- The absence of significant catalysts has left the crypto market sensitive to US macro data prints.

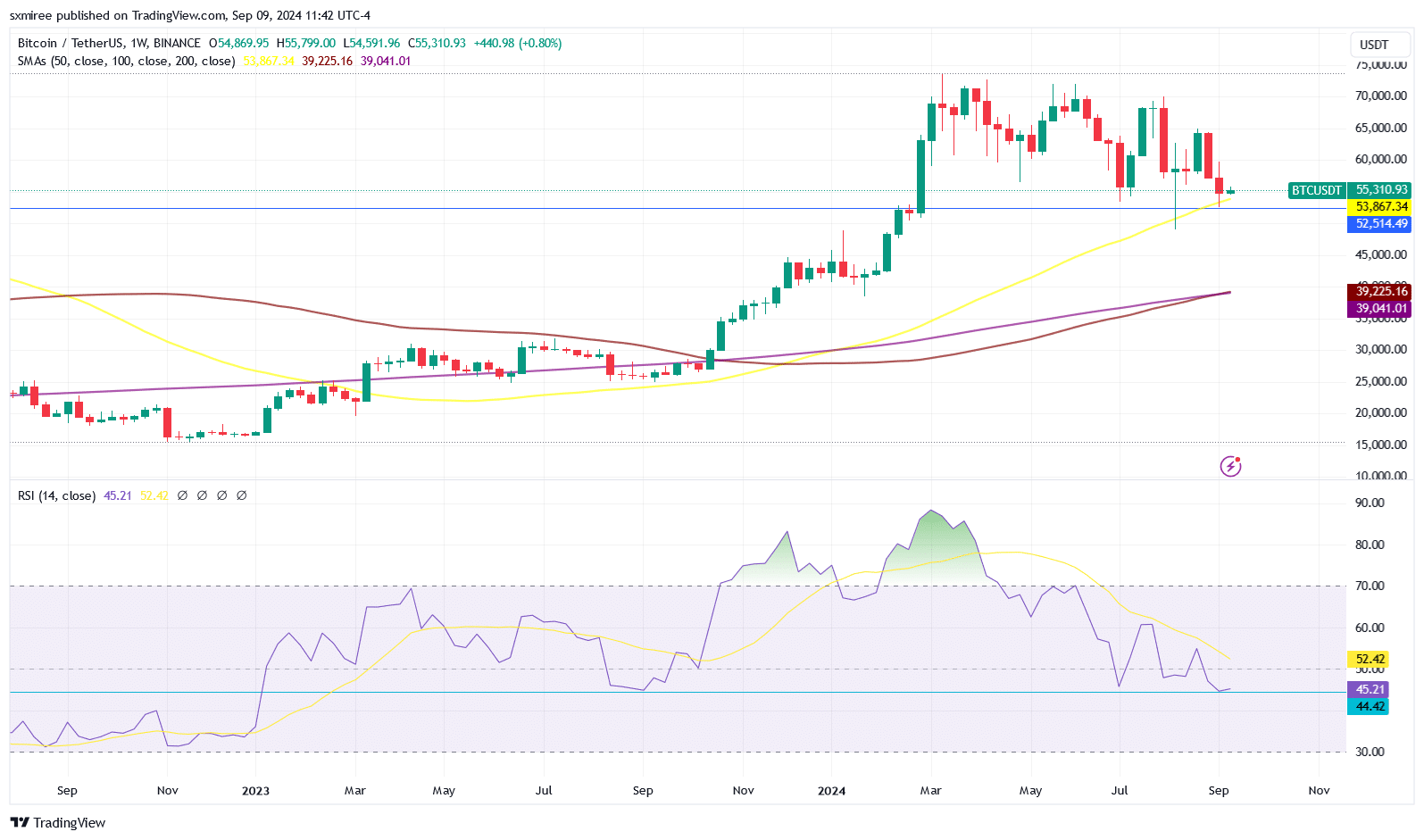

- Bitcoin’s weekly Relative Strength Index reading closed at its lowest level since January 2023.

As a seasoned market analyst with over two decades of experience under my belt, I’ve seen bull markets turn bearish and bears become bulls more times than I can count. The recent trend in Bitcoin [BTC] is no exception, and it’s left me with a sense of deja vu.

On the 9th of September, Bitcoin (BTC) momentarily surged past $55,500, but this was shortly followed by minor weekly losses leading up to the weekend. This price movement culminated in a weekly loss of approximately 4.26%.

While not as significant as the 11% drop experienced the previous week, the modest decrease signifies that the cryptocurrency has now experienced weekly losses in a row since June 10th. This period saw the asset’s value decline for four consecutive weeks.

Last week’s drop was attributed to the release of U.S. non-farm payroll data and a decline in Bitcoin ETF investments. The recent U.S. jobs report showed that only 142,000 new non-farm jobs were created in August, which is lower than the anticipated 160,000.

Meanwhile, data from SoSo Value showed Bitcoin spot ETFs are on an eight-day streak of outflows.

Final week of inflation data before FOMC meeting

This week, investors are eager for additional U.S. economic figures as they may shape the Federal Reserve’s interest rate choice on September 18th, potentially influencing the broader market trend.

As a data analyst, I’m eagerly anticipating the upcoming economic updates. Specifically, on Wednesday, 11th September, the Bureau of Labor Statistics will publish the August’s Consumer Price Index report for the United States. The following day, on Thursday, additional insights will be provided with the release of the Producer Price Index data.

The announcements were made following the U.S. Presidential debate on Tuesday, between Donald Trump and Kamala Harris. Prior to the debate, financial analysts at Bernstein highlighted that neither the election results nor the potential regulatory climate have been factored into the current market.

According to analysts headed by Gautam Chhugani, it’s predicted that Bitcoin might drop within the $30,000 to $40,000 price range should the Democratic nominee, Vice President Harris, win the presidential election.

An electoral win for Donald Trump in November might fuel Bitcoin’s price upward trend, potentially pushing it over $80,000 by the end of the year.

Further decline below $50,000 on the cards

According to Peter Brandt’s recent study using Bayesian probabilities, the technical indicators seem to be more and more supporting his earlier prediction of a price range around $30,000.

He said,

At the moment, my prediction based on Bayesian Probability is that there’s a 65% chance the price will stay below $40,000. If we reach $80,000, it has a potential of 20%, and I estimate that during this halving cycle, the price could advance to $130,000 by September 2025, with a probability of 15%.

Based on his original predictions, Brandt further developed his analysis. Back in April, he noted that Bitcoin’s price peaked at an all-time high of $73,835, signaling a potential market top. Later in May, he anticipated a prolonged bullish trend.

10x Research founder Markus Thielen, much like Brandt, shares a pessimistic viewpoint. He believes that the peak for Bitcoin occurred in April, pointing out a decrease in the Bitcoin network’s activity following the first quarter.

Additionally, Thielen pointed out consistent Bitcoin ETF withdrawals and a struggling U.S. economy as additional pessimistic elements that might cause Bitcoin to decline even more.

Halving thesis still in play

This year, Bitcoin reached an unprecedented peak just prior to its halving, but trading activity has slowed down afterwards. However, certain financial experts believe that Bitcoin could still experience additional growth, given the pattern of price fluctuations during past halving events.

Bitcoin consistently tracked gains across October, November, and December 2016 and 2020.

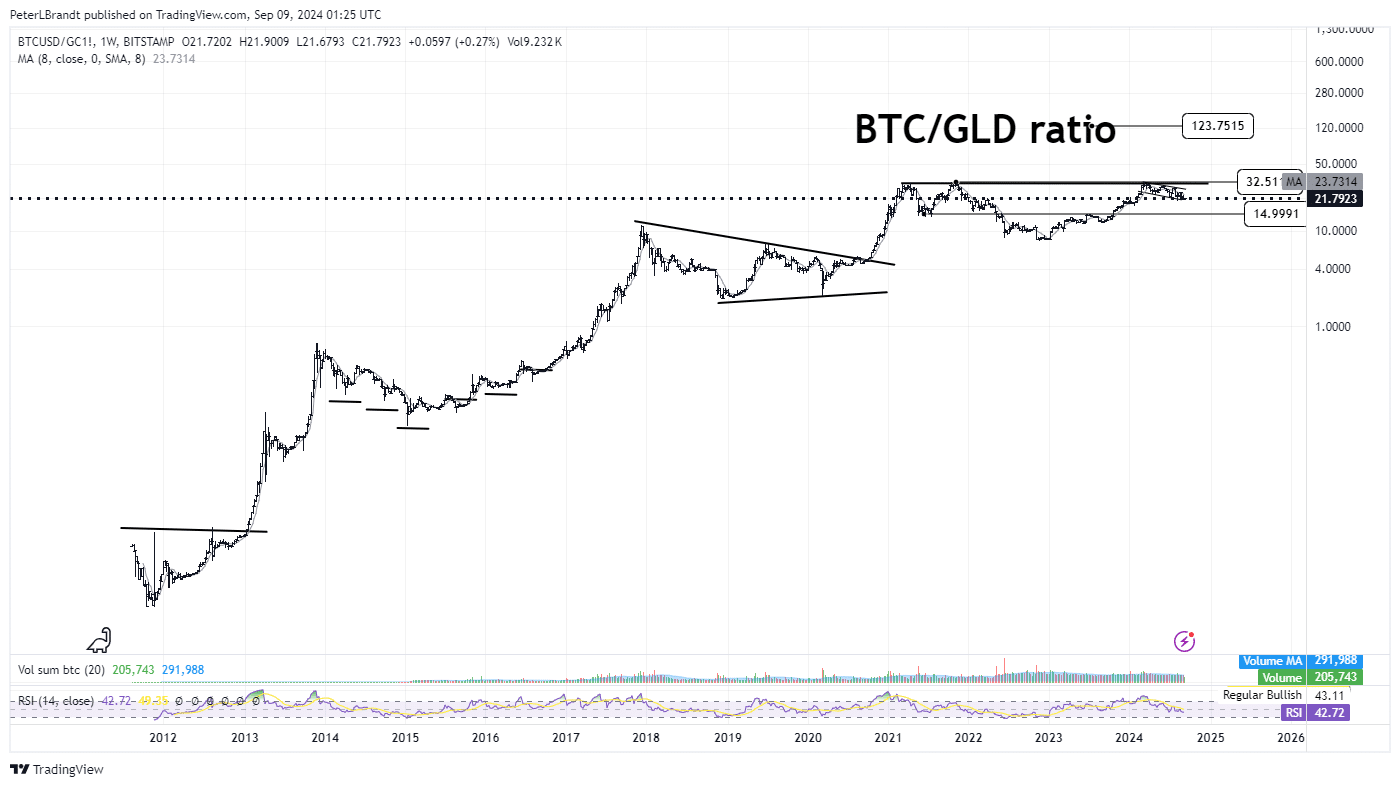

It’s significant to mention that, compared to gold, Bitcoin’s peak prices this year have been decreasing despite the launch of spot Bitcoin ETFs and the March halving event. According to Brandt, this persistent price drop could potentially push the BTC/Gold ratio up to as much as 15 to 1.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

BTC/USDT potential rebound

At this moment, Bitcoin is hovering around $55,400 following a week that saw its lowest closing price since late February. Correspondingly, the Relative Strength Index (RSI) for Bitcoin on a weekly basis also reached its lowest point since the beginning of 2023.

It seems that Bitcoin’s order books and CME futures charts suggest an upcoming bullish trend might be on the rise. The Bitcoin futures market started off this week at a higher level, reentering a descending wedge formation following a brief dip below it.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-09-10 09:12