- Bitcoin rebounded to $96k after dropping to $89k, with limited whale activity impacting momentum

- Key metrics, including open interest and whale transactions, underlines mixed signals for Bitcoin’s near-term outlook

2022 started off favorably for Bitcoin (BTC), reaching a peak of approximately $102,000 on January 7th. Yet, the initial surge in value didn’t last long as the digital currency experienced significant drops shortly afterward, dipping below the $100,000 mark once more.

Currently, when I’m writing this, Bitcoin was valued at approximately $96,556. This is a rebound from its dip to around $89,000 earlier in the week, which caused some worry among investors. Some analysts are examining the fundamental reasons behind this price shift.

Indeed, an analyst from CryptoQuant observed a pattern called “stop hunting,” which involves temporary drops in price that breach crucial support levels, only to bounce back. This behavior has sparked debate over whether Bitcoin can maintain a trend reversal without major market participants getting involved.

Whale activity and market sentiment

According to CryptoQuant’s analysis, the lack of activity from large Bitcoin holders, or “whales,” may be a key reason for Bitcoin’s modest recovery. The data from the Coinbase Premium Gap (CPG) suggests that these whale entities have been selling Bitcoin in large amounts, but there has been no noticeable buying activity to offset this selling pressure.

Normally, when whales (large investors) buy Bitcoin during a dip, it causes increased market volatility. But in its recent price fluctuations, that didn’t seem to happen.

The analyst underscored the significance of transactions happening on significant trading platforms, notably Binance, since the actions of ‘whales’ frequently leave discernible signs in the buying ratio of the market.

In this specific situation, there was no sign of significant purchasing by ‘Binance whales’, implying that big investors are being cautious. Although the daily chart suggested a possible change in trend, the absence of activity from large investors leaves us questioning the immediate direction Bitcoin might take.

Bitcoin’s metrics flash mixed signals

Apart from tracking whale behavior, other Bitcoin indicators also provided valuable insights about its market trends.

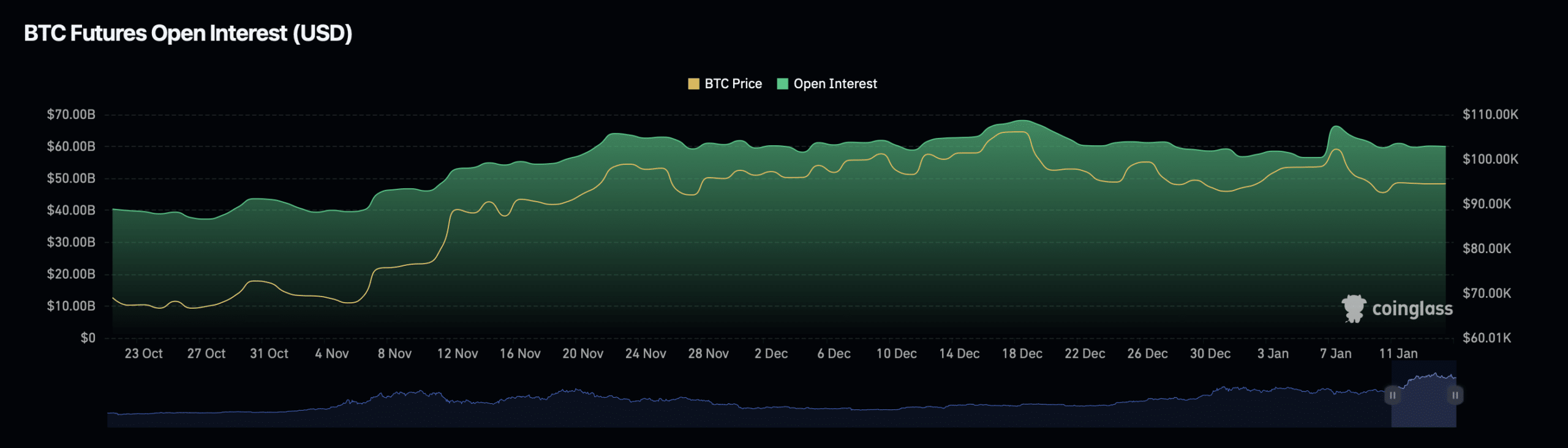

As a researcher, I observed an increase of 2.09% in open interest, which refers to the total number of outstanding derivative contracts, within the past 24 hours. The current figure now stands at approximately $61.88 billion.

This trek through the Open Interest landscape suggests a growing interest in trading and might hint at increased anticipation regarding potential fluctuations in Bitcoin’s future costs. Furthermore, the Open Interest volume significantly increased by approximately 213.18%, demonstrating an uptick in market participation.

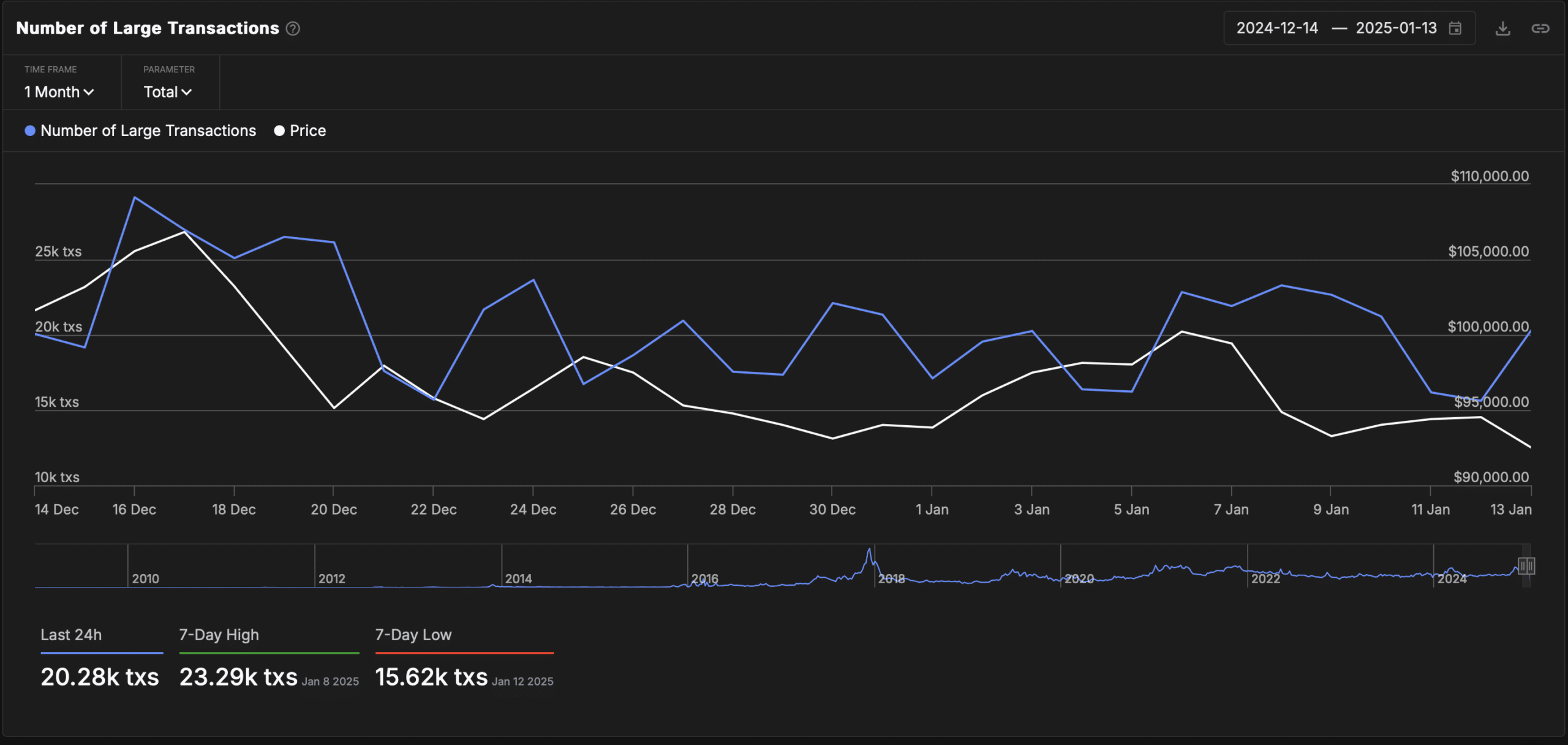

Recently, IntoTheBlock’s data has shown changes in whale activity, which refers to transfers valued over $100,000. In the past month, these transactions have decreased significantly, going from approximately 26,000 on December 16th to around 15,000 by January 12th.

On the contrary, there’s been a significant uptick – more than 20,000 transactions on the 13th of January alone. This surge in whale activity might suggest that big-time Bitcoin investors are showing renewed enthusiasm, which could impact market trends over the next few weeks.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-01-15 09:11