-

Losing the historical support level puts BTC in pole position for another fall.

MVRV Long/Short difference revealed that the coin’s price might recover later in the cycle

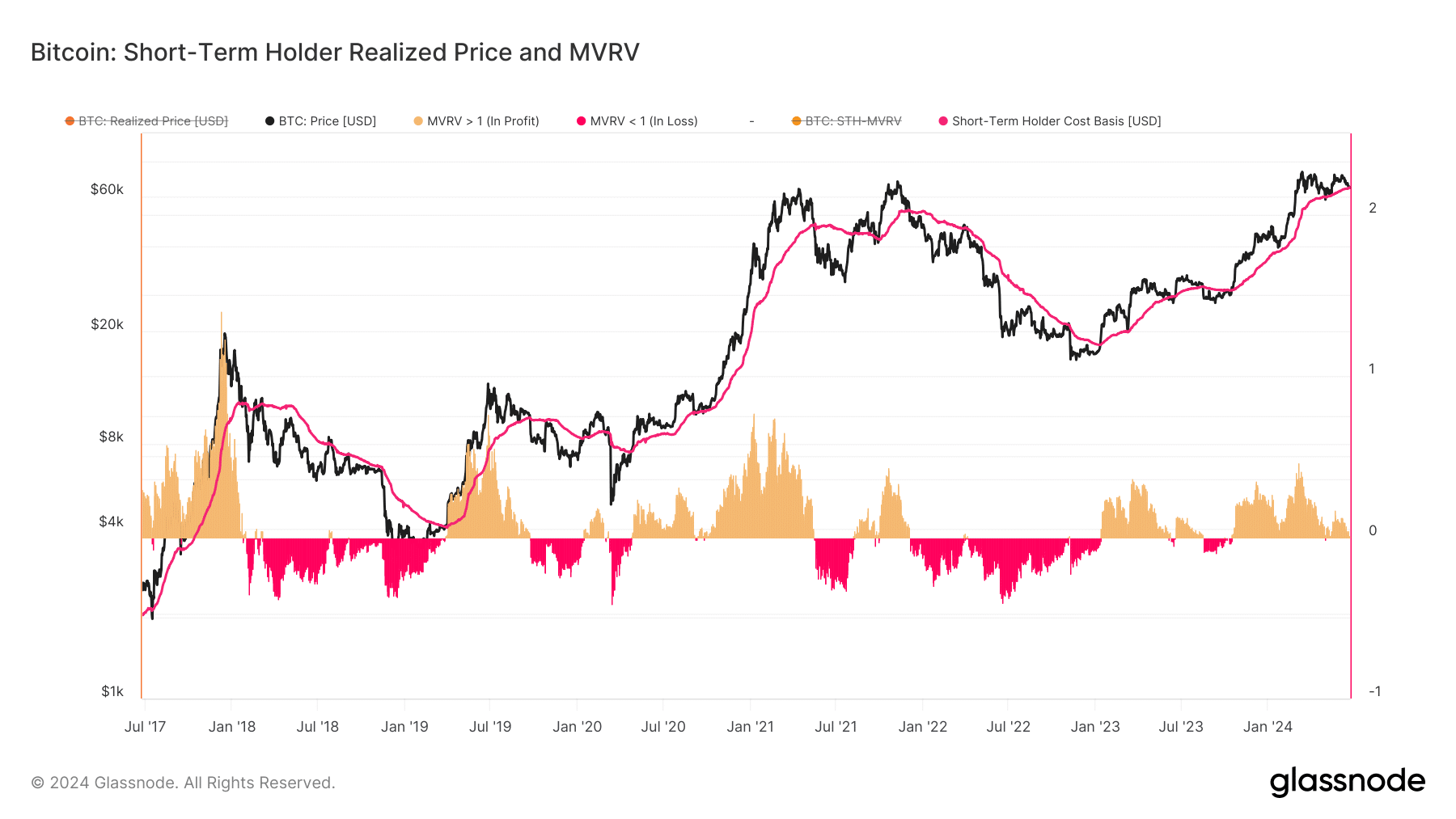

As an experienced analyst, I have closely observed Bitcoin’s market behavior and trends over the years. The recent fall below the Short-Term Holder (STH) Realized Price of $64,372 is a worrying sign for BTC bulls. Historically, this metric has acted as support for the crypto’s price during uptrends. However, when Bitcoin drops below it, there’s an increased likelihood of a correction or even a more significant price drop.

The current price of Bitcoin [BTC] is now lower than the average price at which its short-term investors bought the cryptocurrency. This could be a sign that the price may decline further, potentially reaching around $61,000 or even below $60,000 in the near future.

As a data analyst, I’d explain that based on Glassnode’s latest update, the Realized Price of Bitcoin held by Strong Hands (STH) investors was calculated to be around $64,372. Meanwhile, the current market value of each Bitcoin coin was priced at $64,066. The term “Realized Price” is also referred to as the on-chain cost basis, which represents the average value that these investors originally paid for their BTC holdings.

It’s important to note that the STH Realized Price is determined by the value of Bitcoin at the time of each coin’s last on-chain transaction. Generally speaking, coins sold by Short-Term Holders (STH) were acquired no later than 155 days prior.

Bitcoin looks set to slide

When Bitcoin surpasses its Realized Price, it boosts the likelihood of further price growth. The Realized Price functions as a support level for the cryptocurrency. Conversely, dipping below this benchmark could signal a potential correction. This trend has been observed during prior market fluctuations as well.

In late 2018, the value of a bitcoin coin dipped below its Realized Price of $11,012. A few months afterward, the price plummeted to $8,455. Toward the end of 2021, when Bitcoin’s price stood at $48,962 and the metric exceeded $53,000, it didn’t take much time for the value to slide down to $42,306.

Based on historical trends, there’s a possibility that Bitcoin’s value could experience another price correction, even after its recent 7.82% decrease over the past month.

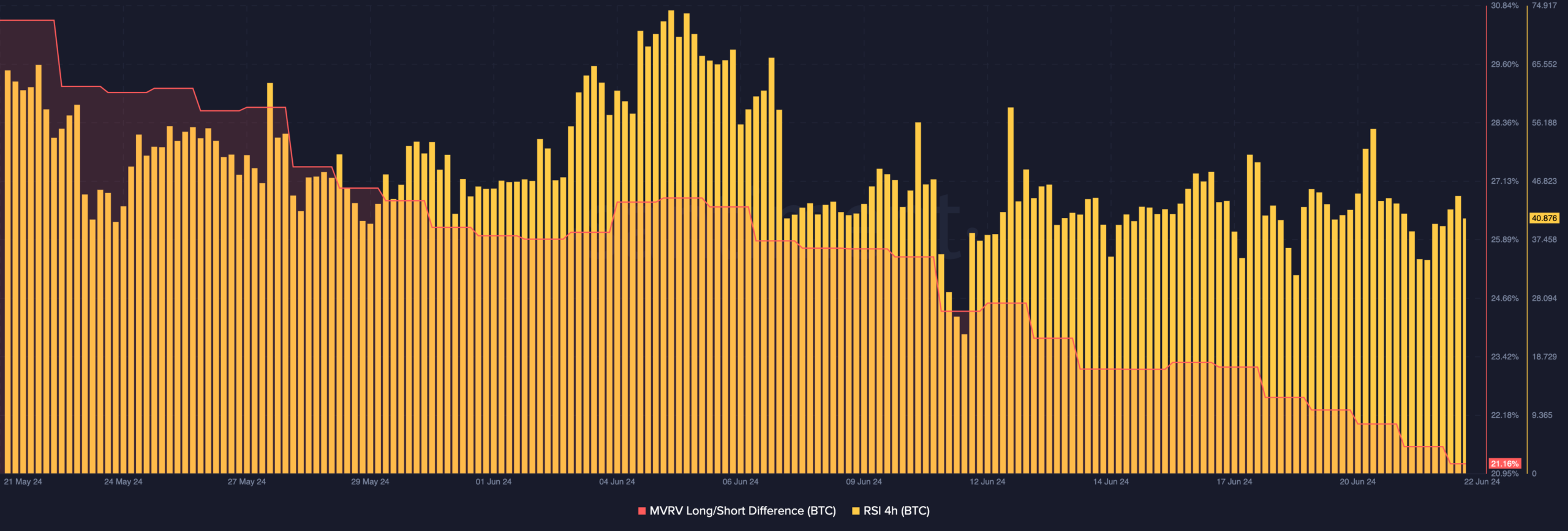

As a crypto investor, I also closely monitor the Market Value to Realized Value (MVRV) Long/Short Difference. By examining this metric, I can assess the balance between long-term holders and new capital entering the Bitcoin market. This ratio provides valuable insights into potential price deviations, helping me make informed investment decisions.

It’s still a bull market!

When the MVRV Long/Short ratio increases, it signifies that fresh capital is flowing into the cryptocurrency’s market. Conversely, a decrease in this ratio suggests that fewer funds are entering the market. Currently, the MVRV Long/Short metric stands at 21.16%.

Significant capital has been missing from Bitcoin’s market recently, indicating a possible price decrease in the near future.

The metric indicates whether a cryptocurrency, like Bitcoin, is experiencing a bear or bull trend. Since the result was favorable, it signifies that Bitcoin remains in a bull market. Consequently, even if the price falls to $61,000, its value could rise significantly during the cycle’s progression.

Furthermore, the Relative Strength Index (RSI) on the 4-hour chart stood at 40.87. This indicator reflects the momentum by determining if it’s bullish or bearish. In this case, its value being below 50 indicates a bearish momentum trend.

Realistic or not, here’s BTC’s market cap in ETH terms

Based on current market trends, the bearish forecast for Bitcoin may hold true. However, a crypto analyst from X – Crypto Caesar believes this downturn could present a buying opportunity prior to another price surge. In his analysis, he stated:

In uptrending Bitcoin markets, the average price paid by short-term holders typically functions as a support level. At present, it stands at around $63,900. Previously, such levels have offered excellent buying opportunities before further price surges.

Read More

2024-06-23 06:15