- Bitcoin cooled off after its latest rally, but Futures demand soared to levels last seen over a year ago

- Market is now embracing caution amid growing levels of uncertainty over major event

As a seasoned researcher who has navigated through numerous market cycles and trends, I must admit that the current state of Bitcoin presents an intriguing conundrum. The recent dip in price after a brief rally seems to have left some investors scratching their heads. However, upon closer inspection, the soaring demand for Futures suggests a bullish sentiment among certain sectors, a trend not seen since last September.

Bitcoin’s recent surge sparked optimism about the cryptocurrency reaching unprecedented price peaks. However, after briefly touching $73,000, its value has retreated below $70,000, signaling that some investors are cashing out. Lately, there seems to be a sense of unease in the marketplace, hinting at potential uncertainty in November.

Could it be that Bitcoin whales are exerting strong purchasing power in the futures market, potentially leading to bulls reasserting control and preventing a significant downtrend?

Based on previous occurrences, the last period of such high demand for Futures was recorded in September 2023. After that instance, Bitcoin experienced a strong bullish trend lasting until April. Could history repeat itself under these circumstances?

The hike in Bitcoin Futures may be in line with bullish expectations or sentiment among Futures investors. However, BTC demand slowed considerably over the last few days. For example, there seemed to be a surge in Bitcoin Spot ETF inflows over the last 7 days.

However, the last day of October was characterized by the lowest inflows during the week.

Bitcoin traders embrace a cautious approach

The abrupt decrease in purchases by institutional investors (ETFs) indicated a swift move towards a more cautious stance, which mirrored the latest changes in market prices and demand patterns.

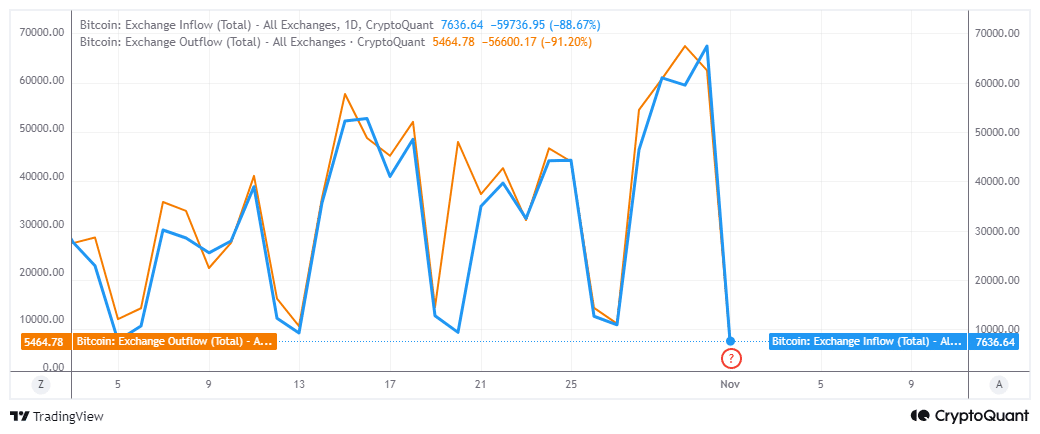

On October 31st, the amount of Bitcoin flowing into exchanges reached a high of 67,373 BTC, significantly more than the 62,024 BTC that was taken out, which also peaked on the same day.

The flow of Bitcoin exchanges has decreased to its lower limits recently, yet inward flows remain significantly greater than outgoing ones. This indicates that selling force has overpowered demand, leading to the observed price drop.

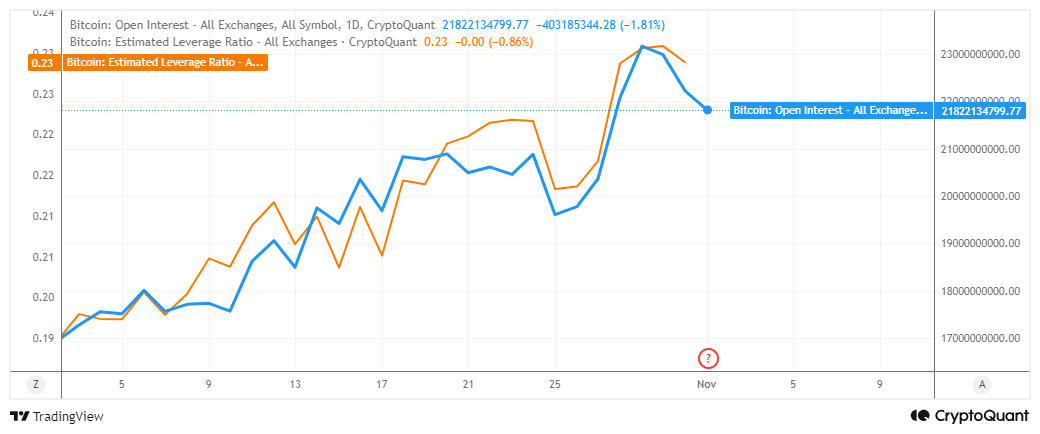

Over the past two days, the market showed a decrease in its desire for borrowing or investing on margin, indicating that investors are uncertain about the full extent of the recent pullback. This uncertainty arises as a result of widespread optimism among bulls who believe prices will rise significantly in the near future.

The substantial drop in Bitcoin’s Open Interest indicates that derivative traders are adopting a more cautious approach. Notably, both the estimated leverage ratio and the Open Interest had reached record highs for 2024 at the end of October.

People tend to be careful due to the anticipation that the U.S elections might bring some unpredictability. Consequently, this uncertainty could lead Bitcoin’s market to return to its usual patterns of supply and demand once the elections have concluded.

Changes in the result can impact the degree of interest as well. Added to this increase in Futures, it could cause exceptionally erratic shifts.

Read More

2024-11-01 22:15