- A notable shift is occurring among BTC holders, signaling potential changes in market dynamics.

- Bid-ask imbalances suggested that selling pressure prevailed, which could potentially trigger a downturn.

As a seasoned crypto investor with a decade-long journey in this ever-evolving digital frontier, I’ve learned to navigate through market turbulence and ride the waves of bull runs with equal enthusiasm. However, the recent shifts in BTC dynamics have me slightly concerned.

Bitcoin‘s (BTC) earnings potential appears to have diminished after the recent market adjustment, as its profits no longer stand at their previous levels. According to the most current information, Bitcoin has managed a 19.86% growth.

Although BTC experienced a slight 0.37% price rise, there remains uncertainty among some investors if this growth can be sustained due to ongoing selling pressure in the market.

Long-term holders begin selling Bitcoin

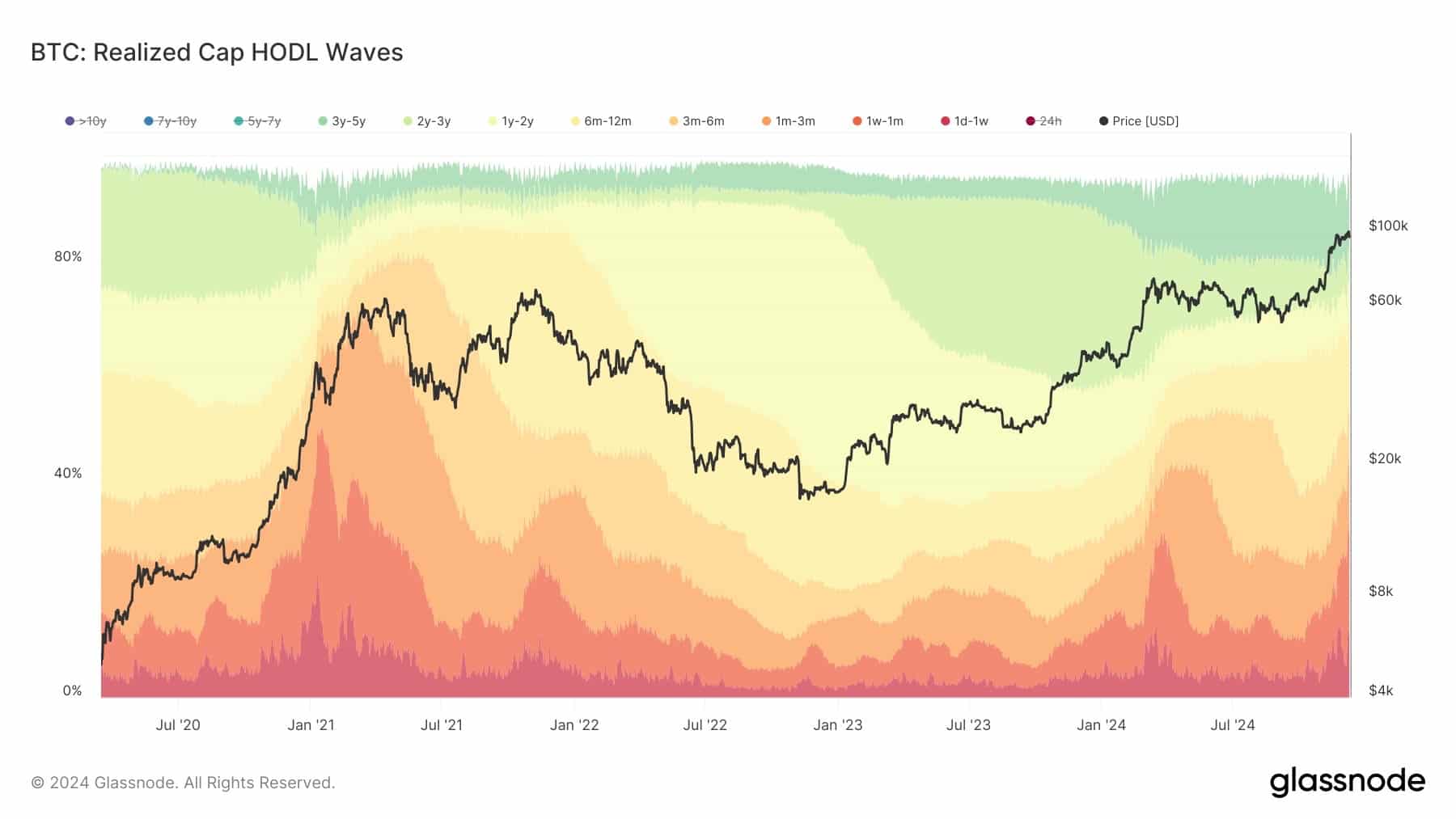

According to Glassnode’s findings, those who have been holding Bitcoin for a while are selling off their coins for profits, with the exception of the “Extremely Long-Term Investors” who have kept their Bitcoin for over seven years.

Long-term holders are defined as addresses that have held BTC for over six months (180 days).

Currently, according to recent statistics, the group you’re referring to now holds roughly 10 percentage points less Bitcoin than before. This means their ownership has fallen from more than 60% to about 50%.

As the pattern of Bitcoin ownership evolves, it significantly influences the market’s development. Initially, long-term and extremely long-term investors tend to hold a substantial portion of the total Bitcoin supply.

However, as selling pressure increases, this balance shifts.

This shift is currently empowering short-term holders with greater influence in the market.

Yet, as long as long-term investors don’t make up 70-80% of the market (which hasn’t happened yet), we can consider the market to be in its initial to developing stages.

At the zenith of the recent bull market, I observed that about 80% of the Bitcoin supply was held by long-term investors, while only around 20% was in the hands of short-term ones.

Contrarily, data from Coinglass indicates a relatively even market, where each side possesses approximately half the share, roughly around 50%.

Long-term holders losing interest in BTC

Long-term holders of Bitcoin are losing interest at a faster rate than anticipated.

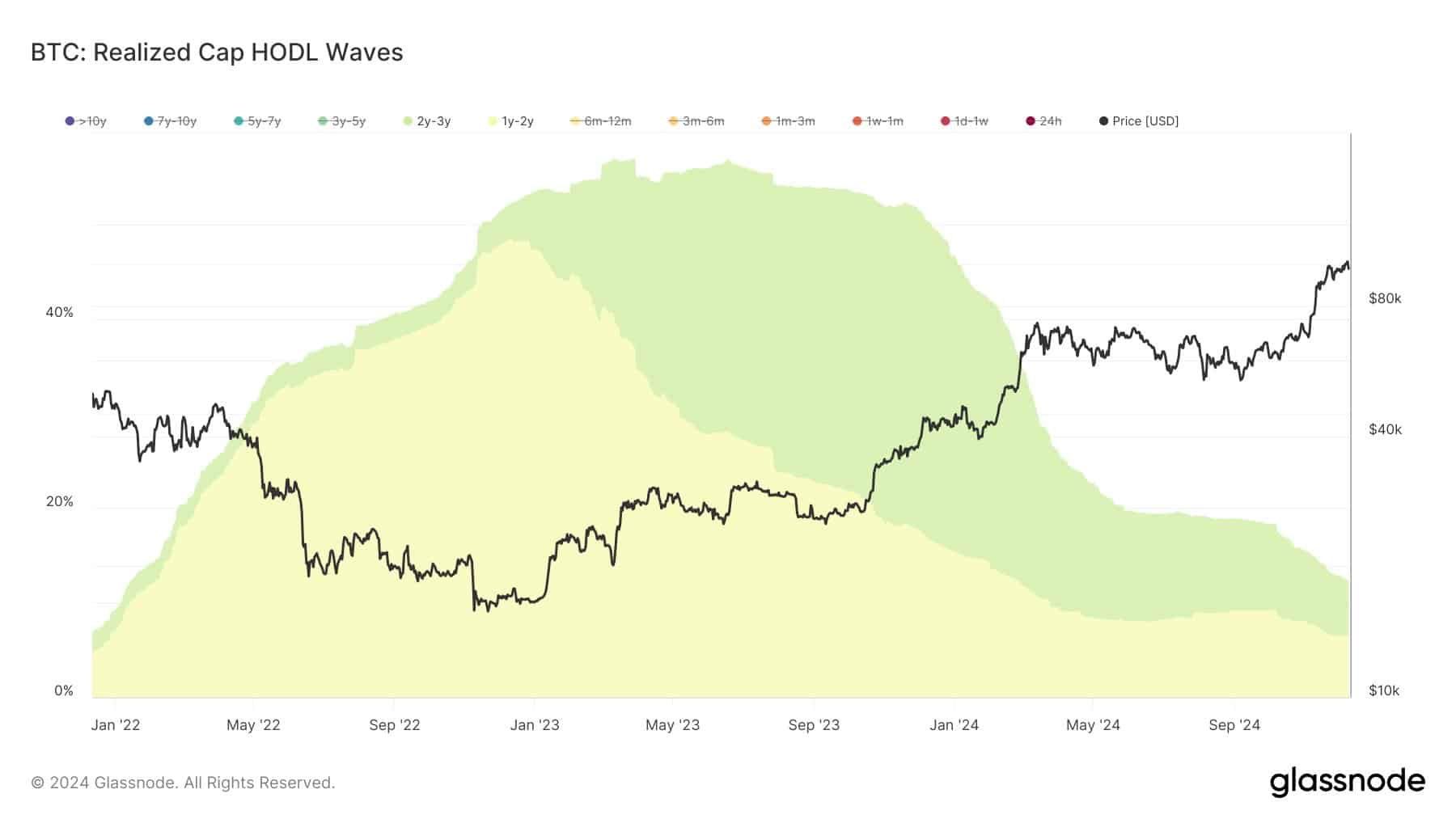

This trend has been observed across distinct cohorts of long-term holders: those who have held BTC for 1–2 years, 2–3 years, and 3–5 years, particularly after accumulating during the bear market between June and November.

As a researcher, I’ve noticed a substantial decrease in the size of the portfolios I’m studying, based on the latest patterns evident in the market charts.

In my analysis, I’ve noticed that the group of investors who have been in the market for three to five years experienced a peak of 15.3% at some point. Now, this percentage has dropped to 13.9%. If selling pressure continues to build up, Bitcoin (BTC) might experience additional declines.

In contrast to past market phases, the debut of Bitcoin spot ETFs has introduced a fresh element of complexity to the market.

Over the recent months, institutional investors have been gradually buying Bitcoin. Now, however, they’re shifting their strategy and selling off some of their holdings. As a result, the percentage of Bitcoin they own has decreased from 25% down to 16%.

Nevertheless, the market could potentially experience a surge due to the fact that substantial selling by long-term investors has not occurred yet. This implies that they might be holding on, anticipating further price increases before cashing out.

Low demand for BTC puts pressure on price

According to Hyblock’s latest findings, approximately 1-2% of the trading volume exhibits a significant difference between bids and asks, which is represented graphically by vertical dots on the chart. In simpler terms, this means that about 1-2% of the orders are not equally balanced between buyers (bids) and sellers (asks).

The skewed situation indicates that Bitcoin’s market is presently in a selling period, marked by reduced buyer interest and an abundance of sellers, resulting in a greater supply compared to demand. This imbalance exerts a force pushing Bitcoin’s price downwards.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Meanwhile, information from CryptoQuant shows a rise in Bitcoin supply on exchanges, with roughly 22,289 Bitcoins being transferred into them.

This situation has led to an incremental increase in the amount of Bitcoin traffic on exchanges, adding to the already expanding volume of Bitcoin available for trade.

Read More

2024-12-12 07:04