As a seasoned researcher with a keen interest in digital assets, I must admit that this Bitcoin surge has been nothing short of exhilarating. Having closely observed the market since its infancy, I can confidently say that this is one of the most significant price surges we’ve seen yet. The momentum behind BTC right now is palpable, and it’s reminiscent of the early adopter days when the potential of blockchain technology was just beginning to surface.

Enthusiasts of Bitcoin (BTC) are experiencing a joyful spree as their hopes for an October rally seem to be materializing. This past week, the leading cryptocurrency staged a significant recovery, surpassing crucial obstacles in its path.

On October 16th, the value of the so-called King Coin reached an impressive peak of $68,424, which was nearly a three-month high for this digital currency. MicroStrategy’s Co-Founder and Chairman, Michael Saylor, added to the buzz, announcing his approval by stating…

“To the moon.”

His speech sparked a sense of optimism within cryptocurrency supporters, because the rise of Bitcoin reignited their faith and enthusiasm.

Currently, as I type this, the value of the coin has retreated to approximately $67,458, yet it still shows a rise of 0.97% in the last 24 hours and an impressive increase of 10% during the last seven days.

Is a Bitcoin supply shock coming?

Beyond just the rise in prices, advancements in the supply sector are stirring up anticipation among traders that more profits could be on the horizon.

Initially, Bitcoin miners generate approximately 450 Bitcoins each day, but this production rate is struggling to keep up with the escalating demand due to continuous buying from institutional investors.

For instance, BlackRock recently added $391.8 million worth of Bitcoin to its holdings.

As an analyst, I’d like to bring your attention to the fact that combined assets of Bitcoin Spot ETFs amount to approximately $64.46 billion, which equates to around 4.82% of Bitcoin’s overall market capitalization. This information is derived from data provided by SoSo Value.

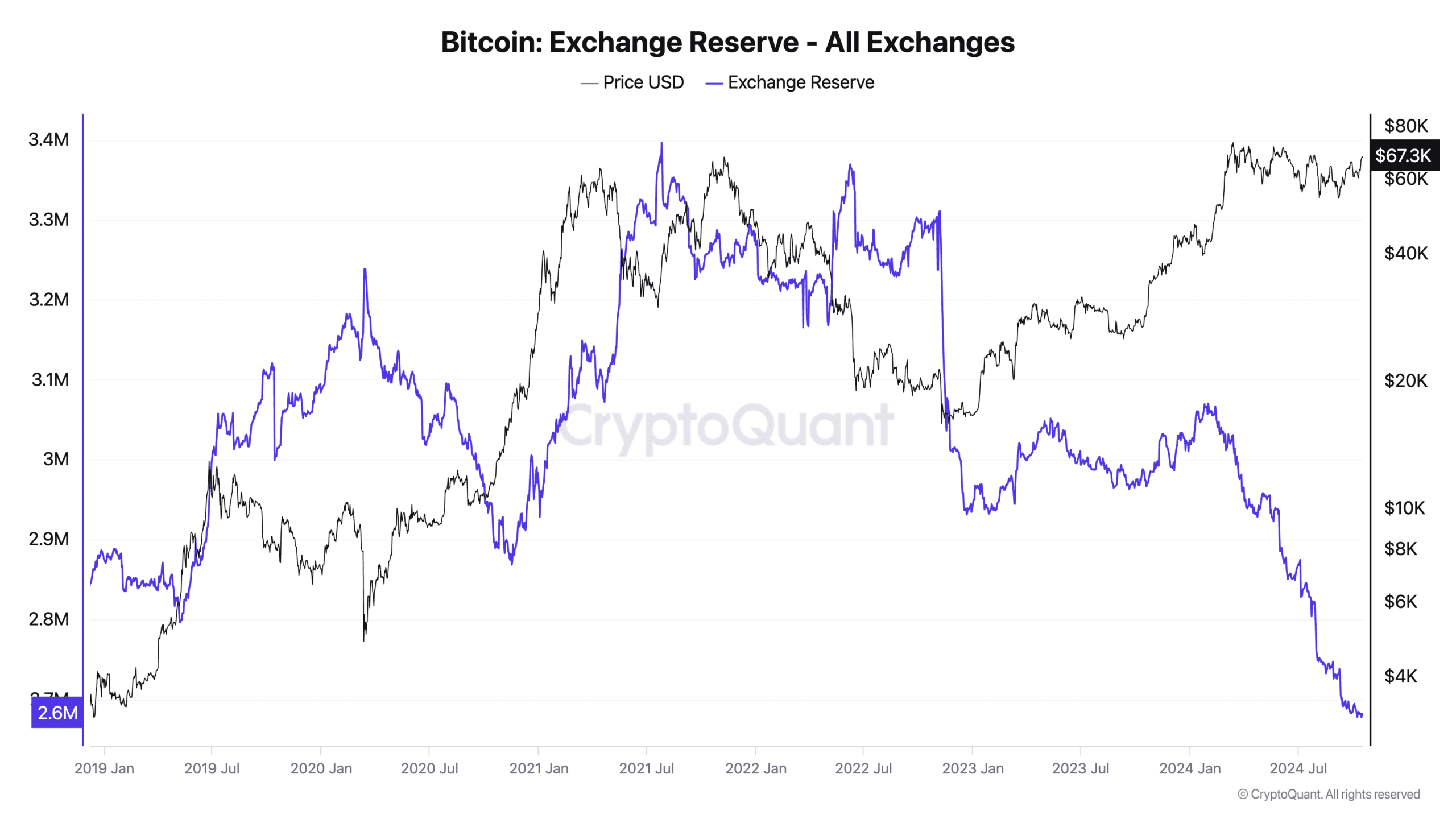

Furthermore, currently, about 19.77 million Bitcoins are in circulation, which makes up nearly 94.14% of its total supply. Notably, according to CryptoQuant, the amount held in exchanges has dropped to a five-year minimum of approximately 2.6 million BTC.

As a result of these factors, the likelihood of a supply shock appears increasingly imminent.

What does the derivative data say?

To gain deeper insights into market sentiment surrounding Bitcoin, AMBCrypto analyzed the derivative’s data.

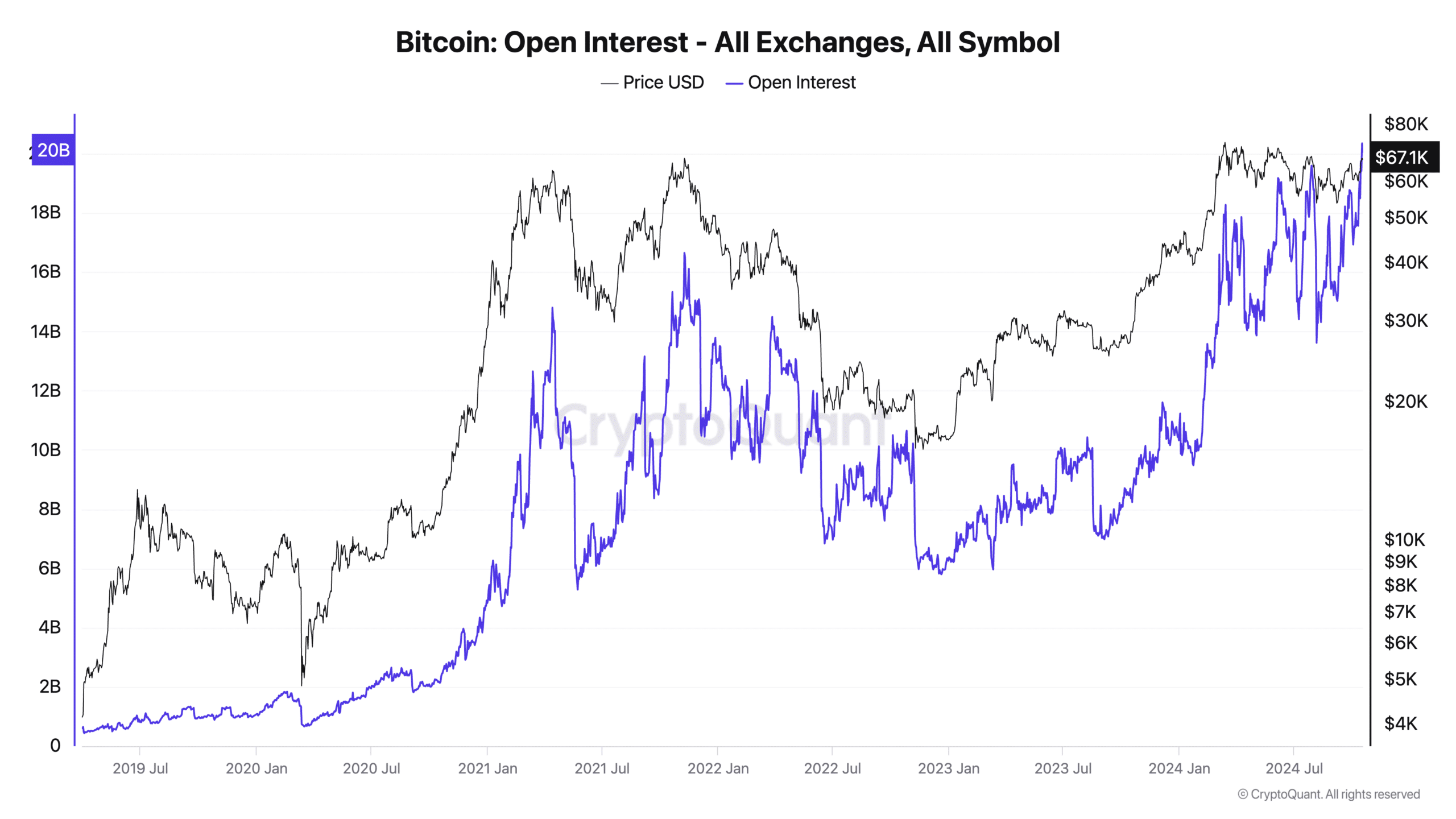

As reported by CryptoQuant, the Open Interest for Bitcoin has hit a record peak of $20 billion, indicating a surge in involvement and curiosity among investors.

CME Bitcoin Futures OI also hit a record high, reflecting growing institutional involvement. Moreover, the funding rate was positive at press time.

According to data from Coinglass, the Long/Short Ratio was approximately 1.02, suggesting a slight inclination towards holding long positions rather than short ones. This ratio implies a general sense of optimism within the market.

BTC closing in on $70K

In a promising market situation, it looks like Dogecoin (Saylor) is aiming high, and some experts believe its price could reach approximately $70,000.

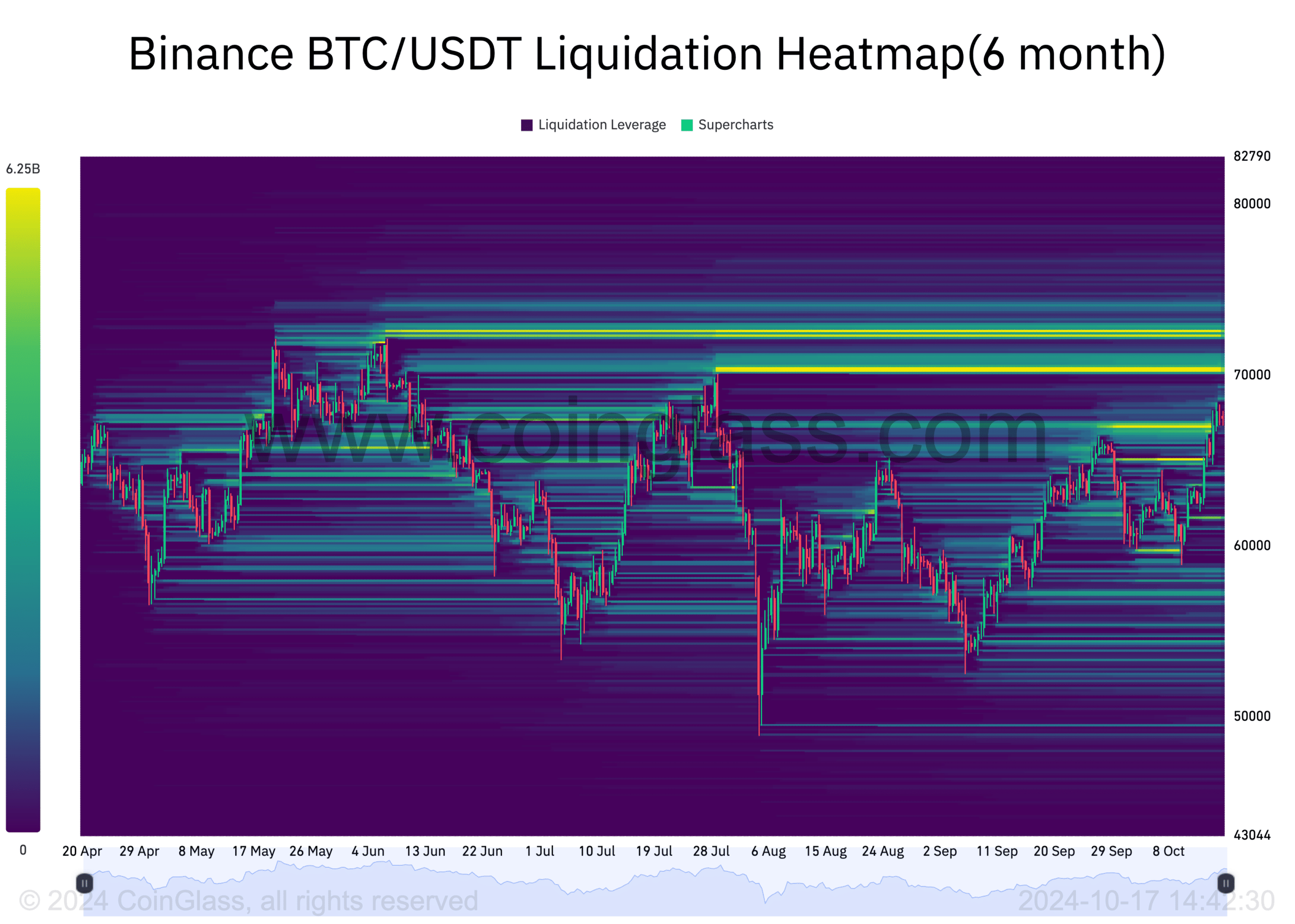

According to the 6-month data analysis by Coinglass, there’s a significant concentration of liquidity around this point. The figures $72,300 and $72,600 are potential attractive levels for the price to move towards next.

On the negative side, a large amount of liquidity is found at approximately $67,000 and $65,000. Should Bitcoin fall to penetrate these prices, there might be a subsequent rise.

Thus, given Bitcoin’s trajectory, bulls remain hopeful of reclaiming the record highs set in March.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-18 07:36