- Bitcoin stabilized above its $60,970-support level – A sign of market strength

- Popular analyst Zen is predicting a potential dip to $60,150 or $53,000 though

As a seasoned crypto investor with years of experience in this volatile market, I find the recent stability of Bitcoin above its critical support level of $60,970 to be an encouraging sign. The market’s strength is evident as it continues to hold above the $60,000 mark, despite popular analyst Zen’s predictions of a potential dip to $60,150 or even $53,000.

In the past 24 hours, Bitcoin’s price has risen by 1.34%, reaching a new trading price of $61,571. This latest increase in Bitcoin’s value indicates a robust market, as evidenced by a market capitalization of $1.214 trillion and daily trading volume of $22.06 billion.

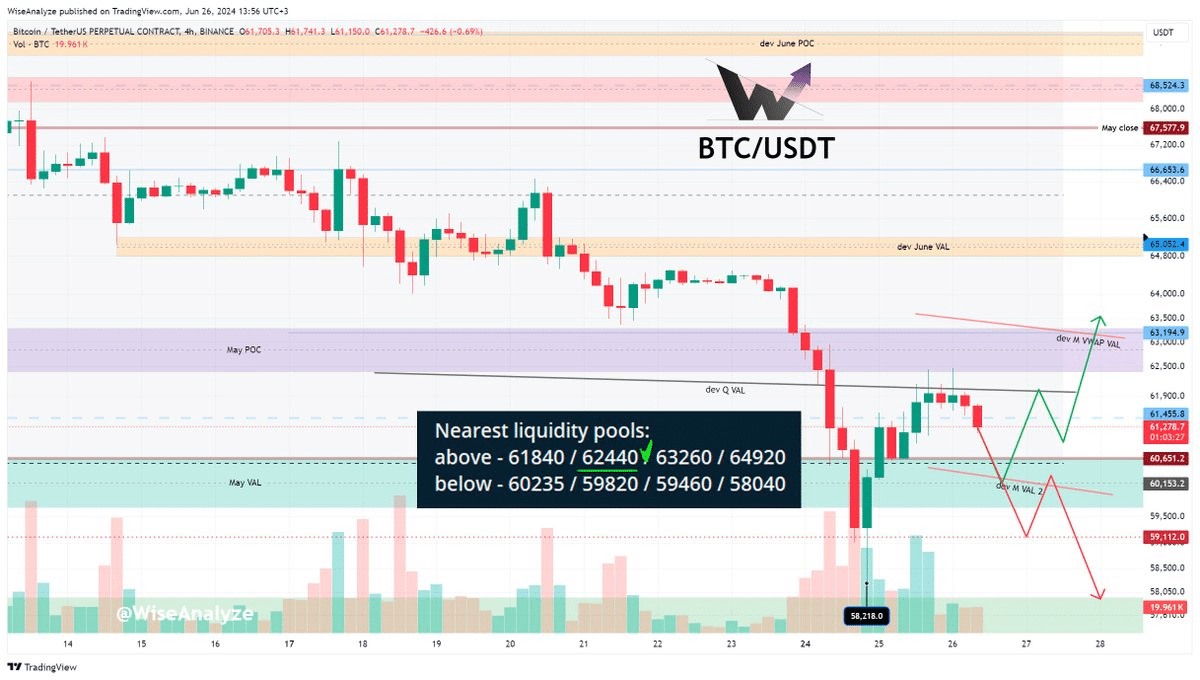

The current Bitcoin price trend indicates that it has found support at $60,970 and faces resistance at $62,000 and $62,250. Following its surge above $61,500, the breach of the support level no longer poses a threat according to Zen’s prediction, suggesting that the price could be stabilizing above the crucial $60,622 – $59,600 range.

In line with Zen’s earlier assessment, this price level stabilization could signal a rebound from the support range if the price continues to hold above it.

It’s important to mention here that Zen forecasted a possible drop down to $60,150 based on insufficient liquidity below $60,630 and minimal trading activity during night hours. He pointed out the descending trendline on the daily chart and the upward trend on the monthly chart, implying a complex but potentially optimistic scenario for the mid-term perspective.

In the end, Zen’s analysis indicates that Bitcoin could potentially drop to the $53,000 mark based on the monthly chart perspective. However, this is a highly speculative prediction as it implies a significant decline of more than 10% in Bitcoin’s value.

At present, according to Zen’s analysis, the closest Bitcoin liquidity pools are located at $61,540 and $62,540, which is above its current price. Additionally, there are pools at $60,260 and $59,440, representing prices below the current level. In essence, Bitcoin’s proximity to these significant liquidity points, particularly the one near $61,540, could significantly impact short-term price fluctuations.

Analyzing Inflows Data

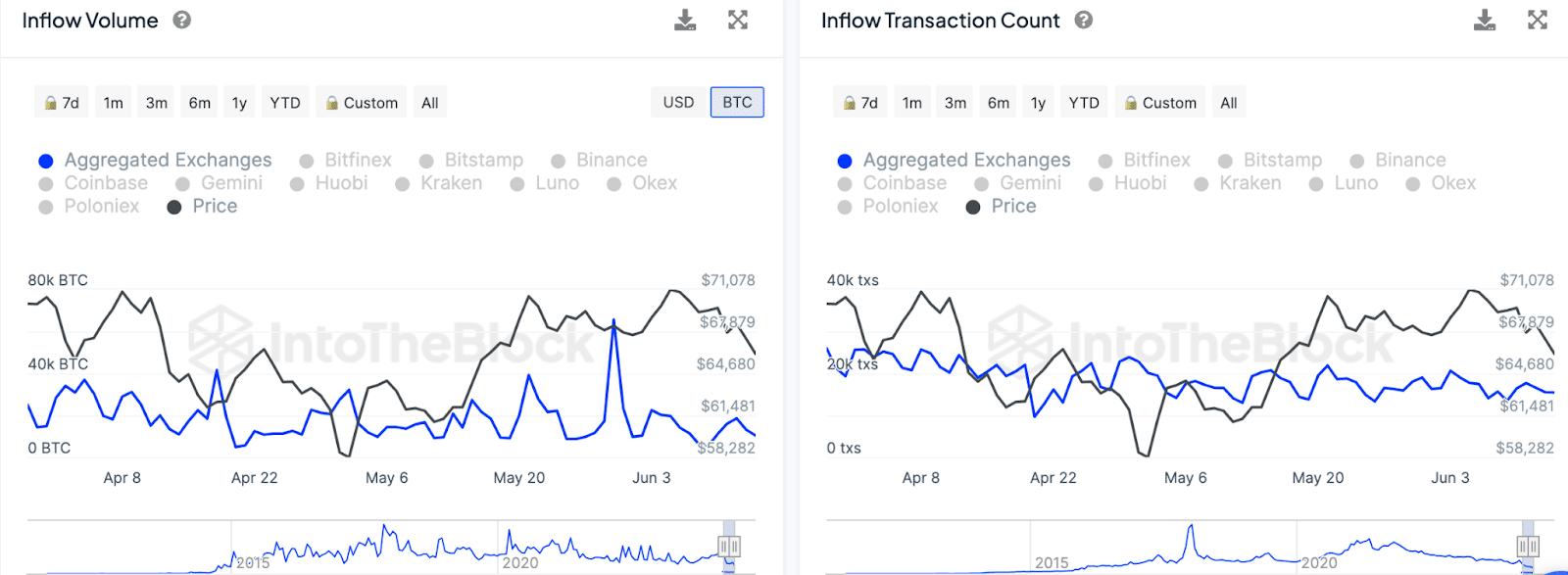

As an analyst, I’ve noticed some considerable variations in inflows elsewhere, specifically observing substantial increases in late April and early June. These surges frequently align with price adjustments, suggesting that a substantial amount of Bitcoin being transferred to exchanges could potentially trigger market volatility. Furthermore, the transaction count data reveals comparable trends, displaying heightened activity in conjunction with price shifts.

During the timeframe from April 8th to April 22nd, there was a significant increase in both inflow volumes and transaction activity. This surge coincided with a noticeable decrease in price, which went from $71,078 to $58,282.

As a crypto investor, I’ve observed some intriguing patterns in the market during late April and early May. The inflow volumes and transaction counts surged significantly around those periods, reaching peaks at approximately $64,680 and $67,879 respectively. These price spikes seemed to be closely linked with the heightened trading activity.

As a data analyst, I have observed that the metrics experienced several spikes towards the end of May and beginning of June. The price hovered approximately around $61,481 during this period, which is relatively near the present value on the graph.

As an analyst, I would recommend examining the following levels and metrics to gain insights into the potential future price movements of a cryptocurrency. These factors can provide valuable perspectives on the asset’s market behavior.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

2024-06-29 01:43