-

QCP Capital foresaw a positive outlook for BTC as Options market increased.

Expected Fed rate cuts could be another positive catalyst, per crypto exec.

As a seasoned researcher with a decade-long career in financial markets, I find myself cautiously optimistic about the current state of Bitcoin (BTC). Having weathered numerous market cycles and witnessed firsthand the resilience of this revolutionary asset, I can’t help but be intrigued by QCP Capital’s bullish outlook. The surge in long call options, coupled with increased institutional interest, indeed points towards a positive trajectory for BTC.

⚡ Flash Forecast: Trump Tariffs Could Wreck EUR/USD Stability!

Analysts sound alarms on major forex disruptions coming soon!

View Urgent ForecastFollowing the latest turmoil and significant drops in the markets, there appears to be a readiness for growth and recuperation. As per the insights derived from Bitcoin options market data, crypto trading firm QCP Capital is optimistic about the future of Bitcoin [BTC], suggesting potential positivity ahead.

On Thursdays update, the company expressed optimism towards the largest cryptocurrency, indicating a significant surge in interest from prominent investment funds.

‘We remain bullish on #BTC as we see significant call buying in the Dec and March expiries. Major funds also continue to roll their Sep long call positions.’

For those not familiar, an increase in “long call” positions suggests that these investors anticipate Bitcoin (BTC) to increase in value by the specified dates (September and December). This means they are betting on a price rise for BTC.

In short, it paints a bullish sentiment and likely BTC appreciation in Q3 and Q4.

BTC: No more macro risk?

Following the significant drop in Bitcoin price down to $49K on the 5th of August, the market showed little movement on the 6th and 7th of August, briefly recovering slightly above the $50K mark.

Based on the statement by Quinn Thompson, founder of Lekker Capital (a crypto hedge fund), Bitcoin reached a peak of $60,000 on August 8th, surprising the market because there were fewer sellers than anticipated.

“Although some were trying to test the previous lows, no sellers appeared ready to do so. Over time, the wider market came to understand that there were no sellers present at those particular price points.”

The executive downplayed the recession fears and claimed that the upcoming Fed rate cuts were the next positive market catalyst.

As a researcher, I am reflecting on the recent economic downturn that occurred in the second quarter. Currently, the financial market is eagerly anticipating the first interest rate reduction in four years, scheduled for next month. Simultaneously, it seems global central banks are once again aligning their policies to facilitate easier economic conditions.

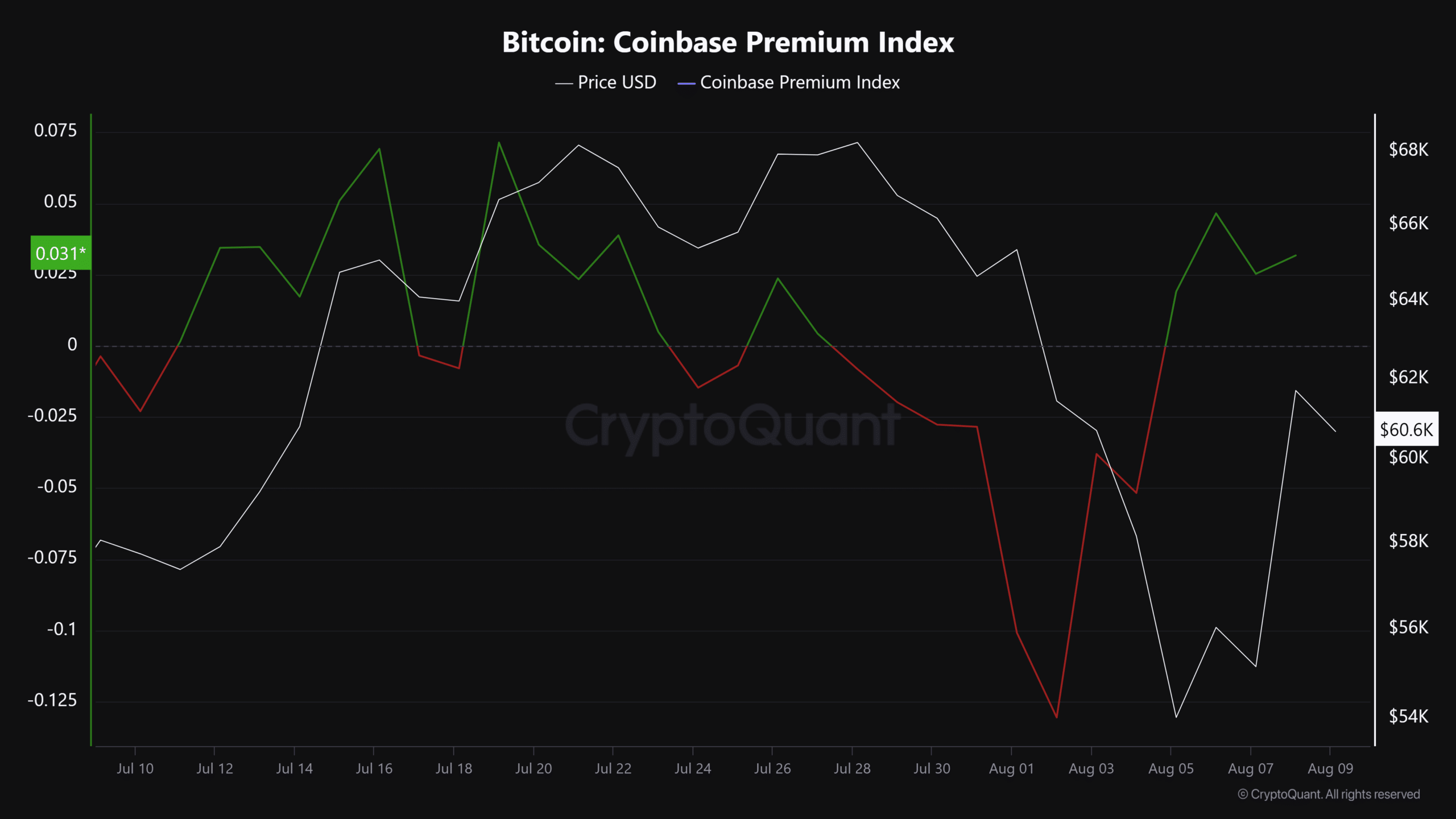

As a long-time cryptocurrency investor, I have witnessed many ups and downs in the market, but this week has been particularly noteworthy for the surge in demand for Bitcoin (BTC). Being an American investor myself, I have noticed that the trend is especially pronounced among my fellow US investors. The Coinbase Premium Index, which reflects the difference between the price of BTC on Coinbase and the global average, has shifted from negative to positive this week, indicating a strong increase in demand from US buyers. This development is an exciting sign for me as it suggests that the market may be turning a corner and that we could see further growth in the value of Bitcoin in the near future. I’m keeping a close eye on the situation and will adjust my investment strategy accordingly.

Generally, a decrease in interest from American investors correlates with downturns for the biggest digital asset. Given the high current demand, this could suggest that Bitcoin’s growth and rebound might continue beyond its present state.

Nevertheless, Bitcoin (BTC) has shown some signs suggesting a potential downturn, which might worry some investors and speculators, even though many anticipate ongoing recovery.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-08-09 23:03