- Bitcoin’s Options OI saw a sharp decline, signaling reduced speculative activity and heightened trader caution.

- Low trading volumes and subdued price action pointed to a consolidation phase for the crypto market.

There was a change in investor feelings towards the cryptocurrency market, as the number of active Bitcoin options contracts (Open Interest) reached an all-time low.

This progression showed a general shift towards cautiousness in the market, stemming from economic uncertainties at a global level and the ups and downs in pricing.

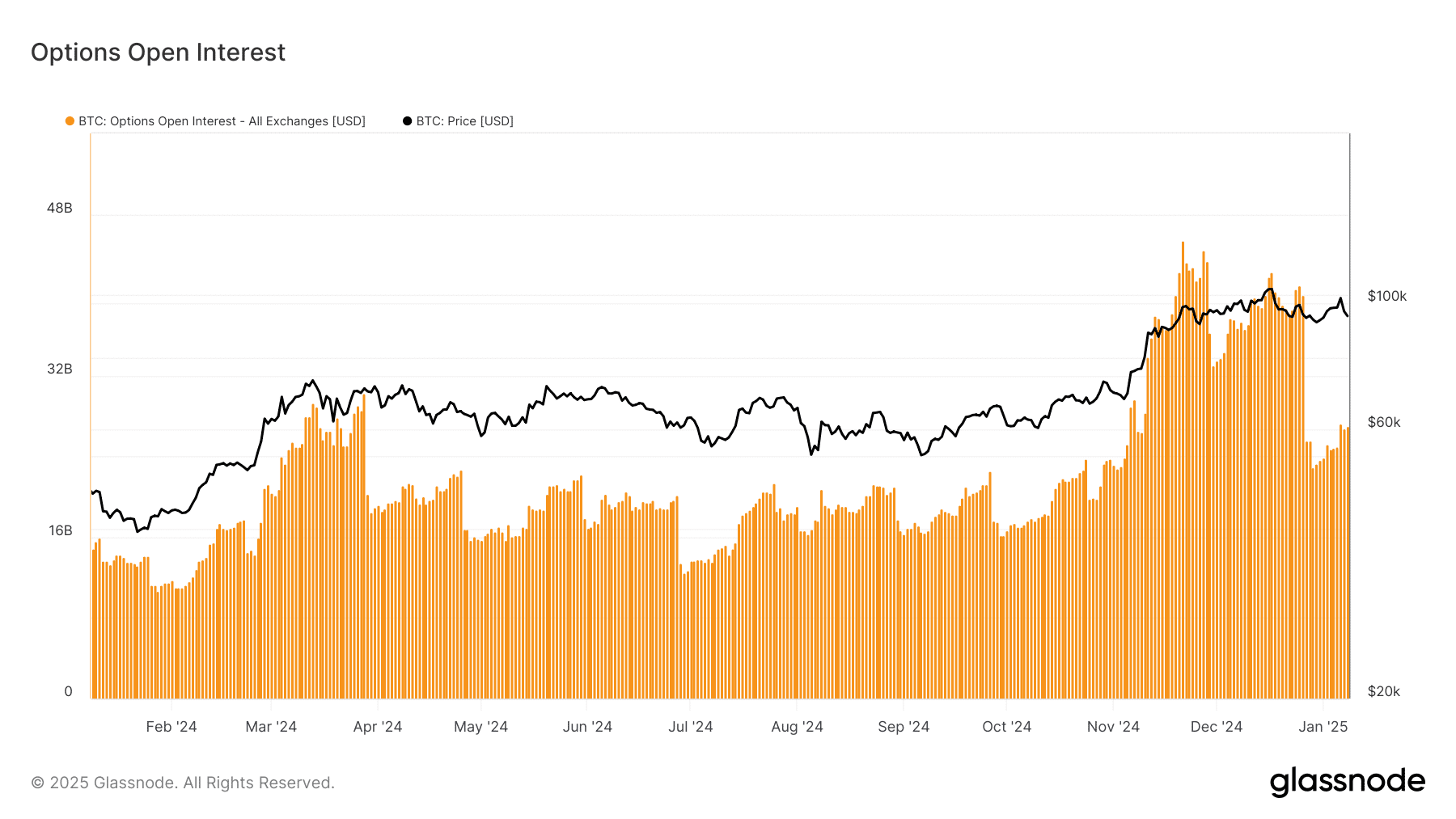

The attached Options OI and BTC price charts highlighted this significant shift in market dynamics.

Historic drop in Bitcoin Options OI

Looking at the chart for Open Interest on options, we can see a dramatic drop, as the numbers have decreased significantly from their previous peaks. This suggests that traders are currently adopting a more cautious strategy.

Historically, OI serves as a barometer of speculative activity and overall market confidence.

According to AMBCrypto’s findings, the Open Interest (OI) has significantly decreased from approximately $40 billion to its current level around $27 billion.

The recent decline in the market suggests that investors are pulling back from high-risk investments, possibly due to international economic stresses and concerns about continued interest rate increases by the Federal Reserve.

The drop in numbers aligns with a wider decrease in trading activities, hinting at insufficient energy to uphold aggressive wagers.

This change might initiate a period of market stabilization, during which investors’ risk tolerance stays low, and they tend to take a cautious “watch and learn” approach.

Bitcoin price reflects caution

Bitcoin’s price action mirrors the cautious sentiment evident in the derivatives market.

Currently valued at $93,316, Bitcoin dipped beneath its 50-day moving average ($97,654), suggesting a potential shift towards bearish trends over the near future.

Meanwhile, the 200-day moving average at $72,962 acted as a critical long-term support level.

As a crypto investor, I noticed that even at 2.64K, the trading volume stayed fairly low, underscoring the diminished trading activity and uncertainty amongst market players about the market’s direction.

This suggests a cautious approach due to economic uncertainties from outside sources, such as robust job market statistics and possible tightening by the Federal Reserve.

From my perspective as a researcher, I’ve been exploring the potential future trajectory of Bitcoin using Ichimoku Cloud analysis and moving averages. It appears that the coming period might see Bitcoin maintaining its range within approximately $90,000 to $95,000.

Violating these thresholds might lead to a rapid decline in prices if the overall market outlook is negative, or it may spark a rebound if the broader market’s mood is optimistic.

Market implications and broader trends

A drop in Bitcoin Options Open Interest (OI) indicates that the market’s momentum is changing, as traders and investors are becoming more cautious and adopting a more reserved strategy.

As a crypto investor, I’ve noticed that the market seems to be slowing down lately. The decrease in trading volumes and muted price fluctuations suggest that there aren’t many strong factors driving substantial market shifts at the moment.

Right now, there’s a lot of care being taken, but this cautious approach might lead to more stability in the future. By decreasing our exposure to risky situations, we minimize the chances of sudden and drastic fluctuations.

Currently, we are proceeding with caution, but this careful method could lay the foundation for increased stability down the line. By limiting our use of riskier strategies, we can lessen the likelihood of severe ups and downs.

Yet, the market continues to be easily influenced by outside factors like economic statistics and policy changes, which might spark renewed speculation or further prolong the period of consolidation.

The market is still very responsive to external stimuli such as macroeconomic indicators and regulatory news. These factors could either fuel more speculative activity or extend the phase of consolidation.

A market in transition

The significant decrease in open interest for Bitcoin Options indicates a shift in investor attitudes within the cryptocurrency market.

Read Bitcoin’s [BTC] Price Prediction 2025-26

Instead of letting enthusiasm cloud their judgment, traders will probably zero in on critical points where prices might bounce back (support levels) or halt (resistance levels), all the while keeping a close eye on international economic signals for guidance.

It’s yet unclear if this shift will result in increased market stability or pave the way for further turbulence.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2025-01-10 07:04