-

As the U.S. Dollar weakens, China looks to strengthen its Yuan currency.

Investor confidence grows steadily as BTC breaks out of micro channel.

As a seasoned analyst with over two decades of experience in global financial markets, I’ve seen my fair share of economic cycles and market shifts. The current situation, with the U.S. Dollar weakening and China actively stimulating its economy, presents an interesting conundrum.

The level of risk that investors face due to concerns about a recession is lessening, since the amount of liquidity in the cryptocurrency market continues to grow.

On platform X, previously known as Twitter, Alpha Extract reported that China is boosting its economy without causing a significant drop in the value of the Yuan compared to the US Dollar.

In simpler terms, the United States significantly influences the availability of funds or liquidity, particularly through continuous bond issuance. Consequently, if the value of the U.S. dollar weakens, it might trigger more liquidity from other central banks.

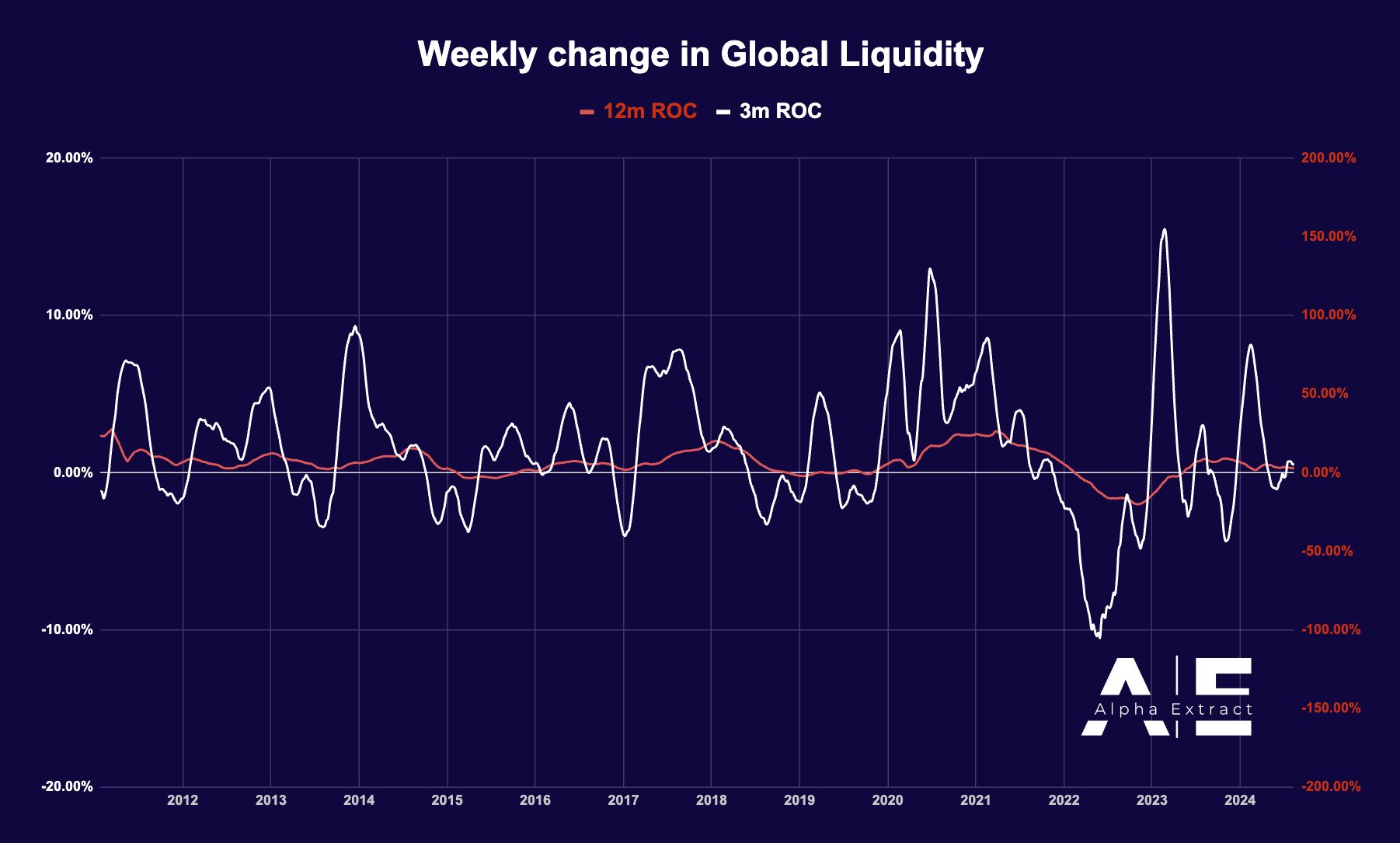

Last week, the Federal Reserve’s credit through its reserve bank decreased by $10 billion. However, an upward trend in collateral values resulted in a minor surge in the Global Liquidity Index (GLI), now standing at approximately $125.975 trillion, representing a 0.165% growth.

The Adjusted Economic Rate of Change (AE RoC) remained positive.

In the long term, other key indicators, along with the interaction between China’s economic stimulus and the decline of the U.S. dollar, may influence the price of Bitcoin [BTC].

During the recent market downturn, there was a substantial reduction in Bitcoin’s price on Coinbase, boosting investor trust due to this attractive opportunity.

However, it recovered quickly, closing with more than 23% gain from its week’s low.

Currently, there’s a higher price for Bitcoin (BTC) on Coinbase compared to other platforms, indicating a rise in optimistic investor attitudes among Americans and potential ETF-related buying activity.

This also signifies that BTC could rally as a result of China’s stimulus and a weakening USD.

Decoupling of BTC and altcoin market caps

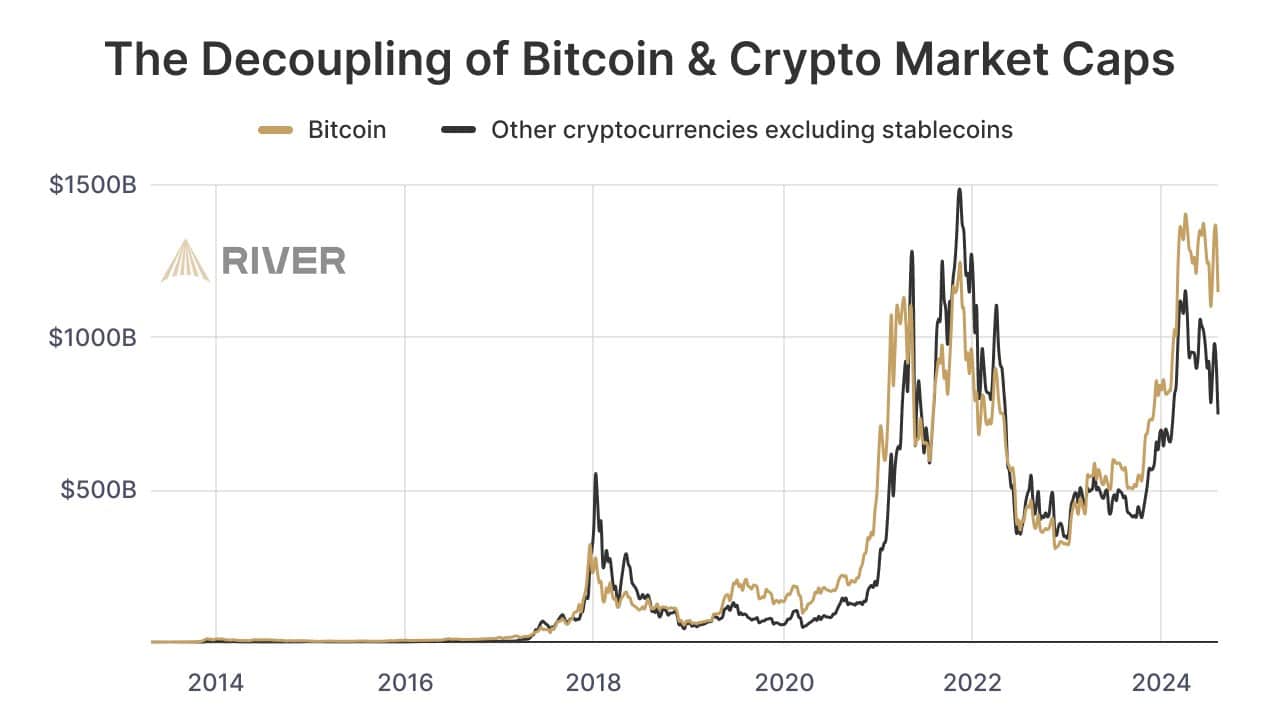

Three years back, I found myself investing in Bitcoin with a market capitalization approximately equivalent to $835 billion. Remarkably, the collective worth of other non-stablecoin cryptocurrencies mirrored that figure as well.

Today, Bitcoin’s market cap has risen 37% to $1.15 trillion, while other coins have dropped 11%.

As a seasoned investor with over two decades of experience under my belt, I’ve seen numerous market cycles come and go, from the dot-com bubble to the housing crash of 2008. In light of recent events, it seems that Bitcoin has once again proven its dominance in the crypto space, leaving me questioning the wisdom of those who blindly diversify their portfolios across multiple digital assets.

As China boosts its economy with stimulus measures and the US dollar weakens, there’s a possibility that Bitcoin may hit unprecedented record highs, underscoring its growing influence within financial markets.

Bitcoin breaks a micro downward trend

Bitcoin has broken out of its recent downward trend, and showing potential for a rally.

Should Bitcoin maintain its position above $58,000, there’s a possibility of it climbing higher towards $61,000, potentially causing short sellers to close their positions. It’s essential to keep an eye on how Bitcoin behaves around the $61,000 mark next.

With China’s economic stimulus and a potential decline in the value of the U.S. dollar, there is a strong possibility that Bitcoin may experience a substantial increase in the near future.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-08-14 10:47