- Drop in fees signals a challenging period for the network’s profitability

- Supply on exchanges fell, with other developments supporting a price hike

As a researcher with extensive experience in the cryptocurrency market, I believe that the recent drop in fees for the Bitcoin network indicates a challenging period for its profitability. The decline to only $5.90 million was the lowest since November 2023 and signals a decrease in trading volume.

Last week, the Bitcoin network earned approximately $7.36 million in fees. However, this week, that figure dropped by nearly 18.25%. As reported by IntoTheBlock, Bitcoin managed to generate a total of around $5.90 million in fees.

Additionally, the decrease brought about the lowest fees for the network since November 2023.

Lower transactions equal lower fees

For those who are new to this topic, the level of trading activity for Bitcoin significantly impacts the amount of transaction fees generated by the network. When trading volumes are high, it signifies a greater need among users for block space.

Miners can validate new blocks and earn a profit at the same time. This situation last occurred during the halving event when the Runes protocol became effective.

During that period, fees reached peak levels and miners experienced substantial profits. Unfortunately, this trend has shifted in more recent instances. Bitcoin’s price has been a significant factor contributing to this change.

As of when this article was published, Bitcoin’s value stood at $58,135. Prior to its latest surge in price, the cryptocurrency had been exchanging hands for as little as $54,832. Its value faced a downturn due to waning interest and insufficient demand.

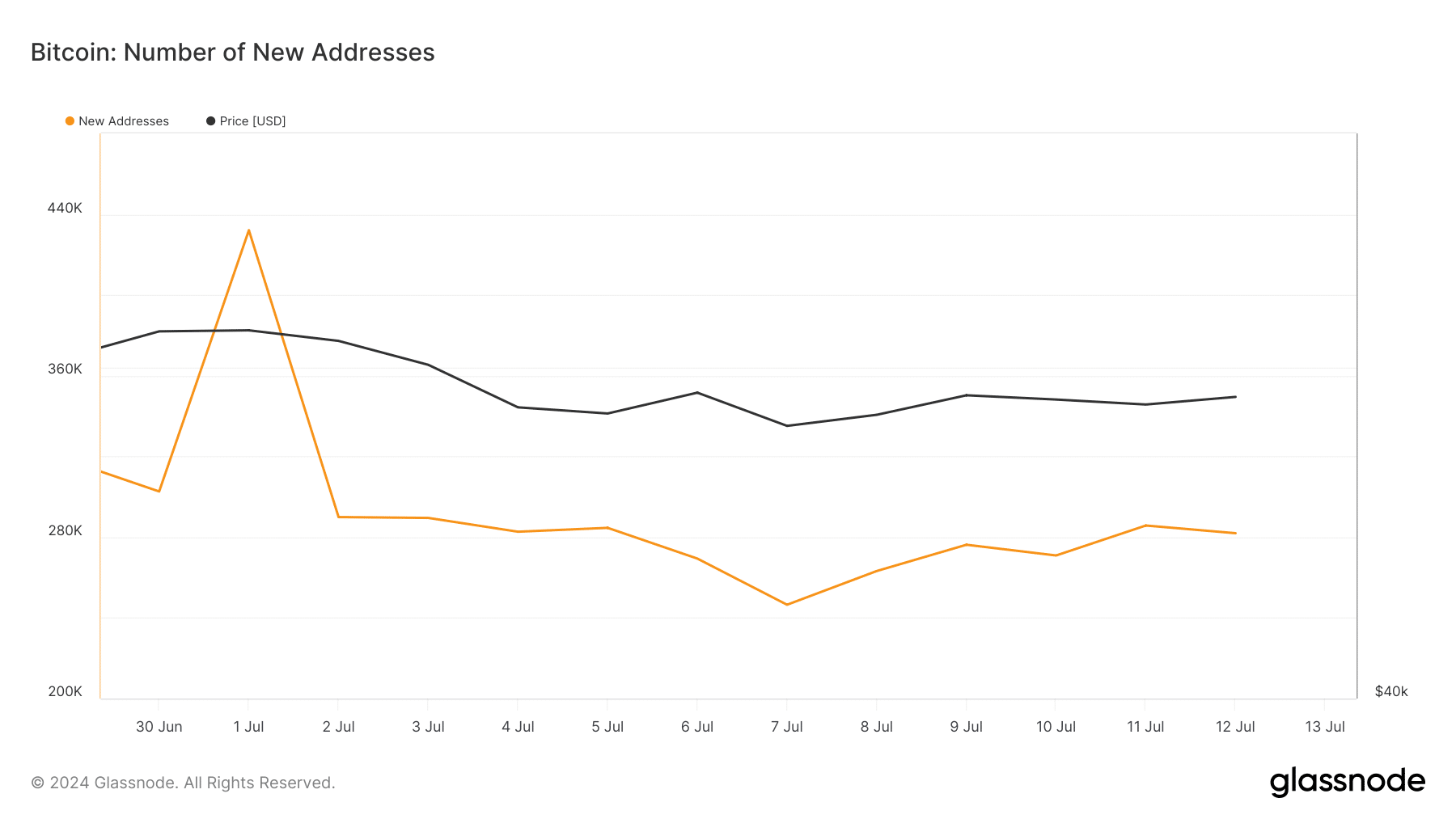

Based on their investigation, AMBCrypto identified a low demand for Bitcoin by examining the count of newly created addresses. Specifically, they noted that on July 12, there were only 289,915 new Bitcoin addresses formed. In contrast, during the early part of July, this figure was significantly higher at 432,026.

As an analyst, I’ve noticed a decrease in the number of initial transactions conducted by distinct addresses on the network.

BTC set to walk its way back up

Should this figure (Bitcoin fees) keep dropping, it’s almost certain that we’ll witness another decrease. On the other hand, a surge in the upcoming weeks could lead to increased network earnings and potentially boost Bitcoin’s value as well.

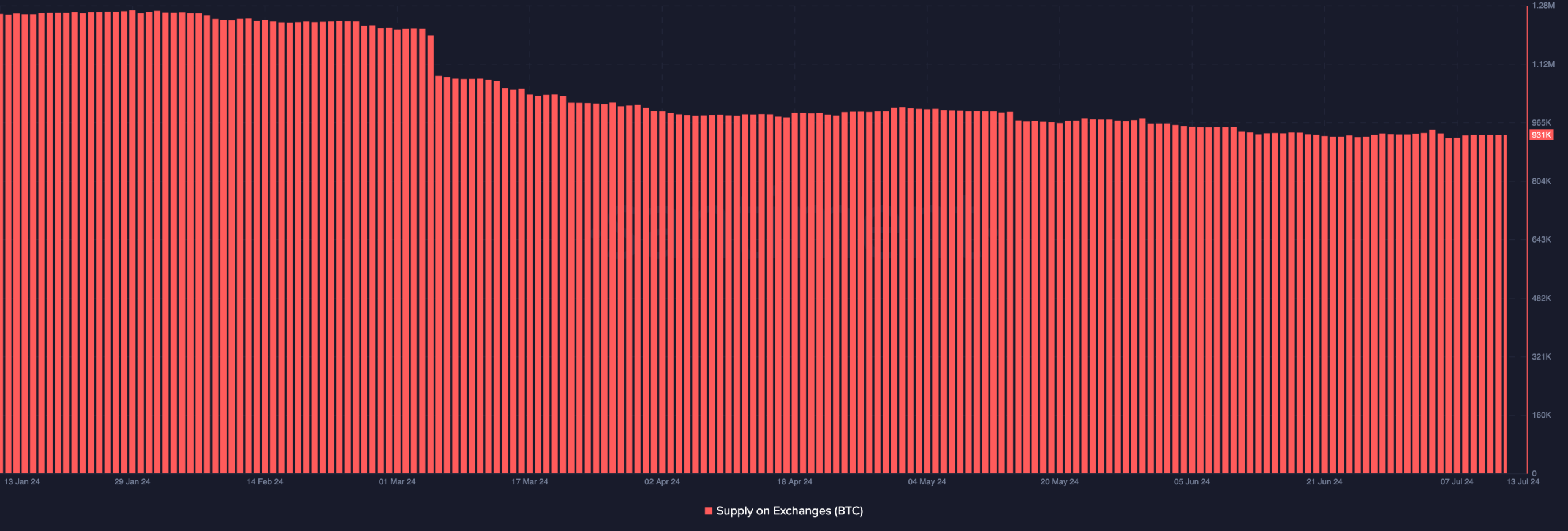

Further investigation revealed that the quantity of Bitcoin available on exchanges was rising. This signifies that many investors may be intending to offload their cryptocurrency holdings. Consequently, a potential drop in the Bitcoin price could ensue as a result.

Currently, the available supply stands at 931,000 units. If this figure persists into the future, there’s a strong likelihood that the cryptocurrency’s price will recover and potentially reach $60,000 again in the near term.

Additionally, Bitcoin appeared to be approaching ideal circumstances for a significant price surge. For instance, according to AMBCrypto’s report, the Cryptocurrency Fear and Greed Index reached an extreme fear level, signaling a potential buying opportunity.

Additionally, the German government played a role in lowering prices due to their large-scale sell-offs. Moreover, Bitcoin experienced its greatest ETF inflows during the month on July 12th.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

If these conditions persist and are followed by significant buying demand, Bitcoin’s price could surge toward $63,000 or $65,000 within a few weeks.

Should another series of whale sell-offs occur, this prediction could be rendered incorrect, potentially causing Bitcoin’s price to drop back down to $57,000.

Read More

2024-07-13 22:16