-

Bitcoin’s price appreciated by more than 4% in the last 24 hours

Several metrics hinted that BTC was overbought on the charts

As a seasoned crypto analyst with years of experience observing and interpreting market trends, I find Bitcoin’s recent price surge of over 4% in the last 24 hours to be quite intriguing. However, I remain cautiously optimistic as several metrics suggest that BTC might have been overbought on the charts.

Last week, I witnessed Bitcoin (BTC) taking the lead in the crypto market’s bull run with a significant surge in its price. Yet, this was only part of the intriguing news. Data emerged revealing an additional update that could potentially fuel another price increase.

As a researcher, I cannot definitively conclude anything based on the current data, as there appears to be conflicting evidence.

Bitcoin’s market dilemma

In the past week, Bitcoin’s price experienced a significant increase of more than 14 percent. This upward trend continued within the last 24 hours as well, with Bitcoin’s value jumping by approximately 4% at that time. Currently, the cryptocurrency is being traded at $66,616.52 and boasts a market capitalization exceeding $1.3 trillion.

As a seasoned crypto analyst with years of experience in the dynamic and ever-evolving world of cryptocurrencies, I have witnessed numerous price movements and trends. Recently, I was thrilled to see Ali, a respected figure in our community, share some exciting news via a tweet. According to his analysis, Bitcoin (BTC) has breached yet another resistance level. Based on my extensive experience and knowledge of market behavior, this bullish development could potentially signal that BTC’s price is poised for further growth in the coming days. This trend aligns with my belief that crypto markets can be unpredictable but also rewarding for those who stay informed and vigilant.

Yet, several factors appeared to be going against Bitcoin (BTC). For example, the TD sequential indicator signaled a sell opportunity based on its reading of BTC’s daily price chart, according to a recent tweet by Ali.

Should that be accurate, Bitcoin’s price surge could be nearing its conclusion. However, the tweet further noted that if Bitcoin can maintain its upward trend and surpass the $67,500 threshold, then the sell warning would be called off.

Where is BTC heading?

As a researcher examining the unclear data sets related to cryptocurrencies, I decided to delve deeper into Bitcoin’s metrics in order to gain a clearer perspective on potential future developments.

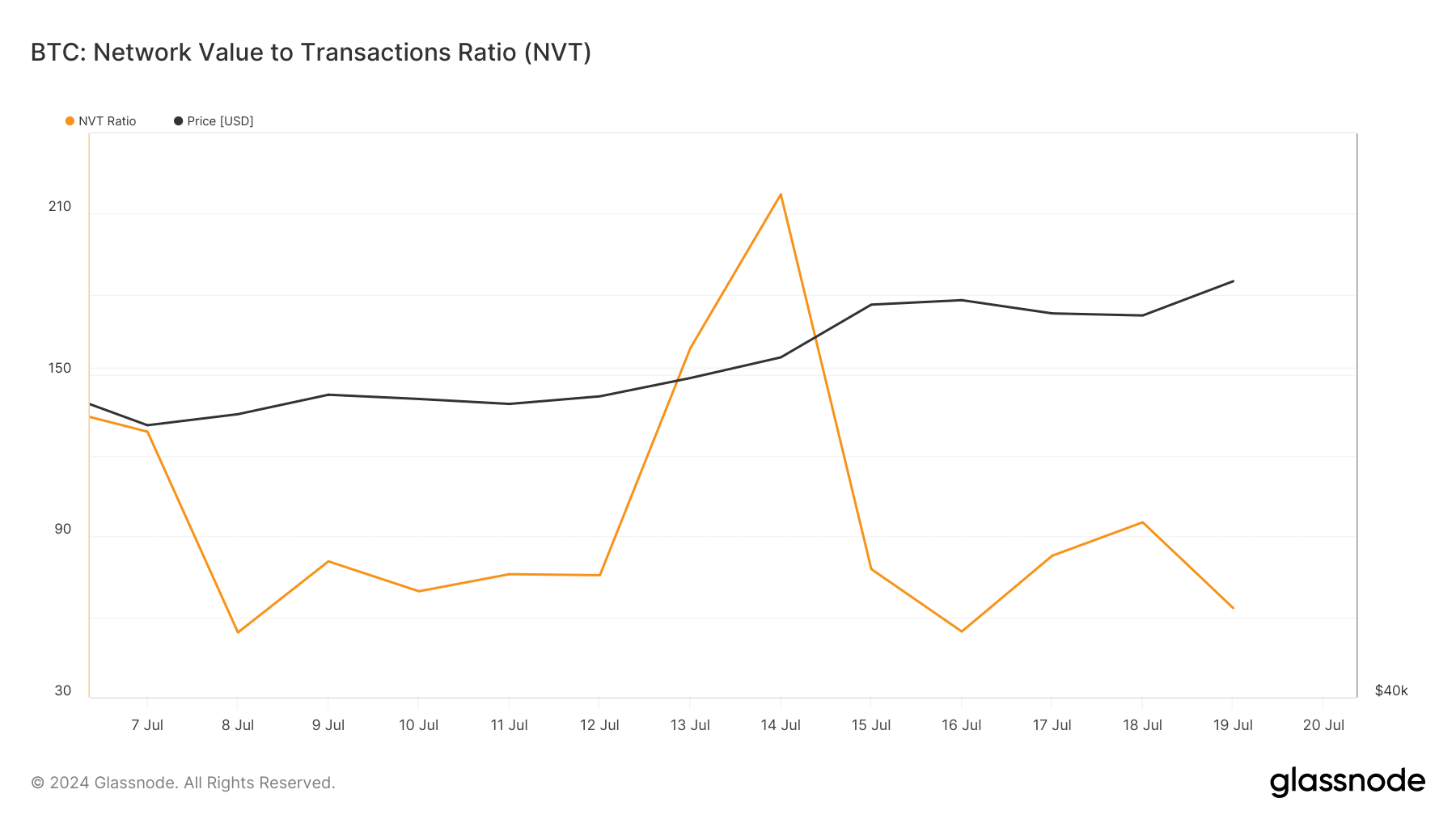

Based on Glassnode’s analysis, Bitcoin’s NVT (Network Value to Transacted Value) ratio has decreased. Historically, a decrease in this ratio indicates that the asset may be underpriced, potentially leading to price increases in the future.

Further examination of CryptoQuant’s data unveiled several other bullish indicators. For example, the net deposit amount of Bitcoin into exchanges was below the seven-day average – an indication of strong buying demand. Additionally, the binary CDD (Coin Days Destroyed) showed that long-term holders moved their coins less frequently than usual during the last week. This suggests that they are holding onto their coins with intent.

In addition, some other measuring tools raised red flags. For instance, Bitcoin’s Relative Strength Index (RSI) and Stochastic oscillator showed signs of being overbought.

The selling pressure could increase imminently, potentially halting Bitcoin’s upward trend on the price charts.

Currently, the crypto fear and greed index stands at 69%. This figure signifies that the market is presently experiencing a “greed” phase. Historically, when this indicator reaches such levels, the probability of a price adjustment becomes significantly elevated.

Read Bitcoin’s [BTC] Price Prediction 2024-25

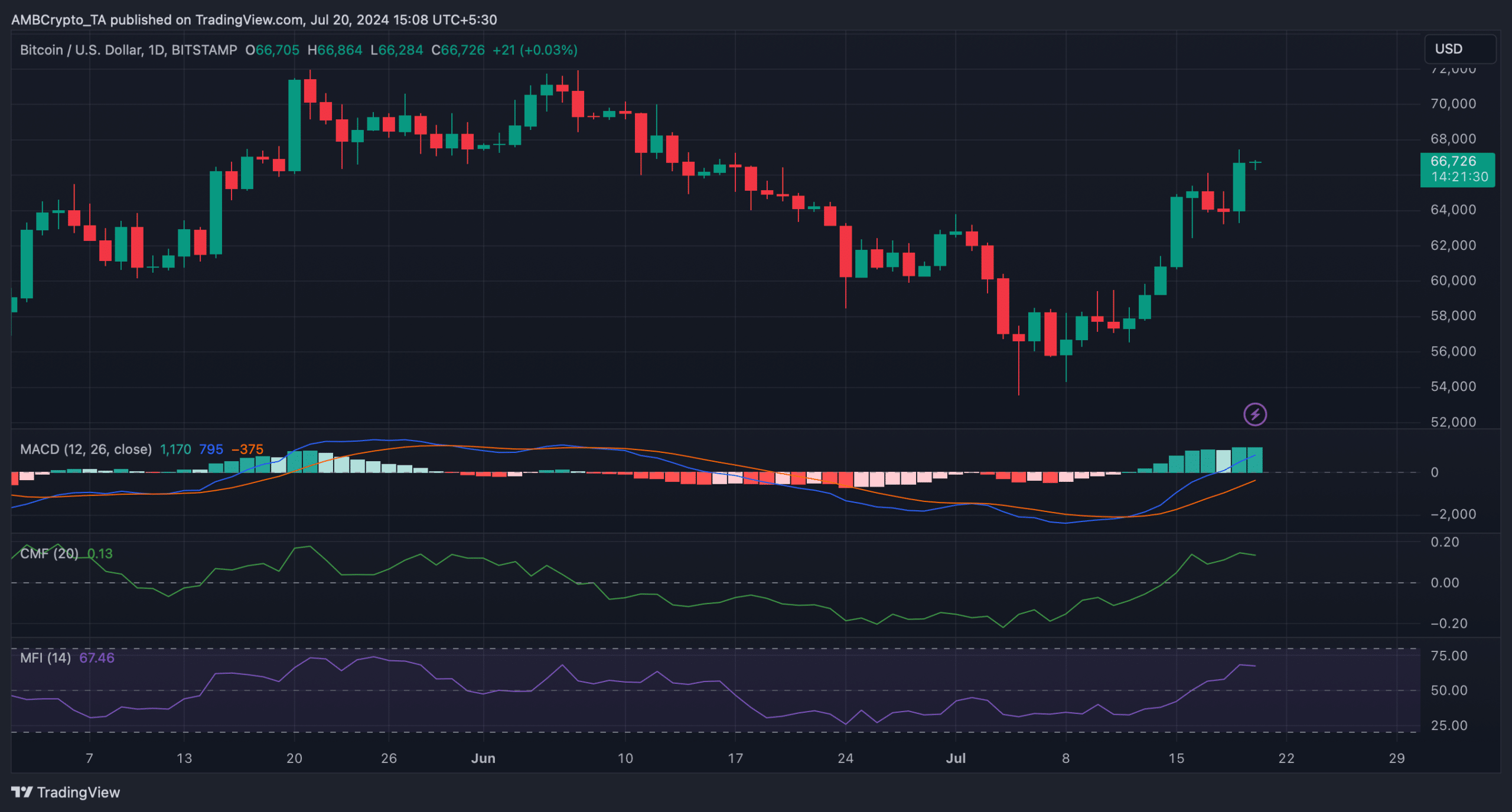

After examining Bitcoin’s daily chart, we noticed that the Money Flow Index (MFI) and Chaikin Money Flow (CMF) indicators had decreased. This could be a sign that a price correction is imminent.

On the contrary, the MACD supported the buyers as it displayed a bullish upper hand.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-07-21 03:04