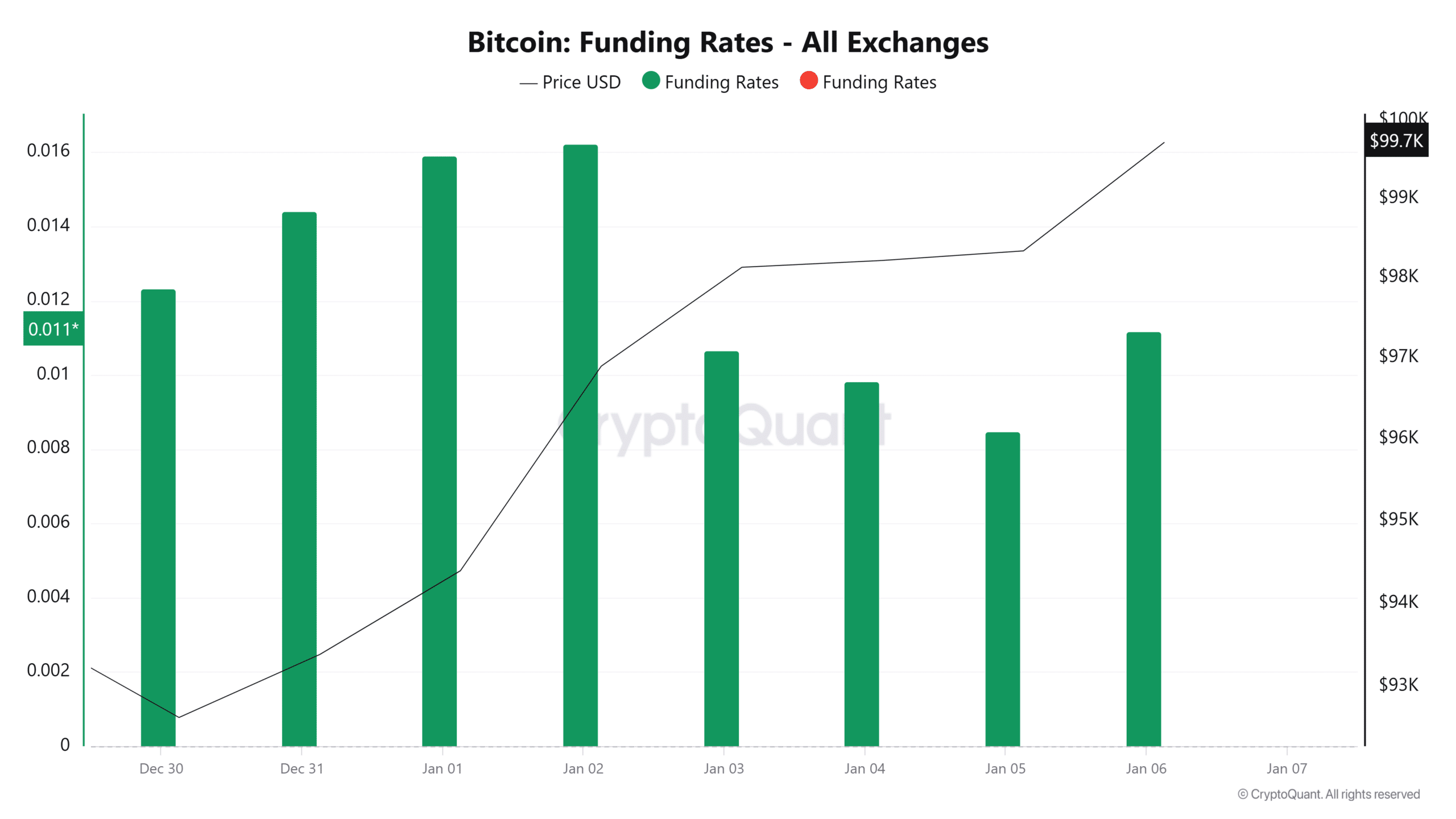

Moreover, the Funding Rate for Bitcoin increased significantly in the last 24 hours, moving up from 0.0084 to 0.0124. An increase in the Funding Rate indicates that a higher number of traders are optimistic about the market and are opening long positions.

Investors’ preference for taking long positions suggests they are optimistic about Bitcoin’s price increase, indicating their confidence in the market.

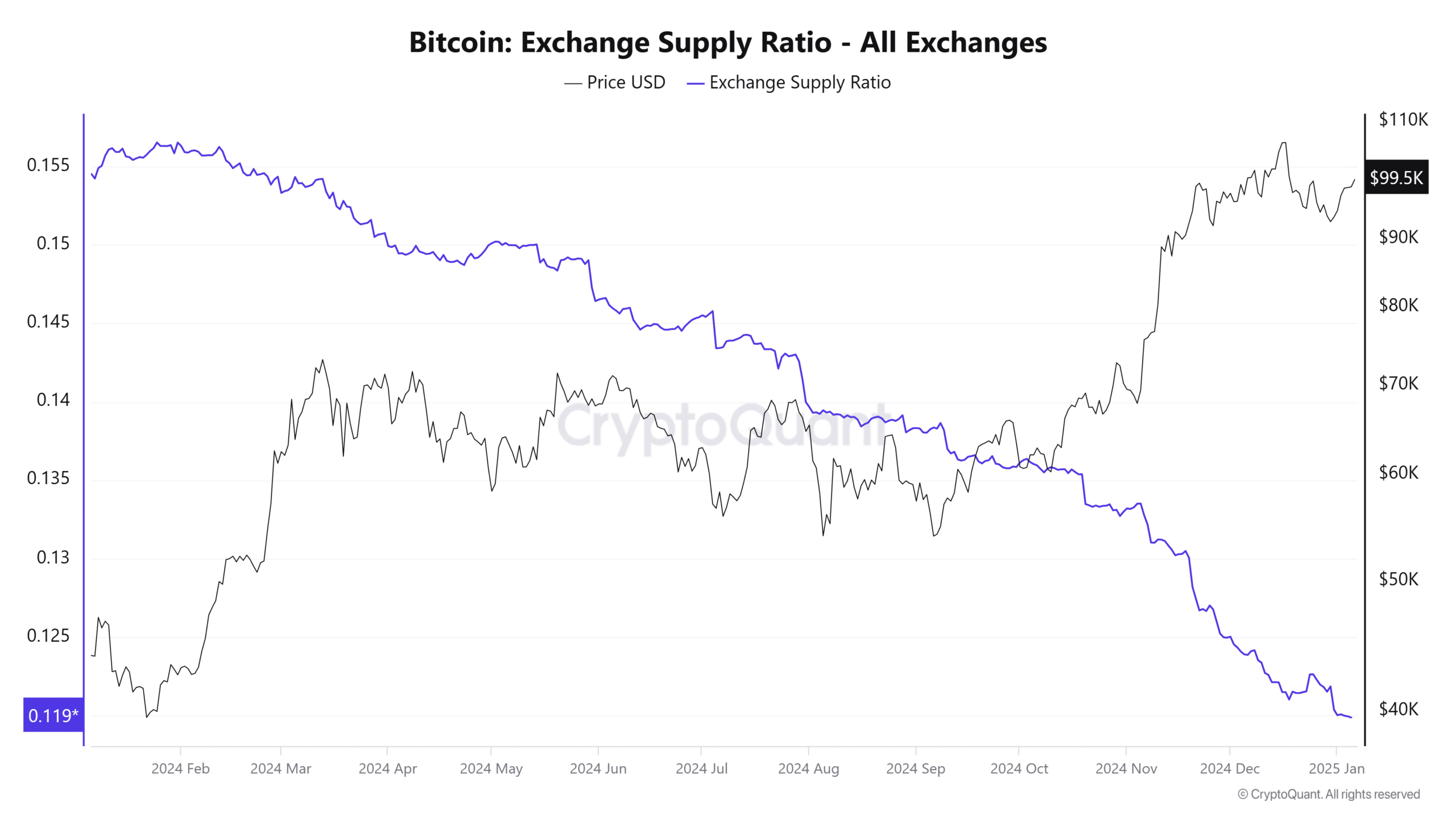

Finally, Bitcoin’s Exchange supply ratio has declined to hit a yearly low.

When the amount of Bitcoin being sent to personal wallets rather than exchanges increases, this typically suggests that investors are stockpiling BTC, anticipating further price growth.

In simpler terms, even though short-term investors might not be making as much profit currently, the market appears robust, particularly for short-term investments.

Consequently, the current decrease in profitability may not indicate an immediate market adjustment since investor sentiment remains optimistic.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

With optimism continuing to dominate the market and purchasers taking charge once more, it’s possible that Bitcoin could regain the $100k mark and soar up to approximately $102,777.

Consequently, if the anticipated correction occurs, Bitcoin will drop to $95000.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

2025-01-06 17:43