-

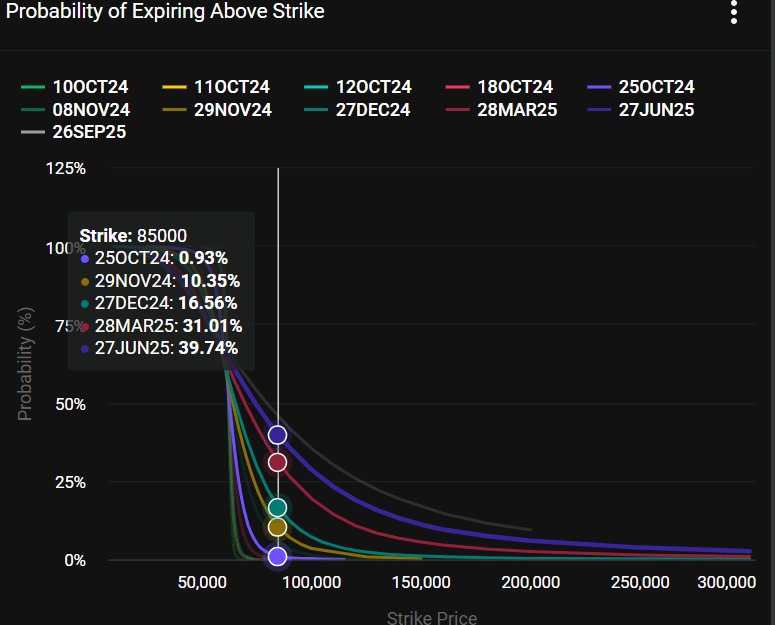

Options data projected only a 16% chance of BTC hitting $85K by year-end.

There was weak market demand and relatively little network growth.

As a seasoned crypto investor with over a decade of experience navigating the tumultuous seas of digital assets, I find myself both intrigued and slightly amused by this current market landscape. The cautious outlook from the options market seems to be the norm these days – much like a weather forecast that’s always predicting rain, even when the sun is shining brightly!

Regardless of the optimistic anticipation for a strong Q4 and an uptrend in late 2024 for Bitcoin [BTC], the options market has shown signs of restraint instead.

Based on the statements made by Jeff Park, who heads alpha strategies at Bitwise, it appears that the options market estimates a relatively low probability of approximately 10% that Bitcoin will reach $85,000 by the end of this year.

According to Deribit’s 12/27 contracts, there is approximately a 10% likelihood that Bitcoin will reach $85,000 by the end of this year. This estimation is based on a 20x leveraged pricing model using a $5,000 call spread. Interestingly, the 7-day Volatility Risk Premium (VRP) turned negative yesterday.

At press time, the odds of BTC hitting $85K by December 2024 were about 16% per Deribit data.

Positive catalysts for BTC

However, Park also noted that the options market outlook might get the target wrong.

He found that the 7-day VRP (Volatility Risk Premium), which captures the volatility difference between the actual (spot) and options markets, turned negative. This meant that spot market volatility was lower than options predicted.

In this case, it’s important to remember that predictions from the options market for Bitcoin’s year-end price might not accurately reflect its actual future performance. They could either overestimate or underestimate Bitcoin’s outlook.

Park mentioned that the impending FTX repayments and continuous global monetary loosening serve as encouraging factors for Bitcoin.

Multiple companies and experts have set Bitcoin price predictions for the year 2024, with Bernstein estimating it could reach $90,000 by the end of 2024 and even soar to $200,000 in 2025.

As a crypto investor, I’m excitedly anticipating that, based on Standard Chartered Bank’s predictions, the value of this digital asset could reach $150,000 by the end of this year and potentially soar even higher to $250,000 by 2025.

As a researcher examining Bitcoin’s short-term prospects, I cannot overlook the opinions of certain financial analysts who suggest that the ongoing geopolitical tensions in the Middle East and the results of the U.S. elections could significantly impact Bitcoin’s near future performance.

Network growth and demand

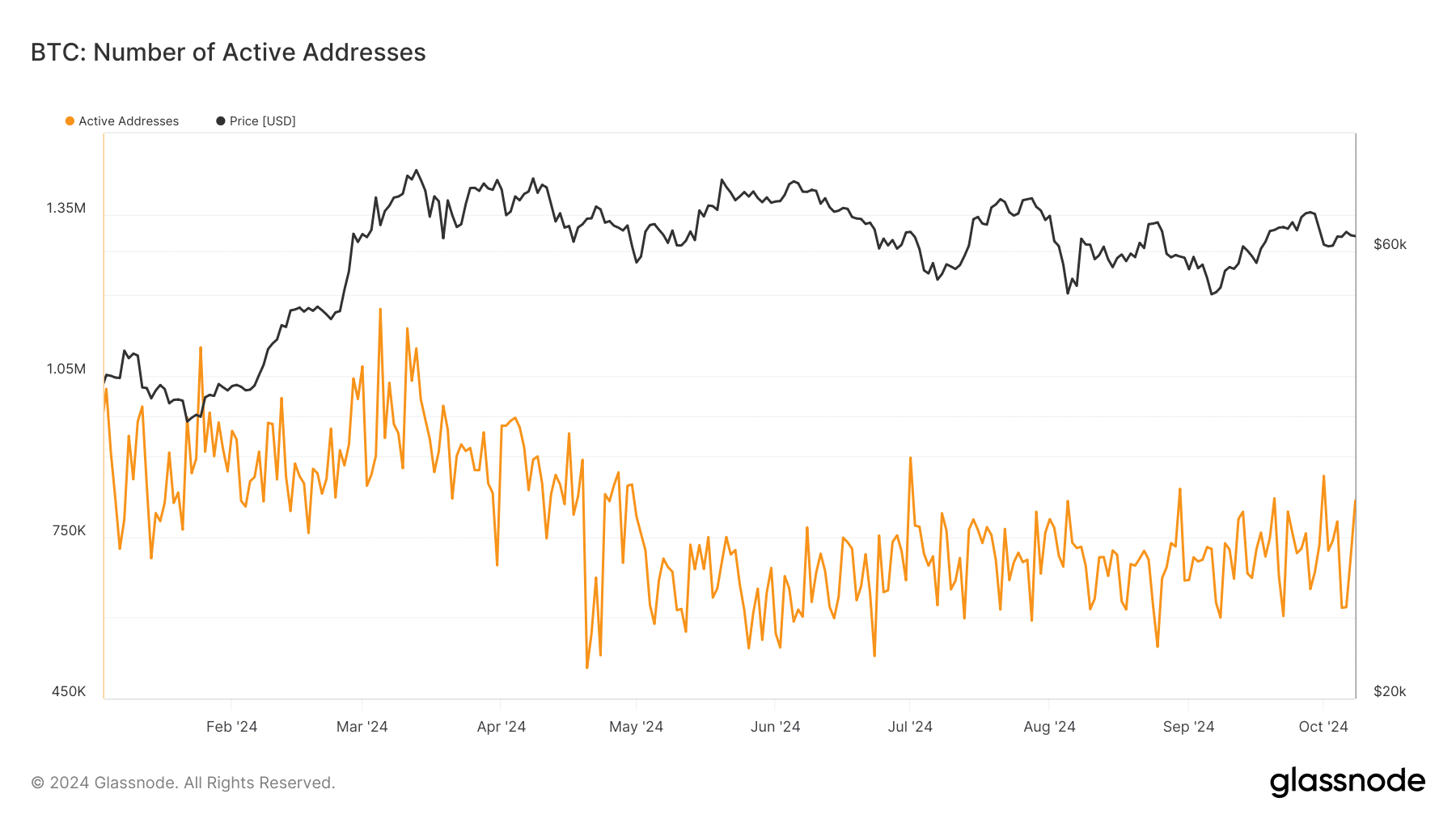

Since late September, the number of active Bitcoin addresses on the network has generally hovered near 750,000, experiencing some fluctuations.

Yet, it didn’t exceed one million, a mark it had breached during Q1 2024 when Bitcoin hit a fresh all-time high. This implied that there was reduced enthusiasm for the asset in Q4 compared to Q1.

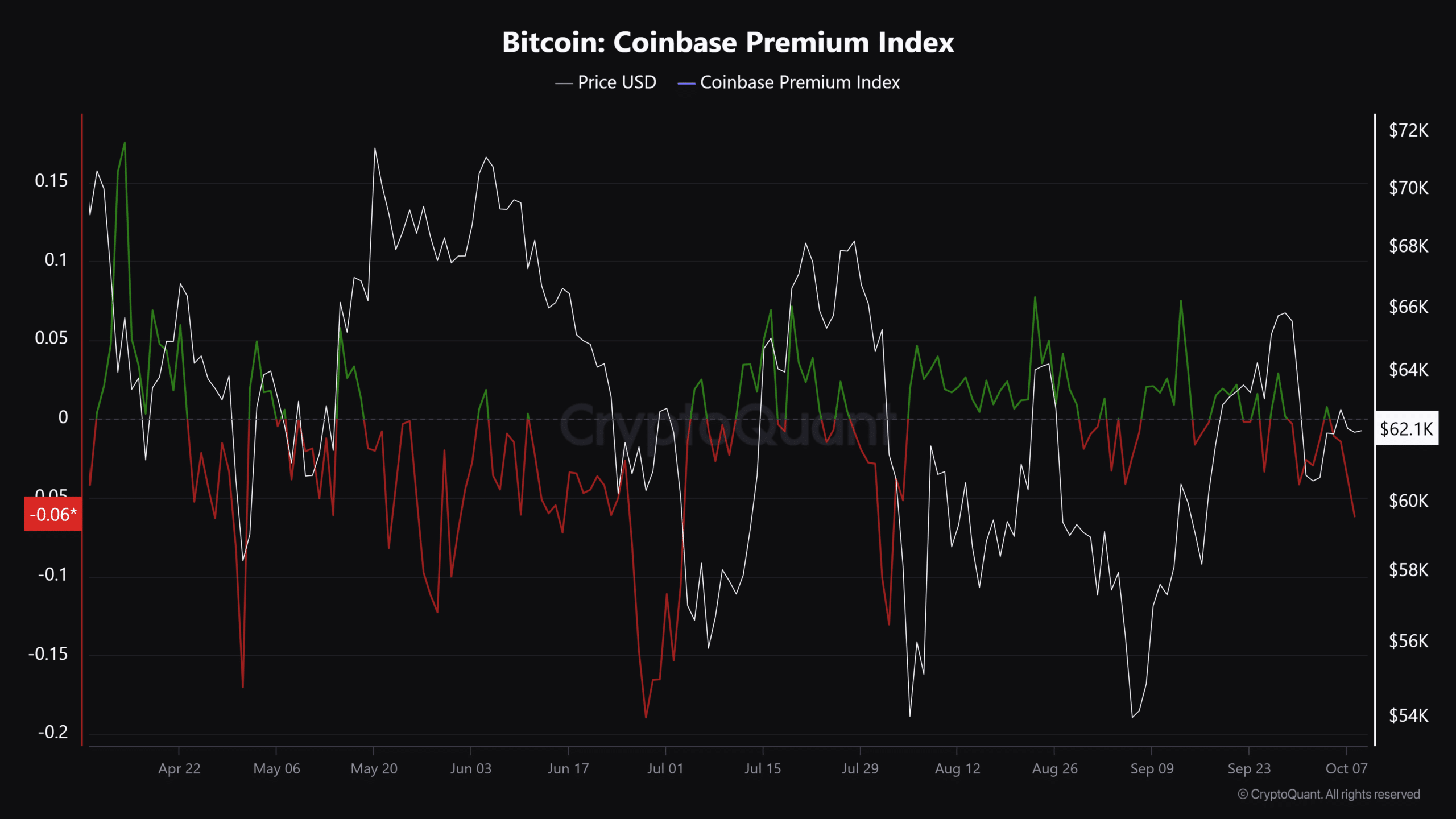

In October, there was a temporary drop in demand, particularly among U.S. investors, which aligns with our previous observations.

For the last several days, the Coinbase Demand Index (which measures the interest among U.S. investors) has shown a negative trend.

In other words, the $63K level acted as significant support for those holding Bitcoin in the short term, and whether Bitcoin can bounce back in the near future may depend on this price point.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

2024-10-09 21:11