- Bitcoin’s open interest hits record $20 billion, just 8% below its ATH, signaling potential price volatility.

- Whales are accumulating Bitcoin, with net outflows from exchanges surging over the past 7 days.

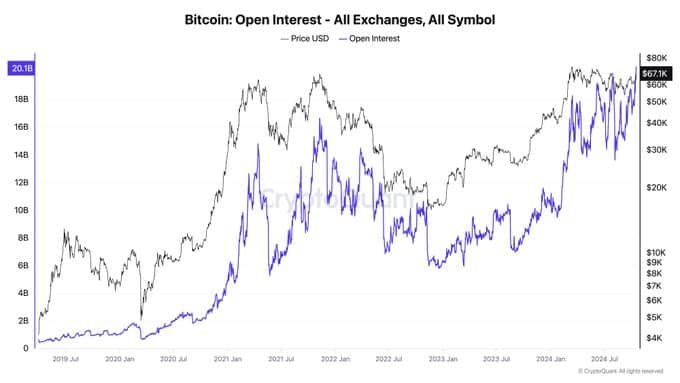

As a seasoned researcher with over two decades of experience in the financial markets, I find myself intrigued by the current state of Bitcoin (BTC). The surge in open interest to record levels of $20 billion and the simultaneous increase in CME Bitcoin Futures open interest hints at an impending period of heightened market activity.

The total value of open Bitcoin (BTC) positions across all trading platforms has surpassed an unprecedented $20 billion, according to Ki Young Ju, the head of CryptoQuant.

Currently, Bitcoin is sitting only 8% away from its record highest price, which indicates a strong expectation for significant price fluctuations. The increased involvement in the Bitcoin futures market is a notable sign of heightened interest in this cryptocurrency, especially among institutional investors.

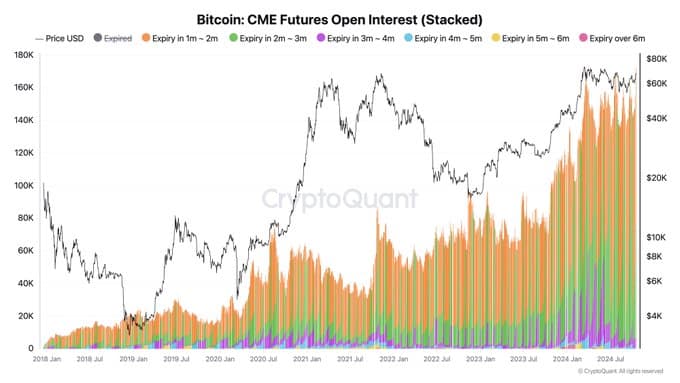

As I’m immersed in the crypto realm, I can’t help but notice the surge in CME Bitcoin Futures open interest reaching an unprecedented peak. This concurrent rise in bitcoin prices and futures contracts positions indicates that traders are gearing up for a stretch of intensified market action, which could potentially mean more opportunities for gains.

Bitcoin open interest surges in 2024

Historically, Bitcoin’s price trend and the amount of open interest have shown a robust connection, particularly during market upswings or bull runs. For instance, during the growth phase from mid-2020 to late 2021, both the price and open interest climbed in tandem due to heightened speculation and increased use of leverage for trading.

In late 2021, as Bitcoin reached its all-time high, there was a surge in open interest, indicating that traders were highly optimistic about the growing market.

In contrast to the year 2022’s bear market, there was a substantial decrease in both open interest and prices as traders chose to either leave their positions or scale them back.

After Bitcoin bounced back from its dips, the number of outstanding contracts (open interest) started increasing once more, eventually peaking at record levels in 2024. Even though Bitcoin is slightly short of its All-Time High (ATH), the surge in open interest implies that market players anticipate a significant price shift in the immediate future.

Whale accumulation and network activity

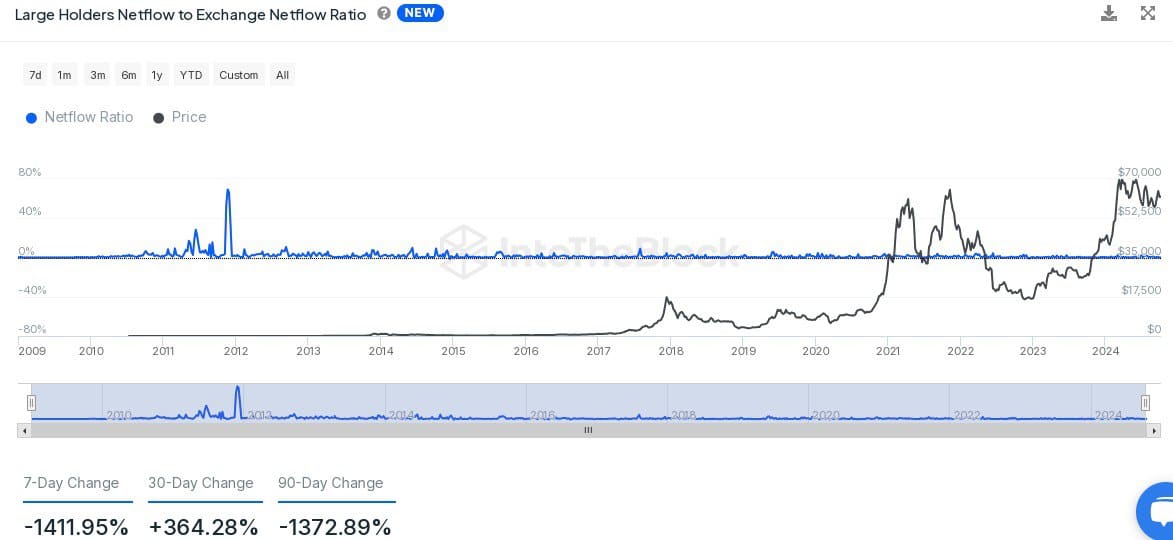

According to IntoTheBlock’s data, large Bitcoin owners have been regularly transferring their coins out of trading platforms, typically indicating an increase in ownership or accumulation.

For the last week, there’s been a significant decrease of approximately 1411.95% in the inflow of Bitcoin to exchanges, suggesting that large investors (whales) might be planning to keep their Bitcoins for an extended period.

Over the past week, the number of new on-chain addresses has risen by 9.59%, while active addresses have seen an uptick of 8.20%. This suggests a growing level of interest in the on-chain activity.

The boost in network usage along with Bitcoin’s price hike seems to indicate a surge in user involvement, fueling optimism in the crypto market.

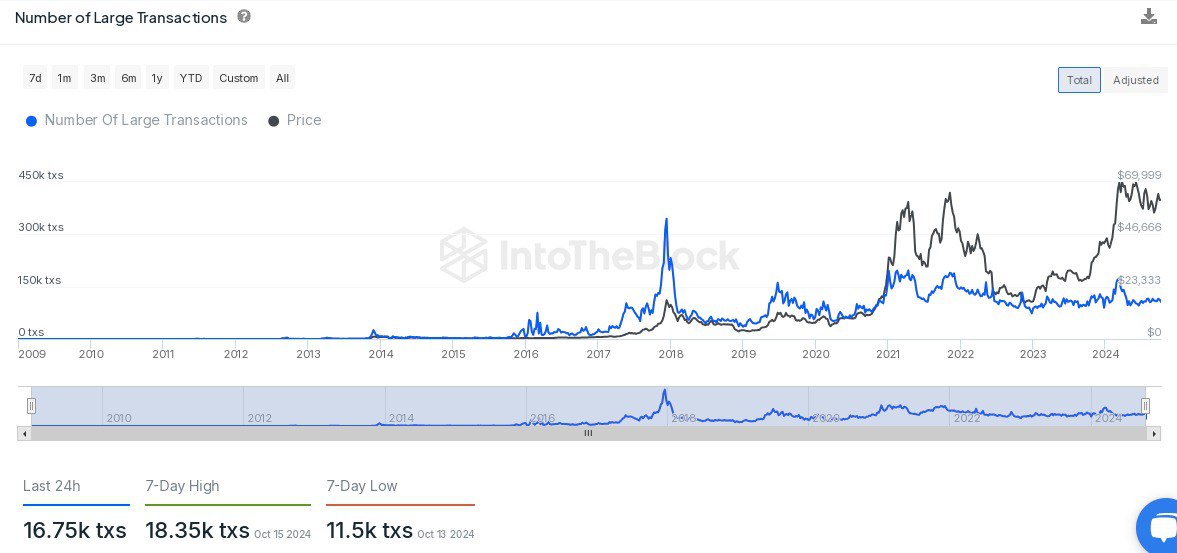

Whale transactions and short-term price outlook

In the last day, there has been significant whale activity, with approximately 16,750 large transactions being registered. Although this falls slightly short of the 7-day peak of 18,350 transactions, the current number still surpasses the recent low of 11,500 transactions significantly.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

The continuous stream of significant trades suggests that ‘whales’ are currently engaged in trading activities. Such activity might influence price fluctuations in the near future.

When Bitcoin inches closer to its all-time high, the confluence of escalating futures open interest, massive whale purchases, and heightened network activity suggests the likelihood of a substantial price surge – a prospect that has me feeling pretty bullish about my crypto investments.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

2024-10-19 00:40