-

As per some analysts, politifi tokens could compete with DOGE, SHIB.

Crypto market volatility has increased in the wake of the U.S. election.

As a seasoned researcher with extensive experience in the crypto market, I have witnessed firsthand the intriguing relationship between politics and cryptocurrencies. The upcoming U.S. elections have added yet another layer of complexity to this already dynamic sector.

😱 Trump's Tariff Bombshell Could Crush EUR/USD!

Markets on edge — read the urgent new forecasts before it’s too late!

View Urgent Forecast1. At present, the cryptocurrency market finds itself at a pivotal juncture in its timeline, with the upcoming U.S. elections playing a significant role. According to a poll conducted by AMBCrypto, approximately 80% of the 9,375 respondents anticipate that Bitcoin will establish the $80,000 mark as a key support level if Donald Trump is re-elected as President.

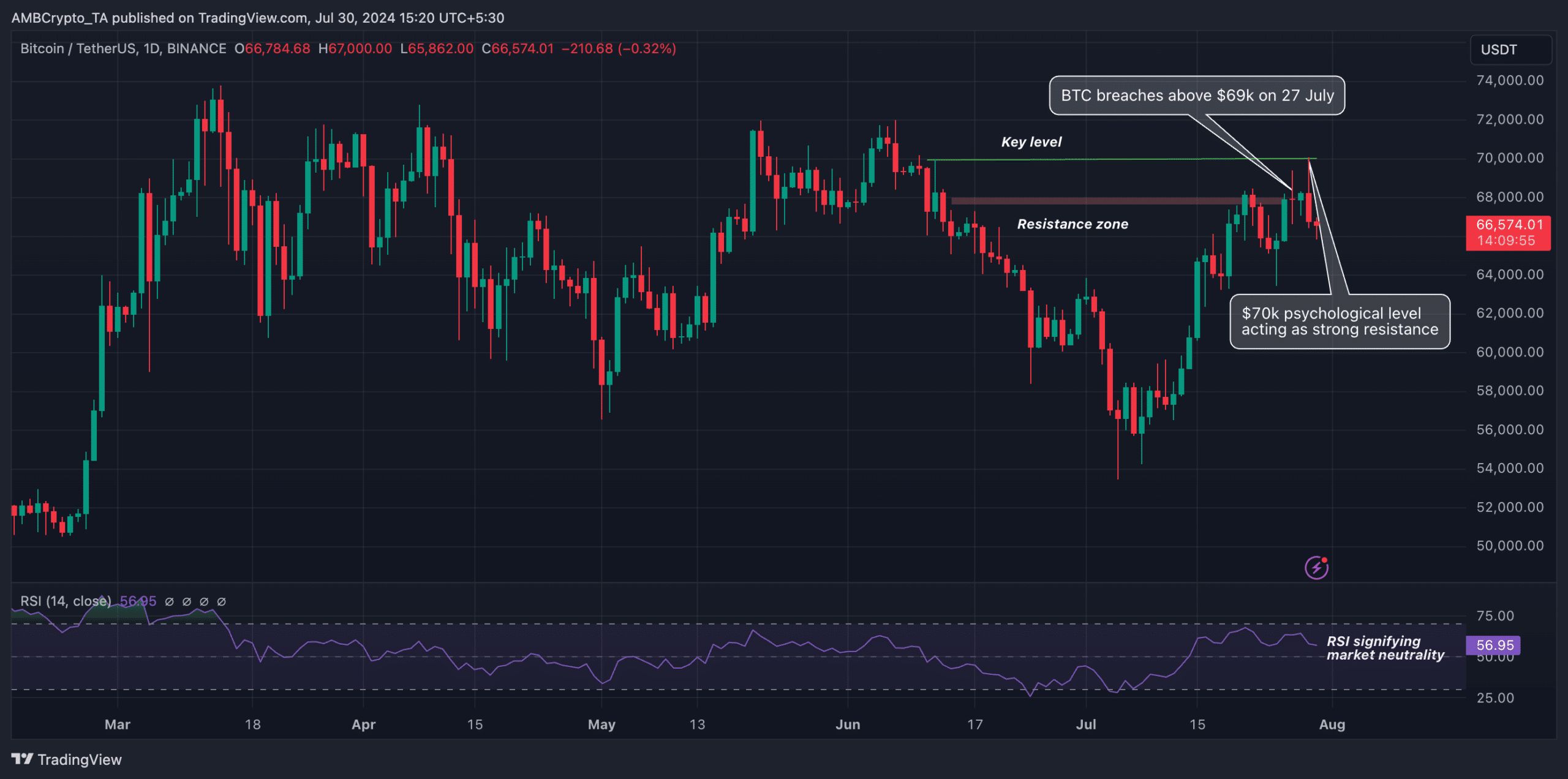

It’s reasonable to anticipate a rally for Bitcoin if we consider its response to President Trump’s speech at the Bitcoin Conference 2024 in Nashville. For over 45 days prior, Bitcoin had been battling to surpass the $69,000 mark. Nevertheless, following Trump’s pledge to position the United States as the “global leader in cryptocurrency,” Bitcoin managed to break through the $69,000 barrier, although with a relatively low trading volume.

Crypto+politics dominates social media

According to AMBCrypto’s July 2024 report, approximately a quarter of all discussions about crypto X currently revolve around the potential influence of U.S. elections on the sector, with a particular focus on Bitcoin. Our recent survey reveals that an overwhelming 76.6% of investors believe that the Republican Party is more inclined to advocate for pro-crypto legislations.

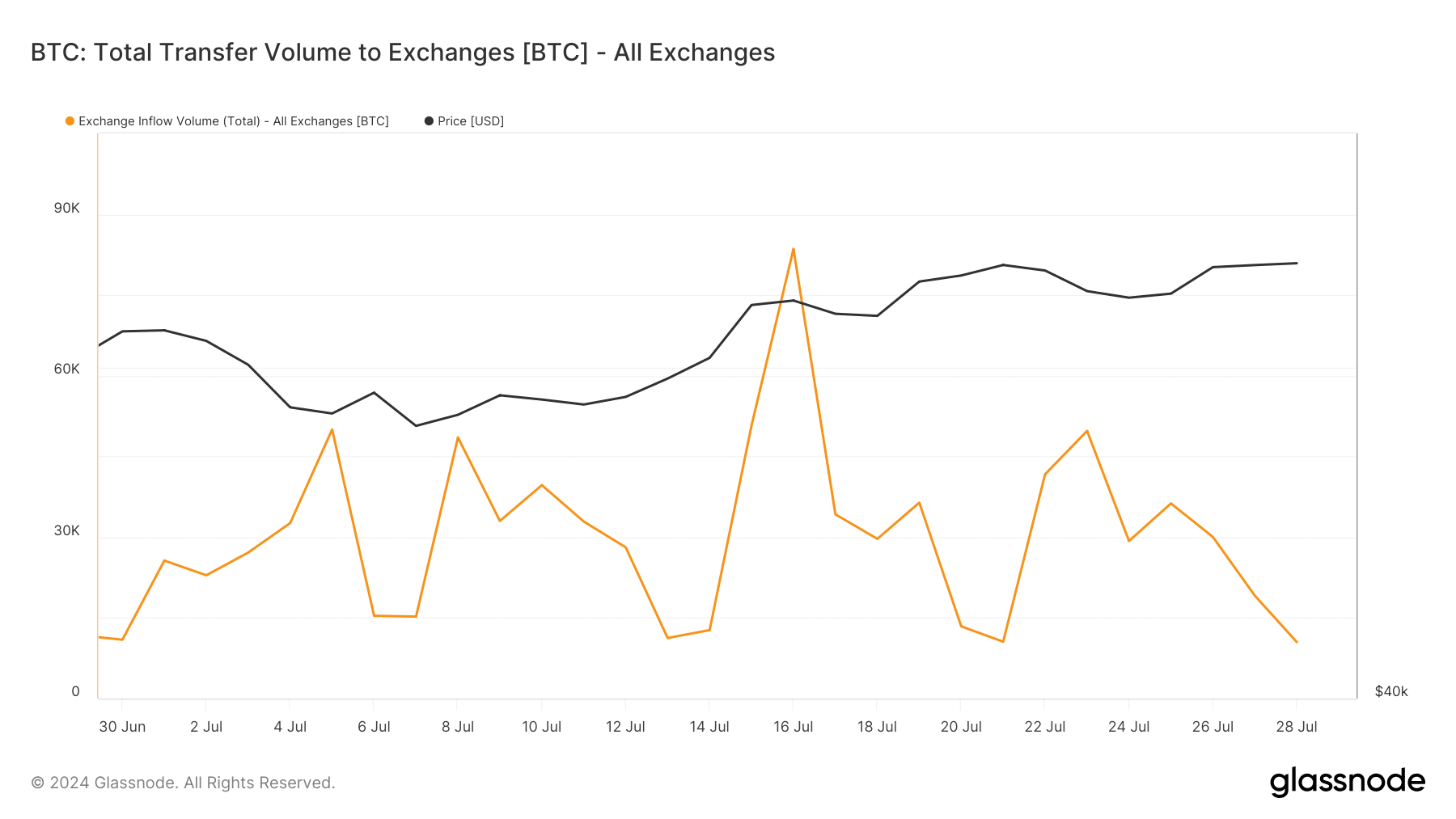

With the expectation coming up once more, Bitcoin investors have renewed their holding strategy – the volume of coins entering exchanges for sale has noticeably decreased since July 16th. This indicates that considering selling at the current price might carry some risks.

According to Julien Bittel, a cryptocurrency analyst at Global Macro Investor, we can anticipate an extraordinary increase in Bitcoin’s value based on historical trends and the present condition of its Bollinger Bands indicator. This sign shows the bands being “extremely compressed,” implying a possible surge towards a record-breaking price of approximately $190,000.

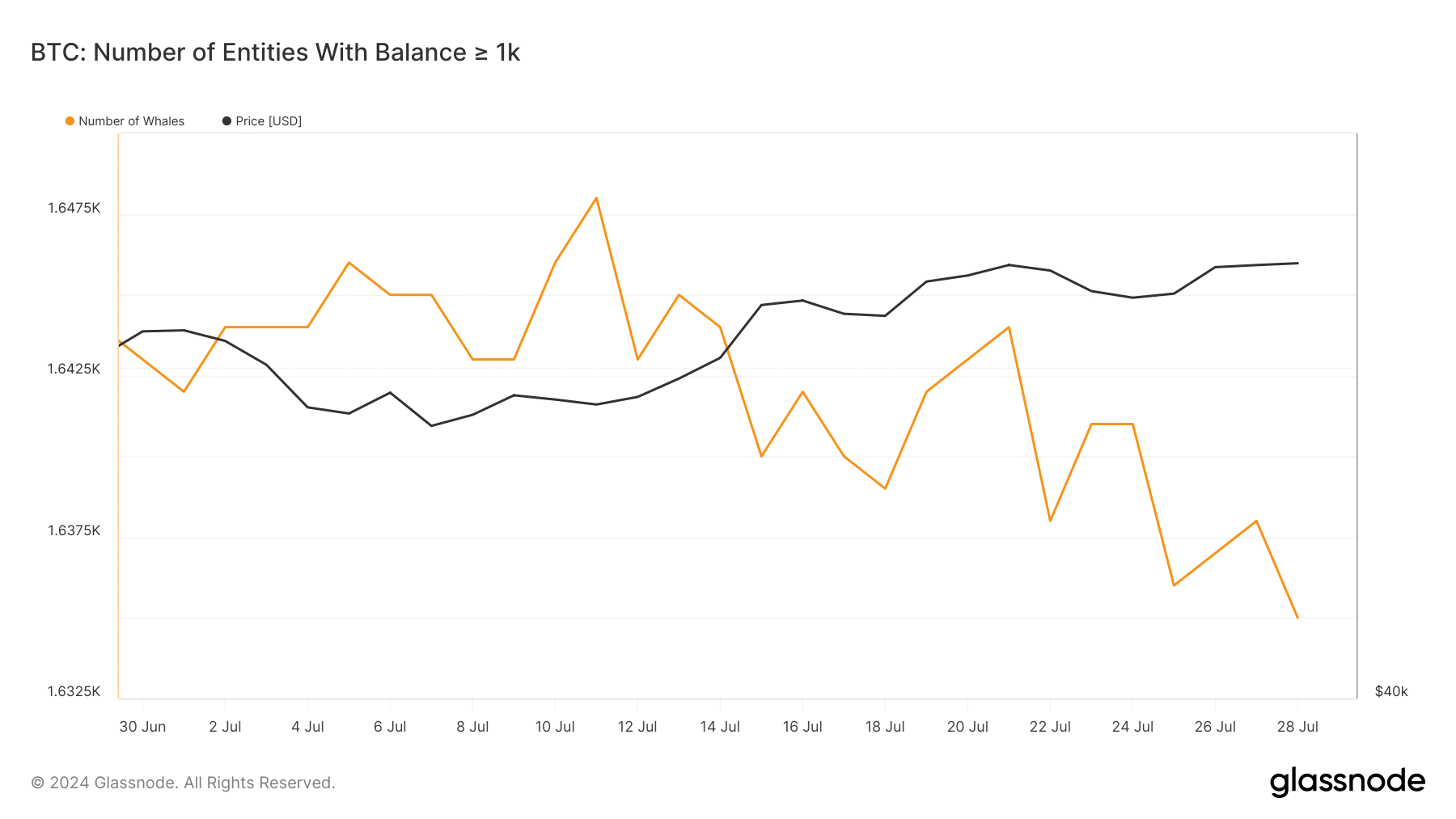

Over the past few weeks, most analysts and on-chain signals have pointed towards an imminent bull market. However, the number of Bitcoin addresses holding over 1,000 coins has shown a noticeable downward trend.

The large-scale investors may be viewing Trump’s endorsement of cryptocurrencies with significant doubt, given his election prospects. It could also mean that a considerable number of these major players in the market are cashing out and shifting their assets due to their skepticism towards Trump’s chances of winning the election.

1. Although Bitcoin’s immediate future may face potential hurdles, its long-term prognosis remains optimistic. Presently, there is a high expectation that the Federal Reserve will not lower interest rates during their meeting on July 30-31. However, there are robust expectations for a rate reduction in September, with a chance of a substantial decrease as well.

It’s intriguing how Politics+crypto discussions have led to significant surges for certain tokens recently. For instance, consider HARRIS token, which holds a market value of approximately $2.9 million. Remarkably, this token witnessed an increase of over 1350% within the last week.

As per the views of Andrew Kang, the founder of Mechanism Capital, it’s possible that PolitiFi tokens may vie for popularity alongside coins such as Dogecoin and Shiba Inu in the future. The comprehensive July 2024 report from AMBCrypto provides valuable insights on this subject to aid traders in their decision-making process.

Dive into AMBCrypto’s July 2024 crypto market report

As a seasoned cryptocurrency analyst with years of experience under my belt, I can tell you that this report offers more than just a rundown of Bitcoin’s performance for the month. Instead, it delves deeper into the world of altcoins and identifies the top performer for the given period. But that’s not all. This comprehensive analysis also explores the intricacies of the Decentralized Finance (DeFi) ecosystem, shedding light on the current DeFi winter. Moreover, it investigates the recent downturn in the Non-Fungible Token (NFT) market. With six essential questions answered within its pages, this exclusive report is a must-read for anyone seeking a well-rounded understanding of the crypto landscape.

- How could Trump’s possible re-election impact Bitcoin’s price, potentially propelling it to $80,000?

- What is the significance of Solana’s staking system attracting $61 billion and surpassing Ethereum?

- How did the GameFi sector outshine the memecoins?

- What challenges are projects like Helium and Akash Network facing?

- Why did NFT sales volume drop by 42.54%?

- What to expect from the crypto market in August?

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-07-30 16:40