-

BTC’s key metric has presented a buying opportunity.

However, bearish sentiments remain significant in the market.

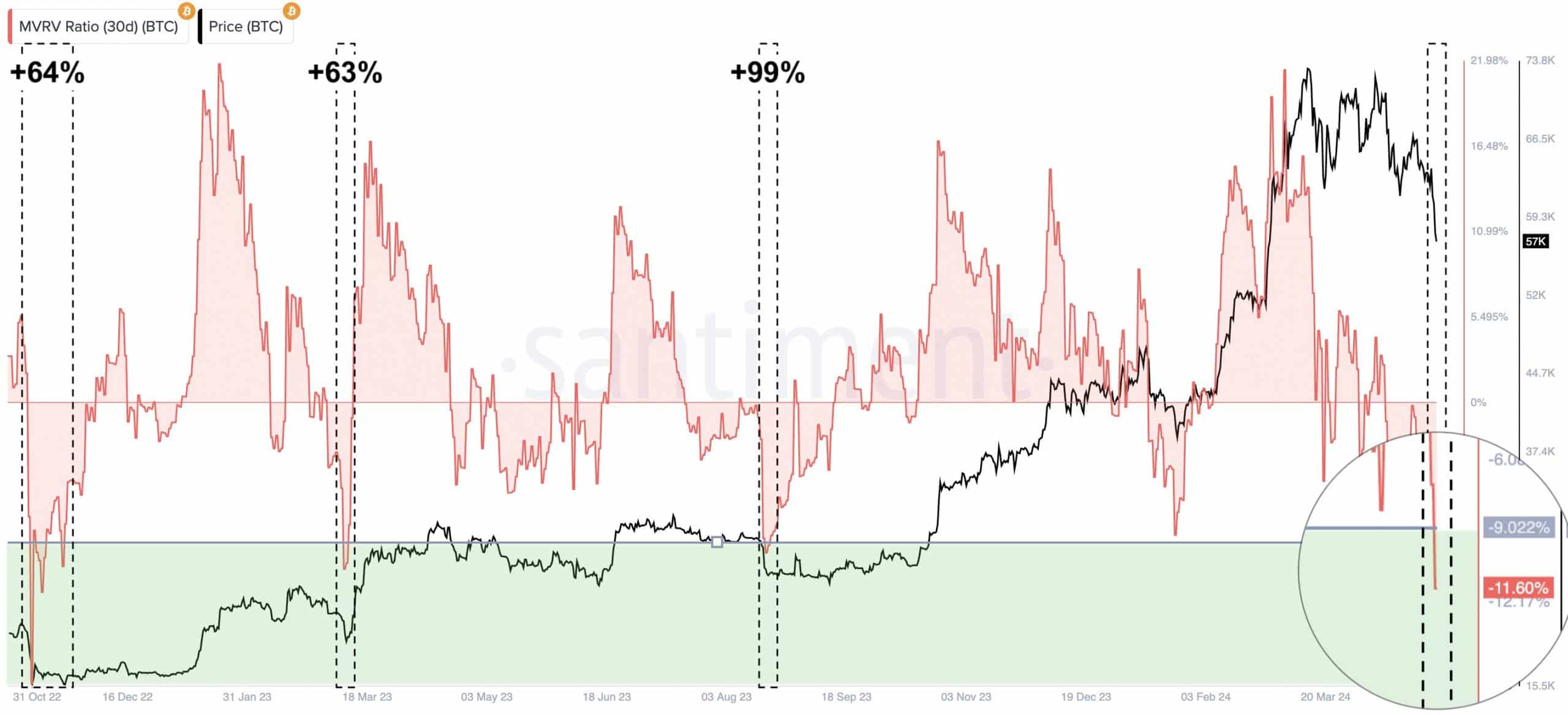

As a researcher with experience in the crypto market, I find the current state of Bitcoin (BTC) intriguing. The Market Value to Realized Value (MVRV) ratio, a crucial metric for assessing whether an asset is undervalued or overvalued, has presented a buying opportunity. According to analyst Ali Martinez, BTC’s MVRV ratio, calculated over the 30-day moving average, now sits under the critical -9% mark. Historically, this has been a strong indicator of substantial price surges for Bitcoin.

In a recent post on social media platform X, crypto analyst Ali Martinez pointed out that the Market Value to Realized Value (MVRV) ratio of Bitcoin (BTC) has triggered a buy signal.

The analyst calculated the token’s MVRV ratio based on the 30-day moving average and found it to be -11.6%. In simpler terms, this means that the token was traded at a price lower than its realized gain over the past 30 days.

As a financial analyst, I would describe this metric as follows: I calculate this ratio by comparing the present market value of a specific asset to the average purchase price of each coin or token for that very same asset in my portfolio.

As an analyst, I would interpret a value greater than one as an indication that the current market price of an asset is substantially higher than the average purchase price for most investors. Consequently, the asset can be characterized as overvalued.

An MVRV value less than zero for an asset indicates that its current market value is lower than the average cost at which all its circulating tokens were bought. This implies that the asset might be underpriced.

Martinez examined the trend of Bitcoin’s MVRV ratio over a 30-day period in history and discovered that each time this indicator dipped below -9%, the cryptocurrency’s price experienced significant gains, specifically increasing by approximately 64%, 63%, and 99% respectively.

As a crypto investor, I’m keeping a close eye on the market trends. Based on recent analysis by Martinez, if we look at the Market Value to Realized Value (MVRV) ratio of the leading coin, it has now dropped below the critical -9% threshold. This could potentially indicate that a double-digit percentage rally might be on the horizon for this coin.

Is a rally feasible?

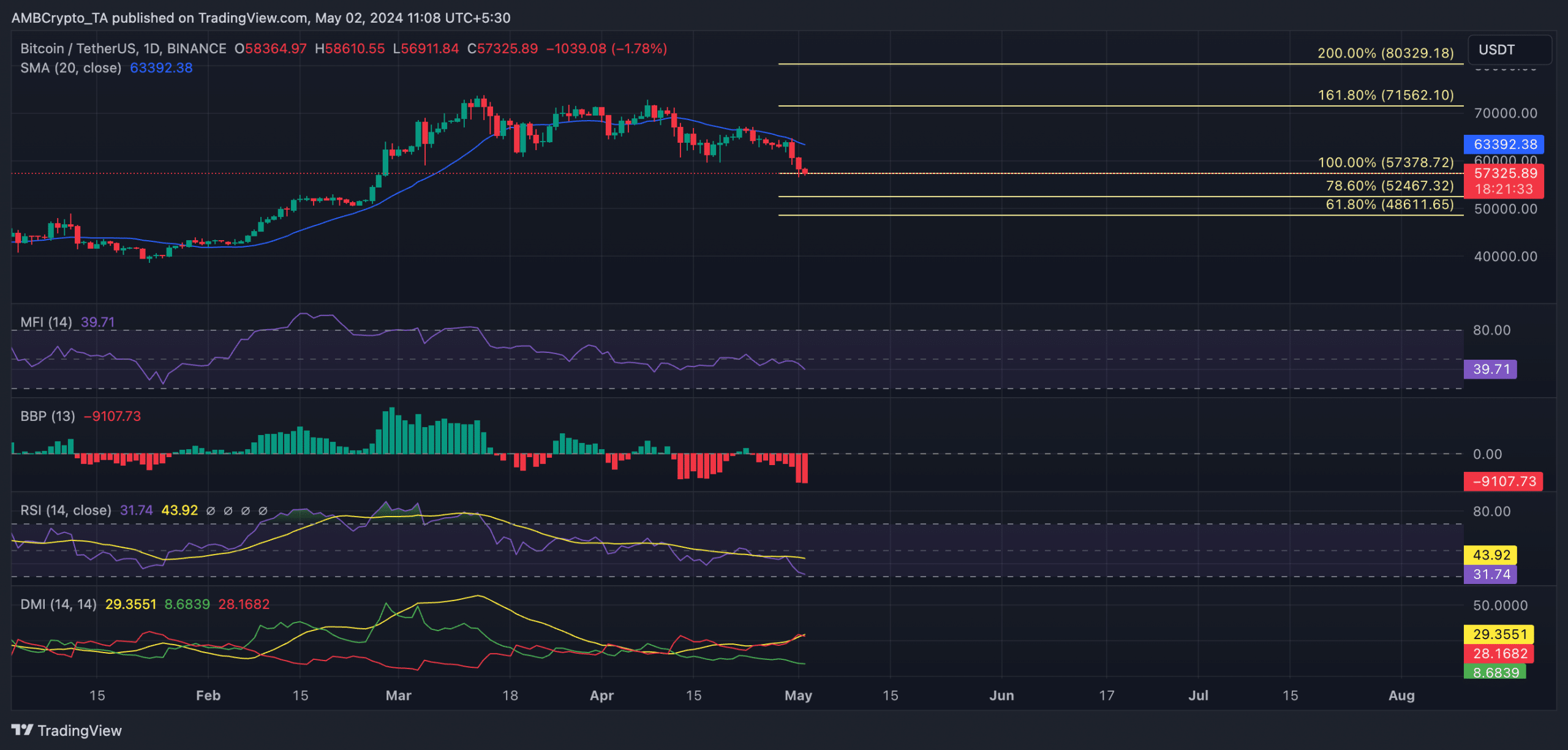

Analyzing the day-to-day fluctuations in the coin’s price chart, it became apparent that on the 30th of April, the asset fell beneath its previous support level, indicating that bearish forces had taken over.

“Several important technical indicators pointed to a notable decrease in bullishness, such as BTC‘s Elder-Ray Index, which has yielded only negative readings since the 24th of April.”

The indicator reflects the balance of buying and selling forces for an asset. A negative value implies that sellers hold more influence over the market.

As a researcher observing the coin market, I noticed an intriguing pattern: the coin’s green directional index, indicating positive activity, was situated below its red index representing negative activity at the time of analysis. This finding suggested that sellers were more active than buyers in the coin marketplace.

In terms of Bitcoin’s demand, both its Relative Strength Index (RSI) and Money Flow Index (MFI) indicators have been decreasing as of now. The RSI stood at 31.74, and the MFI was at 39.71. These figures suggest that the digital coin is moving towards the oversold region in the market.

As a researcher observing the cryptocurrency market, I’ve noticed an uptick in buying activity. However, this momentum might not be sustainable, and bears could potentially step in to bring down the price of the coin. If selling pressure intensifies, we may see the price drop to around $52,000 first, followed by a further decline to approximately $47,000.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Solo Leveling Arise Tawata Kanae Guide

2024-05-02 12:07