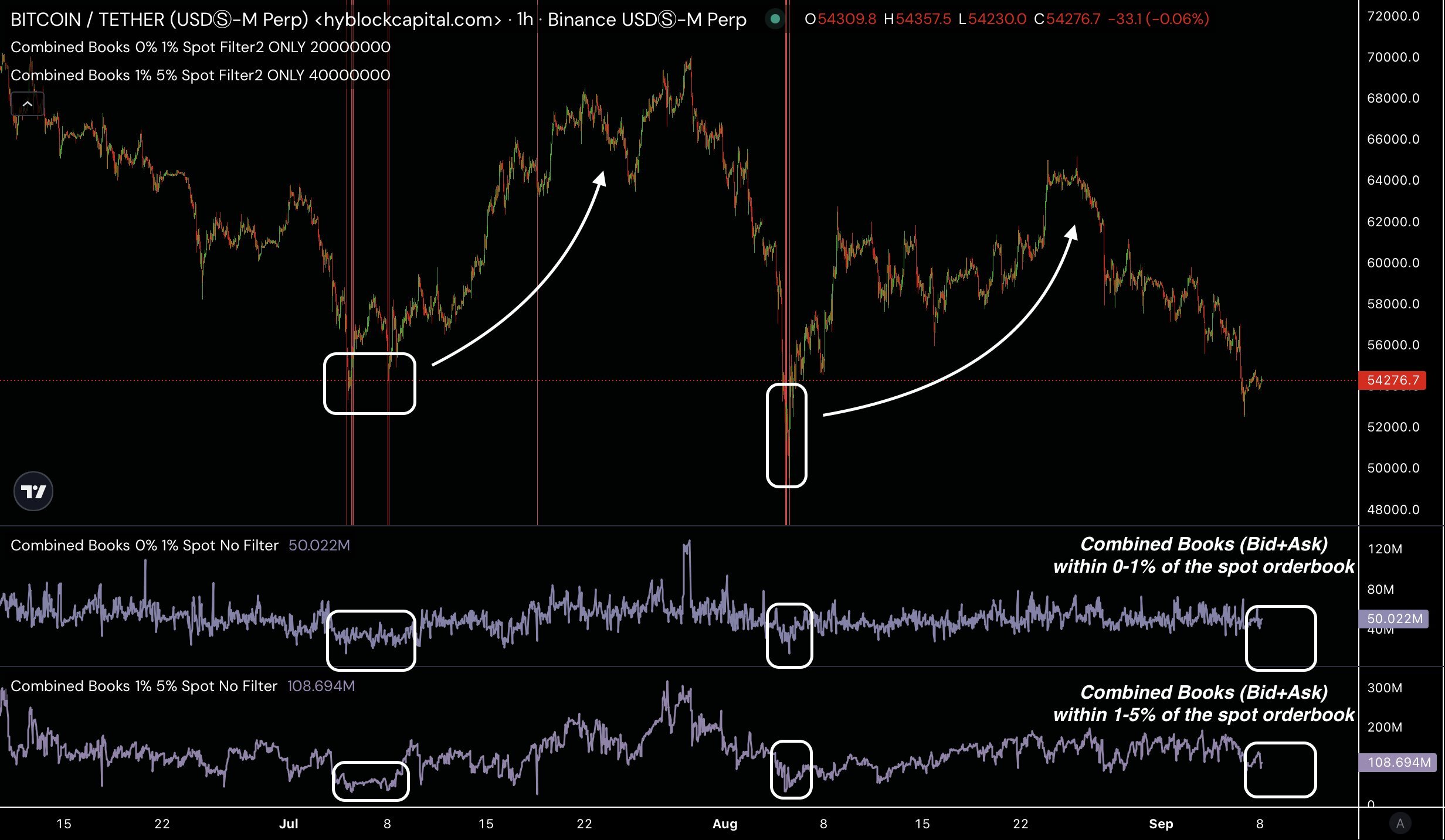

- Bitcoin price action showed low orderbook depth.

- Market indicators say the way is up.

As a seasoned crypto investor with a knapsack full of lessons learned from market cycles past, I find myself optimistically eyeing Bitcoin’s current situation. The low orderbook depth at key levels and Bitcoin’s recent bounce from the 0.786 Fibonacci level have me keeping a keen watch on Q4 2024 for potential price reversals.

Over the past few days, I’ve observed a substantial decline in the value of Bitcoin [BTC], mirroring the trend seen across most cryptocurrencies. This dip appears to be a direct consequence of the market crash that occurred on the 5th of August.

Regardless of a momentary surge that took Bitcoin up to $60K, it encountered significant opposition and swiftly dropped back down to $54K.

On the one-hour chart, Bitcoin’s price movements indicated relatively shallow order book levels at 0-1% and 1-5%. In the past, such shallow order books have frequently marked the end of a rally, leading to a subsequent bullish trend.

As a crypto investor, I find it essential to keep a close eye on the order books in Q4 2024 as they might provide valuable insights into potential price reversals that could impact future market movements.

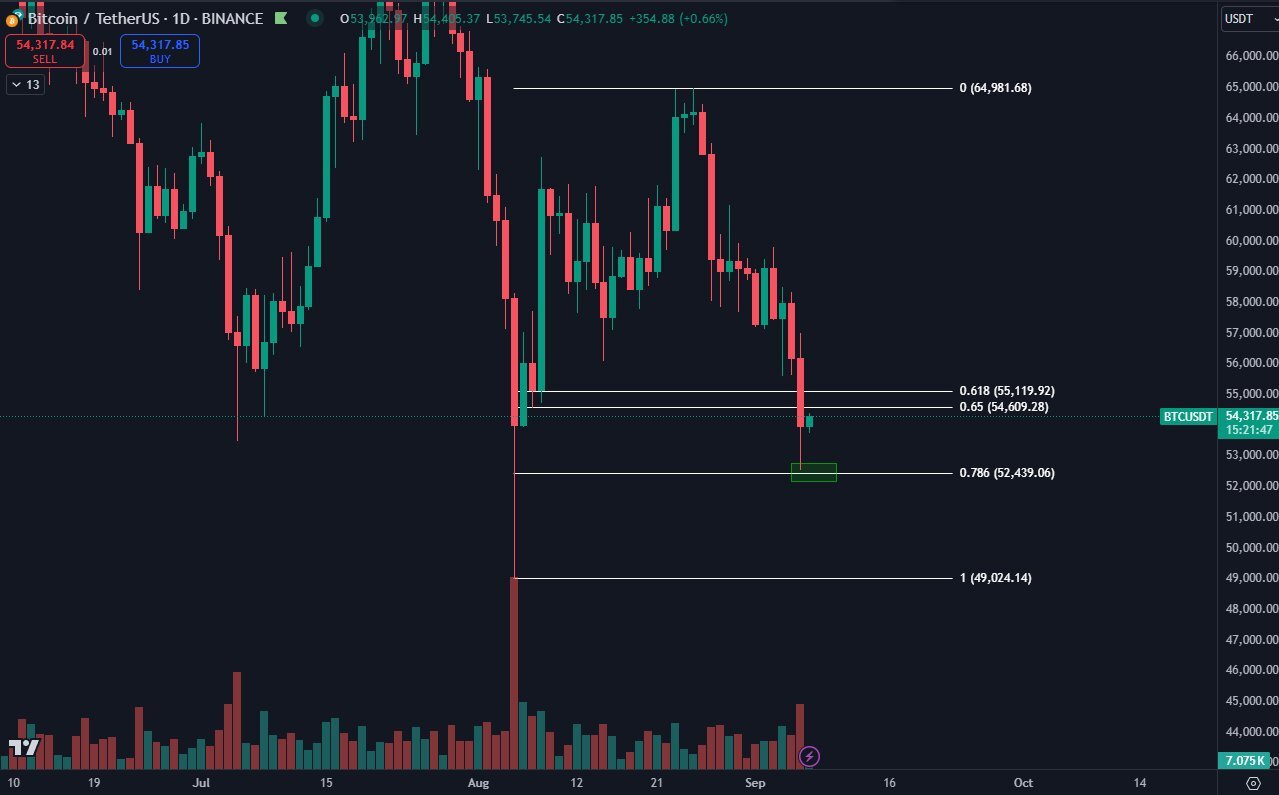

BTC Fibonacci levels

By examining Bitcoin’s price fluctuations, it didn’t adhere to the 0.618 Fibonacci mark, but it did rebound from the 0.786 level – a Fibonacci retracement level that has proven particularly dependable in 2021.

At present, this level might be the final opportunity for a drop that could lead to a lower bottom. If accompanied by shallow order book depth, it may suggest a possible rebound.

If Bitcoin tends to follow historical trends, the significant gap left after the Japanese stock market plummet (known as a ‘wick’) might prompt a rebound, potentially causing the Bitcoin price to rise further.

However, if the pattern fails, BTC may decline further before seeing a rebound.

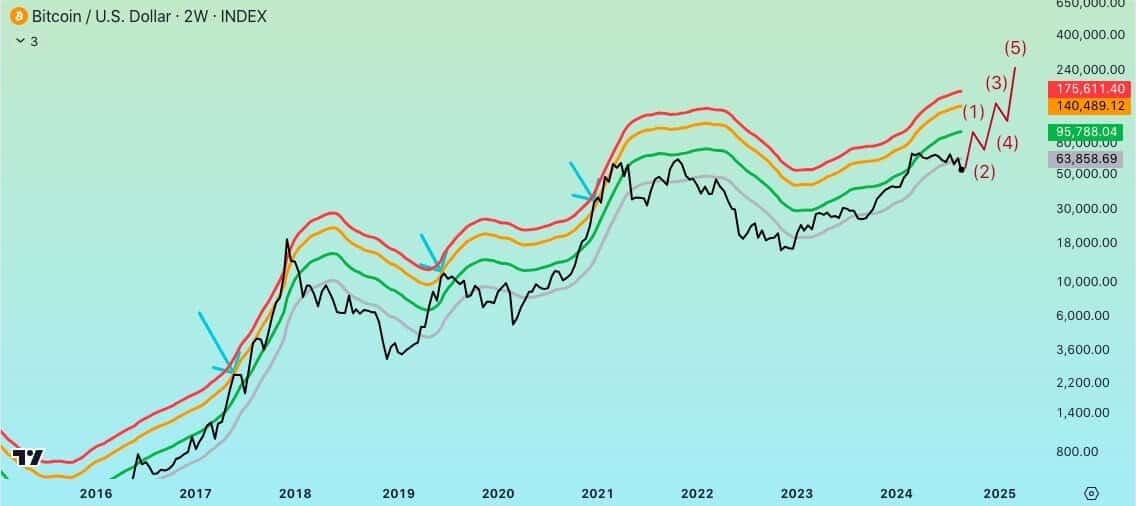

Bitcoin’s Mayers band

According to Mayer’s Band analysis, there are still further revelations about this ongoing Bitcoin bull market. This analysis predicts that the price could reach up to $95,000, but even at this level, it wouldn’t necessarily mean the end of the current cycle.

It’s feasible to aim for a future goal of $140,000. For those who trade over the long term, it might be prudent to avoid short-term graphs until Bitcoin hits a fresh record high.

It seems that this Bitcoin cycle might last longer and grow larger than past ones, possibly suggesting there may be even more expansion to come.

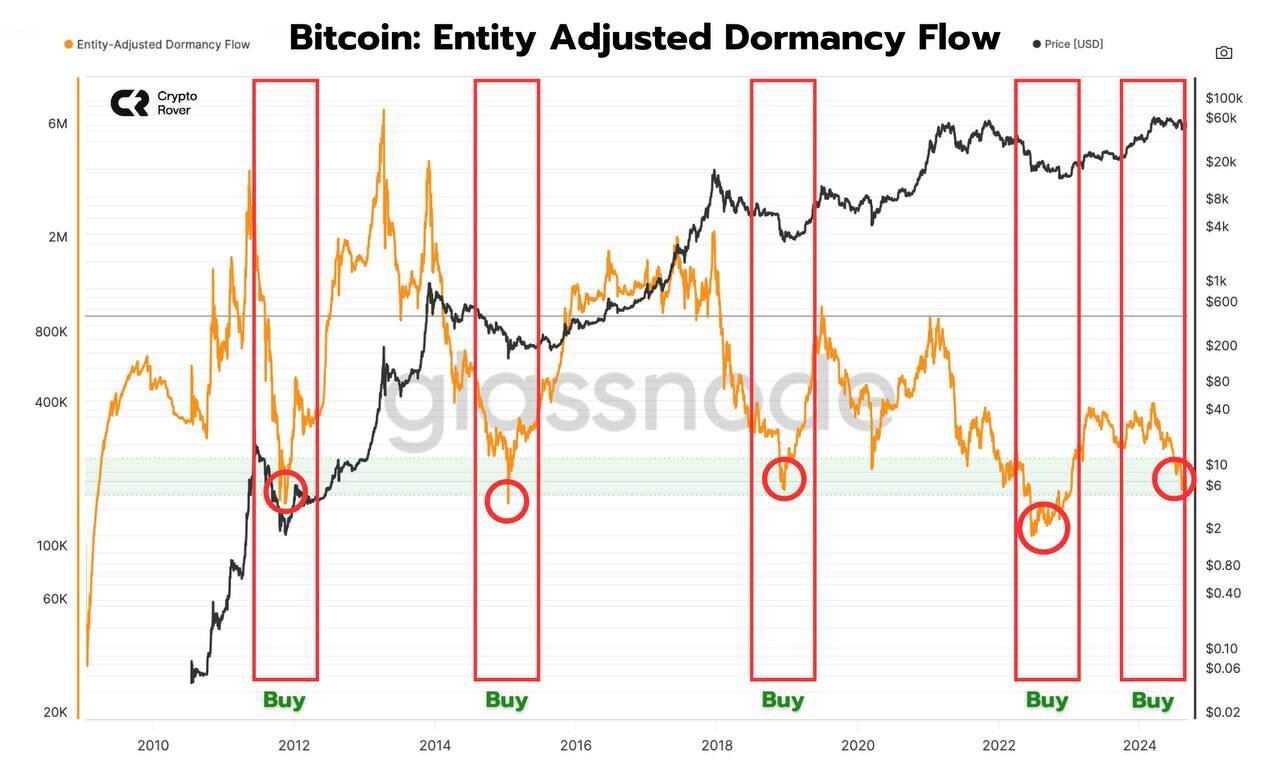

Bitcoin adjusted dormancy flow

An additional significant factor to consider is the Bitcoin-adjusted Dormancy Flow, presently standing at approximately $10. It’s worth noting that historically, the price of Bitcoin has usually rebounded from such points.

As a researcher, I find myself reinforcing my belief that Bitcoin might experience an upward price correction soon, given the shallow orderbook depth I’m observing.

As I delve deeper into the analysis of Bitcoin’s price trends, there’s a plausible scenario where Bitcoin could experience a temporary dip down to around $50,000. If this happens, it might pave the way for a substantial upward surge that could surpass its previous all-time high.

Bitcoin whale activity increasing

To wrap up, we’re seeing a surge in whale activity as they’ve been boosting their long positions in Bitcoin, usually with a moderate level of borrowed funds, ranging from 1.2 times to 3 times the initial investment.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Instead of relying on their emotions like typical retail traders, whales employ algorithms for a method known as Dollar Cost Averaging (DCA), which allows them to gradually invest in low-leverage long positions as the price falls. This way, they can sidestep impulsive decision-making.

By strategically buying Bitcoin during market dips, these large-scale investors (Bitcoin whales) might trigger an upward trend in the BTC price, potentially pushing it towards unprecedented highs. This could be a precursor to a significant price spike in the future.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-09-08 19:04