- Bitcoin showed signs of recovery with a 2.7% increase, trading above $60,842 at press time.

- Analysts predicted either all-time highs or a drop to $48K, based on upcoming economic data.

As a seasoned researcher with years of experience observing Bitcoin’s volatile market dynamics, I find myself standing at the edge of a precipice, peering into the cryptic world of Bitcoin [BTC]. After witnessing its meteoric rise to $73,000 in March and subsequent rollercoaster ride, I can’t help but feel that this digital asset is akin to a tempestuous lover—capricious, unpredictable, yet irresistibly alluring.

Currently, Bitcoin (BTC) finds itself at a pivotal point in its journey. Following a peak above $73,000 back in March, the cryptocurrency has experienced quite the up-and-down ride, characterized by dramatic price swings.

At present, Bitcoin appears to be on the mend, as it rose by around 2.7% over the past day, reaching a trading price of roughly $60,842.

Lately, Bitcoin has been moving back and forth within a limited band, suggesting that investors’ overall feelings about the market might be uncertain or unclear.

Following a sequence of drops and rebounds, we’ve entered a phase of stabilization. The key issue at hand is if Bitcoin can maintain its current rebound and eventually regain momentum towards reaching its previous highs again.

Technical outlook from analysts

Michael Van De Poppe, well-known within cryptocurrency analysis circles, has lately shared his thoughts on where Bitcoin might be headed.

He outlines a bifurcated path depending on key resistance levels and upcoming economic indicators, explaining,

“Should Bitcoin sustain its position above $56,000 and overpower the barriers at around $60,600-$61,000, a route toward testing its previous peak prices becomes evident.”

Instead, unfavorable CPI data might lead to Bitcoin’s price decreasing towards the level of $48,000.

Contributing further to the ongoing discourse, another respected analyst, RektCapital, underscored the significance of trading volume as a crucial factor in validating the recovery’s robustness. In his words, “The volume confirms the strength of the recovery.”

“A rise in trading volumes from buyers is encouraging, however, maintaining this pace is essential for surpassing the current peak levels.”

A daily close above approximately $61,700 would signal a strong bullish confirmation.

Is Bitcoin heading for another dip?

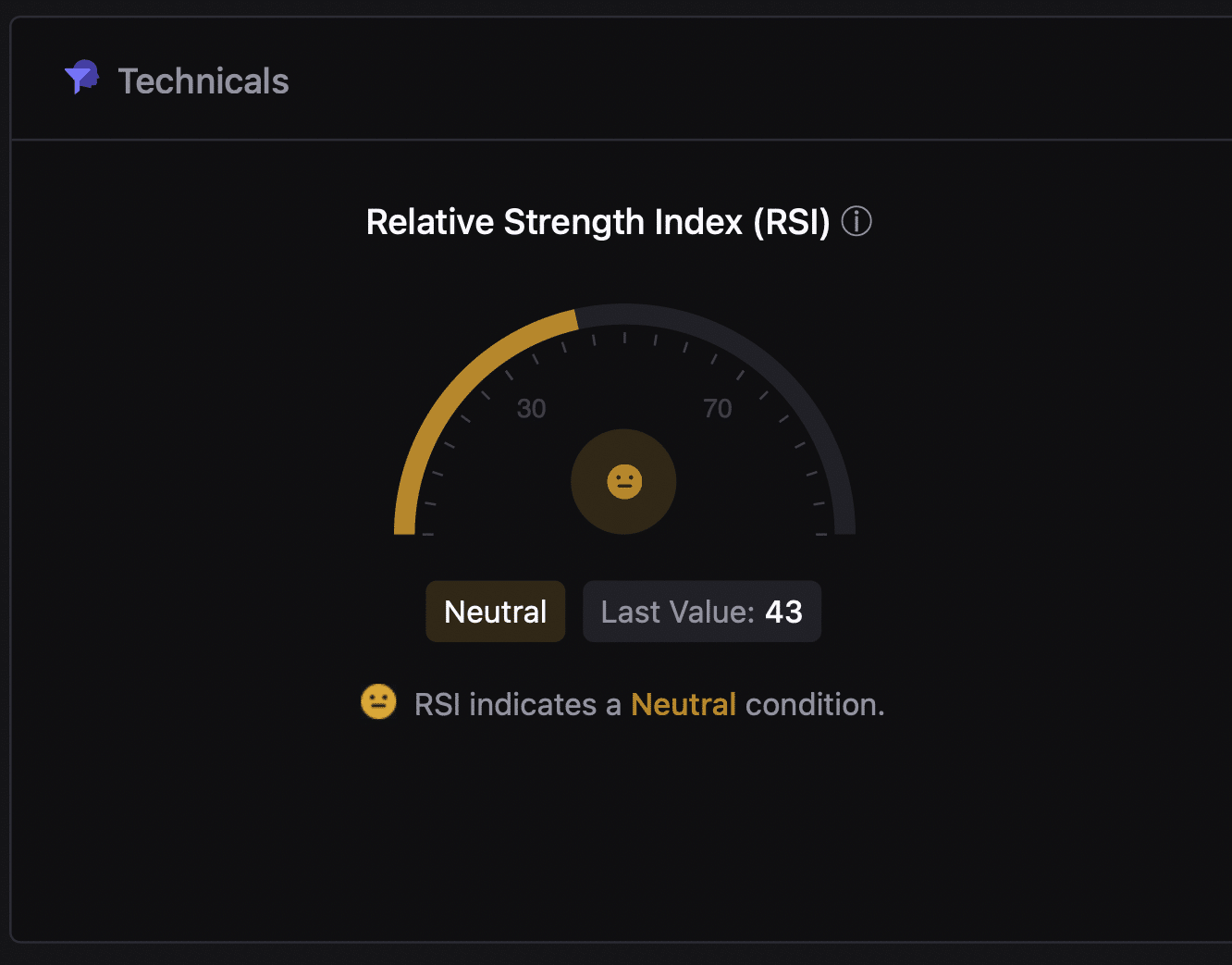

Currently, the Relative Strength Index (RSI) – a handy tool for measuring market momentum and possible price shifts – is reading 43 for Bitcoin.

The impartial analysis indicated that Bitcoin wasn’t excessively bought or sold, offering minimal inclination for a direction and underscoring the market’s present uncertainty.

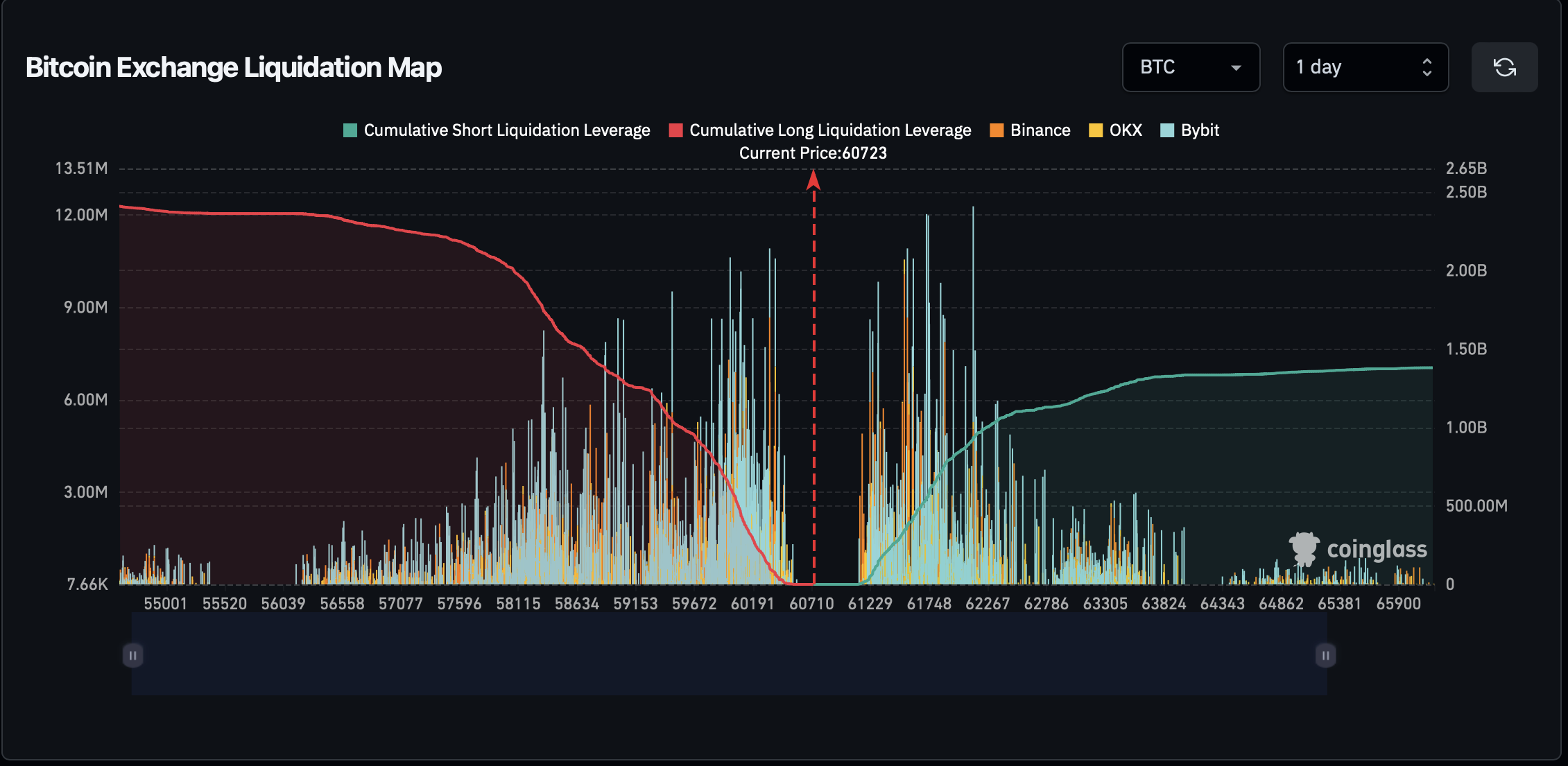

As a researcher delving into market dynamics, I’ve discovered some intriguing insights from Coinglass’s data. It appears that the market leans more towards short positions. In the event of Bitcoin’s price surging, this could potentially trigger liquidations amounting to a substantial $2.41 billion. This massive sell-off could further propel Bitcoin’s price upward momentum.

Conversely, a decrease in price might force out approximately $1.38 billion worth of long positions, potentially exacerbating the current downtrend.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-08-14 22:17