- BTC has declined by 2.43% over the past 24 hours, at press time.

- Bitcoin’s leveraged positions declined amidst economic uncertainty in the U.S.

The crypto market, like an old house creaking in the wind, trembled once more under the weight of uncertainty. Bitcoin [BTC], battered by the storms of U.S. economic ambiguity, found itself sinking to depths not seen since November 2024.

Oh, it fought valiantly. Rising from its lowest trench of $76k, Bitcoin staggered back to $80,338 like a weary boxer. But alas, this was still a tumble of 2.43% in 24 hours, a sign that the once-mighty king of crypto is catching its breath—or throwing in the towel.

Now, the air is thick with an uneasy dread. Investors, like farmers eyeing a storm on the horizon, feel the chill of uncertainty. Fear, that old beast, prowls the risk markets yet again. 😟

Bitcoin’s leveraged positions decline

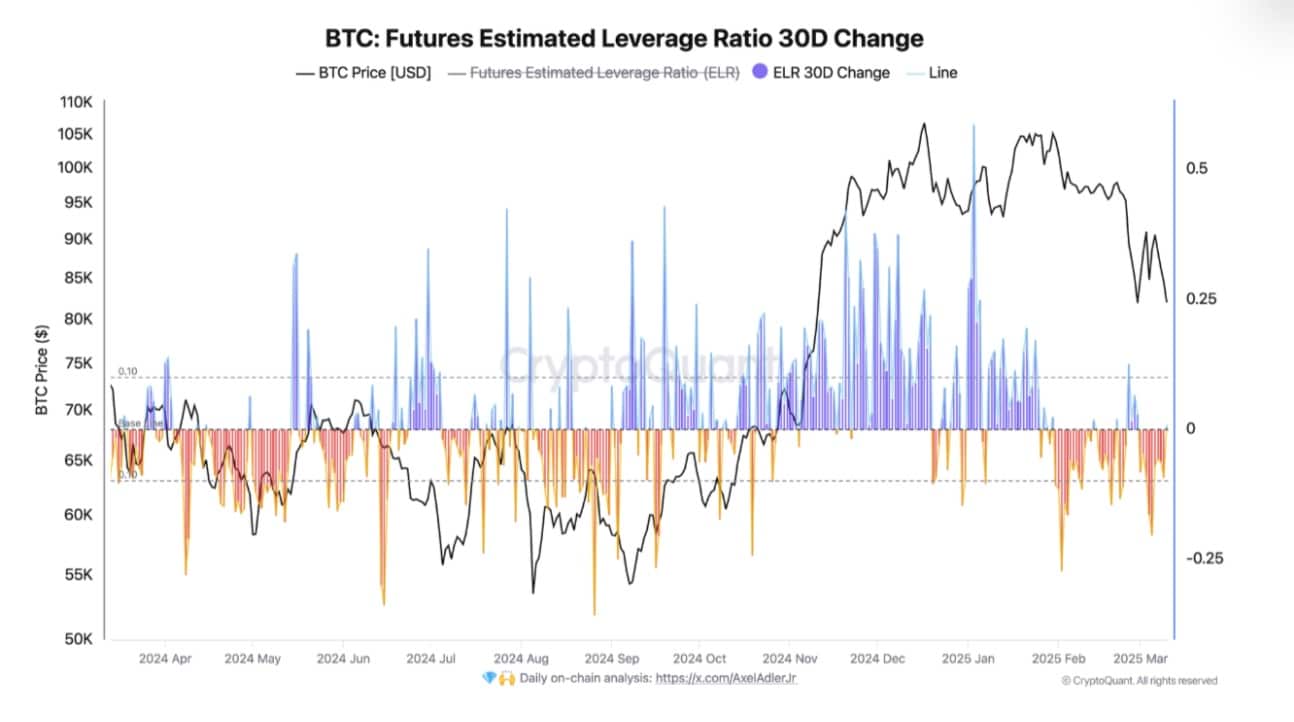

Folks over at CryptoQuant shook their heads knowingly. Since January 29th, the Futures Estimated Leverage Ratio has skulked deep in negative territory, as though traders were tiptoeing away from risk like kids sneaking out of the back door.

At press time, the Estimated Leverage Ratio (ELR) was hovering at -0.13, whispering the tale of traders abandoning speculative dreams and returning to the land of caution. It’s a bit like watching a chef whisk ingredients only to suddenly stop, unsure if the batter is worth baking. 🍰 Or in this case, burning.

Political theater and economic unrest in the U.S. have further backed traders into a corner. The shapeshifting policy agenda of one Donald J. Trump continues to cloud the skies, making the risk markets as jittery as a long-tailed cat in a room full of rocking chairs.

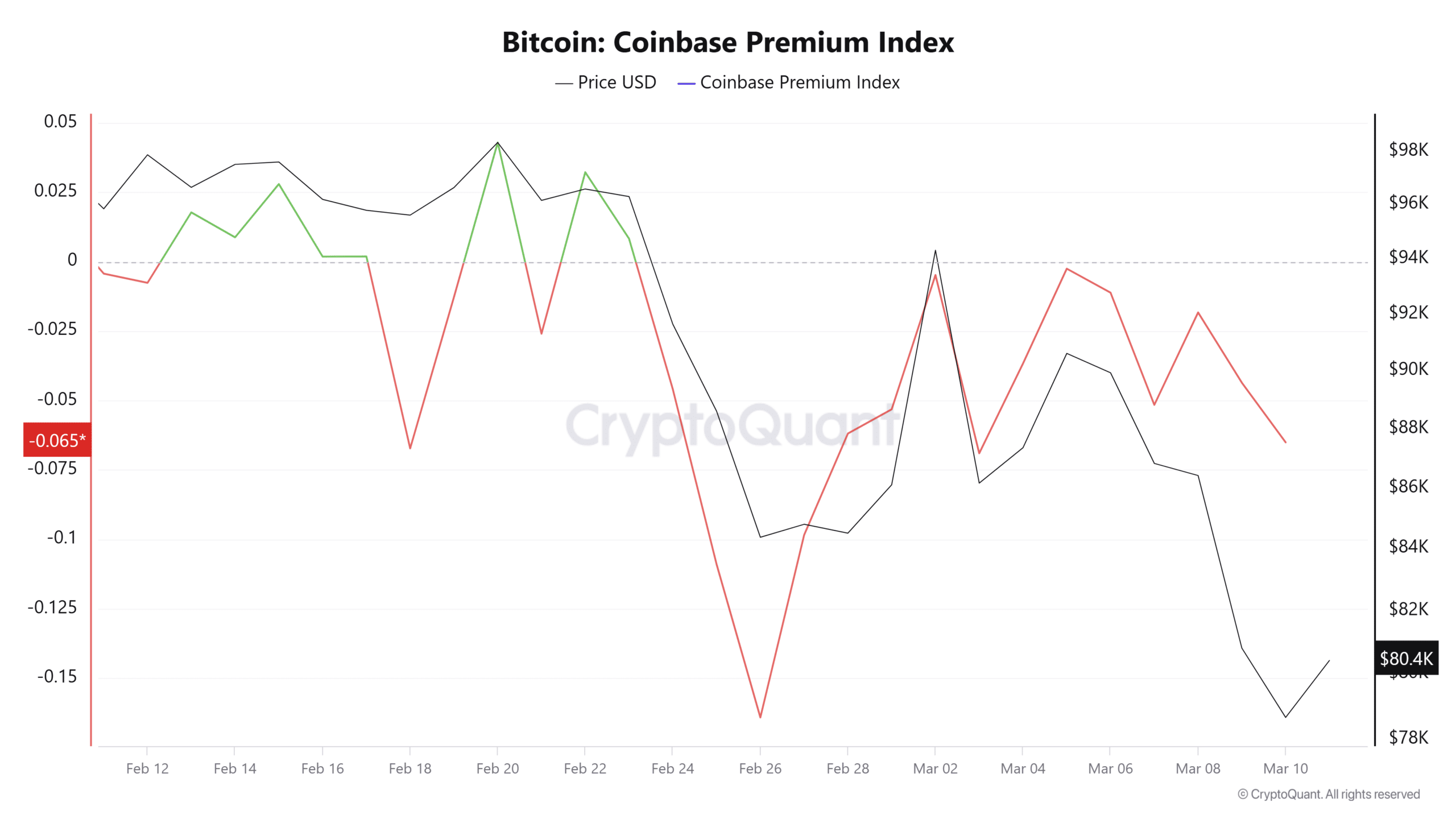

Even the Coinbase Premium Index—a kind of popularity contest for U.S. investors—remained negative for two dreary weeks. And when that premium goes south, it often spells trouble. Traders dump their dreams faster than bridezillas dumping ex-fiancés, with institutional buyers nowhere in sight.

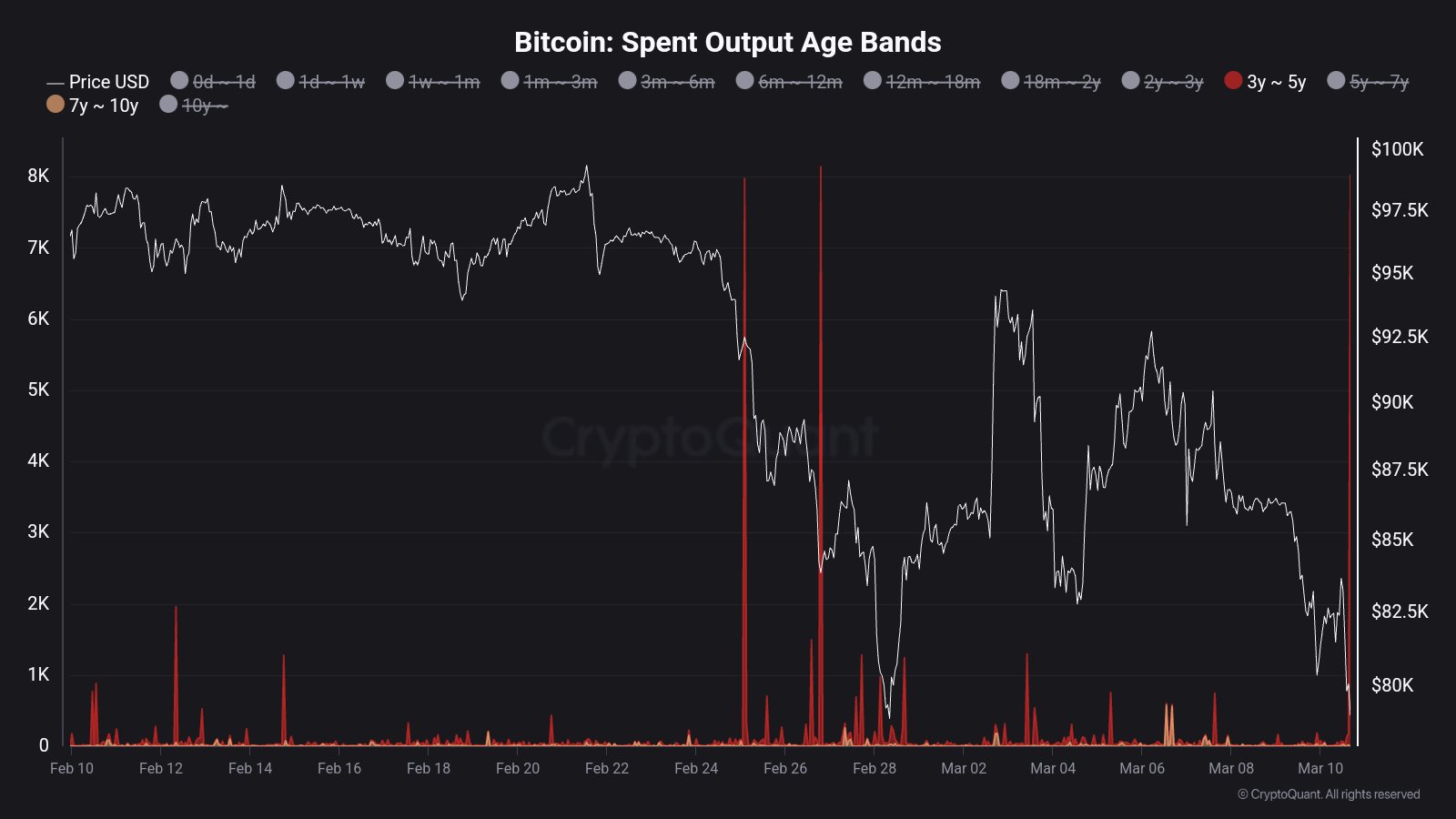

“Dormant coins don’t wake up for nothing,” the old traders whispered at the taverns. Sure enough, 8,000 BTC, aged three to five years, stirred from their slumber. And when these ancient coins turn over in their beds, the market shivers at the thought of a sell-off avalanche. Have mercy. 🧟♂️

If these vintage BTC make their way to exchanges, brace yourself. Historically, such movements bring sell pressure so heavy it could crush optimism like a tin can under a steamroller.

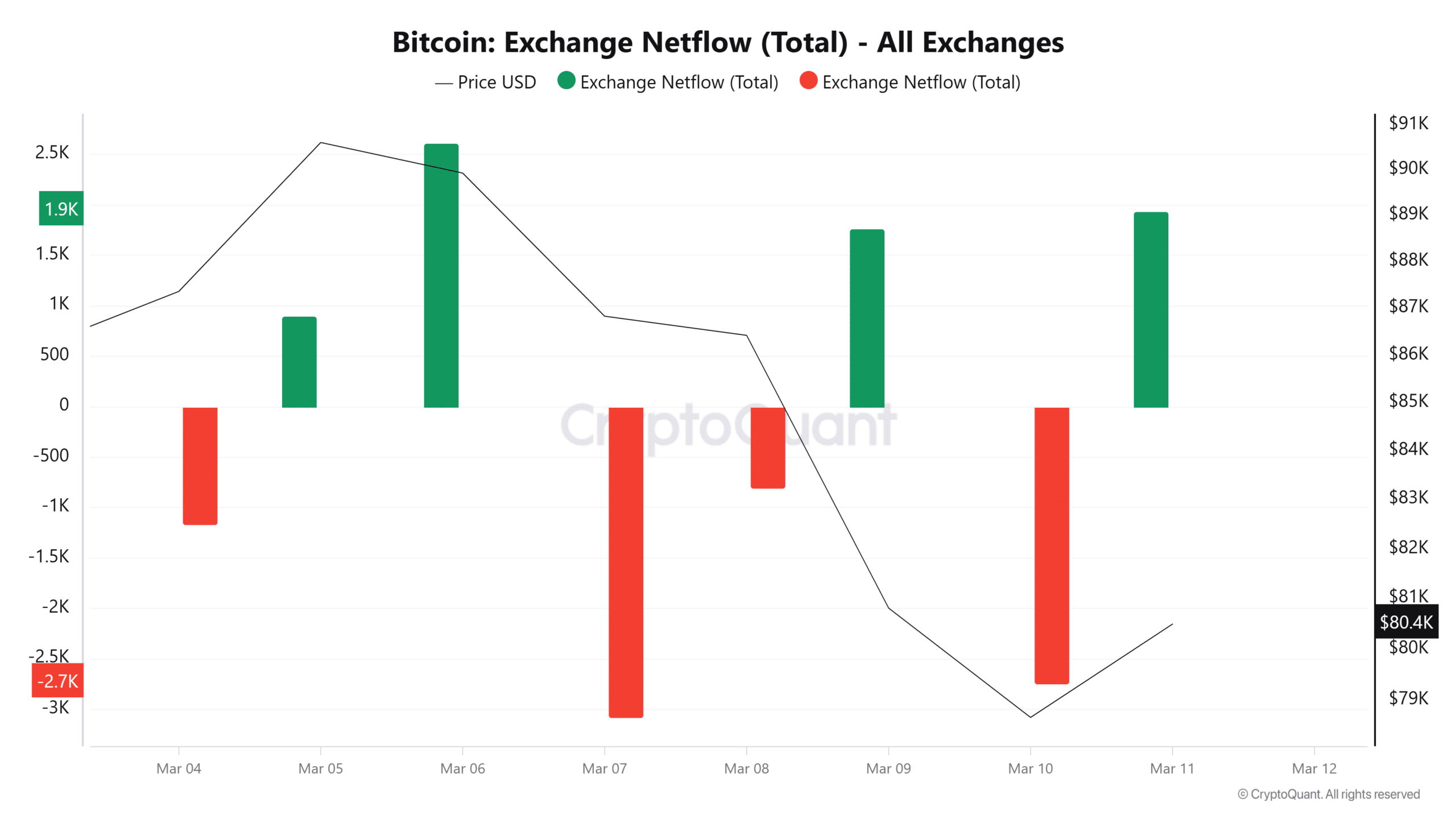

Lo, the Exchange Netflow speaks with unforgiving clarity. Over 50k BTC poured into exchanges, tilting the scales heavily towards inflow. That’s a lot of coins changing hands—like someone yelling “fire!” at a crowded theater. Panic is contagious, and the bear market roars louder than ever. 🐻

What next for BTC

With traders fleeing leveraged positions quicker than a rat fearing a sinking ship, the bearish sentiment dominates. Bitcoin, tethered to the unpredictable beast of the U.S. economy, finds itself at the mercy of political currents and macroeconomic waves.

If current trends persist, don’t be surprised to see BTC sliding further, possibly down to $77,592. But hey, if the U.S. government ever decides to calm the economic waters, Bitcoin might just find the strength to climb back to $84k—and bring some bullish grins to traders’ faces. Until then, keep your helmets on and your hopes guarded. 🌪️

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2025-03-11 19:07