Bitcoin, that digital enigma of modern finance, took a nosedive below $75,000 faster than a wizard forgetting their spellbook. Asian and Pacific stock markets joined the party, shedding 6% in a single day. Why? Because the US decided to slap a 104% tariff on Chinese imports, because apparently, trade wars are easy to win. 🤷♂️

The sell-off wasn’t just a coincidence. It was the result of mounting fears that the world’s two largest economies—China and the US—might just derail the global economic recovery faster than a drunk troll on a unicycle. 🚴♂️

Stock Markets Bleed Worldwide and Bitcoin Follows

In Asia, Japan’s Nikkei 225 plummeted nearly 4% at the open, because why not? South Korea, Australia, and New Zealand also joined the fun, posting significant declines. 🎢

Australian stocks opened 2% lower, wiping out gains from the previous session. Hopes for a US-China trade resolution? Gone. Poof. Like a magician’s rabbit. 🐇

The S&P 500 plunged 1.6%, reversing an earlier 4.1% gain. The Dow Jones Industrial Average slipped 0.8%, and the tech-heavy Nasdaq dropped 2.1%. Because when the going gets tough, the tough get going… to the exit. 🚪

The sharp crypto correction triggered nearly $400 million in daily liquidations, led by leveraged long positions. Because nothing says “financial stability” like a market that can’t decide if it’s coming or going. 🤔

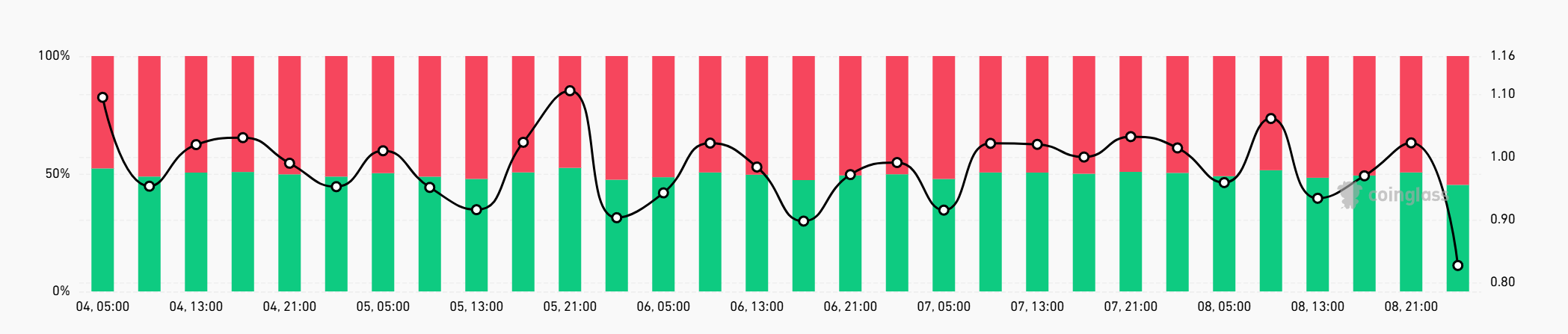

Notably, Bitcoin’s long-short ratio flipped for the first time in weeks, with short positions now accounting for 55% of open interest. A clear sign that bearish sentiment has overtaken the market, like a pack of wolves at a sheep convention. 🐺🐑

Investors are quickly de-risking across asset classes, bracing for further volatility as the trade dispute escalates. Because when the world’s two largest economies start throwing tariffs at each other, it’s time to buckle up. 🎢

Trump’s additional 104% tariffs on China and the lack of diplomatic progress have intensified uncertainty. Traders are seeking liquidity and shifting to defensive strategies, like a knight hiding behind a shield made of spreadsheets. 🛡️📊

With Bitcoin often seen as a barometer of macro risk appetite, its decline underscores the market’s growing unease. Because when the digital gold starts tarnishing, you know things are getting real. 💰

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2025-04-09 05:11